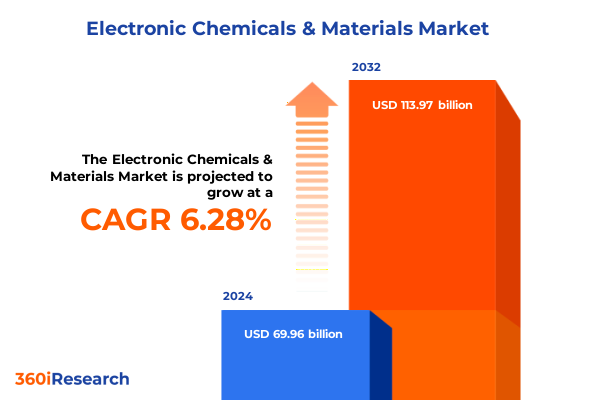

The Electronic Chemicals & Materials Market size was estimated at USD 74.15 billion in 2025 and expected to reach USD 78.66 billion in 2026, at a CAGR of 6.33% to reach USD 113.97 billion by 2032.

Setting the Stage for the Electronic Chemicals and Materials Market Landscape with Key Drivers, Stakeholders, and Emerging Innovations

In an era defined by relentless innovation and shifting global dynamics, understanding the foundational elements of the electronic chemicals and materials market is more critical than ever. This introduction offers a panoramic view of the core drivers propelling demand for specialized chemicals, elucidates the key stakeholder groups shaping industry trends, and highlights the emergent technologies redefining performance benchmarks. As semiconductor manufacturers pursue ever-finer process nodes and higher wafer throughput, the need for advanced cleaning agents, high-purity slurries, photoresists, etchants, and solvents has intensified beyond historical norms. Simultaneously, broader end users-from foundries that anchor high-volume production to assembly and test service providers-are demanding tailored chemistries that align with stringent quality standards and sustainability goals.

Moreover, this overview delineates the interplay between innovation ecosystems and regulatory frameworks that govern chemical handling, safety protocols, and environmental stewardship. By situating electronic chemicals within the larger context of integrated circuit manufacturing and packaging assembly, readers will gain clarity on how upstream R&D investments translate into downstream yield improvements and cost efficiencies. Through this comprehensive lens, stakeholders across the value chain can better anticipate potential disruptions, align cross-functional initiatives, and harness the full potential of next-generation materials to propel manufacturing excellence.

Unveiling the Catalysts of Change: How Technological Innovations and Sustainability Imperatives Are Transforming the Electronic Chemicals Ecosystem

The electronic chemicals and materials landscape has undergone transformative shifts, driven by an interplay of technological breakthroughs and evolving sustainability imperatives. Advanced patterning techniques such as extreme ultraviolet lithography have catalyzed the development of novel photoresist formulations and etchants capable of achieving sub-10 nanometer resolution. Concurrently, the migration to three-dimensional device architectures has intensified demand for precision slurries that ensure uniform planarization across complex topographies. These technological imperatives have not only elevated R&D investments but have also fostered collaborative frameworks between chemical suppliers, equipment manufacturers, and end users.

Parallel to these technical advances, environmental regulations and corporate sustainability commitments have reshaped procurement decisions. Chemical vendors are under pressure to reduce volatile organic compounds, adopt closed-loop recycling for solvents, and minimize wastewater effluents. In response, biosourced cleaning agents and recyclable formulations have moved from concept to commercial adoption. These developments underscore a broader shift from volume-driven consumption to value-centric chemistry, wherein lifecycle impact and supply chain transparency are as critical as performance metrics. Consequently, companies that integrate circular economy principles and demonstrate robust ESG performance are gaining preferential access to major OEMs and foundries, thereby redefining competitive leadership in this sector.

Assessing the Ripple Effects of 2025 US Tariff Policies on Electronic Chemicals and Materials Supply Chains and Cost Structures

In 2025, the United States implemented a new tranche of tariffs targeting key chemical and material imports, significantly altering global supply chain dynamics. These measures have introduced additional cost burdens on imported cleaning agents, specialized slurries, photoresists, etchants, and solvents, compelling domestic producers to adjust pricing strategies and source raw materials more locally. Such adjustments have reverberated across the industry, prompting companies to reassess supplier contracts, renegotiate long-term agreements, and explore dual-sourcing models to mitigate exposure to fluctuating duties.

As a direct consequence, end users have experienced increased procurement lead times and heightened volatility in unit costs. While some manufacturers have absorbed incremental expenses through productivity enhancements and process optimization, others have transferred costs downstream, potentially impacting profit margins. Furthermore, the tariff landscape has incentivized vertical integration, with several chemical suppliers investing in in-country production facilities and joint ventures to circumvent import barriers. Looking ahead, the cumulative impact of these policies underscores the necessity for agile supply chain frameworks and robust tariff management strategies. Stakeholders that proactively adapt to these changes will secure greater resilience and cost control in an increasingly protectionist trade environment.

Deconstructing Market Dynamics through Product, Purity, Form, Application, and End Use Industry Segmentation Insights

Insight into product-based dynamics reveals that cleaning agents, etchants, photoresists, and solvents each exhibit unique demand drivers, while CPM slurry gains prominence due to its critical role in chemical mechanical planarization and further segmentation across metal, nitride, and oxide variants. In parallel, purity grade distinctions underscore the premium placed on electronic grade and semiconductor grade chemistries, with ultra pure grade offerings catering to the most stringent defectivity requirements and advanced node applications. When examining product form, gas-phase precursors facilitate uniform deposition in complex reactor geometries, liquid chemistries enable adaptable process tuning across etch and clean cycles, and solid formulations offer stability and ease of handling for specific specialty applications.

Furthermore, application-centric considerations span the entire fabrication flow: high-efficiency cleaning protocols safeguard wafer integrity, precision deposition reagents form the foundation for thin films, advanced etchants sculpt device features, high-resolution lithography chemistries define circuit patterns, specialized formulations support packaging assembly, and planarization slurries ensure consistent surface planar profiles. End use segmentation highlights the influence of foundry operations on high-volume slurry and solvent consumption, integrated device manufacturers integrating vertical fabrication needs, logic device producers prioritizing novel photoresists, memory device manufacturers emphasizing yield-critical cleaning agents, and OSAT providers requiring robust chemistries for packaging and test readiness. Taken together, these segmentation insights illuminate the multifaceted drivers that shape product portfolios, supply chain strategies, and R&D priorities across the electronic chemicals and materials market.

This comprehensive research report categorizes the Electronic Chemicals & Materials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Purity Grade

- Product Form

- Application

- End-Use Industry

- Distribution Channel

Mapping Regional Trajectories: Comparative Analysis of the Americas, Europe Middle East Africa, and Asia-Pacific Electronic Chemicals Markets

The Americas continue to anchor a significant share of electronic chemicals consumption, driven by leading fab investments in the United States and high-growth demand centers in Canada and Mexico. Advanced node development in Arizona and Texas remains a focal point for cutting-edge chemistries, while strong institutional support for domestic manufacturing attracts new capacity deployments. In contrast, Europe, Middle East and Africa present a heterogeneous environment where regulatory stringency and sustainability mandates vary widely. Western European nations boast robust R&D clusters and stringent environmental controls, imposing higher compliance costs but fostering innovation in green chemistry. Meanwhile, emerging markets in the Middle East are beginning to explore local chemical production, leveraging petrochemical infrastructure to diversify into speciality materials.

Shifting focus to Asia-Pacific, this region stands at the forefront of wafer fab capacity expansion, with leading hubs in Taiwan, South Korea, Japan, and China driving voracious demand for advanced etchants, slurries, and photoresists. Rapid growth in China’s domestic semiconductor ecosystem and government incentives for local chemical production have intensified competition, prompting both global and regional suppliers to scale operations. Furthermore, regional supply chain interdependencies underscore the strategic importance of logistics infrastructure and trade policy stability. As a result, companies that optimize regional footprints and align production capacity with emerging demand corridors will gain a competitive edge in this dynamic market.

This comprehensive research report examines key regions that drive the evolution of the Electronic Chemicals & Materials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders and Innovators: Strategic Partnerships, R&D Investments, and Market Positioning among Key Companies

Industry leaders have adopted a range of strategic initiatives to consolidate their market positions and spur innovation. Major multinational suppliers are forging cross-border partnerships, co-developing next-generation photoresists with leading equipment manufacturers, and investing in localized production capacity to hedge against tariff uncertainties. In addition, several companies are channeling significant R&D budgets into bio-based surfactants, low-waste etchants, and reusable solvent systems, effectively differentiating their offerings through sustainability credentials and reduced total cost of ownership.

Moreover, technology startups specializing in precision fluorination chemistries and advanced nanoparticle-enabled slurry formulations are attracting venture investments and strategic acquisitions. These emerging players bring agility and niche expertise, enabling rapid prototyping and deployment of specialty materials for high-growth applications such as 5G infrastructure, power electronics, and advanced packaging. Collectively, these strategic maneuvers underscore a competitive environment characterized by innovation-led partnerships, targeted M&A activity, and a relentless pursuit of value-added product differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electronic Chemicals & Materials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Albemarle Corporation

- Avantor Inc.

- BASF SE

- Borregaard AS

- Celanese Corporation

- Daicel Corporation

- Daikin Industries Ltd.

- Eastman Chemical Company

- FUJIFILM Holdings Corporation

- Hitachi, Ltd.

- Honeywell International, Inc.

- Huntsman Corporation

- Ineos AG

- JSR Corporation

- Kanto Chemical Co., Inc.

- LANXESS AG

- Linde PLC

- L’AIR LIQUIDE S.A.

- Merck KGaA

- Mitsubishi Chemical Corporation

- Otto Chemie Pvt. Ltd.

- Shin-Etsu Chemical Co., Ltd.

- Sinochem Holdings Corporation Ltd.

- Solvay S.A.

- Songwon Industrial Co., Ltd.

- The Dow Chemical Company

Driving Strategic Action: Targeted Recommendations to Optimize Supply Chains, R&D Focus, and Competitive Positioning in Electronic Chemicals

To navigate the complex terrain of electronic chemicals and materials, industry leaders must prioritize supply chain resilience by diversifying raw material sources, establishing dual-tracking distribution agreements, and integrating digital tools for real-time tariff and lead-time monitoring. Concurrently, increasing investment in green chemistry R&D will future-proof product portfolios against tightening environmental regulations and meet the growing demand for sustainable solutions. By adopting modular production platforms and flex-capacity strategies, companies can rapidly pivot between product lines to address sudden shifts in node transitions or end use demand surges.

Furthermore, fostering deeper collaboration with foundry and IDM partners through joint development programs can accelerate the commercialization of next-generation chemistries and ensure seamless integration with fab processes. Senior leadership should also champion talent attraction and upskilling initiatives, securing specialized expertise in microfluidic deposition, nanoparticle synthesis, and advanced analytics. By implementing a data-driven governance framework for portfolio prioritization, organizations can allocate resources to high-impact projects while maintaining agility in resource reallocation. Taken together, these recommendations will fortify competitive positioning, drive sustained innovation, and deliver measurable returns on R&D investments.

Outlining a Robust Research Methodology: Integrating Primary Interviews, Secondary Data, and Analytical Frameworks for Market Accuracy

This research is underpinned by a dual-layered methodology combining qualitative primary insights with rigorous secondary data analysis. Primary research included in-depth interviews with senior R&D executives, procurement directors, process engineers, and regulatory experts across major semiconductor hubs in North America, Europe, and Asia-Pacific. These conversations provided nuanced perspectives on evolving process requirements, regulatory landscapes, and emerging material performance criteria. Meanwhile, secondary research involved exhaustive reviews of industry publications, technical white papers, patent filings, and corporate sustainability reports to triangulate findings and ensure comprehensive coverage.

Quantitative analysis leveraged a detailed segmentation framework spanning product type, purity grade, product form, application, and end use, with data points sourced from industry consortia, regulatory filings, and leading fab specifications. Analytical models were validated through feedback loops with domain specialists, ensuring the robustness of insights into supply chain dynamics and cost drivers. Furthermore, regional market sizing and growth pattern assessments were cross-verified using trade data, tariff schedules, and public financial disclosures. By integrating these methodologies into a cohesive research architecture, the report delivers both strategic foresight and operationally actionable intelligence for stakeholders across the electronic chemicals ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electronic Chemicals & Materials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electronic Chemicals & Materials Market, by Product Type

- Electronic Chemicals & Materials Market, by Purity Grade

- Electronic Chemicals & Materials Market, by Product Form

- Electronic Chemicals & Materials Market, by Application

- Electronic Chemicals & Materials Market, by End-Use Industry

- Electronic Chemicals & Materials Market, by Distribution Channel

- Electronic Chemicals & Materials Market, by Region

- Electronic Chemicals & Materials Market, by Group

- Electronic Chemicals & Materials Market, by Country

- United States Electronic Chemicals & Materials Market

- China Electronic Chemicals & Materials Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesizing Insights and Future Outlook: Concluding Perspectives on Growth Opportunities and Market Resilience in Electronic Chemicals

In summation, the electronic chemicals and materials market stands at a pivotal juncture, defined by technological strides and trade complexities that will shape the next generation of semiconductor manufacturing. The convergence of advanced node requirements, sustainability mandates, and regional trade policies underscores the importance of strategic agility and collaborative innovation. Stakeholders that internalize segmentation insights spanning product, purity, form, application, and end use will be better positioned to tailor offerings and capture high-growth opportunities.

Looking forward, supply chain resilience and green chemistry leadership will differentiate market champions from laggards. Investments in localized production footprints, digital tariff management, and modular manufacturing platforms will mitigate risk and accelerate time to market. Finally, continued collaboration between chemical suppliers, equipment OEMs, and end users will be essential to co-develop the next wave of materials that underpin 3D architectures, heterogeneous integration, and emerging applications beyond traditional logic and memory. Armed with these synthesized insights and strategic foresight, decision-makers can confidently navigate complexity and drive both operational efficiencies and sustainable growth.

Take the Next Step Today by Connecting with Ketan Rohom to Unlock In-Depth Electronic Chemicals Market Insights and Secure Your Competitive Edge

To gain unparalleled market intelligence and strategic foresight in the rapidly evolving electronic chemicals and materials landscape, reach out to Ketan Rohom, Associate Director, Sales & Marketing. Engage directly to explore tailored insights that will empower your organization to navigate complex supply chain disruptions, capitalize on emerging technological innovations, and refine investment strategies. By partnering with Ketan Rohom, you will unlock access to comprehensive data analytics, expert commentary, and actionable recommendations that drive sustainable growth and competitive differentiation. Don’t miss the opportunity to transform raw data into strategic advantage-contact Ketan Rohom today to secure your copy of the definitive market research report.

- How big is the Electronic Chemicals & Materials Market?

- What is the Electronic Chemicals & Materials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?