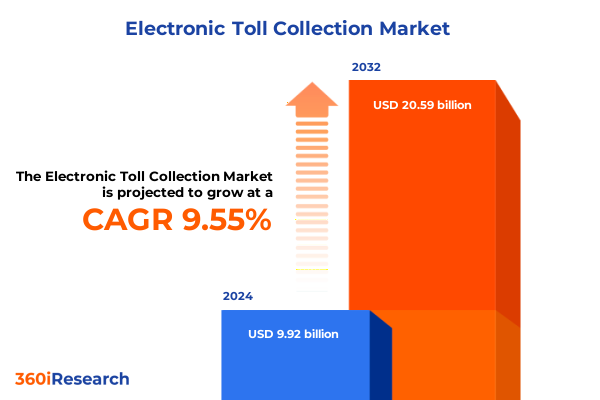

The Electronic Toll Collection Market size was estimated at USD 10.81 billion in 2025 and expected to reach USD 11.80 billion in 2026, at a CAGR of 9.63% to reach USD 20.59 billion by 2032.

Setting the Stage for the Future of Electronic Toll Collection with Insights into Market Dynamics and Emerging Stakeholder Imperatives

Electronic toll collection represents a paradigm shift in how transportation agencies and private operators manage road usage, streamline revenue capture, and enhance the traveler experience. As highway congestion intensifies and digital payment expectations rise, outdated manual toll booths are quickly becoming obsolete. Today’s landscape demands a transition toward interoperable, technology-driven systems that not only reduce operational overhead but also enable real-time pricing, dynamic congestion management, and seamless cross-jurisdictional travel. This section frames the critical context for understanding how market participants-from hardware suppliers to software developers-navigate an increasingly complex ecosystem.

Throughout the executive summary, we uncover the transformative forces reshaping electronic toll collection worldwide, scrutinize the cumulative impact of newly enacted tariffs in 2025, and dissect key segmentation insights across component, technology, transaction type, end user, and application dimensions. Coupled with regional nuances spanning the Americas, Europe Middle East & Africa, and Asia-Pacific, these insights offer decision-makers a clear strategic roadmap. Finally, we highlight leading solution providers and lay out actionable recommendations that ensure industry leaders are equipped to thrive in this dynamic environment.

Unveiling the Fundamental Technological and Policy-Driven Transformations Reshaping the Electronic Toll Collection Ecosystem Across Global Corridors

Over the past decade, electronic toll collection has evolved from isolated pilot projects into fully integrated mobility platforms. Advances in machine vision and Automatic Number Plate Recognition have dramatically expanded enforcement capabilities, while Dedicated Short-Range Communication protocols enable seamless vehicle-to-infrastructure data exchange. Simultaneously, Global Navigation Satellite System and GPS-based tolling solutions have emerged as cost-effective alternatives to roadside infrastructure, particularly in regions with sparse highway networks.

Policy interventions have further accelerated market adoption. Congestion pricing initiatives in major metropolitan areas incentivize peak-period tolling, redirect traffic, and fund infrastructure upgrades. Environmental mandates targeting vehicular emissions are propelling demand for dynamic toll models that reward low-emission vehicles. As a result, governments and private operators are forging partnerships to deploy pilot corridors, testing combinations of infrared-based tolling for urban zones and RFID-based open-road tolling where throughput demands exceed conventional gantry capacities.

In parallel, the rise of cloud-native control software and real-time payment platforms has transformed backend operations. Toll authorities can now integrate mobile wallets, automate exception processing, and analyze traffic patterns for predictive maintenance. These technological shifts, coupled with evolving regulatory frameworks around data privacy and interoperability, are fundamentally reshaping the competitive landscape and setting the stage for the next generation of toll collection ecosystems.

Analyzing the Complex Ripple Effects of the 2025 United States Tariffs on Electronic Toll Collection Infrastructure and Operational Costs

In 2025, the United States introduced a series of tariffs targeting imported hardware components integral to electronic toll collection systems. Cameras, gantries, toll booth infrastructure, readers, antennas, and transponders sourced from select overseas manufacturers now face increased duties, creating immediate pricing pressures. With installation and maintenance contracts typically spanning multiple years, operators must navigate escalating capital costs alongside budgetary constraints. In response, many stakeholders are reassessing supply chain configurations, exploring reshoring options, and entering into long-term procurement agreements to hedge against further tariff volatility.

Beyond hardware implications, the tariffs have triggered ripple effects across software deployment cycles and service delivery models. Slight cost increases in foundational equipment have led to renegotiated licensing fees for control software and payment software modules. The nuanced interplay between physical infrastructure costs and backend platform economics underscores the importance of holistic budgeting frameworks. Moreover, as stakeholders pivot toward hybrid transaction models that combine prepayment accounts with postpaid billing, flexibility in payment software integration becomes a critical competitive advantage.

Looking ahead, the cumulative impact of these tariffs will hinge on the pace of technological innovation and policy evolution. Early evidence suggests that collaborative initiatives between government agencies and domestic manufacturers can mitigate cost pressures, while digital solutions such as remote diagnostics reduce reliance on frequent onsite maintenance. Ultimately, operators that proactively adapt procurement strategies and embrace modular platform architectures will be best positioned to absorb tariff-driven headwinds.

Diving Deep into Component, Technology, Transaction, End User, and Application Dimensions to Reveal Actionable Segmentation-Driven Insights

Deep insights emerge when evaluating electronic toll collection through multiple segmentation lenses. From a component perspective, hardware remains the foundational layer, encompassing camera systems, gantries and toll booth infrastructure, readers and antennas, as well as transponders and tags that interface directly with vehicles. Meanwhile, installation and maintenance services ensure operational uptime and network reliability, and control software coupled with payment software orchestrate transaction processing and data analytics, creating an end-to-end solution tailored to diverse environments.

When viewed through the technology prism, Automatic Number Plate Recognition solutions dominate urban centers where dense traffic volumes necessitate non-intrusive, camera-based enforcement, whereas Dedicated Short-Range Communication protocols and RFID-based toll collection continue to lead in high-speed highway applications. In contrast, GNSS and GPS-based tolling mechanisms gain traction in wide-ranging, multi-jurisdictional corridors by minimizing roadside hardware investments. Infrared-based systems offer an alternative for niche deployments requiring low-cost equipment, though integration complexities limit their broader adoption.

Examining transaction types reveals that prepayment models drive consistent revenue flows, while postpaid solutions cater to commercial fleets and occasional users seeking billing flexibility. Hybrid approaches, blending the predictability of prepaid accounts with the convenience of deferred payments, are increasingly prevalent among private operators aiming to optimize cash flow. End users range from government agencies overseeing public road networks to private operators managing tolled bridges, tunnels, and express lanes, each demanding tailored service-level agreements, security protocols, and data transparency.

Finally, application-centric segmentation underscores the distinct requirements of bridge and tunnel operations, highway corridors, and urban tolling schemes. Within city zones, pay-as-you-go systems prevail to accommodate transient travelers, whereas prepaid urban tolling subscriptions offer commuter discounts and seamless integration with parking services. This multi-faceted segmentation framework equips stakeholders with a granular understanding of market dynamics and highlights the strategic levers needed to tailor offerings across varied operational landscapes.

This comprehensive research report categorizes the Electronic Toll Collection market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Transaction Type

- Toll Collection Type

- Application

- End User

Mapping Regional Nuances Across the Americas, Europe Middle East & Africa, and Asia-Pacific to Illuminate Growth Patterns and Infrastructure Priorities

Regional analysis uncovers distinct trajectories and infrastructure imperatives across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, legacy toll plazas are undergoing rapid modernization, with states and provinces funding corridor upgrades to integrate RFID-based electronic tolling and mobile payment gateways. North American operators prioritize seamless interoperability across adjacent jurisdictions, while Latin American markets focus on low-cost solutions tailored to mixed traffic profiles and incremental service rollouts.

Europe Middle East & Africa presents a mosaic of regulatory environments, from the European Union’s push for cross-border harmonization under interoperable service standards to Gulf Cooperation Council nations investing heavily in DSRC-based open-road tolling for newly constructed express networks. African nations demonstrate growing interest in GNSS-enabled corridor tolling, deploying cloud-based control systems to leapfrog traditional infrastructure constraints and maintain fiscal transparency.

Asia-Pacific remains the fastest-moving region, driven by urbanization megatrends and ambitious public–private partnership initiatives. China’s toll road network is integrating mobile wallet payments at unprecedented speed, while Southeast Asian countries are piloting license plate recognition to curb evasion and expedite traffic flow. Australia and New Zealand continue to refine hybrid transaction environments, blending prepaid toll accounts with postpaid billing to accommodate both domestic commuters and international freight operators. These regional distinctions shape deployment priorities and drive competitive differentiation among solution providers.

This comprehensive research report examines key regions that drive the evolution of the Electronic Toll Collection market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves and Collaborative Ventures Among Leading Electronic Toll Collection Solution Providers to Enhance Competitive Positioning

Leading solution providers are executing a variety of strategic initiatives to fortify their positions in the electronic toll collection market. Technology innovators are forging strategic partnerships to embed artificial intelligence into enforcement workflows, enabling advanced vehicle classification and anomaly detection. Hardware suppliers are investing in in-region manufacturing alliances, mitigating tariff impacts and accelerating delivery timelines for gantries, camera modules, and antenna arrays.

Software vendors are expanding modular control platforms with native cloud integration, simplifying system upgrades and fostering real-time data sharing among agency stakeholders. Payment solution providers are integrating digital wallets and open banking APIs to support multi-currency, cross-border transactions. At the same time, service specialists are enhancing maintenance offerings with predictive analytics capabilities that forecast component degradation, minimize unplanned downtime, and optimize field technician dispatch.

Through selective mergers and acquisitions, some companies are broadening their end-to-end solution portfolios, combining hardware, software, and managed services under a unified governance model. Collaborative pilot programs between vendors and transportation authorities are accelerating adoption of next-generation technologies such as vehicle-mounted DSRC units and GNSS pay-per-mile applications. These strategic moves not only expand addressable market reach but also reinforce long-term value propositions in a landscape defined by interoperability imperatives and evolving payment expectations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electronic Toll Collection market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A-to-Be by Brisa Group

- Amphenol Corporation

- Autotoll Limited

- Conduent Inc.

- Cubic Corporation

- EFkon GmbH

- Far Eastern Electronic Toll Collection Co. (FETC)

- FEIG ELECTRONIC GmbH

- GeoToll Inc.

- Indra Sistemas, S.A.

- Infineon Technologies AG

- International Road Dynamics Inc.

- Kapsch TrafficCom AG

- Metropolitan Expressway Company Limited

- Mitsubishi Heavy Industries, Ltd.

- Neology Inc

- Q-Free ASA

- Quarterhill Inc.

- SICE, S.A.

- Siemens AG

- Skytoll

- STAR Systems International

- T-Systems International GmbH

- Thales Group

- Toshiba Corporation

- Transcore Atlantic LLC

- Vinci SA

- VITRONIC Machine Vision GmbH

Formulating Targeted Strategic Imperatives and Tactical Initiatives to Enable Industry Leaders to Thrive in an Evolving Toll Collection Landscape

Industry leaders should prioritize interoperability by aligning technology roadmaps with emerging open standards, ensuring seamless cross-border and cross-state toll operations. Diversifying the supplier base through strategic dual-sourcing or reshoring agreements can mitigate the impact of ongoing tariff fluctuations and reduce lead times for critical hardware components. Embracing cloud-native architectures for control software and payment processing platforms will unlock real-time analytics, facilitate rapid feature rollouts, and lower overall total cost of ownership.

To enhance user adoption, organizations must integrate mobile payment solutions and digital wallet partnerships, offering commuters frictionless account management and dynamic tariff notifications. Investing in cybersecurity frameworks that encompass hardware encryption, secure data transmission, and comprehensive incident response protocols will safeguard systems against increasingly sophisticated threats. Additionally, piloting advanced GNSS-based tolling on low-volume corridors can validate pay-per-mile models and inform scalable deployment strategies for broader network rollouts.

Engagement with regulatory authorities through collaborative task forces and standards bodies will shape forward-looking policies around dynamic pricing, data privacy, and environmental incentives. Finally, fostering a culture of continuous innovation-supported by field trials, feedback loops, and cross-functional teams-will enable rapid adaptation to evolving market demands and position leaders at the forefront of the electronic toll collection revolution.

Outlining Rigorous Primary and Secondary Research Methodologies Employed to Ensure Data Integrity Analytical Robustness and Comprehensive Market Coverage

This research employs a rigorous combination of primary and secondary methodologies to ensure data integrity and analytical robustness. Primary inputs derive from in-depth interviews with transportation agency executives, private toll operators, hardware OEMs, software developers, and payment platform specialists. These interviews provide firsthand perspectives on operational challenges, technology adoption cycles, and strategic investment imperatives. In parallel, expert workshops and online surveys supplement qualitative findings, enabling triangulation of divergent viewpoints across stakeholder groups.

Secondary research entails the systematic review of government policy documents, regulatory filings, patent databases, industry white papers, and academic publications. Trade association reports and public financial disclosures illuminate historical trajectory, investment patterns, and emerging technology roadmaps. Proprietary data on transaction volumes, technology penetration rates, and service-level benchmarks refine the analytical framework further.

Quantitative analyses employ statistical techniques to correlate tariff enactment dates with procurement pricing trends and project deployment rates. Qualitative insights undergo thematic coding to extract strategic imperatives and classify best practices. The combined methodology ensures comprehensive market coverage, fosters cross-regional comparability, and underpins the actionable recommendations presented throughout this summary.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electronic Toll Collection market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electronic Toll Collection Market, by Component

- Electronic Toll Collection Market, by Technology

- Electronic Toll Collection Market, by Transaction Type

- Electronic Toll Collection Market, by Toll Collection Type

- Electronic Toll Collection Market, by Application

- Electronic Toll Collection Market, by End User

- Electronic Toll Collection Market, by Region

- Electronic Toll Collection Market, by Group

- Electronic Toll Collection Market, by Country

- United States Electronic Toll Collection Market

- China Electronic Toll Collection Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Consolidating Key Observations and Strategic Implications to Provide a Coherent Perspective on the Future Trajectory of Electronic Toll Collection

The convergence of emerging technologies, shifting policy landscapes, and evolving user expectations is propelling electronic toll collection into a new era of efficiency and interoperability. From the integration of cloud-native platforms to the proliferation of GNSS-based solutions, the market is witnessing a fundamental redefinition of how tolling services are conceived, deployed, and managed. Tariff-induced supply chain realignments underscore the importance of strategic procurement flexibility and domestic manufacturing partnerships, while segmentation-driven insights highlight the diverse requirements of applications ranging from urban pay-as-you-go schemes to high-speed highway corridors.

Regional disparities-from North America’s interoperability imperatives to Asia-Pacific’s rapid urban deployments and Europe Middle East & Africa’s regulatory harmonization efforts-create both challenges and opportunities for solution providers. Companies that invest in end-to-end offerings, strengthen cybersecurity postures, and embed advanced analytics within their service portfolios will stand out in an increasingly competitive market. Ultimately, the successful players will be those that couple technological innovation with adaptive strategies, forging collaborative relationships with public agencies and private operators alike.

Take Action Today and Connect with Ketan Rohom to Secure Your In-Depth Electronic Toll Collection Market Research with Personalized Support

Leverage this opportunity to gain unparalleled insights into the electronic toll collection market by partnering directly with Ketan Rohom, Associate Director of Sales & Marketing. With a consultative approach tailored to your strategic priorities, Ketan will guide you through the report’s comprehensive findings, address your specific operational challenges, and outline how the research can inform your next steps. Contact him today to discuss customized packages, request sample chapters, and secure exclusive access to expert briefings that will empower your organization to make data-driven decisions and capitalize on emerging growth avenues.

- How big is the Electronic Toll Collection Market?

- What is the Electronic Toll Collection Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?