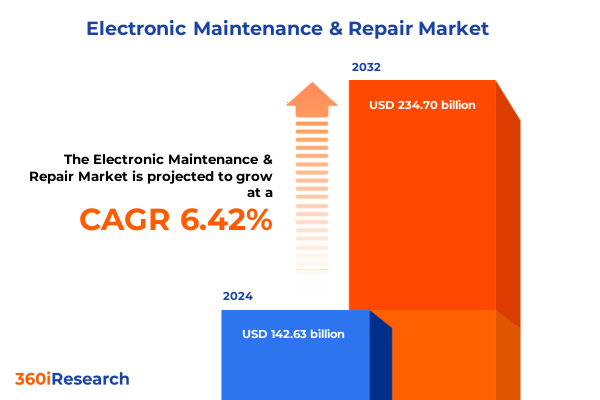

The Electronic Maintenance & Repair Market size was estimated at USD 151.25 billion in 2025 and expected to reach USD 160.39 billion in 2026, at a CAGR of 6.47% to reach USD 234.70 billion by 2032.

Navigating the Evolution of Electronic Maintenance and Repair Amid Rising Complexity Sustainability and Consumer Empowerment through Right to Repair

The electronic maintenance and repair sector is confronted with unprecedented demand driven by the rapid proliferation and increasing complexity of electronic devices across consumer, industrial, and medical domains. Contemporary equipment-from smart home appliances to industrial automation systems-relies on intricate hardware and embedded software, making professional maintenance and repair services essential for operational continuity and longevity. Environmental and regulatory pressures are also amplifying the imperative for repair over replacement, as global electronic waste volumes reached 62 million tonnes in 2022, underscoring the urgency of sustainable end-of-life device management through expert refurbishing services.

At the same time, the right-to-repair movement has gained significant traction, reshaping the regulatory environment and empowering independent service providers. Recent legislative milestones, including the European Union’s 2024 Right to Repair Directive and new state-level statutes in North America, now mandate access to spare parts, diagnostic software, and repair documentation for consumers and third-party technicians. These developments have democratized service capabilities and fostered a more resilient repair ecosystem by reducing dependencies on proprietary manufacturer channels.

Moreover, cultural attitudes toward repair are shifting in favor of refurbishment and reuse, fueled by grassroots initiatives like repair cafés and increased consumer awareness of sustainability. In response, service providers are adopting advanced digital tools-AI-powered diagnostics, remote troubleshooting platforms, and augmented reality-guided repair workflows-to deliver faster, more accurate maintenance solutions. This convergence of consumer sentiment and technological innovation marks a renaissance in repair culture, positioning the industry for transformative growth and efficiency.

Embracing Technological Advancements Driving a Transformative Shift in Electronic Maintenance with IoT-Enabled Diagnostics and Predictive Analytics

The maintenance landscape for electronic equipment has evolved from reactive break-fix models toward proactive, technology-driven strategies that anticipate failures before they occur. Only half of maintenance activities today are preventive, with the remainder largely reactive, exposing organizations to unplanned downtime and inefficiency. By contrast, shifting to predictive maintenance can elevate Overall Equipment Effectiveness to as high as 75 percent, compared to sub-50 percent performance under reactive regimes, as demonstrated by recent industry analyses.

Central to this transformation is the integration of Internet of Things sensors and real-time monitoring platforms. Continuous data streams from vibration transducers, thermal cameras, and ultrasonic meters are now processed at the edge, enabling rapid anomaly detection and localized decision-making. Advanced analytics correlate minute deviations in equipment behavior with potential failure modes, triggering maintenance interventions that avert costly disruptions and extend asset lifecycles.

Another pivotal innovation is the digital twin, which creates a virtual replica of physical assets for simulation and diagnostics. Digital twins allow engineers to model stress scenarios, test remedial actions, and refine service procedures in a risk-free environment, reducing Mean Time To Repair and enhancing maintenance accuracy. Academic research underscores the role of digital twins in bridging gaps between data-driven and physics-based predictive maintenance frameworks, paving the way for more automated, scalable solutions.

Augmented reality is also gaining traction in field service settings, providing technicians with hands-free overlays of schematics and live sensor data. Remote experts can guide on-site personnel through complex repairs, minimizing errors and improving first-time fix rates. Industry projections suggest that AR adoption in maintenance applications will grow by more than 60 percent annually through 2025, accelerating workforce productivity and safety.

Assessing the Far-Reaching Consequences of the 2025 United States Tariff Surge on Electronic Maintenance Operations and Repair Supply Chains

The 2025 escalation of U.S. tariffs on imported electronics components has significantly disrupted maintenance and repair operations, raising input costs and squeezing service margins. Tariffs on smartphone parts have doubled for key sourcing regions-ranging up to 100 percent on Chinese imports, 26 percent on Indian components, and 25 percent on South Korean goods-forcing repair centers to adjust pricing or seek alternative suppliers to maintain profitability and service levels.

Beyond consumer devices, industrial maintenance, repair, and operations (MRO) costs have ballooned as a result of expanded steel, aluminum, and electronic component levies. Service providers report increases of 25 to 40 percent for control system replacements, 30 to 50 percent for sensors and monitoring equipment, and 35 to 45 percent for power supplies and electrical modules, fundamentally altering maintenance budgeting and capital planning.

Large equipment manufacturers have also felt the strain, with major OEMs revising profitability forecasts to account for tariff-induced cost pressures. In fact, one leading aerospace and defense provider recently announced a $125 million hit to its maintenance services division in the first half of 2025 as aluminum and steel duties surged to 50 percent, underscoring the pervasive reach of trade policy into service operations.

Moreover, blanket tariffs on electronics goods have compelled many organizations to realign global supply chains away from traditional hubs. A 60 percent flat duty on Chinese imports, for example, has driven companies to diversify sourcing to Southeast Asia or invest in domestic manufacturing capabilities. While these shifts may stabilize costs over the longer term, they introduce transitional risks around component availability, lead times, and inventory management that require strategic mitigation.

Uncovering Critical Segmentation Insights Shaping Service Models Equipment Categories Frequencies and Vertical-Specific Maintenance Strategies

Service providers are redefining their offerings by transitioning away from reactive maintenance toward analytics-driven models that predict and prevent failures. Predictive maintenance strategies, once confined to capital-intensive industries, are now standard across electronic service portfolios, enabling real-time condition monitoring, data-backed intervention scheduling, and outcome-oriented performance metrics.

Equipment type is a major determinant of repair complexity and service demand. Consumer electronics, spanning home cleaning devices, smart home hubs, smart refrigerators, personal devices such as e-readers, laptops, smartphones, tablets, and wearable devices, fuel high-volume repair volumes. In contrast, industrial electronics-including automation systems with power supplies, PLCs, SCADA systems, sensors, and actuators, as well as motion control components like pneumatic systems and servo drives-require specialized expertise. Medical electronics maintenance adds layers of regulatory compliance and precision, covering diagnostic platforms such as blood analyzers, immunoassay systems, electrophoresis units, HPLC systems, ultrasound and MRI machines, as well as patient monitoring stations in ICUs and remote health settings.

Service frequency ranges from comprehensive annual maintenance and repair programs to routine scheduled maintenance interventions. Annual programs often involve deep inspections and critical component overhauls, while scheduled maintenance ensures continuous uptime through regular servicing intervals aligned with operational cycles.

Service mode is equally diverse, spanning fully in-house maintenance teams within end-user organizations, onsite support contracts at customer premises, outsourced maintenance arrangements managed by third-party specialists, and remote support delivered via secure connectivity platforms. Each mode presents unique cost structures, quality controls, and customer engagement models.

Vertical markets impose their own maintenance imperatives. Aerospace and defense sectors require rigorous adherence to safety standards and lifecycle tracking, automotive maintenance increasingly leverages predictive diagnostics, building and construction rely on preventive inspections to minimize operational disruptions, and consumer goods, education, energy and utilities, food and beverage, government and public sector, healthcare and pharmaceuticals, and IT and telecommunication industries each craft tailored maintenance frameworks informed by compliance, reliability, and service continuity priorities.

This comprehensive research report categorizes the Electronic Maintenance & Repair market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type of Service

- Equipment Type

- Frequency

- Service Mode

- Vertical

Decoding Regional Dynamics Influencing Electronic Maintenance and Repair Markets across the Americas EMEA and Asia-Pacific Growth Hubs

In the Americas, the maintenance and repair market benefits from advanced technology adoption, robust right-to-repair legislation across multiple states, and significant aftermarket service infrastructures. The United States leads in leveraging IoT-enabled diagnostics and remote support platforms, while Canada’s national repair law has created a more accessible parts market for independent technicians. Latin American markets are rapidly emerging, driven by growing electronics adoption and demand for cost-effective repair solutions in urban and rural areas alike.

Europe, the Middle East, and Africa (EMEA) are characterized by stringent e-waste directives and a comprehensive Right to Repair Directive in the EU that mandates manufacturer support for third-party servicing. Western European repair ecosystems emphasize sustainability and circular economy models, while Middle Eastern and African markets demonstrate selective adoption of digital maintenance tools, often supported by government initiatives to modernize infrastructure and build local repair capacity.

Asia-Pacific stands out as the fastest-growing regional market, underpinned by sprawling manufacturing hubs in China, India, Japan, and South Korea. Rapid urbanization, rising disposable income, and an expansive installed base of consumer and industrial electronics drive continuous investments in advanced service platforms. Market leaders are scaling localized digital service networks, forging OEM partnerships for authorized repairs, and upskilling technician workforces to meet growing demand for both high-volume consumer device support and specialized industrial maintenance services.

This comprehensive research report examines key regions that drive the evolution of the Electronic Maintenance & Repair market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Industry Leaders Innovating Electronic Maintenance and Repair Services through Integrated Platforms and Strategic Partnerships

uBreakiFix, a subsidiary of Asurion, has built a formidable franchise network with more than 900 locations across North America, specializing in smartphone and multi-device repairs. Its integration with insurance providers and extended warranty services enables seamless claims processing and customer convenience, bolstering its position as a leader in consumer electronics service.

Best Buy’s Geek Squad leverages its retail footprint to deliver in-store, onsite, and remote support services for a wide array of consumer electronics. The subsidiary’s recycling initiatives and environment-focused programs further differentiate its offering, aligning service delivery with sustainability goals and reinforcing customer loyalty through a circular economy approach.

B2X Care Solutions and Encompass Parts represent platform-based service models that orchestrate OEM repair workflows, manage reverse logistics, and ensure quality control through end-to-end digital solutions. Their partnerships with major device manufacturers streamline parts procurement and warranty management, positioning them as critical intermediaries in the global repair ecosystem.

Independent and community-driven specialists such as iFixit have redefined consumer engagement by providing modular repair kits, detailed online guides, and open-source parts catalogs that empower DIY enthusiasts. This grassroots influence has been instrumental in advancing the right-to-repair movement and expanding the broader repair ecosystem beyond traditional service centers.

In the industrial and medical segments, global conglomerates like Siemens Healthineers, Philips Healthcare, ABB, and Schneider Electric dominate through comprehensive service portfolios. These companies leverage predictive analytics, digital twin technologies, and long-term service contracts to minimize downtime and optimize asset performance in critical environments such as hospitals, manufacturing plants, and energy facilities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electronic Maintenance & Repair market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Acer Inc.

- Apple Inc.

- Aptiv PLC

- ASUSTeK Computer Inc.

- B2X Care Solutions GmbH

- BBK Electronics

- Eaton Corporation PLC

- Electronix Services

- Emerson Electric Co.

- Fujitsu Limited

- General Electric Company

- Honeywell International Inc.

- Mitsubishi Electric Corporation

- Motion Industries, Inc. by Genuine Parts Company

- Olympus Corporation

- Plexus Corp.

- Precision Zone, Inc.

- Quest International

- Repair World Direct Ltd.

- Robert Bosch GmbH

- Rockwell Automation Inc.

- Samsung Electronics Co., Ltd.

- Sanmina Corporation

- Schneider Electric SE

- Siemens AG

- Sony Group Corporation

- Stryker Corporation

- uBreakiFix by Asurion, LLC

Actionable Strategic Recommendations to Strengthen Resilience and Competitive Advantage in Electronic Maintenance and Repair Operations

Organizations should prioritize the deployment of predictive maintenance ecosystems by investing in sensor networks, edge computing architectures, and advanced analytics platforms. By synthesizing real-time operational data with digital twins for simulation and scenario analysis, maintenance leaders can shift from reactive troubleshooting to condition-based interventions, reducing unplanned downtime and extending equipment lifecycles.

Building a robust remote support infrastructure-including secure connectivity, augmented reality tools, and virtual expert assistance-can dramatically improve first-time fix rates and technician productivity. Embedding AR-enabled workflows into field service operations facilitates complex repairs and accelerates knowledge transfer across dispersed workforces, ultimately enhancing service efficiency and customer satisfaction.

To mitigate the financial and operational impacts of tariff fluctuations, firms must diversify their input sources across multiple regions and suppliers while establishing strategic stockpiles of critical components. Collaborating with third-party logistics partners and implementing duty-drawback or bonded warehouse strategies can further alleviate tariff burdens and ensure continuity of repair operations.

Proactive engagement with the evolving regulatory landscape-particularly right-to-repair statutes-enables organizations to influence policy outcomes and align service models with consumer empowerment initiatives. Embracing circular economy principles through certified refurbishment programs and eco-friendly repair processes will not only address sustainability mandates but also unlock new revenue streams in the secondary device market.

Finally, addressing the skills gap through targeted training programs, apprenticeships, and partnerships with technical institutions is essential to build the specialized workforce needed for advanced maintenance roles. Knowledge transfer frameworks, mentorship initiatives, and continuous upskilling will ensure that technicians are equipped to support emerging technologies and sophisticated service platforms.

Research Methodology Underpinning the Comprehensive Analysis of Electronic Maintenance and Repair Market Dynamics and Segmentation

This analysis was constructed through a rigorous research methodology that combined comprehensive secondary research, primary interviews with industry executives, and quantitative data validation. Publicly available financial disclosures, trade publications, and regulatory filings were reviewed to establish a foundational understanding of market dynamics.

Key segmentation frameworks-spanning service types, equipment categories, frequency schedules, service modes, and verticals-were developed to ensure a nuanced examination of market opportunities and challenges. Regional assessments were informed by trade association reports, government statistics, and expert consultations to capture geographic variations in adoption, regulation, and infrastructure.

Primary research comprised structured interviews with senior executives at leading service providers, OEMs, and logistics partners to validate strategic priorities, cost structures, and technology roadmaps. Insights gleaned from these conversations were triangulated with secondary data to refine segmentation insights and forecast qualitative trends.

All findings were subjected to quality control measures, including peer review and cross-verification by subject matter experts, to uphold analytical rigor and factual accuracy. This integrated approach provides a holistic and actionable perspective on the electronic maintenance and repair market, enabling stakeholders to make informed strategic decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electronic Maintenance & Repair market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electronic Maintenance & Repair Market, by Type of Service

- Electronic Maintenance & Repair Market, by Equipment Type

- Electronic Maintenance & Repair Market, by Frequency

- Electronic Maintenance & Repair Market, by Service Mode

- Electronic Maintenance & Repair Market, by Vertical

- Electronic Maintenance & Repair Market, by Region

- Electronic Maintenance & Repair Market, by Group

- Electronic Maintenance & Repair Market, by Country

- United States Electronic Maintenance & Repair Market

- China Electronic Maintenance & Repair Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Conclusion Reflecting on Core Trends Challenges and Opportunities Defining the Future Trajectory of Electronic Maintenance and Repair Services

The electronic maintenance and repair sector stands at a crossroads of technological innovation, regulatory evolution, and shifting consumer expectations. Predictive maintenance, powered by IoT, AI, and digital twins, is redefining service efficiency and asset reliability, while policy shifts such as right-to-repair statutes are expanding the competitive landscape.

Nonetheless, the industry faces headwinds from trade policy volatility, rising component costs, and workforce skill shortages. Strategic adaptation-through diversified supply chains, remote support platforms, and holistic training programs-will be critical to sustaining service quality and profitability.

By leveraging advanced analytics, embracing circular economy principles, and forging collaborative partnerships across OEMs, logistics providers, and educational institutions, market participants can navigate these complexities successfully. The future of electronic maintenance and repair hinges on agility, technological integration, and a steadfast commitment to operational excellence and sustainability.

Connect with Ketan Rohom for Exclusive Access to the Complete Executive Summary and In-Depth Electronic Maintenance and Repair Market Intelligence

For a comprehensive exploration of these insights and to secure a strategic edge in the rapidly evolving electronic maintenance and repair landscape, reach out to Ketan Rohom, Associate Director of Sales & Marketing at our firm. Engaging with Ketan will provide you with access to the full executive summary and detailed market intelligence report, enabling your organization to capitalize on emerging opportunities and navigate industry challenges with confidence. Don’t miss the opportunity to arm your team with the data-driven guidance necessary for informed decision-making and sustained growth in electronic maintenance and repair services.

- How big is the Electronic Maintenance & Repair Market?

- What is the Electronic Maintenance & Repair Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?