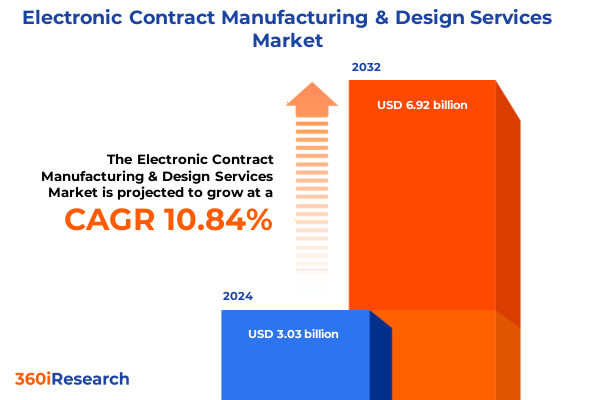

The Electronic Contract Manufacturing & Design Services Market size was estimated at USD 3.32 billion in 2025 and expected to reach USD 3.65 billion in 2026, at a CAGR of 11.02% to reach USD 6.92 billion by 2032.

Unveiling the dynamic transformation of electronic manufacturing partnerships in response to global digitalization and supply chain resilience demands

Electronic contract manufacturing and design services have entered an era defined by heightened complexity and accelerated innovation. Organizations face the challenge of balancing rapid product development cycles with ever-stricter quality and regulatory requirements, while simultaneously managing global supply chain disruptions. As a result, the partnership model between original equipment manufacturers and service providers has evolved beyond traditional outsourcing, demanding seamless integration of design expertise, engineering support, and scalable production capabilities.

This paradigm shift has been propelled by digital transformation initiatives that infuse advanced analytics and real-time visibility into every stage of the product lifecycle. These capabilities enable stakeholders to anticipate production bottlenecks, optimize material flow, and adapt swiftly to design alterations. It also underscores the critical importance of resilience: the ability to weather geopolitical tensions, raw material shortages, and fluctuating demand with minimal downtime. By embracing this holistic approach, industry leaders can not only safeguard continuity but also unlock new avenues for innovation and differentiation.

In this context, the present report delivers a panoramic view of the electronic contract manufacturing and design services sector, unpacking emerging trends, regulatory headwinds, and strategic imperatives. It equips decision-makers with the insights needed to forge stronger collaborative models, leverage advanced technology investments, and position their organizations for sustainable success against a backdrop of relentless market evolution.

Charting the rise of automation, digital twin, and sustainable practices reshaping electronic manufacturing design services in a rapidly evolving industry

The landscape of electronic manufacturing services has been fundamentally reshaped by a convergence of technological breakthroughs and market imperatives. Automation, once confined to high-volume assembly lines, now permeates prototyping and testing environments, driving unprecedented throughput and consistency. Simultaneously, digital twin technology has emerged as a cornerstone for virtual commissioning, allowing engineers to simulate factory layouts and process flows with pinpoint accuracy before physical deployment.

Environmental sustainability has also transitioned from a compliance obligation to a core driver of strategic investment. The integration of eco-friendly materials, waste-minimization practices, and renewable energy sources into manufacturing facilities not only reduces carbon footprints but also meets the rising expectations of brand-conscious end customers. Furthermore, additive manufacturing techniques now complement traditional assembly processes, accelerating time-to-market for specialized components while reducing tooling costs.

Together, these transformative forces are redefining the contours of competitiveness. Firms that harness data-driven decision-making, foster collaborative ecosystems with technology partners, and embed sustainability at the heart of their operations will emerge as the architects of next-generation electronic products.

Analyzing the significant repercussions of newly implemented United States tariffs on electronic contract manufacturing operations and strategic repositioning

Since early 2023, the introduction and subsequent escalation of tariffs on electronic components and subassemblies have exerted measurable pressure on procurement strategies and cost structures within the United States. These measures, aimed at protecting domestic industries, have compelled original equipment manufacturers and contract providers to reassess their sourcing footprints and absorb higher input expenses. The ripple effects have been particularly acute for parts historically imported from East Asia, prompting a wave of contract renegotiations and supplier diversification initiatives.

Confronted with these headwinds, many organizations have accelerated near-shoring efforts, consolidating production closer to end markets to mitigate tariff exposure. While this approach enhances supply chain visibility and shortens lead times, it also necessitates investment in local infrastructure and skills development. Consequently, service partners are channeling resources into facility upgrades, workforce training programs, and strategic alliances to fill the capability gaps that arise during this transition.

Moreover, the added cost burden has reinforced the imperative for lean process optimization and advanced quality control systems. By leveraging inline inspection technologies and predictive maintenance, manufacturers can offset tariff-driven cost increases through yield improvements and reduced scrap rates. Overall, the 2025 tariff landscape has catalyzed a strategic recalibration and highlighted the value of operational agility within electronic contract manufacturing and design services.

Diving into critical service types and application-driven dynamics that delineate diverse opportunities across electronic manufacturing segments

A nuanced understanding of service types and end-use applications is essential for identifying the most promising avenues in electronic manufacturing. Within the service spectrum, Assembly & Packaging operations are transitioning toward smart lines that integrate robotics and advanced vision systems to handle complex board assemblies. Final Assembly & System Integration functions have evolved to accommodate multi-board platforms, necessitating robust testing protocols and streamlined logistics. Printed Circuit Board Fabrication remains the foundational process, yet it now incorporates high-density interconnect (HDI) methods and embedded components to cater to miniaturization trends. Prototyping services have become a critical accelerator for design validation, leveraging rapid tooling and additive manufacturing to compress development timelines. Testing & Inspection has likewise advanced, using automated optical inspection (AOI) and X-ray inspection to ensure compliance with stringent reliability standards.

On the application front, Aerospace & Defense platforms, spanning both Commercial and Defense segments, prioritize system reliability, traceability, and qualification processes that exceed typical consumer benchmarks. Automotive electronics demand robust thermal management and stringent electromagnetic compatibility testing. Within Computing & Peripherals, Desktops & Servers benefit from modular architectures, while Laptops & Notebooks require sophisticated thermal packaging and miniaturized power solutions. Consumer Electronics segments-Smartphones, Tablets, and Wearables-drive continuous innovation in flexible substrates and low-power circuitry. The Energy & Power sector focuses on grid inverters and battery management systems, merging power electronics expertise with safety certifications. Healthcare devices, from diagnostic equipment to wearable monitors, impose rigorous biocompatibility and sterilization standards. Industrial applications, including Machinery and Robotics, emphasize durability under harsh operating conditions and integrated sensor arrays. Telecommunications infrastructure, spanning Networking Equipment and Wireless Infrastructure, increasingly integrates 5G-ready modules and optical backhaul components. The interplay of these service and application factors reveals diverse opportunity pockets shaped by performance requirements, regulatory considerations, and technology roadmaps.

This comprehensive research report categorizes the Electronic Contract Manufacturing & Design Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Technology Type

- Application

- End User

Exploring regional growth catalysts and strategic imperatives defining market developments across the Americas, EMEA, and Asia-Pacific landscapes

Regional landscapes exhibit distinct drivers and constraints that shape strategic imperatives for market participants. In the Americas, proximity to major automotive and aerospace hubs has spurred investments in advanced assembly lines and integrated testing centers. Government incentives aimed at enhancing domestic semiconductor and electronics manufacturing capacity further amplify incentive structures for near-shoring projects. These factors converge to foster a climate of innovation and resilience, allowing service providers to deliver localized solutions with faster turnaround times.

Across Europe, Middle East & Africa, the convergence of stringent environmental regulations and a rich defense procurement pipeline generates a dual focus on sustainability and security. Manufacturers are increasingly embedding circular economy principles into their operations, leveraging remanufacturing and component reclamation to comply with EU regulations while maintaining cost efficiency. Simultaneously, the region’s diverse geopolitical landscape necessitates agile risk management frameworks to address trade barriers and regional policy fluctuations.

In Asia-Pacific markets, robust production ecosystems continue to benefit from scale economies and deep supplier networks. Yet rising labor costs and regulatory scrutiny are prompting a shift toward automation and skill-based workforce development. Emerging Southeast Asian hubs are gaining traction as supplementary nodes for electronics manufacturing, offering cost-competitive alternatives that balance quality and capacity. Collectively, these regional dynamics underscore the need for adaptable strategies that align manufacturing footprints with evolving customer demands and policy landscapes.

This comprehensive research report examines key regions that drive the evolution of the Electronic Contract Manufacturing & Design Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling pioneering industry stakeholders and their differentiated strategies driving competitive advantage in electronic contract manufacturing

The competitive arena is defined by a select group of service providers that differentiate themselves through technological prowess, geographic reach, and strategic partnerships. Leading firms have expanded their digital capabilities by integrating cloud-based execution systems and advanced analytics into production workflows, thereby delivering end-to-end transparency for clients. Simultaneously, several providers have forged alliances with specialized technology vendors to co-develop proprietary automation solutions and accelerate the deployment of smart factories.

Geographical diversification strategies are another key differentiator. Industry stakeholders have established multi-continent manufacturing networks that mitigate single-region exposure and add resilience against localized disruptions. In parallel, sustainability commitments have transitioned from aspirational to operational, with top firms publicly disclosing circularity goals and emission-reduction milestones. Finally, talent development programs and center-of-excellence initiatives enable companies to cultivate specialized skill sets in areas such as advanced inspection, embedded software integration, and high-speed digital circuit design. These collective insights illuminate the evolving playbook employed by market leaders to maintain a competitive edge.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electronic Contract Manufacturing & Design Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Benchmark Electronics, Inc.

- Cal‑Comp Electronics Public Company Limited

- Celestica Inc.

- Creation Technologies LP

- Dixon Technologies (India) Limited

- Enics AG

- Etron Technology, Inc.

- Fabrinet Ltd.

- Flex Ltd.

- Hon Hai Precision Industry Co., Ltd.

- Jabil Inc.

- Kaga Electronics Co., Ltd.

- Kimball Electronics, Inc.

- Kitron ASA

- lexus Corporation

- Plexus Corp.

- Sanmina Corporation

- Scanfil Oyj

- SIIX Corporation

- Venture Corporation Limited

- Zollner Elektronik AG

Empowering industry leaders with practical strategic initiatives to optimize operations and harness emerging trends in electronic manufacturing services

To thrive in a landscape marked by rapid technological change and regulatory complexity, industry leaders must embrace a multi-pronged strategic agenda. First, investment in digital transformation initiatives is paramount. By deploying AI-enabled quality control and predictive maintenance solutions, organizations can preempt equipment failures and elevate yield rates while reducing operational expenditures.

Simultaneously, sustainability must be embedded into core processes. This involves integrating eco-friendly materials, optimizing energy consumption across production lines, and establishing circular supply chains. Such actions not only align with regulatory mandates but also resonate with end-users who increasingly prioritize environmentally responsible partners. Supply chain diversification remains another critical pillar. Engaging with multiple sourcing geographies and establishing strategic buffer inventories can mitigate tariff impacts and geopolitical disruptions, thereby safeguarding continuity.

Furthermore, fostering collaborative ecosystems with technology innovators can accelerate the adoption of next-generation manufacturing methods such as additive electronics and digital twin-driven factory planning. Finally, fortifying organizational capabilities through targeted workforce training and cross-functional knowledge sharing ensures that teams are equipped to navigate emerging challenges. Collectively, these recommendations deliver a roadmap for operational excellence and long-term resilience.

Outlining rigorous research techniques and data validation processes that underpin comprehensive electronic manufacturing services market analysis

This research integrates both primary and secondary data collection methods to ensure a robust and comprehensive analysis of the electronic contract manufacturing sector. Primary research involved in-depth interviews with senior executives, design engineers, and procurement leaders across a range of end-use industries. These qualitative insights were systematically triangulated with quantitative findings obtained from publicly available corporate filings, industry association reports, and government publications.

Secondary research encompassed a thorough review of academic journals, whitepapers, and conference proceedings, focusing on emerging technologies and regulatory developments. Data validation processes included cross-referencing information across multiple sources and applying consistency checks to reconcile any discrepancies. Where possible, proprietary datasets on facility capacities, workforce distributions, and regional trade flows were incorporated to contextualize macro-level trends.

Analytical techniques ranged from thematic content analysis of expert interviews to scenario-based modeling, providing both depth of insight and flexibility to explore potential future developments. This rigorous methodology underpins the credibility of the findings and supports strategic decision-making for stakeholders seeking to navigate the complexities of electronic manufacturing and design services.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electronic Contract Manufacturing & Design Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electronic Contract Manufacturing & Design Services Market, by Service Type

- Electronic Contract Manufacturing & Design Services Market, by Technology Type

- Electronic Contract Manufacturing & Design Services Market, by Application

- Electronic Contract Manufacturing & Design Services Market, by End User

- Electronic Contract Manufacturing & Design Services Market, by Region

- Electronic Contract Manufacturing & Design Services Market, by Group

- Electronic Contract Manufacturing & Design Services Market, by Country

- United States Electronic Contract Manufacturing & Design Services Market

- China Electronic Contract Manufacturing & Design Services Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Concluding insights highlighting strategic imperatives and future trajectories within the evolving electronic contract manufacturing and design services sector

As the electronic contract manufacturing and design services sector continues its trajectory of rapid innovation and strategic realignment, organizations must remain vigilant to shifting technological paradigms and policy environments. The rise of automation and digital twin platforms underscores the need to embed advanced analytics into every layer of production. Concurrently, sustainability and supply chain resilience have emerged as non-negotiable imperatives, influencing investment decisions and partnership models alike.

Segmentation dynamics reveal that service lines ranging from assembly and prototyping to system integration and testing are all being reimagined to support miniaturization, complexity, and speed. Across applications-from defense systems to consumer wearables-differentiation is driven by the ability to deliver specialized capabilities at scale, underpinned by robust quality assurance frameworks. Regionally, the push toward near-shoring in the Americas, regulatory harmonization in EMEA, and automation investments in Asia-Pacific demonstrate that geographic agility will remain a key success factor.

In this environment, the path forward demands a balanced investment portfolio-one that accelerates digital and sustainable transformation while preserving the flexibility to adapt to tariff fluctuations and shifting customer requirements. With these strategic imperatives in focus, stakeholders can confidently navigate the complexities of electronic manufacturing and design services, unlocking new value and competitive advantage.

Connect with Ketan Rohom to access the full market research report and unlock strategic insights driving your electronic manufacturing growth

To engage directly with expert insight and secure access to the comprehensive market research report, readers are encouraged to connect with Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings extensive industry knowledge and can guide prospective clients through tailored solutions that align with their strategic objectives. By partnering with him, organizations can gain customized intelligence, explore licensing options, and fast-track decision-making processes. Reach out to explore how the findings of this study can be operationalized to drive competitive advantage and sustainable growth in electronic contract manufacturing and design services.

- How big is the Electronic Contract Manufacturing & Design Services Market?

- What is the Electronic Contract Manufacturing & Design Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?