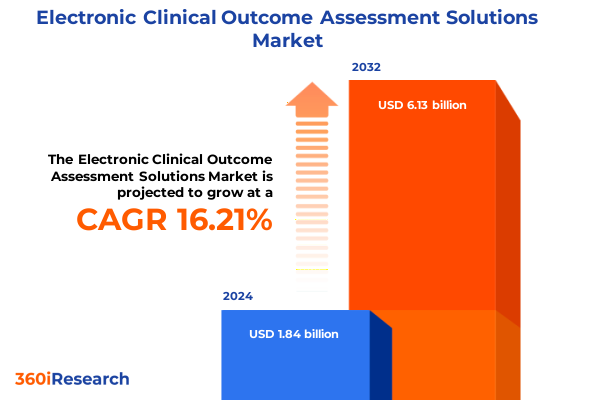

The Electronic Clinical Outcome Assessment Solutions Market size was estimated at USD 2.13 billion in 2025 and expected to reach USD 2.46 billion in 2026, at a CAGR of 16.29% to reach USD 6.13 billion by 2032.

Unveiling the Digital Evolution of Clinical Outcome Assessments Changing the Paradigm of Patient Data Collection and Trial Efficiency Worldwide

The landscape of clinical trials is undergoing a profound digital transformation as traditional pen-and-paper assessments give way to sophisticated electronic platforms. Electronic Clinical Outcome Assessment solutions have emerged as pivotal tools for capturing patient experiences and clinician observations with precision and efficiency. By integrating customizable interfaces and real-time data capture, stakeholders can overcome legacy challenges such as transcription errors, delayed data entry, and fragmented workflows. Consequently, these solutions are reshaping the way sponsors, investigators, and patients engage throughout the trial lifecycle.

Furthermore, the shift toward decentralized and hybrid trial models has amplified the importance of electronic data collection. As trials extend beyond centralized sites, remote monitoring capabilities and mobile interfaces have become indispensable. Patients benefit from more convenient participation, while sponsors gain broader demographic reach and enhanced retention rates. These developments reflect a broader industry movement toward patient-centric research, whereby the voices of trial participants are captured more authentically than ever before.

In addition, regulatory bodies across major markets have issued guidance to support the adoption of electronic assessments, signaling confidence in data integrity and security protocols. The convergence of technological innovation, regulatory endorsement, and evolving trial methodologies establishes a fertile environment for electronic solutions to flourish. As the industry embraces this digital evolution, stakeholders must understand the foundational trends driving adoption and the strategic imperatives for successful implementation.

Navigating the Wave of Technological Disruption and Regulatory Advances Redefining Electronic Clinical Outcome Assessments Across Stakeholders

Clinical research is witnessing a wave of transformative shifts driven by advancements in mobile technologies, artificial intelligence, and interoperability standards. Electronic Clinical Outcome Assessment platforms are no longer isolated tools but components of an integrated ecosystem that connects wearable sensors, electronic health records, and trial management systems. As digital technologies mature, the seamless exchange of data allows for deeper insights into patient health trajectories and more responsive trial adjustments.

Moreover, analytical capabilities have expanded through machine learning algorithms that can flag anomalies in real time, predictive modeling that anticipates patient drop-off risks, and natural language processing that interprets free-text responses. These advancements not only enhance data quality but also reduce manual oversight burdens, enabling clinical teams to focus on strategic decision making rather than routine data cleaning. Consequently, the research community can accelerate timelines and allocate resources with greater precision.

In parallel, stakeholder expectations have evolved. Trial sponsors demand platforms that offer modular architectures, allowing them to tailor assessments for diverse therapeutic areas and patient populations. Meanwhile, end user groups such as academic research centers and contract research organizations seek scalable solutions that support both cloud-based and on-premise deployments. Regulatory agencies in major regions continue to refine guidance on electronic data capture, reinforcing standards for audit trails, user authentication, and data encryption. Taken together, these forces are redefining the benchmarks for innovation, reliability, and user experience in electronic outcome assessment solutions.

Assessing the Ripple Effects of New United States Tariff Measures on Electronic Clinical Outcome Assessment Supply Chains and Cost Structures

The introduction of new tariff measures in 2025 has brought supply chain considerations into sharper focus for electronic clinical outcome assessment providers. Import duties on specialized hardware components such as tablets, sensors, and secure communication modules have led to adjustments in sourcing strategies. Consequently, some vendors have explored partnerships with domestic manufacturers to mitigate cost pressures and ensure consistent availability of critical devices.

Meanwhile, service providers offering software platforms have felt the ripple effects through increased operational expenses associated with data hosting and technical support infrastructures. Rising costs for server hardware and network equipment have prompted a re-assessment of deployment models, with several organizations accelerating migrations to cloud service providers that benefit from economies of scale. In doing so, they can distribute the impact of tariffs across a broader user base, preserving profitability and maintaining competitive pricing for end clients.

Moreover, insurers and sponsors managing trial budgets are scrutinizing total cost of ownership more closely, leading to a renewed emphasis on transparent pricing and flexible licensing arrangements. To stay ahead, vendors are increasingly bundling device procurement with long-term service agreements and offering multiyear support contracts at fixed rates. This approach not only shields customers from future tariff fluctuations but also bolsters vendor-client relationships through predictable financial planning. As the market adapts to these tariff dynamics, strategic collaboration and supply chain diversification have become essential pillars for sustaining growth and service excellence.

Delving into Defined Segmentation Dimensions to Reveal Strategic Electronic Clinical Outcome Assessment Market Opportunities and Stakeholder Value Paths

Insight into market segmentation reveals that the hardware and software offerings form the backbone of electronic outcome assessment solutions. While hardware components facilitate secure and reliable data capture, sophisticated software modules drive the core capabilities. Within the software realm, modules designed for clinician-reported outcomes prioritize structured input and decision support, whereas observer-reported solutions enable third-party evaluations with standardized eCRFs. Patient-reported instruments focus on user-friendly interfaces and adaptive questioning to enhance compliance, and performance outcome modules integrate quantitative measures from wearable devices and digital sensors.

Clinical trial phases also influence solution requirements, with early-stage studies favoring rapid deployment and high configurability to accommodate protocol adjustments, whereas later phases demand robust data management and integration with safety reporting systems. As trials advance from Phase I through Phase IV, the need for scalability and cross-study analytics increases, underscoring the value of platforms that can unify outcomes across multiple protocols.

Deployment mode is another critical vector, as cloud-based solutions offer speed of implementation and seamless updates, while on-premise deployments remain essential for organizations with stringent data residency or security policies. Furthermore, therapeutic area considerations shape feature sets: cardiovascular studies often require integration of ECG data and vital sign monitoring, neurology trials benefit from digital cognitive assessments, oncology sponsors seek patient symptoms tracking alongside biomarker data, and respiratory research hinges on pulmonary function measurements captured through connected devices.

Finally, end users from academic research centers to contract research organizations and pharmaceutical and biotechnology companies bring distinct priorities, ranging from cost sensitivity and interoperability to vendor support and regulatory compliance. Together, these segmentation dimensions provide a strategic foundation for vendors and stakeholders to tailor their offerings and optimize user experiences.

This comprehensive research report categorizes the Electronic Clinical Outcome Assessment Solutions market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Clinical Trial Phase

- Deployment Mode

- Therapeutic Area

- End User

Exploring Regional Dynamics and Adoption Drivers Across Americas Europe Middle East Africa and Asia Pacific for Optimal Global Implementation

Geographical nuances play a pivotal role in the adoption and implementation of electronic clinical outcome assessments. In the Americas, robust clinical trial infrastructures and favorable reimbursement frameworks have accelerated uptake of digital solutions across North and South America. Regulatory clarity and the presence of major pharmaceutical hubs drive demand for platforms that can support large-scale studies and real-time monitoring.

Across Europe, the Middle East, and Africa, diverse regulatory environments and varying levels of digital maturity present both challenges and opportunities. Countries with well-established e-health initiatives show high endorsement of electronic data capture, whereas emerging markets are gradually building digital capabilities through targeted pilot programs and regional collaborations. Harmonized standards such as GDPR and EMA guidelines further shape solution features, placing emphasis on data privacy, localized language support, and interoperability with national health systems.

In the Asia-Pacific region, rapid growth in clinical trial activity has coincided with government incentives for digital health innovation. Markets such as Japan, Australia, and South Korea lead in the adoption of mobile-enabled patient assessments, while China and India are investing heavily in cloud infrastructure and telemedicine to support decentralized trial models. Across the region, strategic alliances between global vendors and local service providers facilitate compliance with country-specific regulations and cultural nuances.

Taken together, these regional dynamics underscore the importance of flexible deployment options, multilingual interfaces, and robust security frameworks to ensure seamless integration across heterogeneous ecosystems and to capitalize on the distinct drivers in each geography.

This comprehensive research report examines key regions that drive the evolution of the Electronic Clinical Outcome Assessment Solutions market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Competitive Landscape and Innovative Leadership Strategies Driving Growth in the Electronic Clinical Outcome Assessment Ecosystem

In a competitive ecosystem marked by rapid innovation, leading providers are distinguishing themselves through strategic partnerships and technological differentiation. Companies offering end-to-end electronic outcome assessment suites have invested in AI-driven analytics to surface actionable insights and streamline trial operations. Others have focused on interoperability, ensuring seamless integration with third-party EDC systems, CTMS platforms, and patient engagement portals to create holistic trial environments.

Moreover, select vendors have strengthened their market position by expanding into adjacent service areas such as mobile health monitoring, virtual site visits, and regulatory consulting. By coupling software capabilities with bespoke implementation services, these organizations assist clients in navigating complex compliance landscapes and optimizing protocol design. Their investments in user experience research have also yielded intuitive interfaces that drive higher patient engagement and adherence rates.

Additionally, the emergence of niche providers specializing in specific therapeutic assessments-such as digital cognitive tests for neurology trials or remote spirometry for respiratory studies-reflects a broader trend toward vertical integration of clinical endpoints. These specialized offerings complement broader suites and provide clients with tailored solutions that address unique protocol requirements.

Taken together, the competitive landscape is characterized by a blend of established global players and agile innovators. Success hinges on the ability to balance comprehensive functionality with flexibility, delivering secure, scalable, and user-centric solutions that meet the evolving needs of sponsors, CROs, and research sites alike.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electronic Clinical Outcome Assessment Solutions market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 4G Clinical

- ArisGlobal LLC

- Clario, Inc.

- Climedo Health GmbH

- ClinCapture, Inc.

- Clinical Ink, Inc.

- Clinion Inc.

- Cloudbyz Inc.

- CRF Health Group Ltd

- Curebase, Inc.

- eClinical Solutions LLC

- EvidentIQ Group GmbH

- IBM Corporation

- ICON PLC

- IQVIA Inc.

- Kayentis Medidata Solution, Inc.

- Medable, Inc.

- Medidata Solutions, Inc.

- MedNet, Inc.

- Merative L.P.

- Obvio Health USA, Inc.

- Oracle Corporation

- Paraxel International Corporation

- Signant Health

- TransPerfect Global, Inc.

- Veeva Systems Inc.

- YPrime, Inc.

Strategic Action Plans for Industry Leaders to Leverage Advanced Technologies and Partnerships in Elevating Electronic Clinical Outcome Assessment Practices

To capitalize on emerging opportunities, industry leaders should prioritize the development of modular platforms that support rapid configuration and seamless integration with existing clinical trial infrastructures. By leveraging open APIs and adhering to interoperability standards, organizations can reduce implementation timelines and foster collaborative ecosystems that span sponsors, CROs, and technology partners. Furthermore, investing in advanced analytics capabilities and real-time dashboards will enable proactive risk mitigation and enhance decision making throughout the trial lifecycle.

In addition, forging strategic alliances with device manufacturers and data orchestration specialists can ensure reliable end-to-end data flows from patient to sponsor. These partnerships facilitate early identification of technical issues and drive continuous performance improvements. Leaders should also consider hybrid deployment models that combine the agility of cloud-based services with the security and regulatory compliance of on-premise installations, catering to organizations with diverse operational mandates.

Moreover, an unwavering commitment to the patient experience remains essential. Incorporating user-centered design principles, multilingual support, and adaptive assessment schedules will foster higher retention and data quality. Training programs for site staff and comprehensive change management plans can accelerate adoption and reduce resistance.

Finally, maintaining a proactive stance on evolving regulatory requirements-through dedicated compliance teams and participation in industry working groups-will ensure that solutions remain aligned with global standards and best practices. By executing these strategic actions, industry leaders can secure a competitive advantage and deliver meaningful value to all stakeholders.

Unveiling the Rigorous Multimodal Research Framework and Data Validation Processes Underpinning Insights into Electronic Clinical Outcome Assessment Markets

The foundation of this research is built on a rigorous multimodal framework, combining primary and secondary data collection methods to ensure comprehensive and balanced insights. Primary research involved in-depth interviews with stakeholders across pharmaceutical companies, CROs, academic research centers, and technology vendors, capturing qualitative perspectives on adoption drivers, operational challenges, and feature preferences.

Secondary research encompassed the systematic review of regulatory guidance documents, industry white papers, and scholarly publications to validate market trends and technology advances. Key sources included published best practice guidelines from major regulatory bodies, vendor technical manuals, and peer-reviewed studies on digital assessment methodologies. Triangulation of insights across these sources and cross-verification with real-world implementation case studies strengthened the validity of findings.

Quantitative data points were corroborated through anonymized usage statistics provided by leading platform providers, ensuring that reported adoption patterns and deployment breakdowns reflect current market realities. Data validation processes included consistency checks, outlier analysis, and peer review by subject matter experts to identify and rectify any discrepancies.

In addition, an iterative review cycle involving independent analysts and industry advisors was employed to refine the research framework, adapt to emerging trends, and enhance the comprehensiveness of market segmentation. This methodological rigor underpins the credibility and reliability of the strategic insights presented in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electronic Clinical Outcome Assessment Solutions market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electronic Clinical Outcome Assessment Solutions Market, by Offering

- Electronic Clinical Outcome Assessment Solutions Market, by Clinical Trial Phase

- Electronic Clinical Outcome Assessment Solutions Market, by Deployment Mode

- Electronic Clinical Outcome Assessment Solutions Market, by Therapeutic Area

- Electronic Clinical Outcome Assessment Solutions Market, by End User

- Electronic Clinical Outcome Assessment Solutions Market, by Region

- Electronic Clinical Outcome Assessment Solutions Market, by Group

- Electronic Clinical Outcome Assessment Solutions Market, by Country

- United States Electronic Clinical Outcome Assessment Solutions Market

- China Electronic Clinical Outcome Assessment Solutions Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing Critical Discoveries and Future Direction Opportunities in Electronic Clinical Outcome Assessment for Informed and Strategic Decision Making

Through the synthesis of technological, regulatory, and commercial insights, this analysis elucidates the pivotal factors shaping electronic clinical outcome assessment solutions. Key discoveries highlight the importance of integrated ecosystems, where data flows seamlessly between devices, platforms, and stakeholders, fostering more responsive and efficient trial designs. Additionally, the emergence of AI-enabled analytics stands out as a transformative enabler for risk-based monitoring and adaptive trial methodologies.

Future directions point toward deeper personalization of assessment pathways, leveraging patient-generated health data and wearable technologies to capture real-world evidence beyond the confines of traditional sites. As regulatory agencies continue to endorse decentralized approaches, the market is poised to embrace hybrid models that balance remote participation with essential site-based activities.

Moreover, the ongoing shift toward value-based healthcare underscores the need for outcome assessments that not only meet clinical endpoints but also demonstrate patient quality-of-life improvements. Solutions that can bridge clinical data with electronic medical records and post-market surveillance systems will gain a competitive edge.

By aligning strategic planning with these emerging themes, stakeholders can navigate the evolving landscape with confidence, ensuring that investments in electronic outcome assessment platforms yield lasting benefits for patients, researchers, and the broader healthcare ecosystem.

Drive Impactful Outcomes Today by Connecting with Ketan Rohom for Exclusive Electronic Clinical Outcome Assessment Research Insights and Tailored Solutions

To engage decision makers seeking cutting-edge data and actionable insights in electronic clinical outcome assessments, reach out to Ketan Rohom for a tailored consultation and discover how comprehensive research can elevate your strategy. Take the next step toward optimizing trial outcomes by securing a customized briefing that aligns with your organization’s unique challenges and objectives. Ketan Rohom, Associate Director of Sales & Marketing, stands ready to guide you through the nuanced findings and demonstrate how the report’s in-depth analyses can translate into measurable value. Don’t miss the opportunity to differentiate your approach and accelerate innovation in patient-centric data collection solutions. Contact Ketan today to arrange a personalized presentation and explore exclusive access options that will empower your team with the intelligence needed to lead in this dynamic market

- How big is the Electronic Clinical Outcome Assessment Solutions Market?

- What is the Electronic Clinical Outcome Assessment Solutions Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?