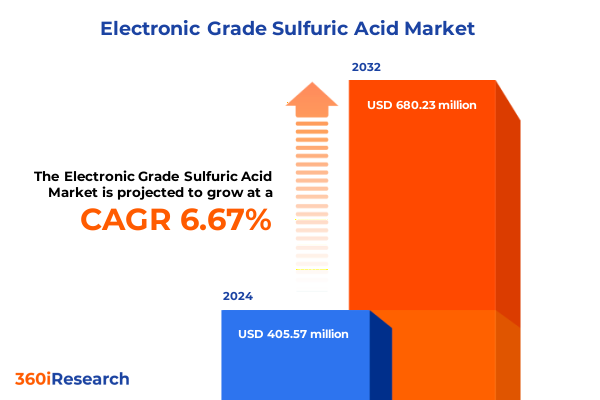

The Electronic Grade Sulfuric Acid Market size was estimated at USD 431.00 million in 2025 and expected to reach USD 458.29 million in 2026, at a CAGR of 6.73% to reach USD 680.23 million by 2032.

Unveiling the Critical Role and Emerging Dynamics of Electronic Grade Sulfuric Acid in Advanced Manufacturing and High-Purity Applications

Electronic grade sulfuric acid has emerged as an indispensable reagent underpinning the manufacturing processes of advanced electronics and renewable energy systems. Distinguished by its ultra-high purity specifications-measured in parts per billion (PPB) and parts per trillion (PPT)-this specialty chemical serves as a critical etchant, cleaning agent, and dopant medium across semiconductor wafer fabrication, flat panel display production, printed circuit board (PCB) manufacturing, and photovoltaic cell assembly. As device nodes continue to shrink, purity requirements intensify, compelling producers and end-users alike to adopt more sophisticated quality controls and handling procedures. Moreover, the convergence of digital transformation initiatives and sustainability mandates is reshaping procurement strategies, supply chain resilience, and product development roadmaps in a market that operates at the very margins of chemical and materials science.

Against this backdrop, the market for electronic grade sulfuric acid is characterized by intricate interdependencies between raw material sourcing, process innovation, regulatory frameworks, and end-user demand cycles. Regional policy shifts and international trade dynamics further complicate the landscape, driving fluctuations in feedstock availability and cost structures. Consequently, stakeholders-from chemical manufacturers to semiconductor foundries-must navigate a matrix of technical, economic, and environmental considerations to maintain operational continuity and competitive differentiation. This executive summary distills the core themes, strategic imperatives, and emerging trends that are poised to influence the trajectory of this vital chemical segment through and beyond 2025.

Exploring the Paradigm Shifts Reshaping Supply Chains Quality Standards and Technological Demands in Electronic Grade Sulfuric Acid Markets

The electronic grade sulfuric acid market is undergoing transformative shifts as technological advancements and environmental priorities converge. Innovations in nanofabrication have propelled semiconductor feature sizes below 7 nanometers, generating unprecedented demands for sub-ppt impurity levels and ultra-low particulate counts. Consequently, chemical suppliers are investing in membrane separation techniques, enhanced scrubbing systems, and closed-loop purification architectures to meet next-generation purity thresholds. In addition, the widespread adoption of Industry 4.0 principles has introduced digital twin simulations and real-time process monitoring, enabling manufacturers to detect trace contaminants instantaneously and optimize reagent utilization.

Simultaneously, sustainability imperatives are prompting a reevaluation of traditional sulfuric acid production methods. While the contact process remains predominant, growing scrutiny of sulfur dioxide emissions has inspired pilot projects employing renewable sulfur feedstocks and waste gas recycling. In parallel, the lead chamber process, once favored for its cost effectiveness, is experiencing a resurgence in niche applications where low-temperature operations and reduced capital expenditure align with localized manufacturing strategies. These parallel advancements underscore a broader industry trend: the pursuit of greener chemistries without compromising the exacting standards demanded by high-precision electronics.

Evaluating the Comprehensive Consequences of 2025 United States Tariff Structures on Raw Material Costs and Competitive Dynamics in Electronics

In 2025, the United States implemented a series of revised tariff schedules targeting imported specialty acids, including electronic grade sulfuric acid precursors and downstream derivatives. These measures, designed to bolster domestic chemical manufacturing and encourage onshoring of critical supply chains, have had multifaceted repercussions across price structures and procurement strategies. Import duties on high-purity feedstocks increased by up to 15 percent, compelling certain end-users to renegotiate long-term contracts or pivot toward domestic suppliers capable of meeting stringent PPB and PPT specifications. As a result, raw material costs surged, exerting upward pressure on overall production expenses for semiconductor fabs, PCB fabricators, and photovoltaic module assemblers.

However, these tariff adjustments have also stimulated investment in local purification facilities and spurred strategic alliances between chemical producers and electronic manufacturers. Domestic refiners have responded by expanding their contact-process capacities and deploying advanced purification trains, thereby capturing marginal market share previously dominated by imports. At the same time, supply chain agility has become a critical competitive differentiator: organizations that proactively diversified their sourcing networks, leveraged bonded warehouses, and optimized inventory buffers have mitigated the most severe impacts of tariff volatility. Consequently, the cumulative effect of the 2025 tariff realignment is a reconfigured market topology in which cost, quality, and logistical resilience now wield greater influence over supplier selection than ever before.

Illuminating Core Market Segmentation Dimensions Revealing Purity Concentration Process Distribution and Application-Based Nuances

A nuanced appreciation of market segmentation is essential to understanding the dynamics of electronic grade sulfuric acid demand and supply. When segmenting by purity grade, the landscape fractures into parts per billion and parts per trillion tiers, each serving distinct end-use sectors. Within the PPB domain, flat panel display manufacturers rely on rigorous acid etchants for pixel patterning, whereas PCB producers leverage tailored concentrations for precise copper layer development. Photovoltaics applications exploit PPB grades to optimize silicon wafer texturing, and semiconductor fabs demand the strictest protocols, with subdivisions for 14-nanometer, 20-nanometer, 28-nanometer and above, and the emerging sub-7-nanometer nodes. Similarly, the PPT concentration bucket caters to cutting-edge display and PCB processes, photovoltaic module encapsulation, and semiconductor manufacturing at the most advanced nodes, where even trace impurities can compromise device yields.

Beyond purity, concentration level serves as a critical differentiator. Concentrated formulations, often exceeding 98 percent sulfuric acid by weight, enable aggressive etching and doping cycles, while diluted grades provide safer handling profiles and lower process temperatures for sensitive substrates. Production processes further delineate market segments: the established contact process accounts for high-volume output and economies of scale, whereas the lead chamber process retains relevance in regions favoring lower energy intensity and smaller batch sizes. Distribution channels also shape accessibility and service levels; offline sales through established chemical distributors ensure comprehensive technical support and just-in-time delivery, while emerging online platforms offer streamlined procurement and predictive restocking algorithms. Finally, application-based segmentation into downstream and upstream categories highlights value chain positioning, with downstream users focusing on final device fabrication and upstream entities providing foundational materials and reagents for integrated manufacturing ecosystems.

This comprehensive research report categorizes the Electronic Grade Sulfuric Acid market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Purity Grade

- Concentration Level

- Production Process

- Distribution Channel

- Applications

Deciphering Regional Market Characteristics through Comparative Analysis of Americas Asia-Pacific and Europe Middle East and Africa Dynamics

Geographic diversity plays a decisive role in electronic grade sulfuric acid demand profiles and strategic imperatives. In the Americas, the ongoing resurgence of semiconductor fabs in the United States and Mexico has catalyzed investments in local acid purification facilities and integrated logistics hubs. This regional concentration of upstream and downstream capabilities is further reinforced by supportive federal incentives and workforce development programs aimed at strengthening the domestic supply chain. Consequently, North American manufacturers benefit from proximity to cutting-edge customers and reduced exposure to maritime freight volatility.

Across Asia-Pacific, unparalleled consumption volumes are driven by the semiconductor powerhouses of China, Taiwan, South Korea, and Japan. These markets command the lion’s share of global capacity for both PPB and PPT grades, with major chemical producers situated near industrial clusters to streamline just-in-time deliveries. Emerging economies within the region are also scaling photovoltaic and display panel operations, thereby intensifying competition for high-purity reagent supplies and prompting continuous capacity expansions. Meanwhile, Europe, the Middle East, and Africa present a more heterogeneous picture; strict environmental regulations in Europe have prompted facility retrofits and adoption of best-in-class scrubbing technologies, while select Middle Eastern countries leverage low-cost energy to establish bulk sulfuric acid complexes. In Africa, nascent electronics and renewable energy projects are gradually increasing demand, albeit on a smaller scale.

This comprehensive research report examines key regions that drive the evolution of the Electronic Grade Sulfuric Acid market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Stakeholders Driving Innovation Strategic Partnerships and Competitive Differentiation in Electronic Grade Sulfuric Acid Industry

The competitive landscape in electronic grade sulfuric acid is defined by a mix of global chemical conglomerates and specialized regional producers, each pursuing distinct value creation strategies. Leading players have intensified efforts to secure feedstock supplies through strategic partnerships with sulfur mining companies and refineries, thereby stabilizing input costs and ensuring uninterrupted access to critical raw materials. At the same time, several manufacturers have rolled out modular purification units capable of toggling between PPB and PPT production modes, offering customers enhanced flexibility and reduced lead times.

Innovation alliances between reagent suppliers and advanced electronics fabricators have also become commonplace, with joint research centers focusing on next-generation purification membranes, real-time contaminant detection systems, and closed-loop acid recycling. To differentiate their portfolios, key companies are pursuing sustainability certifications that validate low carbon footprints and minimal effluent discharge. Moreover, digital transformation initiatives are being embedded across sales and service functions, leveraging AI-powered demand forecasting, automated quality inspections, and blockchain-enabled traceability to reinforce customer confidence and foster long-term partnerships.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electronic Grade Sulfuric Acid market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AIREDALE CHEMICAL HOLDINGS LIMITED

- Asia Union Electronic Chemical Corporation

- BASF SE

- Chemtrade Logistics Inc

- Chung Hwa Chemicals Industrial Works, Ltd.

- FUJIFILM Holdings Corporation

- GRILLO-Werke AG

- Honeywell International Inc.

- Jiahua Group Co.,Ltd.

- Kanto Chemical Co., Inc.

- Korea Zinc Company, Ltd.

- LANXESS AG

- Linde PLC

- LS MnM Inc.

- Merck KGaA

- Moses Lake Industries Inc

- National Company For Sulphur Products

- Nouryon Chemicals Holding B.V.

- PVS Chemicals Inc.

- Seastar Chemicals ULC

- Spectrum Chemicals Mfg. Corp.

- Sumitomo Chemical Co., Ltd.

- Supraveni Chemicals Pvt. Ltd.

- The Beaming Co., Ltd.

- Thermo Fisher Scientific Inc.

Actionable Strategic Imperatives Guiding Industry Leaders to Optimize Value Chains Drive Sustainable Growth and Enhance Competitive Positioning

To navigate the evolving electronic grade sulfuric acid landscape, industry leaders should prioritize diversification of their sourcing strategies by establishing multi-tier supply networks that balance domestic and international capacities, thereby mitigating risk from geopolitical and tariff disruptions. Investment in advanced purification technologies-particularly membrane filtration and continuous scrubbing systems-can yield substantial returns through reduced waste generation, enhanced impurity control, and lower total cost of ownership over the asset lifecycle. Furthermore, embedding digital twins and real-time analytics into production workflows will empower rapid adjustments to process parameters, ensuring consistent compliance with PPB and PPT thresholds.

Sustainability must remain at the core of strategic planning; adopting circular economy principles, such as on-site acid recovery loops and zero-liquid discharge systems, will not only satisfy tightening regulations but also reinforce corporate social responsibility credentials. Collaboration across the value chain-spanning feedstock suppliers, equipment vendors, and end-users-can accelerate the development of breakthrough chemistries and green manufacturing pathways. Finally, proactive engagement with policy makers and trade associations will enable organizations to anticipate regulatory shifts, influence tariff negotiations, and secure early insights into emerging standards.

Outlining Rigorous Mixed-Method Research Approaches Ensuring Data Integrity Analytical Precision and Robust Insights into Sulfuric Acid Markets

This report synthesizes findings derived from a rigorous mixed-method research framework designed to ensure data integrity and analytical precision. Primary research involved structured interviews with senior executives, technical managers, and procurement specialists at leading chemical producers and electronics manufacturers. These interactions provided firsthand perspectives on technology roadmaps, operational challenges, and strategic priorities. Secondary research encompassed a comprehensive review of peer-reviewed journals, patent filings, regulatory documents, and global trade databases to map production capacities, purity grade specifications, and regional supply chain dynamics.

Quantitative analyses incorporated time-series data on import/export volumes, tariff schedules, and price indices, which were triangulated with proprietary survey results from end-user segments. Advanced statistical models were employed to identify correlation patterns between tariff changes and procurement behaviors, while scenario planning workshops validated potential market trajectories under alternative regulatory and technological developments. Throughout the process, an iterative validation protocol ensured consistency between primary insights and secondary data, culminating in a robust dataset that underpins the strategic recommendations and segmentation mappings presented in this executive summary.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electronic Grade Sulfuric Acid market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electronic Grade Sulfuric Acid Market, by Purity Grade

- Electronic Grade Sulfuric Acid Market, by Concentration Level

- Electronic Grade Sulfuric Acid Market, by Production Process

- Electronic Grade Sulfuric Acid Market, by Distribution Channel

- Electronic Grade Sulfuric Acid Market, by Applications

- Electronic Grade Sulfuric Acid Market, by Region

- Electronic Grade Sulfuric Acid Market, by Group

- Electronic Grade Sulfuric Acid Market, by Country

- United States Electronic Grade Sulfuric Acid Market

- China Electronic Grade Sulfuric Acid Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Key Findings Reinforcing Strategic Imperatives and Highlighting Future Trajectories in the Electronic Grade Sulfuric Acid Landscape

The collective insights presented herein underscore the pivotal role of electronic grade sulfuric acid as a cornerstone reagent in the high-tech manufacturing ecosystem. From the granularity of purity segmentation to the macro-level impacts of trade policies, stakeholders must adopt a holistic perspective that integrates technological innovation, regulatory compliance, and supply chain resilience. As the industry accelerates toward ever-more stringent quality thresholds and heightened sustainability expectations, the ability to anticipate shifts in demand drivers and operationalize advanced purification solutions will determine competitive success.

Looking ahead, market participants that embrace diversified sourcing, digital transformation, and circular economy frameworks will be best positioned to capture emerging opportunities in semiconductor, display, and renewable energy sectors. Ultimately, the agility to adapt to evolving tariff landscapes, regional policy shifts, and technological breakthroughs will define the next chapter in the evolution of electronic grade sulfuric acid markets.

Engage with Ketan Rohom to Secure Exclusive Market Intelligence and Empower Strategic Decisions on Electronic Grade Sulfuric Acid Investments

To gain a comprehensive understanding of the forces shaping electronic grade sulfuric acid markets and to position your organization at the forefront of technological and regulatory transformations, reach out today to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). He will guide you through the exclusive research findings, tailored insights, and strategic frameworks contained in the full market report. Engage with Ketan to explore customized data sets, in-depth analyses, and expert recommendations crafted to drive your decision-making and secure competitive advantage in this critical reagent space.

- How big is the Electronic Grade Sulfuric Acid Market?

- What is the Electronic Grade Sulfuric Acid Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?