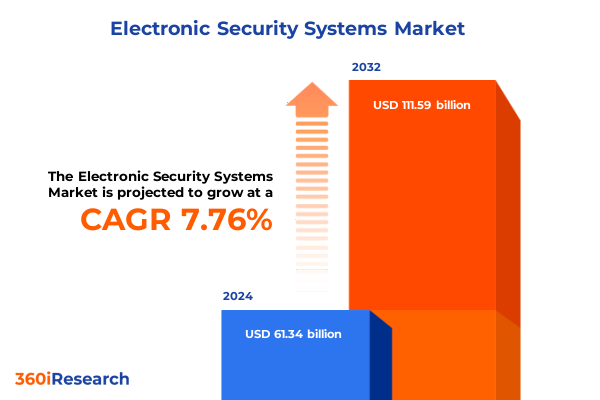

The Electronic Security Systems Market size was estimated at USD 66.07 billion in 2025 and expected to reach USD 71.21 billion in 2026, at a CAGR of 7.77% to reach USD 111.59 billion by 2032.

Compelling insight into the dynamic evolution of electronic security systems highlighting emerging technologies, competitive drivers, regulatory influences, and strategic decision imperatives

The electronic security systems arena is undergoing a period of rapid transformation characterized by an unprecedented confluence of technological innovation, evolving threat landscapes, and shifting regulatory frameworks. As organizations contend with increasingly sophisticated security breaches and demand seamless, intelligent protection mechanisms, suppliers and integrators are compelled to reimagine conventional approaches. This introduction establishes the foundational context for understanding how modern security architectures are evolving to meet real-time data analytics requirements and proactive threat mitigation needs.

Amid the proliferation of cloud services and mobile-enabled solutions, stakeholders are tasked with balancing scalability, reliability, and privacy considerations. Advances in artificial intelligence, machine learning, and computer vision have catalyzed a new era of predictive risk detection, enabling continuous system improvement cycles based on behavioral analytics. These technological infusions are complemented by rising expectations for user-centric interfaces, unified management platforms, and interoperable frameworks that bridge the gap between physical and cyber domains.

In parallel, regulatory bodies and industry consortia are intensifying standards and compliance mandates, underscoring the importance of robust data governance and incident response protocols. For decision-makers, grasping these multifaceted dynamics is essential not only to safeguard critical assets but also to leverage emerging market opportunities. By framing the executive summary within this context, readers gain a clear line of sight into the strategic imperatives shaping investment priorities and solution roadmaps across the electronic security systems landscape.

Key paradigm shifts reshaping the electronic security systems landscape through AI integration, cloud migration, and user-centric design innovations unlocking new possibilities

The electronic security systems landscape is being reshaped by transformative shifts that span technological breakthroughs, evolving deployment models, and changing threat vectors. As cloud-native platforms gain prominence, organizations are transitioning from monolithic, hardware-centric architectures to modular, software-defined ecosystems that enable rapid feature deployment and remote management. This shift has been amplified by a surge in edge computing capabilities, which facilitate real-time data processing at the device level and reduce latency for critical functions such as intrusion detection and biometric authentication.

Artificial intelligence and machine learning are accelerating the migration from reactive to predictive security postures. Computer vision algorithms now enable proactive anomaly detection in video surveillance feeds, while advanced analytics drive adaptive access control decisions based on behavioral patterns. Concurrently, the integration of physical security with cybersecurity operations centers is fostering a unified risk management paradigm that accounts for both digital and physical threat vectors. This convergence demands novel interoperability standards and cross-disciplinary expertise to ensure cohesion across diverse security layers.

User experience is another critical vector of transformation. Intuitive mobile credentialing, voice authentication interfaces, and cloud-hosted dashboards are elevating end-user satisfaction and simplifying administrative workflows. Moreover, heightened emphasis on privacy-by-design principles is steering solution architects toward decentralized identity models and end-to-end encryption schemes. Collectively, these paradigm shifts are redefining competitive differentiation and fueling strategic investment in platforms that blend agility, intelligence, and seamless integration.

In-depth analysis of the cumulative impact of United States 2025 tariffs on electronic security systems supply chains, costs, and competitive dynamics

The U.S. government’s imposition of tariffs on select electronic security system components in 2025 has had a cascading effect across supply chains and cost structures. Manufacturers dependent on imported sensors, circuit boards, and specialized optics experienced immediate input cost inflation, compelling them to reassess supplier portfolios and negotiate new terms to maintain margin integrity. Simultaneously, distributors and integrators began adjusting pricing models, often passing through incremental cost pressures to end users or reengineering solution packages to mitigate upfront expenses.

In response to tariff-induced constraints, several industry leaders have expedited near-shoring initiatives, relocating critical production steps to domestic or friend-shoring locales. This realignment has alleviated some exposure to cross-border tariff volatility, yet it has also introduced complexities in scaling capacity and maintaining quality control during transition phases. Organizations with nimble procurement functions have leveraged multi-sourcing strategies, balancing legacy OEM partnerships with emerging regional manufacturers to diversify risk and preserve lead times.

Competitive dynamics have also evolved as a result of these trade measures. Large system integrators have capitalized on scale to absorb tariff shocks internally, offering volume discounts that challenge smaller competitors. Conversely, agile innovators have differentiated through software-centric solutions that de-emphasize hardware dependency and, in turn, reduce the impact of hardware tariffs. Looking ahead, stakeholder agility in supply chain orchestration, tariff forecast modeling, and strategic inventory management will continue to be decisive factors in sustaining profitability and market positioning under evolving trade regimes.

Comprehensive segmentation insights revealing differentiated market opportunities across system types, end users, technologies, and service modalities

Diving into market segmentation reveals a multilayered ecosystem where strategic focus areas can uncover distinct growth pockets. System type segmentation dissects the industry into access control, fire detection and alarm, intrusion detection, perimeter security, and video surveillance. Within access control, biometric modalities such as facial recognition, fingerprint, and iris authentication compete alongside card-based methods including magnetic stripe, proximity, and smart cards, as well as mobile credential solutions leveraging BLE and NFC technologies. Fire detection and alarm segmentation spans flame, heat, and smoke detectors; heat detection further branches into fixed temperature and rate-of-rise sensors, while smoke detection encompasses ionization, multi-sensor, and photoelectric technologies. Intrusion detection is refined into door and window contacts, glass break sensors, motion sensors, and vibration sensors, with motion sensors categorized by dual-technology designs, microwave detection, and PIR. Perimeter security includes fence-mounted systems, fiber optic sensors, ground radar, and microwave barriers. Video surveillance is further defined by analog cameras partitioned into bullet and thermal imaging, IP cameras available in bullet, dome, and PTZ form factors, PTZ cameras, and dedicated thermal imaging devices.

When considering end user segmentation, the landscape extends across commercial, government and defense, healthcare, industrial, residential, and transportation verticals. Commercial installations are prevalent in hospitality, office, and retail environments, whereas government and defense applications address corrections facilities, military installations, and public safety operations. Healthcare security systems are tailored to clinics, hospitals, and long-term care settings, each with unique patient privacy and safety requirements. Industrial deployments serve energy and utilities, manufacturing plants, and oil and gas infrastructures. Residential solutions span multi-family complexes and single-family homes, while transportation security is specialized for airports, railway stations, and seaports, integrating public safety protocols with asset protection.

Technology availability further stratifies the market into wired and wireless offerings. Wired solutions depend on copper or fiber optic backbones to ensure robust connectivity and bandwidth for high-definition video and data-intensive applications. On the wireless front, Bluetooth, cellular, RF, and Wi-Fi networks deliver flexibility for rapid deployments; Wi-Fi solutions themselves are delineated into legacy and next-generation standards-802.11ac, 802.11ax, and 802.11n-to support varying performance requirements and device densities.

Lastly, service type segmentation covers consulting, installation, maintenance and support, and system integration. Consulting services include risk assessment and system design engagements that align security postures with organizational risk tolerances. Installation services ensure proper deployment and configuration of hardware and software components. Maintenance and support offerings are bifurcated into corrective maintenance for reactive issue resolution and preventive maintenance to proactively sustain system uptime. System integration services orchestrate hardware integration and software integration, creating seamless ecosystems that unify multiple security modalities under cohesive management platforms.

This comprehensive research report categorizes the Electronic Security Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- System Type

- Technology

- Service Type

- End User

Strategic regional insights unveiling unique trends, growth drivers, and regulatory landscapes across the Americas, EMEA, and Asia-Pacific markets

Regional dynamics in the electronic security systems domain vary widely as a result of economic maturity, regulatory environments, and technology infrastructure. In the Americas, innovation hubs within North America are driving adoption of AI-powered analytics and IoT-enabled device management. Government incentives aimed at upgrading critical infrastructure are bolstering demand across transportation hubs and public safety agencies, while private sector entities in commercial and industrial verticals prioritize seamless integration and data-driven security assurances. Latin America, though more price sensitive, is emerging as a growth frontier for scalable, cloud-based offerings that lower total cost of ownership and simplify remote management.

Across Europe, the Middle East, and Africa, stringent privacy regulations and GDPR enforcement are shaping solution architectures toward privacy-by-design approaches, with an emphasis on encryption, anonymization, and data residency controls. Western European nations are early adopters of unified security operations centers that converge physical and cyber threat intelligence, whereas Middle East security initiatives often focus on large-scale perimeter protection and mass transport security. Africa presents a mosaic of market readiness, where demand for cost-effective, solar-powered systems coexists with pilot projects in smart cities that integrate video analytics for public safety.

The Asia-Pacific region exhibits a dual trajectory of rapid urbanization and advanced manufacturing capabilities. Economies such as China, Japan, and South Korea lead in high-resolution video surveillance deployment and AI-driven access control systems. Southeast Asian markets are increasingly investing in smart building frameworks that pair energy management with security controls, while Australia and New Zealand demonstrate robust uptake of integrated security service platforms. Across prime urban centers and emerging secondary cities, the rising focus on smart mobility and critical infrastructure modernization fuels sustained growth in Asia-Pacific electronic security systems.

This comprehensive research report examines key regions that drive the evolution of the Electronic Security Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Insightful review of leading strategies and partnerships showcasing how top players optimize portfolios, leverage alliances, and enhance resilience in a dynamic market

Leading participants in the electronic security systems market are navigating competitive pressures through targeted investments in research and development, strategic partnerships, and portfolio diversification. Established industrial conglomerates with legacy hardware footholds are accelerating software-as-a-service offerings, embedding artificial intelligence capabilities to enhance analytics and predictive maintenance functions. Meanwhile, specialized technology firms are forging alliances with cloud providers and telecommunications operators to deliver integrated access control and video surveillance solutions that capitalize on expansive network infrastructures.

Innovation roadmaps frequently highlight strategic acquisitions of niche technology startups in fields such as facial recognition, advanced motion detection, and thermal imaging. These bolt-on strategies enhance product modularity and support cross-sell initiatives across existing client bases. Concurrently, manufacturers are refining channel programs and certification pathways for system integrators, incentivizing end-to-end deployment services that lock in recurring revenue streams through subscription-based licensing models.

Geopolitical considerations and supply chain constraints have prompted top players to cultivate regional manufacturing hubs and localized support centers, ensuring agility in parts distribution and service delivery. As cybersecurity concerns intensify, companies are investing in dedicated security operations teams and secure coding practices to defend against firmware manipulation and network intrusion attempts. Through these initiatives, they aim to balance innovation velocity with the integrity and resilience required by mission-critical deployments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electronic Security Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ADT Inc.

- Allegion plc

- ASSA ABLOY AB

- Avigilon Corporation

- Bosch Sicherheitssysteme GmbH

- CP Plus GmbH & Co. KG

- Dahua Technology Co., Ltd.

- FLIR Systems, Inc.

- G4S Limited

- Hikvision Digital Technology Co., Ltd.

- Honeywell International Inc.

- Johnson Controls International plc

- MOBOTIX AG

- NEC Corporation

- Panasonic Holdings Corporation

- Pelco, Inc.

- Samsung Electronics Co., Ltd.

- Schneider Electric SE

- Securitas AB

- SIS Limited

- Toshiba Corporation

- Tyco International Ltd.

Actionable strategic recommendations empowering industry leaders to capitalize on emerging technologies, streamline operations, and drive sustainable growth

Industry leaders should prioritize integration of advanced analytics and machine-learning modules within existing security architectures to transition from reactive incident response to proactive threat forecasting. Establishing cross-functional teams that combine physical security expertise with data science and cybersecurity proficiency will facilitate holistic solution development and faster time to deployment. This collaborative model fosters continuous improvement and empowers organizations to address emerging vulnerabilities before they escalate into critical breaches.

Investing in modular, open-architecture platforms is essential for future-proofing security ecosystems against shifting regulatory requirements and evolving technology standards. By adopting interoperable frameworks and standardized APIs, stakeholders can seamlessly integrate third-party innovations, reduce vendor lock-in, and accelerate technology refresh cycles. Additionally, creating a robust partner ecosystem of integrators, cloud providers, and specialist vendors enhances solution scalability and broadens market reach.

To maintain cost competitiveness amid tariff volatility and supply chain disruptions, organizations should implement dynamic procurement strategies that combine near-shoring options with bulk purchasing agreements. Leveraging data analytics for inventory forecasting and just-in-time replenishment reduces overhead while safeguarding against component shortages. Finally, cultivating a culture of continuous workforce development-through targeted training in AI applications, cybersecurity protocols, and system integration techniques-ensures that human capital aligns with technological advancements and drives long-term operational excellence.

Robust research methodology outlining data collection, primary and secondary analysis, and expert validation processes ensuring analytical rigor

The research methodology underpinning this report encompasses multiple stages of data collection, validation, and analysis designed to ensure comprehensive coverage and analytical rigor. Initially, a thorough secondary research phase was conducted, drawing upon industry publications, regulatory filings, white papers, patent databases, and technology vendor documentation. This desk research established a baseline understanding of market structures, technology lifecycles, and existing solution portfolios.

Building on this foundation, primary research engagements comprised one-on-one interviews with senior executives, product managers, and technical architects from leading suppliers, system integrators, and end-user organizations. These interviews provided qualitative insights into strategic priorities, investment rationales, and adoption challenges. In parallel, online surveys of end-user security professionals across five major regions captured quantitative data on deployment preferences, budget allocations, and satisfaction metrics.

Data triangulation techniques were employed to cross-verify findings, correlating primary input with secondary sources and industry benchmarks. An expert review panel including independent analysts and security consultants evaluated preliminary conclusions, ensuring alignment with real-world market dynamics. Rigorous quality control measures, including data integrity checks and peer reviews, were applied throughout, guaranteeing the validity and reliability of the final report outputs.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electronic Security Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electronic Security Systems Market, by System Type

- Electronic Security Systems Market, by Technology

- Electronic Security Systems Market, by Service Type

- Electronic Security Systems Market, by End User

- Electronic Security Systems Market, by Region

- Electronic Security Systems Market, by Group

- Electronic Security Systems Market, by Country

- United States Electronic Security Systems Market

- China Electronic Security Systems Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 4770 ]

Conclusive synthesis of key insights illuminating the future trajectory of electronic security systems and strategic priorities for stakeholders

This executive summary has distilled the pivotal elements shaping the future of electronic security systems, from disruptive technological infusions to the nuanced impacts of 2025 U.S. tariffs. The dynamic interplay of cloud migration, AI-driven analytics, and edge computing is redefining system architectures, while evolving regulatory mandates and privacy concerns continue to guide solution design. Comprehensive segmentation analysis has highlighted distinct pathways for market entry across system types, end-user verticals, technology modalities, and service offerings.

Regional analysis underscores the importance of tailoring strategies to local regulatory climates and infrastructure readiness, with the Americas, EMEA, and Asia-Pacific each presenting unique growth catalysts and operational considerations. Leading companies are responding with diversified portfolios, strategic collaborations, and regional manufacturing initiatives, balancing innovation velocity with supply chain resilience and cybersecurity imperatives.

Looking forward, organizations that embrace modular, interoperable platforms and cultivate cross-disciplinary talent pools will be best positioned to anticipate emerging threats and capitalize on new market opportunities. By adopting dynamic procurement frameworks and proactive risk management practices, stakeholders can navigate trade uncertainties and sustain competitive advantage in an increasingly complex security landscape.

Unlock in-depth actionable insights today by connecting with Ketan Rohom Associate Director Sales & Marketing to secure your comprehensive electronic security systems research report

Engaging with a dedicated expert provides an immediate pathway to harness the full breadth of strategic insights uncovered in this comprehensive electronic security systems analysis. By reaching out to Ketan Rohom, Associate Director of Sales & Marketing, stakeholders can secure a tailored consultation that aligns report findings with their unique business priorities and challenges. This personalized engagement ensures that key decision-makers gain clarity on actionable next steps, market entry strategies, and investment optimization.

Leveraging this collaboration accelerates time to insight by allowing in-depth discussions on topics such as advanced access control innovations, regional regulatory nuances, and the long-term implications of recent tariff shifts. Ketan’s expertise in translating complex data into pragmatic roadmaps empowers clients to navigate shifting competitive landscapes with confidence. In addition, clients benefit from early notifications about forthcoming updates and supplementary data supplements designed to keep strategies agile and forward-looking.

Initiating contact today positions organizations at the forefront of market intelligence, granting priority access to client-only webinars, bespoke data visualizations, and ongoing support aimed at driving revenue growth and operational resilience. To capitalize on these opportunities and secure the complete electronic security systems research report, please connect directly with Ketan Rohom.

- How big is the Electronic Security Systems Market?

- What is the Electronic Security Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?