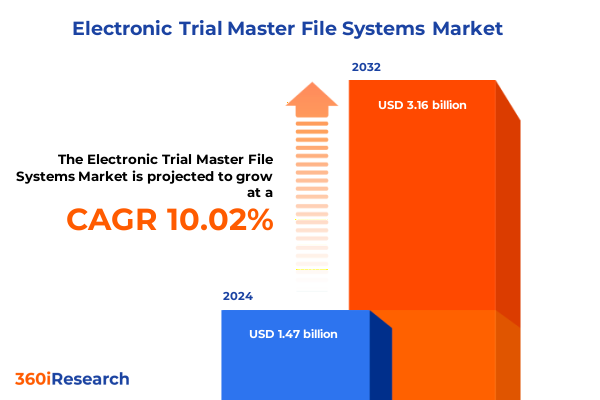

The Electronic Trial Master File Systems Market size was estimated at USD 1.61 billion in 2025 and expected to reach USD 1.76 billion in 2026, at a CAGR of 10.11% to reach USD 3.16 billion by 2032.

Strategic Overview Addressing the Critical Role of Electronic Trial Master File Systems in Modern Clinical Research Workflows

In an era marked by accelerated clinical development timelines and increasingly stringent regulatory oversight, electronic trial master file (eTMF) systems have emerged as indispensable tools for modern pharmaceutical, biotech, and contract research organizations. By digitizing document management, facilitating real-time collaboration, and ensuring rigorous compliance with global standards, these platforms have fundamentally reshaped the way critical trial records are generated, stored, and accessed across the research lifecycle.

This introduction provides a strategic vantage point for understanding the pivotal role of eTMF solutions in contemporary clinical research ecosystems. It outlines the convergence of technological innovation, regulatory demands, and operational efficiency imperatives that have elevated these systems from back-office utilities to enterprise-wide strategic assets. As stakeholders strive to reduce administrative burdens, accelerate study start-up, and support remote and decentralized trial models, the value proposition of robust, scalable, and integrated eTMF platforms becomes ever more pronounced.

The forthcoming sections will delve into the transformative shifts redefining eTMF capabilities, the implications of newly imposed United States tariffs in 2025, nuanced segmentation insights across multiple dimensions, regional dynamics shaping adoption patterns, and an assessment of leading vendors driving market innovation. This executive summary aims to equip decision-makers with a clear narrative of current trends, strategic considerations, and actionable recommendations essential for leveraging eTMF solutions to achieve compliance rigor, operational agility, and competitive differentiation.

Emerging Technological Advancements and Regulatory Evolution Driving the Transformation of Trial Master File Management Practices

The landscape of trial master file management has undergone a profound metamorphosis over the past decade, catalyzed by rapid technological advancements and evolving regulatory expectations. Early eTMF platforms primarily focused on digital storage and basic document indexing, whereas contemporary solutions now harness cloud-native architectures, embedded analytics, and native collaboration tools that transcend traditional record-keeping.

Simultaneously, regulatory authorities such as the FDA, EMA, and MHRA have issued increasingly detailed guidance around electronic records, data integrity, and audit trail requirements, compelling eTMF vendors to build comprehensive compliance management modules. This regulatory impetus has driven the integration of features like automated audit logs, granular access controls, and configurable workflows, ensuring end-to-end traceability and adherence to Good Clinical Practice standards.

Emerging trends such as artificial intelligence-driven metadata extraction, predictive analytics for missing document identification, and seamless interoperability with eClinical systems are redefining user expectations. Additionally, the rise of decentralized and hybrid trial models has amplified the need for remote monitoring capabilities and mobile-friendly interfaces, prompting vendors to innovate around offline document capture, eSignatures, and real-time stakeholder notifications.

Together, these technological and regulatory shifts have not only expanded the functional footprint of eTMF systems but also elevated their strategic significance as critical enablers of trial efficiency, risk mitigation, and data integrity.

Comprehensive Analysis of the 2025 United States Tariff Implementation Effects on Electronic Trial Master File Ecosystems

In 2025, the United States implemented a series of targeted tariffs on software licenses, cloud hosting services, and technology consulting fees, creating new cost considerations for organizations deploying electronic trial master file systems. These measures, aimed at bolstering domestic service provision and data sovereignty, have introduced incremental expense layers that require strategic budgetary adjustments and procurement optimization.

Specifically, tariffs on cloud-based hosting services have increased the total cost of ownership for publicly hosted eTMF deployments, prompting a reevaluation of deployment strategies. Organizations that previously favored public cloud environments to capitalize on scalability and lower upfront investments are now assessing private cloud and hybrid models to mitigate added tariff expenses while preserving data control and security.

Furthermore, heightened duties on imported professional services have influenced the pricing models of global implementation partners, impacting project timelines and cost forecasts. Service providers and system integrators have responded by enhancing self-service deployment toolkits and expanding domestic professional service teams to deliver localized support without incurring tariff penalties.

Overall, the cumulative impact of these 2025 tariffs has driven a nuanced realignment of deployment mode preferences and vendor selection criteria, compelling stakeholders to weigh long-term operational agility against short-term cost implications within an increasingly complex regulatory and economic landscape.

Insightful Examination of Market Segmentation Drivers Based on Component, Deployment, End Users, Trial Phases, and Core Functionalities

A nuanced examination of the eTMF market reveals multiple segmentation layers that drive purchase behavior and solution differentiation. When viewed through the lens of component offerings, the software segment dominates strategic innovation by embedding analytics, compliance, document, and workflow management capabilities into unified platforms, while managed services and professional services bundles provide essential operational support and customization for complex study environments.

Deployment mode further shapes the eTMF value proposition, as organizations balance the agility of public cloud and private cloud configurations against the security and control of on-premises deployments. Hybrid architectures are increasingly leveraged to optimize data residency requirements and cost efficiencies, with many sponsors opting for private cloud infrastructures to mitigate the impact of tariff adjustments while retaining the benefits of cloud scalability.

End users exhibit diverse requirements aligned with their organizational mandates. Academic and research institutes prioritize flexible, low-cost platforms with collaborative features, whereas CROs emphasize centralized oversight and vendor-agnostic integration. Medical device and pharmaceutical companies demand robust compliance modules and audit trails to support regulatory submissions, while regulatory authorities focus on secure, standardized access to critical trial documentation for inspections and reviews.

Trial phase segmentation underscores varying documentation intensity and workflow complexity. Early-phase studies necessitate agile, iterative document versioning, whereas pivotal Phase III trials require stringent reporting dashboards and predictive analytics to track missing endpoints. Functionality breakdown highlights the strategic interplay of analytics and reporting with dashboard and predictive modules, compliance management enriched by audit trail and regulatory reporting, document management anchored by access control and version control, and collaborative workflows driven by communication tools and task management to streamline cross-functional coordination.

This comprehensive research report categorizes the Electronic Trial Master File Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Mode

- Trial Phase

- Functionality

- End User

Global Regional Perspectives Highlighting the Unique Drivers Shaping Electronic Trial Master File Adoption Across Key Geographies

Regional dynamics significantly influence the adoption trajectory and feature prioritization of electronic trial master file systems. In the Americas, mature regulatory ecosystems and a high concentration of leading life sciences companies have driven early adoption of advanced analytics, compliance automation, and seamless integration with broader eClinical platforms. Sponsors in North America often pilot AI-powered metadata tagging and missing document prediction capabilities to accelerate audit readiness.

Across Europe, the Middle East, and Africa, eTMF uptake is shaped by diverse regulatory frameworks and data residency mandates, leading to hybrid deployment structures that combine regional private cloud data centers with global software platforms. Organizations in EMEA increasingly focus on multilingual document management and configurable workflows to harmonize cross-border clinical operations, while maintaining GDPR compliance and local inspection readiness.

In the Asia-Pacific region, burgeoning pharmaceutical R&D hubs and expanding CRO footprints have stimulated demand for cost-effective, scalable eTMF solutions. Stakeholders emphasize flexible subscription models and modular service offerings to manage budget constraints, and local partnerships are leveraged to navigate complex regulatory requirements. Mobile-first interfaces and offline capture functionalities are particularly valued in regions with variable connectivity.

These regional insights underscore the imperative for eTMF vendors to offer adaptable deployment frameworks, localized support capabilities, and industry-specific compliance features that resonate with the distinct operational and regulatory priorities of each geography.

This comprehensive research report examines key regions that drive the evolution of the Electronic Trial Master File Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Profiles of Leading Vendors Demonstrating Innovation and Competitive Positioning in Trial Master File System Solutions Market

Leading technology providers in the eTMF domain have differentiated themselves through a combination of platform innovation, strategic partnerships, and service excellence. One prominent vendor has established a reputation for pioneering AI-driven metadata extraction and predictive analytics, embedding these capabilities directly into its core offering to facilitate proactive identification of missing documents and streamline audit preparation processes.

Another market leader has focused on expanding its global infrastructure footprint, enabling sponsors to select private cloud or hybrid configurations with local data residency guarantees across multiple continents. This vendor’s modular architecture allows clients to tailor compliance management, document control, and workflow collaboration functionalities to their unique trial designs and regulatory contexts.

A third key player has leveraged strategic alliances with major CROs and academic research networks to integrate eTMF solutions into broader clinical operations platforms. By embedding trial master file functionalities within unified clinical trial management and safety reporting ecosystems, this vendor has delivered end-to-end visibility and real-time cross-platform interoperability.

Additional innovative providers have introduced managed service offerings that combine best-in-class software modules with expert professional services, enabling sponsors to outsource day-to-day eTMF administration while focusing internal resources on core scientific and regulatory activities. Collectively, these companies are driving market evolution by emphasizing scalability, compliance depth, and user-centric design.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electronic Trial Master File Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anju Software, Inc.

- ArisGlobal Inc.

- CareLex, Inc.

- Dassault Systèmes SE

- Database Integrations, Inc.

- Ennov, S.A.

- Forte Research Systems, Inc.

- Freyr Solutions Pvt. Ltd.

- Honeywell International Inc.

- IQVIA Holdings Inc.

- Laboratory Corporation of America Holdings

- MasterControl Inc.

- Montrium Inc.

- NCGS, Inc.

- Octalsoft, Inc.

- OmniComm Systems Inc.

- Oracle Corporation

- Paragon Solutions, Inc.

- PharmaVigilant, Inc.

- Phlexglobal Ltd.

- Signant Health Ltd.

- SterlingBio, Inc.

- SureClinical, Inc.

- Veeva Systems Inc.

- Wingspan Technology, Inc.

Pragmatic Strategic Recommendations Empowering Industry Stakeholders to Optimize Their Trial Master File System Implementation and Compliance Frameworks

Industry leaders should prioritize the adoption of cloud-native eTMF platforms that seamlessly integrate advanced analytics and compliance management functionalities. By harnessing AI-powered document indexing and predictive gap-analysis tools, organizations can proactively identify missing or incomplete records, reducing audit cycles and enhancing data integrity across the trial lifecycle.

Investing in flexible deployment strategies is essential to balance cost, performance, and regulatory compliance imperatives. Enterprises should evaluate hybrid cloud models that combine the agility of public cloud services with the security and control of private data centers, thereby mitigating tariff-driven hosting costs while preserving scalability and rapid provisioning capabilities.

To maximize user adoption and cross-functional collaboration, stakeholders must embed intuitive workflow and collaboration modules within the eTMF environment. Integrating communication tools and task management features directly into document approval and distribution processes fosters accountability, accelerates study start-up, and enhances remote monitoring efforts.

Finally, forging strategic alliances with implementation partners and leveraging professional managed services can expedite deployment timelines and ensure adherence to global regulatory standards. By combining platform innovation with expert guidance, organizations will enhance operational resilience, bolster regulatory readiness, and position themselves to adapt swiftly to emergent trial designs and compliance requirements.

Comprehensive Research Methodology Detailing Rigorous Data Collection, Validation Processes, and Analytical Frameworks Underpinning Report Findings

This report’s findings are underpinned by a rigorous research methodology combining qualitative and quantitative data collection approaches. Primary research entailed structured interviews with senior R&D executives, regulatory compliance officers, and IT leaders across pharmaceutical, biotech, and contract research organizations to capture firsthand insights into eTMF challenges and solution preferences.

Secondary research involved an exhaustive review of publicly available literature, regulatory guidance documents, vendor white papers, and patent filings to identify technological innovations, compliance trends, and competitive positioning strategies. This phase also incorporated detailed analysis of implementation case studies, service provider catalogs, and annual reporting disclosures to contextualize vendor offerings and market dynamics.

Data triangulation techniques were employed to validate emerging themes and ensure consistency across divergent information sources. Quantitative data points were cross-verified through a combination of expert surveys and anonymized client feedback panels, while qualitative observations were subjected to thematic coding and peer review within the research team.

The analytical framework leveraged a blend of SWOT (strengths, weaknesses, opportunities, threats) analysis, five-force industry assessment, and use-case mapping to derive strategic implications and actionable recommendations. This multi-layered approach ensured that the report’s conclusions are robust, defensible, and directly aligned with stakeholder requirements for operational excellence and regulatory compliance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electronic Trial Master File Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electronic Trial Master File Systems Market, by Component

- Electronic Trial Master File Systems Market, by Deployment Mode

- Electronic Trial Master File Systems Market, by Trial Phase

- Electronic Trial Master File Systems Market, by Functionality

- Electronic Trial Master File Systems Market, by End User

- Electronic Trial Master File Systems Market, by Region

- Electronic Trial Master File Systems Market, by Group

- Electronic Trial Master File Systems Market, by Country

- United States Electronic Trial Master File Systems Market

- China Electronic Trial Master File Systems Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Conclusive Insights Synthesizing the Strategic Implications and Future Outlook for Electronic Trial Master File System Adoption and Evolution

The convergence of regulatory stringency, technological innovation, and evolving trial paradigms has elevated electronic trial master file systems from administrative repositories to strategic enablers of clinical research efficiency and integrity. Organizations that embrace integrated, analytics-driven platforms and adopt adaptive deployment models will be best positioned to navigate the complexities of global compliance requirements and accelerate time-to-market.

Key insights underscore the importance of modular architectures that allow incremental capability deployment, AI-driven metadata management to mitigate documentation risks, and robust collaboration features that support remote and decentralized trial operations. Additionally, regional considerations such as data residency mandates and local regulatory nuances must inform deployment strategies to ensure seamless inspection readiness.

Strategic alignment between IT, regulatory affairs, and clinical operations teams is paramount to realize the full potential of eTMF investments. By fostering cross-functional governance frameworks and leveraging professional managed services where appropriate, sponsors can achieve heightened operational resilience and sustained regulatory compliance.

As trial designs continue to evolve toward adaptive, decentralized, and patient-centric models, the role of next-generation eTMF solutions will become increasingly critical. Embracing these platforms now will provide organizations with the agility and data integrity foundations required to lead in the future landscape of clinical research.

Engage Directly with Associate Director of Sales & Marketing to Unlock Exclusive Trial Master File Systems Report Insight and Drive Informed Decisions

To secure the comprehensive insights, detailed analytics, and expert commentary contained in this market research report, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, for personalized guidance and next steps. By engaging with Ketan, industry stakeholders will gain tailored support to navigate the complexities of electronic trial master file adoption, align strategic priorities with cutting-edge innovations, and unlock exclusive deliverables that empower informed decision-making. Initiating a dialogue with Ketan Rohom ensures prompt access to supplementary data, custom consultancy options, and subscription details, setting the stage for accelerated implementation roadmaps and measurable process enhancements. Contact Ketan today to transform insight into action and drive your organization’s operational excellence within clinical document management and regulatory compliance frameworks.

- How big is the Electronic Trial Master File Systems Market?

- What is the Electronic Trial Master File Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?