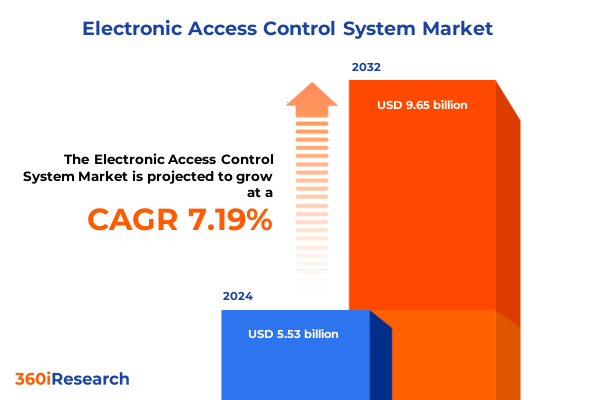

The Electronic Access Control System Market size was estimated at USD 50.86 billion in 2025 and expected to reach USD 55.11 billion in 2026, at a CAGR of 8.51% to reach USD 90.14 billion by 2032.

Unlocking the Future of Electronic Access Control as Security Technologies Converge with IoT and Cloud-Driven Innovations Across Industries

In an era marked by heightened security challenges and rapid technological advancements, electronic access control systems have emerged as critical enablers of facility protection and operational resilience. Organizations are no longer content with standalone locks or simple card readers; they are increasingly integrating sophisticated controllers, cloud-based management platforms, and AI-driven analytics to safeguard assets and optimize entry flows. This transformative pivot toward intelligent, interconnected architectures reflects a broader convergence of cybersecurity and physical security domains, reshaping traditional perimeters into dynamic ecosystems that demand real-time visibility and adaptive response capabilities.

Against this backdrop, industry leaders must grasp the evolving interplay between hardware components, software intelligence, and specialized services to craft solutions that balance ease of use with uncompromised security. The shift to networked controllers and panels underscores the need for scalable infrastructures capable of supporting mobile credentials, biometric enrollment, and encryption protocols. Meanwhile, software suites are advancing to deliver centralized dashboards, policy automation, and threat detection, moving beyond simple access logs to predictive risk modeling. As the marketplace accelerates toward fully integrated offerings, stakeholders require a clear understanding of emerging drivers-ranging from cloud migration to regulatory mandates-in order to navigate procurement strategies and deliver differentiated value.

Navigating a Dynamic Security Ecosystem Fueled by AI Analytics Edge Computing and Seamless Integration in Access Control Solutions

The electronic access control landscape is undergoing profound transformation, propelled by the rise of artificial intelligence, edge computing, and the Internet of Things. Traditional reader-and-card configurations are giving way to multimodal systems that combine fingerprint recognition, facial analytics, and voice biometrics to deliver frictionless yet highly secure authentication. At the same time, controllers and servers are migrating from on-premise racks to hybrid cloud deployments, granting organizations unprecedented agility in provisioning credentials and updating security policies across distributed sites.

These technological shifts are tightly interwoven: edge-enabled panels now process encrypted biometric templates locally to accelerate decisioning, while aggregated data streams from servers fuel machine learning algorithms that predict and preempt security incidents. The result is a self-optimizing network in which access logs evolve into actionable security insights, and administrators benefit from real-time anomaly detection. Furthermore, deployment of wireless locks and electric strike mechanisms underscores a move toward simplified retrofitting, enabling organizations to modernize legacy infrastructures without extensive cabling or downtime. Collectively, these innovations are redefining the concept of a secure perimeter, transforming it into a continuous continuum of intelligent checkpoints and adaptive controls.

Assessing the Cumulative Effects of 2025 United States Tariff Measures on Supply Chains Component Costs and Strategic Sourcing Decisions

Since the introduction of new tariff schedules in early 2025, organizations reliant on imported controllers, readers, and specialized encryption modules have experienced a recalibration of sourcing and manufacturing strategies. The increased duty rates on key hardware components have prompted several leading vendors to reassess supply chains, favoring regional assembly lines and nearshoring initiatives to mitigate cost pressures and potential transit delays at ports. This trend has been especially pronounced for brands that previously concentrated production in East Asia, where transport and tariff uncertainties introduced margin volatility and lengthened lead times.

In parallel, software providers have responded by decoupling licensing models from hardware dependencies, allowing clients to shift seamlessly between device manufacturers without incurring prohibitive fees. Installed-base service providers have likewise adjusted maintenance contracts to account for component replacement costs. Although the tariff changes have not fundamentally altered the strategic importance of electronic access control systems, they have catalyzed a shift toward diversified manufacturing footprints and stronger regional partnerships. Decision-makers now prioritize flexibility in procurement agreements, emphasizing clauses that hedge against future trade policy fluctuations while preserving the integrity of security ecosystems.

Revealing Actionable Insights from Component to Application Segmentation That Drive Tailored Strategies in Electronic Access Control Markets

Dissecting the market through the lens of component distinctions reveals that hardware revenue has increasingly skewed toward advanced controllers and encrypted readers, while server and panel deployments in hybrid models have grown more commonplace. Within services, consulting engagements have expanded to guide organizations through integration challenges, and maintenance contracts now bundle remote monitoring and predictive diagnostics. On the software front, access management suites are evolving with privilege automation and encryption layers, meeting rising demand for centralized policy enforcement and regulatory compliance.

Turning to product typologies, biometric systems have surged as enterprises pursue facial and fingerprint recognition solutions, although iris and voice applications are finding niche adoption in high-security environments. Card-based implementations maintain strong footing in large campuses via smart cards and proximity credentials, while wireless locks and keypad interfaces cater to retrofit scenarios. Analyzing control models highlights a clear shift toward role-based and attribute-based frameworks, which deliver granular access rights aligned with organizational hierarchies and attribute profiles. Meanwhile, discretionary and mandatory models persist in legacy deployments and regulated sectors respectively.

When evaluating end-use verticals, commercial venues such as hotels and retail spaces are upgrading to contactless access, whereas healthcare and government facilities emphasize biometric authentication for high-risk zones. Deployment preferences split between agile cloud solutions favored by SMBs and on-premise configurations retained by large enterprises with stringent data sovereignty requirements. Speaking of enterprise scale, small organizations lean into modular, plug-and-play offerings to manage budgets effectively, while medium and large enterprises invest in fully integrated, enterprise-grade architectures. Lastly, the line between indoor and outdoor applications blurs as weather-proof readers and wireless perimeter locks support seamless security from lobbies to parking entrances.

This comprehensive research report categorizes the Electronic Access Control System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Product

- Access Control Model

- End Use Industry

- Deployment Model

- Application Area

Understanding Regional Dynamics in Security Infrastructure Across the Americas Europe Middle East Africa and Asia-Pacific Growth Hotspots

Across the Americas, demand for electronic access control systems is being driven by robust investment in commercial real estate and manufacturing facilities, where the focus lies on consolidating security centralization across multi-site operations. In North America, the combination of evolving privacy regulations and enterprise digitization has elevated appetite for cloud-based access management platforms, while Latin American markets appreciate modular hardware solutions that accommodate phased deployments.

In Europe, Middle East, and Africa, regulatory compliance with GDPR in European Union member states has underscored the importance of encryption and access logs, prompting vendors to localize data processing. Government initiatives in the Middle East around smart city development have further spurred adoption of biometric terminals and integrated surveillance. African markets, though varied, are showing early traction for mobile credentialing as smartphone penetration rises.

Turning to Asia-Pacific, ongoing smart infrastructure programs in Southeast Asia and Australia have fostered the integration of wireless locks and video intercom systems, linked through IoT gateways. Rapid urbanization in India and China continues to fuel demand for biometric deployments in high-rise residential and commercial projects. Meanwhile, Japan and South Korea remain at the forefront of facial recognition and advanced encryption adoption, reflecting broader digital identity initiatives. Together, these regional nuances illustrate how geographic dynamics shape procurement strategies, infrastructure investments, and technology roadmaps.

This comprehensive research report examines key regions that drive the evolution of the Electronic Access Control System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Access Control Innovators and Strategic Partnerships Shaping Competitive Landscape and Driving industry Advancement

Leading manufacturers have differentiated themselves through a combination of vertical integration, strategic alliances, and breadth of solution portfolios. Enterprise-grade incumbents have leveraged acquisitions to augment software capabilities with AI-enabled analytics, while specialized start-ups have carved niches in biometric innovation and edge processing. Partnerships between hardware providers and cloud service firms have given rise to bundled offerings that simplify procurement and accelerate deployment timelines for end-users.

In the services arena, integrators have deepened their expertise in consulting and managed services, establishing regional centers of excellence to support complex rollouts. At the same time, third-party maintenance providers have expanded their footprints, offering predictive upkeep and remote monitoring as value-added services. Among software vendors, the rise of subscription-based licensing has unlocked new revenue streams, while interoperability certifications have become a competitive necessity, assuring customers of seamless integration across multi-vendor environments.

Competitive advantage is increasingly tied to the ability to deliver unified, end-to-end ecosystems rather than standalone components. This transformation is exemplified by collaborative initiatives between card-based system leaders and biometric innovators, which strive to offer unified credential platforms. Moreover, commitment to rigorous cybersecurity standards and certification processes is emerging as a differentiator, reinforcing trust among risk-averse sectors such as finance and healthcare.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electronic Access Control System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ASSA ABLOY group

- Honeywell International Inc.

- Johnson Control, Inc.

- Allegion plc

- Genetec Inc.

- Dormakaba Group

- Salto Systems, S.L.

- Robert Bosch GmbH

- Cisco Systems, Inc.

- Fujitsu Limited

- Dahua Technology Co., Ltd

- Bio-Key International, Inc.

- Thales Group

- Aiphone Corporation

- Alarm.com Incorporated.

- AnG India Ltd

- Axis Communications AB

- Brivo Systems, LLC.

- Cognitec System GMBH

- Eviden SAS

- GALLAGHER GROUP LIMITED

- Godrej & Boyce Manufacturing Company Limited

- IDEMIA France SAS

- Kisi Inc.

- NEC Corporation

- Nedap N.V.

- Nice North America LLC

- PACOM Systems Pty Ltd.

- Verkada Inc.

Implementing Proven Strategies and Best Practices to Capitalize on Emerging Access Control Trends and Build Operational Resilience in an Evolving Market

To capitalize on evolving market dynamics, industry leaders should prioritize the development of open, interoperable architectures that facilitate seamless integration of hardware, software, and analytics components. Investing in edge processing capabilities will accelerate authentication decision-making at the point of entry, reducing latency and bolstering resilience in network-constrained environments. In parallel, establishing flexible licensing models that decouple software from proprietary hardware will empower clients to adopt best-of-breed devices while maintaining policy consistency.

Organizations should also cultivate robust regional partnerships, particularly in response to tariff-induced supply chain shifts, by identifying local assembly and distribution channels that align with market demands. Emphasis on cybersecurity hardening-through firmware signing, encryption key management, and continuous vulnerability assessments-will be critical to preserving stakeholder trust, especially as access control systems become integral to broader smart building initiatives. Finally, fostering continuous learning through certification programs and service training will enable integrators and end-users to unlock advanced functionalities, ensuring that deployments evolve in step with emerging threat landscapes and technological breakthroughs.

Outlining a Rigorous Mixed-Methods Research Framework Combining Primary Industry Interviews Data Triangulation and Comprehensive Secondary Analysis

This study employs a mixed-methods approach, combining primary research through in-depth interviews with security architects, system integrators, and C-level executives across key end-use sectors. Quantitative insights were gathered via a comprehensive survey targeting procurement and technology decision-makers, yielding granular data on deployment preferences, budget allocation, and procurement timelines. Secondary research sources included industry whitepapers, regulatory documentation, and proprietary patent filings to map the trajectory of technology innovation within the electronic access control domain.

Data triangulation was achieved by cross-referencing findings from multiple sources, ensuring consistency between self-reported priorities and market behavior. Vendor consolidation trends and partnership announcements were tracked over a rolling twelve-month period to identify strategic shifts and mergers. Rigorous validation protocols, including peer debriefings and stakeholder workshops, were conducted to refine the analysis and mitigate biases. The result is a robust framework that aligns qualitative insights with empirical evidence, providing a credible and actionable foundation for both executive decision-making and operational planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electronic Access Control System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electronic Access Control System Market, by Component

- Electronic Access Control System Market, by Product

- Electronic Access Control System Market, by Access Control Model

- Electronic Access Control System Market, by End Use Industry

- Electronic Access Control System Market, by Deployment Model

- Electronic Access Control System Market, by Application Area

- Electronic Access Control System Market, by Region

- Electronic Access Control System Market, by Group

- Electronic Access Control System Market, by Country

- United States Electronic Access Control System Market

- China Electronic Access Control System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Concluding Strategic Imperatives Emphasizing Integration Innovation and Collaboration to Future-Proof Electronic Access Control Solutions Amid Rapid Change

As the security landscape continues to evolve, electronic access control systems will play a pivotal role in safeguarding physical and digital assets alike. The convergence of edge computing, AI analytics, and cloud orchestration heralds a new paradigm of intelligent, adaptive security that transcends traditional perimeters. Organizations that embrace open architectures and flexible deployment models will be best positioned to navigate policy uncertainties, supply chain shifts, and emerging threat vectors.

Ultimately, the future of access control hinges on the seamless fusion of technology and strategy. By aligning component innovation with customer use cases-whether in commercial real estate, government facilities, or smart cities-vendors and integrators can deliver tailored solutions that drive both security and business performance. As regulatory environments tighten and privacy concerns intensify, the emphasis on encryption, auditability, and interoperability will only grow, demanding that stakeholders remain vigilant and proactive. With a clear understanding of market segmentation dynamics, regional nuances, and competitive imperatives, industry leaders are well equipped to steer their organizations toward sustained success.

Take the Next Step in Strengthening Security Infrastructure by Engaging with Ketan Rohom to Secure Comprehensive Electronic Access Control Market Intelligence

Elevate your organization’s access control capabilities with tailored insights and tactical guidance designed to maximize security and operational efficiency. Reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to secure the comprehensive market research report that will equip your leadership team with the intelligence needed to drive strategic decisions. By leveraging this report, you will gain unparalleled clarity on component innovations, product evolution, and regional dynamics shaping the access control landscape. Connect today to unlock the full breadth of data-driven analysis, expert recommendations, and competitive benchmarking that will empower you to outpace rivals and deliver robust security solutions to stakeholders. Begin the conversation with Ketan Rohom now to refine your roadmap and accelerate growth in one of the most dynamic technology markets of our time.

- How big is the Electronic Access Control System Market?

- What is the Electronic Access Control System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?