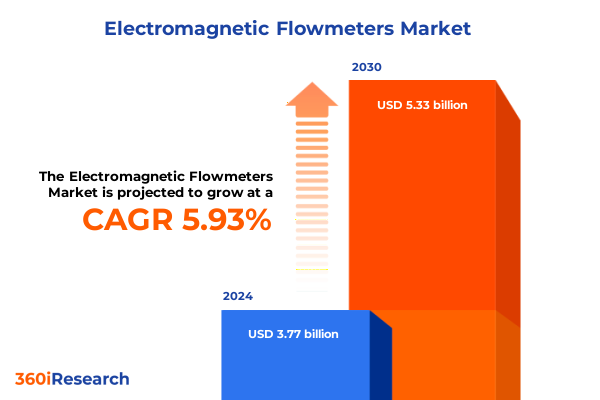

The Electromagnetic Flowmeters Market size was estimated at USD 3.77 billion in 2024 and expected to reach USD 3.99 billion in 2025, at a CAGR of 5.93% to reach USD 5.33 billion by 2030.

Uncovering the Core Principles and Expanding Strategic Importance of Electromagnetic Flowmeters Across Diverse Industrial Sectors and Processes

Electromagnetic flowmeters, rooted in Faraday’s law of electromagnetic induction, have emerged as indispensable instruments for accurately measuring the volumetric flow of conductive fluids. By generating a magnetic field and detecting the resultant voltage as fluid traverses the meter, these devices offer non‐intrusive measurement with minimal pressure drop. Over time, continual enhancements in sensor materials, lining technologies, and signal conversion electronics have significantly improved both the precision and reliability of flow measurement, making these instruments the preferred choice in critical process control environments.

In recent years, the adoption of electromagnetic flowmeters has accelerated across sectors that demand rigorous process optimization and regulatory compliance. From water and wastewater treatment to chemicals, food and beverage, and pharmaceuticals, industry leaders increasingly rely on their stable performance under challenging conditions, including high temperatures, corrosive media, and variable flow regimes. As operational efficiency becomes a strategic imperative, the unique ability of electromagnetic flowmeters to deliver repeatable, maintenance-friendly measurement-and to integrate seamlessly with digital control systems-underscores their expanding strategic importance in modern industrial operations.

Evaluating Disruptive Technology Advances and Digital Transformation Trends Reshaping the Electromagnetic Flowmeter Market Landscape Worldwide

In the contemporary industrial environment, a series of transformative shifts is redefining how electromagnetic flowmeters are designed, deployed, and managed. Foremost among these is the convergence of smart sensing and the Industrial Internet of Things, which has accelerated the migration from standalone instruments to interconnected networks. Manufacturers are embedding digital signal converters and web-enabled transmitters that provide real‐time diagnostics, enabling predictive maintenance and reducing unplanned downtime. This integration of advanced analytics platforms and cloud‐based monitoring has transformed flowmeters from passive measurement tools into proactive components of an Industry 4.0 ecosystem.

Simultaneously, emphasis on sustainability and resource optimization is driving demand for ultra-low-maintenance meters that conserve energy and minimize waste. Developments in liner materials and non-metallic sensor housings are extending instrument lifespans while reducing lifecycle environmental impact. Meanwhile, rapid advances in additive manufacturing and modular design techniques are paving the way for custom configurations that address niche applications. Taken together, these technological, regulatory, and operational trends are converging to reshape the electromagnetic flowmeter market landscape and establish new benchmarks for performance and adaptability.

Analyzing the Aggregate Effects of 2025 United States Tariff Policies on Electromagnetic Flowmeter Supply Chains Costs and Market Dynamics

The introduction of enhanced United States tariffs in 2025 has created a consequential ripple effect across global electromagnetic flowmeter supply chains. With revised duties aimed at promoting domestic manufacturing, import costs for key components-particularly sensor tubes and precision‐machined electrodes-have risen sharply. In response, leading original equipment manufacturers have intensified efforts to localize production, forging partnerships with U.S.-based metal fabricators and electronics assemblers. This realignment is mitigating short‐term cost pressures but also entails substantial capital investment and extended time‐to‐market for domestically made variants.

Moreover, end users face elevated total cost of ownership due to higher initial equipment prices, which in turn is catalyzing exploration of alternative technologies-including ultrasonic and coriolis flowmeters-that may be sourced without tariff exposure. However, the intrinsic advantages of electromagnetic meters, such as superior accuracy with abrasive or corrosive fluids and minimal moving parts, continue to preserve their market preference in regulated sectors. As a result, manufacturers are increasingly offering value-added services, such as extended warranties, on-site calibration packages, and performance‐based contracts, to sustain customer loyalty and offset the financial implications of new tariff structures.

Decoding Market Segmentation Insights by Product Type Component Electronics Power Connectivity End User Distribution Channel Strategies

A nuanced view of electromagnetic flowmeter adoption emerges when examining how product type, component architecture, electronics formats, power options, connectivity methods, end‐user demands, and distribution pathways intersect. Instruments designed for inline installation continue to dominate critical process lines, providing seamless integration and high turndown ratios, while insertion models address budget constraints and retrofitting needs in large‐diameter piping. At the component level, innovation in display units and interfaces is enhancing usability, as advances in electrode metallurgy, liner materials, and flow tube geometries deliver improved measurement stability. The evolution from analog to digital electronics has unlocked higher resolution and advanced signal processing, whereas power supply diversity-including battery, mains, or solar energy-allows deployment in remote locations or hazardous zones without compromising performance.

Connectivity paradigms are likewise expanding. Foundation Fieldbus, HART, and Modbus continue to serve wired networks, but the growing prevalence of Bluetooth, WiFi, and WirelessHART is enabling wireless asset management and rapid commissioning workflows. These enhancements support sophisticated condition monitoring tailored to the stringent requirements of industries such as chemicals, food and beverage, and pharmaceuticals, while ruggedized sensor housings address the high‐abuse environments of metals and mining, oil and gas, power generation, and water and wastewater treatment. On the distribution front, traditional offline channels remain vital for specialized engineering projects, but online platforms-ranging from broad ecommerce marketplaces to dedicated manufacturer websites-are streamlining procurement, enabling rapid quote comparisons, and improving delivery lead times.

This comprehensive research report categorizes the Electromagnetic Flowmeters market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Component

- Electronics Type

- Power Supply

- Connectivity

- End User

- Distribution Channel

Examining Regional Divergence and Growth Drivers for Electromagnetic Flowmeter Adoption Across the Americas EMEA and Asia-Pacific Markets

Regional performance in the electromagnetic flowmeter sector exhibits pronounced variation driven by distinct economic, regulatory, and industrial factors. In the Americas, water and wastewater infrastructure renewal initiatives, coupled with sustained investment in oil and gas pipelines, underpin robust procurement of flow measurement solutions. The North American emphasis on retrofit projects is catalyzing demand for insertion meters, while Latin American industrial expansion in process manufacturing is driving adoption of more advanced inline systems.

Within Europe, the Middle East, and Africa, stringent environmental regulations and extensive utilities modernization programs are energizing growth. European directives on water quality and emissions monitoring have compelled utilities and chemical processors to upgrade legacy metering, resulting in a surge of digital-enabled electromagnetic flowmeter deployments. In the Middle East, large‐scale petrochemical complexes and desalination plants are seeking high‐precision instruments to optimize operations, whereas in Africa, rising investment in mining and energy infrastructure is generating new opportunities for cost-effective measurement technologies.

Asia-Pacific remains the largest single market region, propelled by rapid industrialization, urbanization, and smart city initiatives. China’s water management reforms and Southeast Asia’s burgeoning pharmaceuticals sector are driving demand for high-reliability, low‐maintenance flowmeters. Concurrently, Japan, South Korea, and Australia are spearheading innovation in sensor miniaturization and digital networking, setting regional benchmarks that echo across global R&D efforts.

This comprehensive research report examines key regions that drive the evolution of the Electromagnetic Flowmeters market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Electromagnetic Flowmeter Manufacturers Highlighting Innovation Partnerships and Competitive Strategies Driving Market Leadership

Competition among key electromagnetic flowmeter manufacturers is intensifying around technology leadership, service offerings, and geographic reach. Major multinational players are heavily investing in digital platforms that aggregate flow data, diagnostics, and lifecycle management tools, thereby positioning themselves as comprehensive solution providers rather than mere equipment suppliers. Strategic partnerships with automation software vendors are enabling these incumbents to embed meter performance into broader plant‐wide analytics frameworks, deepening customer engagement and creating recurring revenue streams through software subscriptions and remote monitoring services.

Simultaneously, targeted acquisitions of niche instrumentation specialists are allowing established firms to broaden their product portfolios, incorporating specialized sensor coatings and advanced lining technologies to address extreme service conditions. Collaboration with materials science laboratories is accelerating the development of next-generation electrodes resistant to fouling and erosion. In parallel, lean manufacturing initiatives and regional assembly hubs are being set up to ensure cost competitiveness and faster delivery, particularly in tariff‐sensitive markets. Together, these strategies reflect an ecosystem where continuous innovation and customer-centric service models are paramount to securing market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electromagnetic Flowmeters market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Aichi Tokei Denki Co. Ltd.

- ARROWMECH INSTRUMENTS & AUTOMATION

- Azbil Corporation.

- Badger Meter, Inc.

- Dwyer Instruments, LLC

- Emerson Electric Co.

- Endress+Hauser Group Services AG

- Euromag International Srl

- FLUIDO SENSE PVT LTD.

- Fuji Electric Co., Ltd.

- Honeywell International, Inc.

- ISOIL INDUSTRIA SPA

- KROHNE Messtechnik GmbH

- Manas Microsystem Pvt. Ltd.

- McCrometer, Inc.

- ONICON Incorporated

- Schneider Electric SE

- Siemens AG

- Tianjin Sure Instrument Co., Ltd.

- TOKYO KEISO CO., LTD.

- Toshiba Corporation

- Yantai Auto Instrument Making Co., Ltd.

- Yokogawa Electric Corporation

Presenting Actionable Strategic Recommendations for Industry Stakeholders to Innovate Optimize Supply Chains and Navigate Regulatory Complexities in Electromagnetic Flowmeter Sector

To capitalize on evolving market dynamics and maintain a competitive advantage, industry leaders should prioritize a multi-pronged strategy. First, diversifying supply chains by establishing dual‐source component agreements and regional assembly lines will mitigate exposure to tariff fluctuations and logistical disruptions. Concurrently, accelerating investments in smart sensor development-particularly in digital signal conversion and wireless connectivity-will address growing demand for predictive maintenance and remote monitoring capabilities.

Moreover, forging strategic alliances with cloud analytics and automation platform providers can deepen integration into customers’ digital ecosystems, transforming flowmeters into indispensable nodes within broader Industry 4.0 architectures. Elevating the customer experience through value‐added services-such as performance‐based contracts, on-site training programs, and flexible financing options-will help offset pricing pressures and enhance long-term retention. Finally, embedding sustainability considerations throughout product design and lifecycle management, including eco-friendly materials and low-power operation modes, will align flowmeter offerings with corporate ESG objectives and regulatory requirements, unlocking access to environmentally driven project budgets.

Outlining Comprehensive Research Methodology Integrating Primary Expert Interviews Secondary Data Analysis and Robust Triangulation for Market Intelligence

Our research encompassed a rigorous, multi-tiered approach combining quantitative and qualitative methodologies to ensure robust insights and market validity. Secondary research involved a comprehensive review of technical publications, patent filings, regulatory frameworks, and whitepapers related to flow measurement technology. This foundation was supplemented by primary interviews with industry executives, research and development specialists, distribution channel leaders, and end‐user procurement managers, capturing diverse perspectives on adoption drivers, operational challenges, and innovation priorities.

Data triangulation techniques were applied to reconcile and validate information across sources, ensuring consistency between manufacturer disclosures, trade data, and end‐user feedback. We also leveraged a proprietary framework to assess segmentation dynamics, regional growth trajectories, and competitive positioning, supported by scenario analysis to evaluate the impact of policy shifts and technological disruptions. Finally, draft findings were reviewed by an expert advisory panel to refine conclusions and strengthen strategic recommendations, delivering a meticulously vetted intelligence product.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electromagnetic Flowmeters market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electromagnetic Flowmeters Market, by Product Type

- Electromagnetic Flowmeters Market, by Component

- Electromagnetic Flowmeters Market, by Electronics Type

- Electromagnetic Flowmeters Market, by Power Supply

- Electromagnetic Flowmeters Market, by Connectivity

- Electromagnetic Flowmeters Market, by End User

- Electromagnetic Flowmeters Market, by Distribution Channel

- Electromagnetic Flowmeters Market, by Region

- Electromagnetic Flowmeters Market, by Group

- Electromagnetic Flowmeters Market, by Country

- United States Electromagnetic Flowmeters Market

- China Electromagnetic Flowmeters Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Synthesizing Critical Findings and Strategic Insights to Illuminate Future Opportunities Challenges and Value Creation in Electromagnetic Flowmeter Technologies

The landscape of electromagnetic flowmeter technology is poised at the intersection of digital transformation, regulatory evolution, and shifting global supply paradigms. As smart sensing capabilities and wireless connectivity become baseline expectations, manufacturers must balance innovation investments with cost discipline to navigate tariff pressures and competitive intensity. Regional market dynamics further underscore the need for agile strategies that align product portfolios with local infrastructure priorities and regulatory standards.

Moving forward, the most successful organizations will be those that transcend traditional equipment sales models, delivering integrated hardware‐software solutions underpinned by value-added services and sustainable design principles. By acting on the insights presented-from segmentation nuances and regional growth catalysts to supply chain resilience and partnership imperatives-industry participants can unlock new avenues for differentiation, foster deeper customer relationships, and chart a course toward long-term market leadership in electromagnetic flowmeter technologies.

Driving Decision-Making Momentum with a Personalized Call to Action to Engage with Ketan Rohom for Comprehensive Electromagnetic Flowmeter Market Research Insights

As you navigate the complexities and opportunities within the electromagnetic flowmeter landscape, securing thorough, data‐driven insights is critical to maintaining a competitive edge. Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to explore how our comprehensive market research report can guide your strategic decisions, illuminate emerging trends, and pinpoint high‐potential growth segments. Engage now to leverage tailored analyses, expert commentary, and actionable intelligence that will empower your organization to optimize investments and accelerate innovation in electromagnetic flowmeter technologies.

- How big is the Electromagnetic Flowmeters Market?

- What is the Electromagnetic Flowmeters Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?