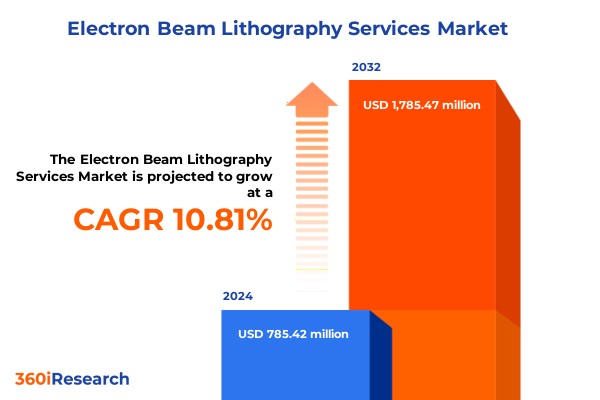

The Electron Beam Lithography Services Market size was estimated at USD 862.58 million in 2025 and expected to reach USD 958.44 million in 2026, at a CAGR of 10.95% to reach USD 1,785.47 million by 2032.

Setting the Stage for Precision Patterning with Advanced Electron Beam Lithography Serving Next-Generation Nanoelectronics Demands

Electron beam lithography stands at the forefront of nanoscale fabrication, enabling unparalleled precision in patterning requirements for advanced semiconductor and device applications. As process nodes shrink below the 10-nanometer threshold, traditional photolithography faces inherent physical and economic challenges, making electron beam approaches indispensable. This report introduces the current state of the electron beam lithography landscape, examines emerging catalysts for adoption, and outlines the critical success factors that decision-makers must consider in an era of intensifying miniaturization demands.

Amidst rapid technological convergence, stakeholders must navigate complex trade-offs between throughput, resolution, and cost. By synthesizing insights from equipment vendors, research institutes, and end-use practitioners, this section offers a foundational understanding of how electron beam lithography has evolved from niche laboratory tools to strategic enablers in high-precision manufacturing. Ultimately, the introduction frames the key issues-ranging from material chemistry innovations to supply chain resilience-that will guide subsequent sections of the analysis.

Navigating Disruptive Paradigm Shifts in Nanofabrication Ecosystem Driven by Emerging Materials and Process Innovations

The electron beam lithography ecosystem is undergoing transformative shifts driven by breakthroughs in resist chemistries, automation technologies, and integration with complementary fabrication techniques. Recent advances in hybrid patterning platforms combine direct write versatility with mask-based throughput, enabling rapid prototyping alongside volume production. Simultaneously, the adoption of ultra-sensitive resists and high-speed multi-beam systems has pushed achievable resolutions into the sub-10 nanometer realm, further blurring the lines between research-oriented applications and mainstream manufacturing.

In parallel, digital transformation and data‐driven process optimization have become integral to next-generation lithography workflows. Machine learning algorithms now assist in pattern correction, overlay alignment, and defect prediction, thereby reducing cycle times and enhancing yield. Moreover, evolving design requirements for quantum computing devices, high-density data storage media, and advanced sensors are fueling collaborative R&D initiatives among equipment suppliers, semiconductor foundries, and academic institutions. These converging forces illustrate a dynamic landscape where agility and innovation are paramount, paving the way for new business models and strategic partnerships.

Assessing the Far-Reaching Consequences of 2025 United States Tariff Measures on Electron Beam Lithography Supply Chains and Pricing Dynamics

Since the early months of 2025, newly imposed tariffs by the United States have introduced significant cost pressures across the electron beam lithography supply chain. Increased duties on imported column components, vacuum systems, and precision optics have translated into higher capital expenditures for system integrators and end-users alike. Many equipment manufacturers have responded by seeking alternative sourcing strategies, including reshoring key subassemblies or negotiating long-term procurement agreements with domestic suppliers to mitigate price volatility.

Beyond direct hardware impacts, the tariffs have also affected service providers and research facilities that rely on high-throughput mask-based systems supplied from abroad. The resulting adjustments in total cost of ownership have prompted some consumer segments to accelerate modernization timelines, while others have deferred non-critical upgrades. Collectively, these shifts underscore the broader strategic implications of trade policy on technological adoption, compelling industry stakeholders to reevaluate risk management practices and align investment decisions with evolving regulatory conditions.

Uncovering Deep Insights into Electron Beam Lithography Market Segmentation Across Patterning Modes End Users Applications and Resolution Tiers

A nuanced understanding of electron beam lithography market dynamics emerges when examining patterning mode, end-user segments, application areas, and resolution tiers in concert. Analysis based on patterning mode distinguishes between direct write and mask-based approaches, revealing that direct write systems excel in rapid prototyping and low-volume production, whereas mask-based techniques deliver superior throughput for large-scale manufacturing. This distinction not only shapes capital allocation decisions but also informs strategic roadmaps for system developers seeking to balance productivity with customization.

Separately, end users such as semiconductor foundries, integrated circuit manufacturers, and research institutions each exhibit distinctive adoption profiles. Foundries emphasize high-volume mask-based workflows to maintain economies of scale, while IC manufacturers leverage direct write capabilities to support specialized device architectures. Research institutes, meanwhile, prioritize resolution and flexibility to enable exploratory studies. When these end-user insights intersect with application segments-from data storage solutions spanning bit patterned media and HDD head patterning to MEMS, photomask repair across binary and phase-shift masks, and broader semiconductor domains encompassing discrete and power devices, logic ICs, and memory ICs-a cohesive picture emerges. Overlaying this with resolution bands categorized as sub-10 nanometers, 10–20 nanometers, 20–50 nanometers, and above 50 nanometers further clarifies technology readiness levels and investment priorities across diverse use cases.

This comprehensive research report categorizes the Electron Beam Lithography Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Patterning Mode

- Resolution

- Application

- End User

Harnessing Regional Growth Drivers and Adoption Patterns in the Americas Europe Middle East Africa and Asia-Pacific Electron Beam Lithography Markets

Regional contexts play a pivotal role in shaping electron beam lithography adoption and development. In the Americas, significant investments in advanced packaging, aerospace, and defense sectors drive demand for high-precision direct write systems. Collaboration between leading U.S. research universities and national laboratories fosters an ecosystem where emerging device concepts can swiftly transition from prototype to pilot production. Concurrently, select market participants in Latin America explore mask-based offerings to support localized printed circuit board and sensor manufacturing.

The Europe, Middle East, and Africa region integrates strong governmental support for collaborative research in photonics, sensor integration, and industrial Internet of Things applications. Germany, the Netherlands, and the United Kingdom host centers of excellence that accelerate multi-beam technologies, while funding programs in the Middle East increasingly target dual-use applications spanning civil and defense markets. Across Asia-Pacific, robust semiconductor manufacturing hubs in China, South Korea, and Japan prioritize capacity expansion, with domestic equipment vendors scaling production to address surging local demand. Government initiatives, such as national technology roadmaps and fiscal incentives, reinforce this momentum and encourage cross-border partnerships that bridge research endeavors with commercial deployment.

This comprehensive research report examines key regions that drive the evolution of the Electron Beam Lithography Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Electron Beam Lithography Technology Providers and Strategic Alliances Shaping Competitive Dynamics and Innovation Trajectories

Leading technology providers continue to shape the competitive landscape through differentiated offerings and strategic collaborations. Established incumbents have expanded service portfolios to include turnkey integration, customizable resist formulations, and end-to-end workflow solutions. Meanwhile, emerging vendors concentrate on niche capabilities such as multi-beam parallelization, electron optics enhancements, and cloud-enabled process monitoring. These strategic moves reflect a broader shift toward platform extensibility and software-defined equipment architectures.

In addition to product innovation, partnerships among equipment suppliers, semiconductor consortia, and end-user communities amplify collective expertise. Joint development agreements aim to accelerate the commercialization of next-generation patterning modes and to optimize process modules for targeted applications. Select alliances also emphasize sustainability, exploring low-environmental-impact consumables and energy-efficient system designs. Collectively, these collaborative endeavors underscore the importance of ecosystem orchestration in driving continuous innovation and maintaining competitive differentiation in a rapidly evolving market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electron Beam Lithography Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advantest Corporation

- Applied Materials, Inc.

- Elionix Inc.

- Heidelberg Instruments Mikrotechnik GmbH

- Hitachi High‑Tech Corporation

- IMS Nanofabrication GmbH

- JEOL Ltd.

- NTT Advanced Technology Corporation

- Raith GmbH

- Vistec Electron Beam GmbH

Driving Success in Electron Beam Lithography with Actionable Strategies for Enhancing Process Efficiency Market Positioning and Collaborative Ecosystems

Industry leaders can derive immediate benefits by embracing a strategic framework that prioritizes both operational excellence and innovation agility. First, investing in automation and machine learning integration reduces cycle times and minimizes variability, thereby enhancing throughput without sacrificing resolution. Simultaneously, firms should pursue targeted partnerships with academic institutions and foundry consortia to access emerging device architectures and novel resist materials that could unlock new application domains.

Moreover, diversifying supply chain relationships and nurturing resilient procurement strategies are essential in the current geopolitical environment. Organizations that develop modular equipment platforms can rapidly adapt to component shortages or regulatory shifts, safeguarding continuity of operations. Finally, embedding sustainability goals into system design and process development not only strengthens brand reputation but also aligns with increasingly stringent environmental mandates. Through these actionable steps, decision-makers will be well positioned to capture growth opportunities and reinforce technological leadership.

Detailing Rigorous Research Methodologies Employed for Generating Robust Electron Beam Lithography Market Insights and Ensuring Data Integrity

The analysis underpinning this report draws on a rigorous combination of primary and secondary research methods designed to ensure data integrity and relevance. Primary inputs include structured interviews with key executives from equipment manufacturers, foundry operators, and research institutions, supplemented by panel discussions with semiconductor material and process experts. These qualitative insights are further validated through detailed case studies and technology benchmarking exercises.

Secondary research involved an exhaustive review of peer-reviewed publications, patent filings, industry white papers, and publicly available trade data. Quantitative analysis techniques, such as supply chain mapping and patent citation analysis, were employed to triangulate findings and identify emerging trends. Throughout the research process, cross-validation against multiple data sources and iterative expert feedback loops ensured the robustness of conclusions and the actionable value of strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electron Beam Lithography Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electron Beam Lithography Services Market, by Patterning Mode

- Electron Beam Lithography Services Market, by Resolution

- Electron Beam Lithography Services Market, by Application

- Electron Beam Lithography Services Market, by End User

- Electron Beam Lithography Services Market, by Region

- Electron Beam Lithography Services Market, by Group

- Electron Beam Lithography Services Market, by Country

- United States Electron Beam Lithography Services Market

- China Electron Beam Lithography Services Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Concluding Perspectives on the Future Trajectory of Electron Beam Lithography Amidst Evolving Technological Advances and Strategic Partnerships

As electron beam lithography continues to transcend its traditional confines, it becomes increasingly integral to the advancement of next-generation electronics, photonics, and quantum devices. The convergence of high-resolution patterning, automation, and materials innovation positions this technology as a versatile enabler across diverse sectors. Stakeholders who integrate these capabilities into their strategic roadmaps will not only drive performance improvements but also gain competitive advantage in rapidly shifting markets.

Looking ahead, sustained collaboration among equipment vendors, foundries, academic researchers, and policy makers will be essential to overcoming persistent challenges such as throughput constraints and cost optimization. By leveraging the insights presented in this report, industry participants can chart a course toward scalable, sustainable lithographic solutions that meet the demands of an increasingly miniaturized world.

Empower Your Strategic Decisions with Expert Guidance from Ketan Rohom and Secure Comprehensive Electron Beam Lithography Insights Today

For tailored insights and in-depth analysis that will steer your strategic initiatives, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, who stands ready to guide your acquisition of the comprehensive Electron Beam Lithography market research report. Ketan’s expertise in aligning technical findings with commercial imperatives ensures you will receive a report that addresses your unique requirements and delivers actionable intelligence.

Engage in a consultation to explore how this report can empower your decision-making, enhance competitive positioning, and support investment priorities. By securing this resource, you gain immediate access to proprietary data, expert commentary, and forward-looking scenarios. Don’t miss the opportunity to drive innovation and achieve operational excellence-connect with Ketan Rohom to finalize your purchase and unlock the full potential of advanced lithography insights today

- How big is the Electron Beam Lithography Services Market?

- What is the Electron Beam Lithography Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?