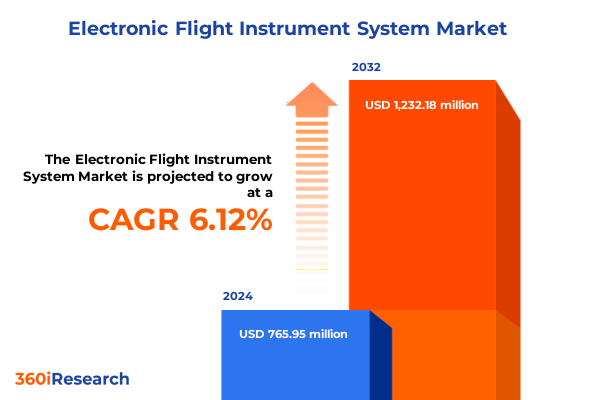

The Electronic Flight Instrument System Market size was estimated at USD 176.38 million in 2025 and expected to reach USD 195.61 million in 2026, at a CAGR of 11.19% to reach USD 370.71 million by 2032.

Setting the Stage for Next-Generation Avionics Evolution: Unveiling the Critical Role of Electronic Flight Instrument Systems in Modern Aviation

Electronic Flight Instrument Systems (EFIS) have redefined how flight data is synthesized and presented to pilots, marking a pivotal shift from analog gauges to integrated digital displays. As cockpit real estate has evolved, the transition to glass cockpit environments has become foundational to enhancing situational awareness, reducing pilot workload, and streamlining decision-making. This executive summary delves into the core functions of EFIS, illustrating how primary flight displays, multi-function displays, and engine indicating and crew alerting systems converge to create a cohesive operational picture.

By converging critical parameters such as attitude, altitude, airspeed, navigation, and system health onto high-resolution liquid crystal or light-emitting diode screens, EFIS solutions have propelled aviation into a new era of safety and efficiency. Pilots now benefit from customizable display configurations, trend analysis capabilities, and integrated alerts that were previously unattainable with traditional electromechanical instruments. Consequently, airlines, business jet operators, rotorcraft fleets, and military aviators are aligning their cockpit modernization strategies with EFIS adoption to meet stringent regulatory mandates and competitive pressures.

As connectivity solutions mature, EFIS components interface seamlessly with onboard data networks, enabling predictive maintenance workflows and in-flight performance analytics. Moreover, increasing interoperability with unmanned aerial systems and urban air mobility platforms underscores the adaptability of EFIS architectures across diverse aircraft categories. This introduction establishes the foundation for exploring transformative trends, segmentation insights, and actionable recommendations that will guide industry leaders in capitalizing on the expanding digital cockpit frontier.

Navigating a Paradigm Shift in Avionics Architecture as Digital Integration and Advanced Display Technologies Redefine Pilot Interfaces

The EFIS landscape has undergone a profound transformation as digital integration and advanced display technologies reshape cockpit workflows. Initially rooted in cathode ray tube configurations, modern screens leverage high-definition liquid crystal and ultra-efficient light-emitting diode backlighting to deliver crisp imagery under varied lighting conditions. This evolution has enabled the convergence of primary flight display functions with multi-function display capabilities, consolidating critical flight, navigation, engine, and alerting information within a unified graphical framework.

With the rise of next-generation processors and scalable architectures, EFIS modules now support dynamic graphical overlays, synthetic terrain imagery, and interactive charting tools that empower pilots to anticipate and respond to flight path deviations and weather phenomena. Furthermore, the integration of touchscreen interfaces and customizable control logic has democratized cockpit management, allowing for rapid system reconfiguration tailored to mission profiles, from regional turboprop operations to high-performance military sorties. These shifts have not only optimized human-machine interaction but also bolstered compliance with evolving safety standards.

Additionally, the convergence of EFIS with integrated satellite communications and wireless avionics networks is paving the way for distributed cockpit solutions, where supplemental displays and remote monitoring systems complement primary screens. This approach promises to further mitigate pilot workload while ensuring redundancy across safety-critical systems.

In parallel, emerging connectivity protocols enable real-time data exchange between flight decks and ground-based analysis platforms, catalyzing proactive maintenance regimes. As a result, manufacturers and operators are directing research and development investments towards modular EFIS platforms that can accommodate future sensor expansions, enhanced cybersecurity measures, and scalable display architectures. Ultimately, this transformative wave of digital integration is redefining the core tenets of avionics design, forging a new paradigm for flight deck innovation.

Assessing the Ripple Effects of Recent U.S. Tariff Measures on Electronic Flight Instrument System Supply Chains and Cost Structures in 2025

In 2025, the imposition of additional tariff levies on select avionics components and raw materials has introduced new complexities into the EFIS supply chain. With duties applied to imported display assemblies and semiconductor chips, manufacturers have confronted elevated procurement costs, prompting a reevaluation of sourcing strategies. The cumulative impact of these tariffs has reverberated through tier one suppliers, who now face pressure to absorb increased expenses or pass them down to aircraft OEMs and aftermarket service providers.

Consequently, industry stakeholders have accelerated initiatives aimed at nearshoring critical subcomponent production and diversifying supplier networks across lower-tariff jurisdictions. As an immediate response, several display module producers have established secondary fabrication sites in North America and regional partnerships in Mexico to mitigate exposure to punitive customs duties. This strategic shift has not only reduced transit times but also enhanced supply chain resilience against further policy volatility. In addition, a parallel emphasis on standardizing modular design elements has enabled greater interchangeability among EFIS platforms, thus offsetting some of the cost escalation associated with customs adjustments.

Moreover, the tariff landscape has catalyzed collaborative R&D efforts focused on alternative materials and next-generation electronic substrates that can maintain performance benchmarks while circumventing duty classifications. Although these transitions demand upfront investment, they promise longer-term stability in cost structures and regulatory compliance. Looking ahead, industry leaders must continue to monitor trade policy developments and integrate flexible procurement frameworks to safeguard both profitability and operational continuity.

Uncovering Strategic Segmentation Insights to Illuminate Diverse Market Dynamics across Aircraft Types Display Technologies and End-User Preferences

A nuanced understanding of the EFIS market emerges through a layered segmentation approach that reflects the diversity of aircraft platforms and operational demands. Aircraft classifications range from corporate-owned business jets, which span lightweight, midsize, and large-cabin variants, to high-capacity commercial airliners differentiated by narrow-body and wide-body configurations. Simultaneously, the sector encompasses rotary-wing platforms, including utility and attack helicopters, as well as military-grade fighter jets and tactical transports. Regional turboprop and turbofan aircraft further illustrate how seating capacity and mission profiles drive distinct avionics requirements.

Display technology choices similarly carve out discrete market niches, evolving from legacy cathode ray tube systems toward liquid crystal and cutting-edge light-emitting diode panels. Meanwhile, EFIS architectures themselves split into functional types that include electronic horizontal situation indicators, engine monitoring and alerting suites, multifunction graphical interfaces, and primary flight attitude presentations. End users span original equipment manufacturers and tier-one avionics suppliers, along with commercial cargo and passenger airline operators, and defense branches such as air forces and naval aviation units. Each stakeholder group balances certification mandates, performance objectives, and lifecycle support considerations.

Finally, the market diverges along integration parameters, contrasting fully integrated EFIS architectures that consolidate flight, navigation, and system alerts against standalone units designed for retrofit and specialized mission enhancements. Through the interplay of these segmentation lenses, decision-makers can align product roadmaps and customer engagement strategies with evolving operational scenarios. By recognizing how display modality, aircraft class, system functionality, end-user context, and integration level intersect, manufacturers and service providers can tailor offerings to segmented needs, enhancing market penetration and lifecycle value.

This comprehensive research report categorizes the Electronic Flight Instrument System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Aircraft Type

- Display Technology

- Efis Type

- Integration

- End User

Exploring Regional Growth Trajectories in the Americas Europe Middle East Africa and Asia-Pacific to Reveal Distinct Adoption Patterns

The Americas continue to serve as a leading epicenter for EFIS adoption, propelled by a robust presence of business jet operators, regional airline networks, and substantial military modernization initiatives. North American OEMs and aftermarket integrators invest heavily in digital cockpit upgrades to enhance safety compliance and reduce pilot burden. Latin American carriers, while more price-sensitive, increasingly retrofit legacy turboprops and regional jets with modular display upgrades to satisfy performance mandates and extend aircraft lifecycles. This dynamic underpins a steady pipeline of program renewals and retrofit contracts across the hemisphere.

Across Europe, the Middle East, and Africa, varied regulatory frameworks and defense procurement cycles shape EFIS deployment patterns. Western European nations emphasize interoperability and compliance with stringent air traffic management directives, driving demand for standardized primary and multifunction displays. The Middle Eastern market, buoyed by fleet expansions in Gulf-based carriers and significant defense spending, prioritizes high-end integrated avionics suites that can support both commercial and military platforms. African operators, constrained by infrastructure limitations, often favor standalone EFIS retrofits to enhance navigational capabilities on turboprop and narrow-body services, balancing cost-effectiveness with incremental performance gains.

In the Asia-Pacific region, rapid growth in passenger air travel and defense modernization programs fuels a broad spectrum of EFIS requirements. Southeast Asian airlines pursue seamless integration of flight deck systems to optimize route networks and maintenance turnarounds, while Australia and Japan invest in advanced cockpit solutions to bolster regional connectivity and joint operations. Additionally, the burgeoning urban air mobility initiatives in China and India create nascent demand for lightweight, modular EFIS configurations tailored to next-generation rotorcraft and eVTOL demonstrators. Collectively, these regional trajectories underscore how geopolitical, economic, and infrastructural variables drive differentiated EFIS strategies worldwide.

This comprehensive research report examines key regions that drive the evolution of the Electronic Flight Instrument System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Competitive Landscape and Innovative Strategies of Leading Electronic Flight Instrument System Manufacturers Driving Industry Leadership

Leading players in the EFIS domain have adopted multifaceted strategies to fortify their market positions and accelerate innovation cycles. One prominent avionics supplier has leveraged strategic acquisitions to expand its portfolio of integrated flight decks and multifunction displays, thereby consolidating market share among commercial and business aviation segments. Meanwhile, another manufacturer has prioritized software-centric enhancements, releasing modular upgrade kits that facilitate seamless retrofits on legacy narrow-body and regional fleets, effectively capturing aftermarket opportunities.

Innovation has also been a focal point for mid-tier avionics firms that collaborate with display panel producers to co-develop ultra-high definition LED screens optimized for extreme environmental conditions. These partnerships have enabled the introduction of adaptive brightness controls and touch-responsive overlays that streamline mission-critical workflows. In parallel, several companies have instituted dedicated research labs focused on next-generation synthetic vision systems and augmented reality overlays, aiming to differentiate their EFIS offerings through immersive situational awareness.

Service and support initiatives have further distinguished industry contenders. By establishing regional centers of excellence and digital analytics platforms, top-tier suppliers provide predictive maintenance solutions and real-time performance monitoring, enhancing uptime for commercial airlines and defense operators alike. Additionally, vendor-neutral training academies and certification programs have emerged to accelerate customer familiarity with advanced cockpit interfaces, fostering stronger brand loyalty and recurring revenue streams.

Collectively, these strategic approaches underscore the competitive intensity and ongoing technological evolution within the EFIS market, as companies vie to deliver the most capable, customizable, and support-ready avionic solutions to a diverse global customer base.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electronic Flight Instrument System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Astronautics Corporation of America

- Avidyne Corporation

- Collins Aerospace, Inc.

- Elbit Systems Ltd.

- Garmin Ltd.

- Genesys Aerosystems, Inc.

- Honeywell International Inc.

- L3Harris Technologies, Inc.

- Thales S.A.

- Universal Avionics Systems Corporation

Driving Proactive Strategic Actions for Industry Leaders to Capitalize on Emerging Avionics Innovations Strengthen Supply Chains and Mitigate Geopolitical Risks

Industry leaders should prioritize the development of modular EFIS platforms that accommodate rapid technological refreshes and facilitate cost-effective retrofits across diverse aircraft categories. By adopting open-systems architectures and standardized interface protocols, suppliers can streamline certification pathways and empower operators to tailor display configurations according to mission requirements. Furthermore, establishing strategic alliances with semiconductor manufacturers and display technology innovators will ensure access to the latest high-resolution panels and low-power processors, reinforcing competitive differentiation.

To mitigate geopolitical risk and tariff-induced cost pressures, enterprises must implement diversified sourcing strategies that blend regional production hubs with trusted supplier networks. Nearshoring critical subcomponent fabrication and qualifying alternate vendors in lower-duty jurisdictions will enhance supply chain agility and safeguard operational continuity. Concurrently, integrating advanced analytics and predictive maintenance capabilities into EFIS support services can generate higher value for end users, reduce unscheduled downtime, and create recurring revenue models.

In the realm of cybersecurity and software assurance, companies should invest in robust encryption methodologies and continuous vulnerability assessments to comply with evolving aviation safety regulations. Proactive monitoring and secure over-the-air update frameworks will be vital to maintaining system integrity and customer confidence. Finally, cultivating comprehensive training and simulation environments-spanning virtual reality walkthroughs and scenario-based drills-will expedite pilot proficiency with next-generation EFIS functionalities, fostering safer flight operations and bolstering customer loyalty.

By harmonizing these strategic imperatives-modularity, supply chain resilience, advanced services, cybersecurity, and training-industry leaders can position themselves to capture emerging opportunities within the digital cockpit ecosystem and drive sustained growth in an increasingly connected aviation environment.

Detailing Rigorous Research Methodology Employed to Ensure Data Integrity Reliability and Comprehensive Analysis of Electronic Flight Instrument System Dynamics

This research employs a structured methodological framework combining extensive secondary data aggregation with targeted primary counsel to deliver comprehensive EFIS market insights. Secondary inputs encompass technical white papers, regulatory documentation, manufacturer product specifications, and peer-reviewed journal articles. These sources facilitate the mapping of technological evolution, certification requirements, and display platform trajectories. Moreover, industry reports and technical presentations supplement an understanding of emerging avionics trends, regulatory compliance mandates, and tariff policy implications.

Complementing the literature review, primary engagement with key stakeholders underpins the analysis. Semistructured interviews with executive leaders from aircraft manufacturers, Tier One avionics suppliers, commercial and cargo airline flight operations managers, and defense procurement officials yield nuanced perspectives on market drivers, implementation challenges, and adoption timelines. These dialogues inform a real-world appraisal of integration complexities, cost considerations, and user preferences. Data gathered through these conversations undergoes rigorous validation against publicly available procurement announcements, patent filings, and certification records.

To ensure data integrity, the research team applies a triangulation protocol, cross-referencing quantitative shipment and installation figures with qualitative trend observations. Advanced analytics tools support pattern recognition and thematic clustering across segmentation dimensions and regional markets. Finally, the methodology incorporates periodic review checkpoints, enabling iterative refinement of findings based on emerging policy changes or breakthrough technological developments. This hybrid approach guarantees a balanced, reliable, and actionable depiction of the EFIS ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electronic Flight Instrument System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electronic Flight Instrument System Market, by Aircraft Type

- Electronic Flight Instrument System Market, by Display Technology

- Electronic Flight Instrument System Market, by Efis Type

- Electronic Flight Instrument System Market, by Integration

- Electronic Flight Instrument System Market, by End User

- Electronic Flight Instrument System Market, by Region

- Electronic Flight Instrument System Market, by Group

- Electronic Flight Instrument System Market, by Country

- United States Electronic Flight Instrument System Market

- China Electronic Flight Instrument System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesizing Comprehensive Insights to Deliver a Concise Conclusion Underscoring the Strategic Importance of Electronic Flight Instrument Systems

Taken together, the evolution of electronic flight instrument systems reflects a confluence of digital innovation, regulatory imperatives, and global economic forces. The shift toward high-definition displays and integrated cockpit solutions has not only elevated safety and efficiency standards but also opened pathways for predictive maintenance and real-time data analytics. Simultaneously, the imposition of 2025 tariff measures has underscored the necessity for supply chain diversification and modular design strategies, ensuring cost resilience and operational continuity.

Segmentation insights highlight the varying priorities across aircraft categories-from large-cabin business jets demanding bespoke display configurations to regional turboprops and rotary-wing platforms seeking cost-effective retrofits. Moreover, technological divergence between CRT, LCD, and LED modalities continues to inform procurement and R&D investments, while functional distinctions among horizontal situation indicators, crew alerting systems, multifunction consoles, and primary flight displays shape end-user adoption patterns. Regional analyses reveal distinct growth trajectories, with the Americas leading in retrofit programs, EMEA balancing stringent certification norms and defense acquisitions, and Asia-Pacific experiencing robust expansion fueled by commercial airline growth and urban air mobility initiatives.

As technology roadmaps mature and geopolitical dynamics evolve, stakeholders must remain agile in navigating digital integration, tariff fluctuations, and cybersecurity demands. These insights coalesce to underscore the strategic importance of EFIS in forging the next chapter of avionics advancement.

Seizing the Opportunity to Elevate Operational Excellence through Tailored Executive Briefings and Customized Market Insights with Associate Director Ketan Rohom

To capitalize on these comprehensive insights and secure a competitive advantage in the evolving EFIS landscape, engage with Ketan Rohom, Associate Director of Sales & Marketing. Ketan can provide tailored executive briefings detailing advanced analysis, strategic recommendations, and region-specific intelligence.

By collaborating directly, you can gain privileged access to proprietary data sets, in-depth segmentation studies, and nuanced tariff impact assessments designed to inform critical investment and deployment decisions. Reach out to schedule a personalized consultation and explore how this market research report can empower your organization to navigate emerging opportunities, optimize avionics integration strategies, and drive sustainable growth within the digital cockpit revolution

- How big is the Electronic Flight Instrument System Market?

- What is the Electronic Flight Instrument System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?