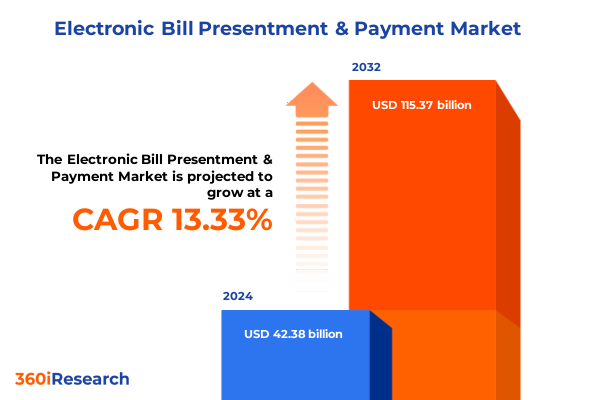

The Electronic Bill Presentment & Payment Market size was estimated at USD 47.60 billion in 2025 and expected to reach USD 53.47 billion in 2026, at a CAGR of 13.48% to reach USD 115.37 billion by 2032.

Setting the Stage for the Future of Electronic Bill Presentment and Payment Solutions in an Increasingly Digital Financial Ecosystem

The accelerating shift toward digital economies has placed electronic bill presentment and payment at the forefront of financial innovation. As businesses and consumers navigate increasingly complex ecosystems of transactions, the need for streamlined, secure, and personalized billing solutions has never been more pronounced. Electronic Bill Presentment and Payment (EBPP) platforms now represent critical infrastructure for utilities, financial services, healthcare providers, and beyond, driving efficiency and enhancing customer satisfaction.

Investments in artificial intelligence and machine learning are revolutionizing billing experiences by enabling predictive analytics and tailored interactions. AI-driven personalization tools allow providers to anticipate payment behaviors, optimize billing cycles, and deliver customized reminders, significantly improving on-time payment rates and reducing operational costs. Moreover, as organizations embed payment capabilities into IoT devices and digital touchpoints, the bill presentment process is transforming into an interactive engagement channel rather than a transactional afterthought. This growing integration underscores the potential for EBPP to serve as a strategic interface that fosters long-term customer loyalty and drives meaningful insights into consumer preferences.

With regulatory frameworks tightening data security and privacy requirements, providers are challenged to deliver robust solutions that comply with evolving standards while remaining agile. Simultaneously, end users demand frictionless experiences across multiple channels, from mobile wallets to web portals and voice-assisted platforms. In this landscape of rising expectations, an authoritative understanding of market dynamics, technological advancements, and stakeholder priorities is essential for industry leaders seeking to capitalize on EBPP’s transformative potential.

Unprecedented Transformative Shifts Driving Innovation and Disruption in Electronic Bill Presentment and Payment Technologies

The EBPP market is experiencing an unprecedented wave of innovation as legacy billing processes give way to sophisticated, technology-driven models. Foremost among these catalysts is the integration of artificial intelligence into core billing and payment workflows. Machine learning algorithms now process extensive user data to forecast payment behaviors, identify at-risk accounts, and deliver dynamic offers for alternative payment methods. This AI-driven approach enhances customer engagement by tailoring reminders and interface layouts to individual preferences, reducing friction and boosting satisfaction levels.

Simultaneously, the proliferation of connected devices is extending payment capabilities beyond traditional channels. Embedded payment experiences in wearables, smart appliances, and connected vehicles enable auto-initiated utility payments or in-app subscription management, effectively transforming bill presentment into a seamless extension of daily life. These IoT-integrated payment flows reduce manual intervention and foster continuous engagement, positioning EBPP as a proactive revenue touchpoint rather than a reactive process.

Blockchain and cryptocurrency are also reshaping the EBPP landscape by offering decentralized, secure transaction frameworks. Blockchain’s immutable ledger structure enhances transparency and minimizes fraud risk, while tokenized payment rails promise faster settlement cycles and lower reconciliation costs. Pilot programs leveraging smart contracts for automated billing events have demonstrated accelerated processing times and increased trust among stakeholders. As regulatory clarity around digital assets improves, blockchain-enabled EBPP solutions are poised for broader adoption.

In parallel, real-time payment networks are redefining expectations for settlement speed and availability. Financial institutions are increasingly adopting a multi-rail strategy that leverages both private networks like The Clearing House’s RTP® and the Federal Reserve’s FedNow® service. This dual-track approach ensures continuous, instant payment processing capabilities, enhances resilience, and meets rising consumer demands for immediacy. According to recent data, 58% of U.S. banks now connect to both networks to optimize coverage and flexibility in EBPP transactions.

Assessing the Cumulative Economic and Operational Impact of United States Tariffs on Electronic Bill Presentment and Payment Services in 2025

As the U.S. government has applied broad tariff measures on imported technology goods in 2025, EBPP service providers are grappling with increased input costs that ripple through the entire payment ecosystem. Semiconductors, essential for servers, networking gear, and data center hardware, now face sustained tariffs as high as 25%, raising operational expenses for data center operators and cloud service vendors. Analysis indicates that a blanket semiconductor tariff of this magnitude could reduce U.S. GDP growth by 0.76% over a ten-year horizon, cumulatively shaving off $1.4 trillion in economic output and adding over $4,000 in direct costs to the average household by year ten.

Consumer-facing technology segments, including smartphones and laptops that support digital payment applications, are not immune to these trade pressures. Recent assessments reveal that tariffs on everyday tech products have eroded purchasing power by approximately $123 billion, with average price increases of 31% for smartphones and 34% for laptops and tablets. These cost escalations slow the replacement cycles for billing interfaces and reduce the ability of consumers to upgrade to newer devices optimized for EBPP experiences, potentially dampening overall adoption rates.

Meanwhile, high-tech firms are reevaluating global supply chains in response to rising duties, seeking to mitigate risk through repatriation of manufacturing and diversification into tariff-exempt regions. Semiconductor manufacturers and cloud infrastructure providers are accelerating domestic investments to offset inflated import costs, but these shifts require multi-year commitments and capital outlays. As a result, EBPP vendors dependent on offshore hardware and services may face onboarding delays for new billing modules and capacity constraints, challenging their ability to scale operations efficiently under the current tariff regime.

Key Segmentation Insights Revealing How Solution Components, Payment Methods, Deployment Models, Industry Verticals, and Organization Sizes Shape Market Dynamics

Within the solution component spectrum, presentation capabilities-encompassing web and mobile interfaces-claim a dominant position, accounting for the lion’s share of EBPP revenue. Providers have prioritized intuitive user journeys and multi-channel delivery options to meet consumer expectations for simplicity and accessibility. This focus on front-end excellence drives on-time payments and reduces customer support costs, reinforcing presentation services as a critical differentiator.

Examining payment methods reveals a diverse landscape that extends beyond traditional ACH and credit card options. Real-time payments have emerged as the fastest-growing segment, driven by the expansion of instant payment rails such as RTP and FedNow. Meanwhile, e-wallet integration continues its upward trajectory, offering seamless in-app payment experiences. Vendors capable of orchestrating multiple payment paths within a single EBPP platform are best positioned to capture varied consumer preferences and increase transaction completion rates.

Deployment models also shape market dynamics, with cloud-based solutions experiencing a 200% surge in adoption since 2020. Organizations favor cloud hosting for its scalability, continuous upgrades, and reduced capital expenditure, while hybrid architectures appeal to enterprises requiring a balance of on-premises control and cloud flexibility. Nevertheless, on-premises deployments retain relevance in highly regulated sectors where data residency and strict compliance mandates drive demand for localized infrastructure.

Industry verticals display distinct adoption patterns. The healthcare segment, propelled by stringent regulatory compliance and the imperative to streamline revenue cycles, registers the highest growth rate among all end markets. As providers navigate complex billing rules and patient payment journeys, EBPP platforms tailored to healthcare workflows deliver significant efficiency gains and improved patient satisfaction. Concurrently, BFSI and utilities maintain substantial volumes due to high billing frequencies and diverse payment mandates.

Organization size further influences EBPP deployment strategies. While large enterprises leverage extensive resources to implement end-to-end integrations and advanced analytics, small and medium-sized enterprises represent the fastest-growing user base. SMEs benefit from turnkey cloud offerings that minimize upfront investments and accelerate time to value, underscoring the importance of scalable, pay-as-you-go licensing in capturing this expanding segment.

This comprehensive research report categorizes the Electronic Bill Presentment & Payment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Solution Component

- Payment Method

- Deployment Model

- Industry Vertical

- Organization Size

Critical Regional Insights Highlighting Variations in Electronic Bill Presentment and Payment Adoption Across the Americas, EMEA, and Asia-Pacific

Analyzing regional footprints, the Americas sector demonstrates mature EBPP adoption, underpinned by robust digital banking infrastructure and high consumer expectations for seamless payment experiences. In North America alone, revenue exceeded $8.2 billion in 2024, while Latin America contributed another $0.9 billion, reflecting strong growth in both established and emerging markets. Providers in this region focus on multi-rail instant payments, mobile wallet integration, and enhanced security features to maintain competitive leadership.

In Europe, Middle East, and Africa (EMEA), regulatory frameworks such as GDPR and PSD2 have accelerated the standardization of secure EBPP practices. The region generated $5.4 billion in 2024, with robust adoption in utilities, telecommunications, and financial services. Meanwhile, Middle Eastern and African markets are rapidly embracing digital transformation initiatives, supported by government incentives and growing fintech ecosystems. Cross-border EBPP transactions have surged, indicating a trend toward regional interoperability and consolidated billing platforms.

The Asia-Pacific region recorded $4.1 billion in EBPP revenue in 2024, driven by high smartphone penetration and expanding internet accessibility in China, India, and Southeast Asia. Governments in the region are investing heavily in digital payment infrastructures, with national real-time payment systems complementing private offerings. Innovative use cases, such as embedded billing in super apps and e-commerce ecosystems, exemplify the region’s appetite for integrated, consumer-centric payment solutions. Rapid urbanization and rising middle-class cohorts further fuel demand for EBPP services, positioning APAC as the fastest-growing regional market segment.

This comprehensive research report examines key regions that drive the evolution of the Electronic Bill Presentment & Payment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Companies Insights Examining Leading Players, Strategic Initiatives, and Competitive Differentiators in the EBPP Ecosystem

The competitive landscape of EBPP is defined by a mix of established financial technology providers and agile fintech disruptors. Fiserv remains at the forefront with its comprehensive CheckFree RXP platform, serving nearly 4,000 institutions and leveraging integrated call-to-action notifications to enhance on-time payments and reduce operational complexities. Recent enhancements to BillMatrix® and multi-channel communication integrations demonstrate Fiserv’s commitment to delivering seamless, personalized billing experiences that drive digital adoption.

FIS is another leading player, focusing on strategic partnerships and embedded payment services. The company’s emphasis on real-time billing capabilities and open API frameworks enables financial institutions to introduce innovative features such as request-for-payment (RFP) and instant payroll disbursements. FIS continues to build on market feedback to refine user interfaces and expand ecosystem integrations, reinforcing its position as a key EBPP enabler.

Among specialized cloud-based providers, Paymentus has distinguished itself through robust growth and platform extensibility. The company reported a 48.9% year-over-year revenue increase in Q1 2025, processing 173.2 million transactions and achieving an adjusted EBITDA margin of 34.2%. Paymentus’s Instant Payment Network®, which includes cash bill pay capabilities and digital wallet integrations, has been recognized as best-in-class by leading industry analysts for its omni-channel reach and next-generation functionalities.

Emerging challengers such as ACI Worldwide and specialized vertical-focused vendors also contribute to innovation, offering targeted solutions for utilities, healthcare, and government sectors. These players differentiate through modular architectures, advanced analytics, and sector-specific compliance tooling, underscoring the diverse array of competitive strategies shaping the EBPP ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electronic Bill Presentment & Payment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACI Worldwide, Inc.

- Alacriti Inc.

- Bill.com Holdings, Inc.

- BlueSnap, Inc.

- Bottomline Technologies, Inc.

- Broadridge Financial Solutions, Inc.

- Checkout Ltd.

- CSG Systems International, Inc.

- Cubic

- Ebix Inc.

- FIS

- Fiserv, Inc.

- GoCardless Ltd.

- Ingenico Group SA

- Intuit Inc.

- Jack Henry & Associates, Inc.

- Mastercard Incorporated

- Oracle Corporation

- Paymentus Holdings Inc.

- PayPal Holdings, Inc.

- SAP SE

- Stripe, Inc.

- Visa Inc.

- Worldline SA

- Yapstone Inc.

Actionable Recommendations for Industry Leaders to Enhance Resilience, Drive Innovation, and Maximize Value in Electronic Bill Presentment and Payment Operations

To navigate the escalating complexities of global trade policies and maintain cost stability, EBPP providers should prioritize supply chain diversification. By expanding hardware sourcing to include tariff-exempt jurisdictions and strengthening partnerships with domestic manufacturers, organizations can mitigate the impact of import duties and secure consistent access to critical infrastructure components.

Implementing a multi-rail real-time payment strategy is essential for enhancing transaction resilience and meeting customer demands for instant settlement. Financial institutions and billers should integrate both private and public instant payment rails-such as RTP and FedNow-to optimize coverage, leverage complementary features, and ensure continuous service availability during peak loads or network disruptions.

Investing in AI-driven tools for billing optimization and fraud detection remains a top priority. Advanced machine learning models can analyze payment behavior patterns, segment customer profiles, and automate exception handling, unlocking operational efficiencies and reducing losses. Providers should allocate resources to scale these AI capabilities within their EBPP platforms to deliver more predictive, personalized billing journeys.

Bolstering cybersecurity measures through emerging technologies like blockchain can enhance data integrity and build trust with stakeholders. Implementing decentralized ledger solutions for transaction logging, identity verification, and smart contract–based billing events can reduce reconciliation times, minimize fraud risk, and support compliance initiatives.

Embracing sustainable billing practices and green computing will differentiate providers in an increasingly eco-conscious market. Strategies such as optimizing data center energy consumption, reducing paper-based processes, and quantifying environmental impact savings-over 2 million trees preserved through EBPP adoption in 2023-reinforce corporate responsibility and can attract environmentally aligned customers.

Comprehensive Research Methodology Outlining the Data Sources, Analytical Frameworks, and Validation Processes Underpinning the EBPP Market Study

This study leverages a rigorous, mixed-methods approach to deliver a comprehensive analysis of the electronic bill presentment and payment landscape. Secondary research involved a systematic review of industry publications, regulatory filings, vendor press releases, and leading financial news sources to map market trends and validate segment definitions.

Primary research included in-depth interviews and surveys with senior executives, IT decision-makers, and billing operations managers from diverse industries such as utilities, healthcare, financial services, and retail. Insights from these stakeholders provided qualitative context around adoption drivers, technology preferences, and integration challenges.

Quantitative data were triangulated through analysis of transaction volumes, pricing models, and deployment statistics obtained from vendor disclosures, trade associations, and real-time payment network operators. Cluster analysis and correlation techniques were utilized to identify key relationships among segmentation variables, while scenario modeling assessed the potential impact of macroeconomic factors, including tariff changes and digital payment policy shifts.

To ensure accuracy and reliability, findings were subjected to multi-tier peer review by industry experts and cross-referenced against publicly available financial data. This methodology underpins the depth and credibility of the strategic insights, market breakdowns, and recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electronic Bill Presentment & Payment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electronic Bill Presentment & Payment Market, by Solution Component

- Electronic Bill Presentment & Payment Market, by Payment Method

- Electronic Bill Presentment & Payment Market, by Deployment Model

- Electronic Bill Presentment & Payment Market, by Industry Vertical

- Electronic Bill Presentment & Payment Market, by Organization Size

- Electronic Bill Presentment & Payment Market, by Region

- Electronic Bill Presentment & Payment Market, by Group

- Electronic Bill Presentment & Payment Market, by Country

- United States Electronic Bill Presentment & Payment Market

- China Electronic Bill Presentment & Payment Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Conclusion Synthesizing Critical Findings and Forward-Looking Perspectives on the Evolution of Electronic Bill Presentment and Payment Services

The evolution of electronic bill presentment and payment is characterized by rapid technological advancements, shifting regulatory landscapes, and changing customer expectations. Providers that embrace AI-driven personalization, integrated real-time payment networks, and decentralized ledger innovations will gain a competitive edge while meeting rising demands for speed and security.

Segmentation analysis highlights the importance of tailored strategies across solution components, payment methods, deployment models, verticals, and organization sizes. As healthcare continues to lead growth, and SMEs emerge as a pivotal segment, vendors must balance customizable offerings with scalable architectures to capture diverse market needs.

Regional disparities underscore the necessity for localized approaches-leveraging established digital banking ecosystems in the Americas, navigating stringent compliance frameworks in EMEA, and capitalizing on mobile-first innovations in Asia-Pacific. Leading players like Fiserv, FIS, and Paymentus exemplify strategic differentiation through platform extensibility, multi-channel engagement, and robust analytics.

By adopting the recommended actions-diversifying supply chains, integrating multi-rail instant payments, scaling AI and blockchain solutions, and championing sustainability-industry leaders can fortify their market positions, drive operational efficiencies, and deliver compelling customer experiences. This report provides the foundational insights and practical guidance required to shape future-ready EBPP strategies and achieve sustained growth.

Engage with Ketan Rohom to Unlock Strategic Insights and Acquire the Complete Electronic Bill Presentment and Payment Market Research Report

To explore the full breadth of comprehensive insights, detailed analyses, and strategic recommendations presented in this market research report, reach out to Ketan Rohom, Associate Director, Sales & Marketing. Engage directly with Ketan to discuss tailored licensing options, obtain exclusive sample chapters, or arrange a personalized briefing. Whether you represent a financial institution, utility provider, technology vendor, or consulting firm, Ketan will guide you through the report’s methodologies, key findings, and actionable intelligence to support data-driven decision-making and competitive positioning. Secure your organization’s access to this essential resource and unlock a deep understanding of the electronic bill presentment and payment landscape-contact Ketan Rohom today to acquire the definitive market research report and begin transforming billing and payment strategies for sustained growth and resilience

- How big is the Electronic Bill Presentment & Payment Market?

- What is the Electronic Bill Presentment & Payment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?