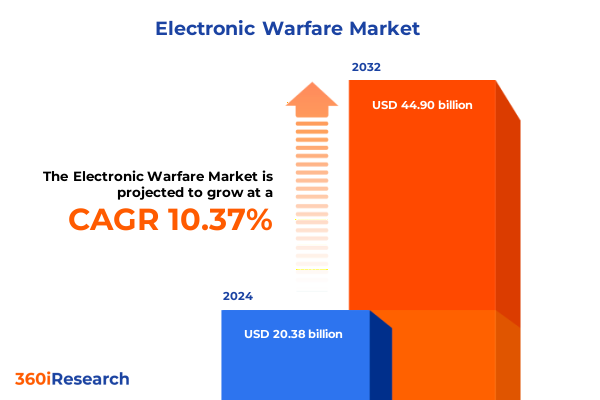

The Electronic Warfare Market size was estimated at USD 22.45 billion in 2025 and expected to reach USD 24.73 billion in 2026, at a CAGR of 10.40% to reach USD 44.90 billion by 2032.

Setting the Stage for Electronic Warfare Evolution Unveiling Strategic Dynamics Technological Trends and Emerging Market Forces Shaping Defense Capabilities

The electronic warfare domain has entered a pivotal era defined by the convergence of advanced signal processing, artificial intelligence, and networked defense architectures. Over the past decade, the relentless pace of technological innovation has reshaped the electromagnetic spectrum from a contested environment into a critical frontier for strategic advantage. Rising near-peer threats and the proliferation of cost-effective unmanned platforms have intensified demand for capabilities that disrupt adversary communications, degrade radar effectiveness, and protect friendly assets from a spectrum of electronic attacks.

Against this backdrop, defense organizations worldwide are rethinking procurement strategies, investing in multi-domain solutions that integrate seamlessly across air, land, naval, and space platforms. The need for resilient, adaptive electronic warfare systems that can sense, decide, and act in milliseconds has never been greater. This executive summary distills the complex interplay of technological breakthroughs, regulatory shifts, and geopolitical pressures that will determine the trajectory of electronic warfare through 2025 and beyond. By framing the emerging trends, tariff implications, and segmentation insights, this report equips decision-makers with the context necessary to navigate a rapidly evolving battlespace with confidence.

Identifying the Pivotal Technological and Strategic Shifts Redefining Electronic Warfare Capabilities Across Domains and Operational Theaters

Electronic warfare is undergoing a transformative upheaval, driven by breakthroughs in digital radio frequency memory, cognitive electronic warfare algorithms, and software-defined systems. Traditional fixed-function jammers are yielding to reprogrammable architectures capable of dynamic waveform synthesis and real-time adaptation to threat signatures. This shift toward modular, open-architecture designs enables rapid integration of third-party sensors and processing modules, accelerating deployment cycles and reducing logistical footprints.

Simultaneously, the rise of artificial intelligence and machine learning in electronic support measures is enhancing situational awareness, enabling systems to autonomously classify and prioritize signals of interest. This evolution has profound implications for electronic counter-countermeasures, where adaptive algorithms can distinguish between decoys and genuine threats amid dense signal environments. The transition to network-centric operations further amplifies these capabilities, as disparate platforms share spectrum intelligence through low-latency data links, fostering cooperative engagement against agile adversaries.

Converging with these technological trends, the proliferation of unmanned systems across domains has expanded the tactical application of electronic warfare. Swarming drones equipped with miniature jammers and sensors can saturate adversary defenses, while unmanned surface and underwater vessels extend electronic attack reach into maritime theaters. As these capabilities mature, frontier warfare scenarios will increasingly pivot on the electromagnetic spectrum, making electronic dominance as decisive as kinetic firepower.

Examining the Far-Reaching Consequences of 2025 U.S. Tariff Policies on Electronic Warfare Supply Chains R&D Investment and Global Partnerships

In 2025, revised U.S. tariff policies targeting select semiconductors, high-power amplifiers, and specialized antenna components have recalibrated supply chains for electronic warfare systems. While intended to protect domestic manufacturers and incentivize onshore production, these measures have introduced complexity for defense primes reliant on global sourcing. Import duties on certain power amplifiers have elevated costs for jamming systems, prompting procurement officers to explore alternative suppliers or to accelerate localized manufacturing investments.

The cumulative impact extends beyond component prices. R&D partnerships with overseas technology firms face delays as exporters adjust to new regulatory requirements, hampering the rapid prototyping cycles integral to modern system development. Conversely, the tariff framework has spurred domestic industrial capacity expansion, with new fabrication facilities coming online to meet demand for critical radio frequency modules and circuit boards. Over time, this shift promises greater supply-chain resilience but demands agile program management in the near term to mitigate schedule slippages and budget overruns.

Moreover, the tariffs have reshaped collaborative research initiatives. International defense consortiums are evaluating restructure options to navigate the revised trade landscape, while government agencies are allocating funds to subsidize the domestic production of dual-use technologies. The net effect of these policies is a complex interplay of short-term cost pressures and long-term strategic autonomy, with defense stakeholders forced to balance immediate program needs against the imperative of securing a sovereign industrial base.

Deep Dive into Multi-Domain Segmentation Revealing Growth Drivers and Capability Demands Across Air Land Naval and Space Electronic Warfare Applications

A multi-domain examination of electronic warfare reveals distinct opportunity spaces within each operational environment. In the air domain, fixed wing platforms demand high-power, long-range jamming systems to secure contested airspace, whereas rotary wing assets prioritize lightweight, line-of-sight countermeasures compatible with tactical communication networks. Concurrently, unmanned aerial vehicles are integrating compact, energy-efficient electronic support payloads to autonomously detect and geolocate adversary emitters.

Transitioning to land operations, armored vehicles require hardened electronic countermeasure suites capable of withstanding battlefield shocks, while wheeled ground vehicles benefit from scalable electronic support sensor kits that can be rapidly installed in expeditionary theaters. Infantry units are increasingly equipped with man-portable, networked electronic attack tools that disrupt hostile improvised explosive devices and communication relays at the squad level, enhancing survivability and mission effectiveness.

Naval forces are pursuing dual-purpose systems for surface ships and submarines, blending active and passive sensing with advanced decoy launchers to protect high-value assets in littoral and blue-water operations. On submarines, low-probability-of-intercept sonobuoy analogs are being adapted for electronic intelligence gathering, while surface combatants integrate high-power wideband jammers to safeguard carrier strike groups.

In the space domain, satellites are adopting resilient payloads that employ frequency hopping and beamforming to counter hostile signal interference. As military and commercial operators expand low-Earth-orbit constellations, the requirement for space-hardened electronic warfare capabilities grows more acute, ensuring continued functionality of reconnaissance and communication networks in contested orbital environments.

This comprehensive research report categorizes the Electronic Warfare market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Capability

- Product Type

- Application

- End User

Analyzing Regional Dynamics Shaping Electronic Warfare Adoption and Development Trends in the Americas EMEA and Asia-Pacific Defense Sectors

Regional dynamics significantly influence the pace and direction of electronic warfare adoption. In the Americas, defense investments focus on modernizing legacy fleets and integrating unmanned systems, with both government and commercial space operators accelerating deployment of resilient satellite payloads. U.S. policy prioritizes industrial base expansion under the new tariff regime, emphasizing domestic research laboratories and innovation hubs to foster next-generation electronic warfare technologies.

In Europe, the Middle East & Africa region, shifting security paradigms drive demand for interoperable spectrum management and counter-drone systems. Collaborative initiatives among NATO members bolster collective defense, while Gulf states pursue bespoke electronic attack and protection suites tailored to asymmetrical threat environments. Technology transfers and joint exercises underpin capacity building, ensuring regional actors can synchronize electronic warfare doctrines with allied frameworks.

Asia-Pacific stands out for its rapid procurement cycles and aggressive investment in both offensive and defensive capabilities. Naval powers are commissioning new surface combatants with integrated jamming and deception systems, while regional air forces retrofit fighter jets with advanced electronic support measures. Simultaneously, multiple governments are expanding indigenous semiconductor foundries to safeguard component supply chains, aligning with broader strategic imperatives to reduce reliance on external providers.

This comprehensive research report examines key regions that drive the evolution of the Electronic Warfare market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players Forging Innovation Pathways and Strategic Alliances to Dominate the Electronic Warfare Market Evolution

Leading defense contractors are forging the next frontier of electronic warfare through strategic partnerships, targeted acquisitions, and continuous innovation. Major prime integrators are layering artificial intelligence modules onto existing legacy platforms, while small and mid-sized enterprises introduce specialized payloads optimized for modular open-systems architectures. Collaborative ventures between multinational firms and academic research centers yield novel sensing techniques that push the boundaries of signal detection sensitivity.

Many companies are also investing heavily in digital twins and model-based system engineering to simulate electromagnetic engagements at scale, reducing test-range costs and accelerating iterative design cycles. Such virtual environments allow developers to refine algorithmic counter-countermeasure suites against evolving threat libraries. Concurrently, firms are expanding specialized manufacturing capabilities for high-power semiconductors and photonic components, positioning themselves to address supply-chain constraints exacerbated by new tariff policies.

To maintain competitive differentiation, players across the ecosystem are embracing data-driven decision-making, leveraging advanced analytics to forecast emerging threat vectors and prioritize capability development. By integrating market intelligence with internal R&D roadmaps, these companies proactively align investment portfolios with shifting defense priorities, ensuring they remain at the forefront of electronic warfare innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electronic Warfare market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus SE

- BAE Systems plc

- Elbit Systems Ltd.

- General Dynamics Corporation

- Israel Aerospace Industries Ltd.

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Rheinmetall AG

- Saab AB

- Textron Inc.

- Thales S.A.

- The Boeing Company

Proactive Strategies and Tactical Recommendations for Defense Leaders to Capitalize on Emerging Electronic Warfare Opportunities and Mitigate Risks

To navigate the evolving electronic warfare landscape, industry leaders should adopt a dual focus on technological agility and resilient supply-chain strategies. Prioritizing modular open-systems architectures will facilitate rapid integration of emerging capabilities, enabling seamless upgrades without overhauling entire platforms. Organizations that cultivate standardized interfaces and interoperable software frameworks can significantly reduce time-to-field for new electronic attack and protection suites.

Simultaneously, executives must proactively mitigate tariff-driven disruptions by diversifying supplier networks and accelerating domestic manufacturing investments. Establishing strategic partnerships with regional fabrication facilities can buffer programs against import duties and regulatory uncertainty. In parallel, embedding advanced analytics into procurement and inventory management will allow planners to anticipate component shortages and adjust ordering cadences before mission-critical shortfalls occur.

Finally, to outpace adversary developments, companies should invest in collaborative research consortia that bridge government laboratories, academic institutions, and commercial innovators. Such ecosystems foster cross-pollination of ideas, from photonic metamaterials to AI-augmented electronic support measures, fueling breakthroughs that deliver decisive operational advantage in contested spectrums.

Overview of Rigorous Research Approaches Data Collection Techniques and Analytical Frameworks Underpinning the Electronic Warfare Market Analysis

This analysis employs a comprehensive, multi-phase research methodology designed to capture the complexity of electronic warfare markets. Our primary research program included structured interviews with senior defense procurement officials, program managers, and systems engineers across major allied nations. Complementing these insights, vendor roadmaps and product white papers provided detailed technical specifications and development timelines.

Secondary research encompassed a rigorous review of defense policy directives, budgetary documents, and open-source intelligence reports. We analyzed government solicitation archives to identify procurement trends, while patent landscaping and citation analysis illuminated emerging technology clusters in antenna design, signal processing, and RF power amplification. Quantitative data extraction and synthesis were facilitated through proprietary databases and peer-reviewed engineering journals.

Analytical rigor was ensured through iterative validation workshops, where preliminary findings were vetted by subject-matter experts. This triangulated approach-integrating interviews, document analysis, and expert review-ensures that our conclusions rest on a robust evidentiary foundation, delivering actionable insights for decision-makers navigating this high-stakes domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electronic Warfare market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electronic Warfare Market, by Capability

- Electronic Warfare Market, by Product Type

- Electronic Warfare Market, by Application

- Electronic Warfare Market, by End User

- Electronic Warfare Market, by Region

- Electronic Warfare Market, by Group

- Electronic Warfare Market, by Country

- United States Electronic Warfare Market

- China Electronic Warfare Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2226 ]

Synthesizing Critical Insights and Strategic Imperatives to Chart the Future Trajectory of Electronic Warfare Capabilities and Market Dynamics

The confluence of advanced digital signal processing, AI-driven sensor fusion, and modular open-systems design is reshaping the electronic warfare landscape into a highly dynamic strategic frontier. Technological innovations have introduced unprecedented capabilities for both electronic attack and protection, while evolving tariff policies have underscored the critical importance of supply-chain resilience. Segmentation insights across air, land, naval, and space domains reveal distinct drivers that demand tailored solutions to maintain operational superiority.

Regionally, diverging defense priorities in the Americas, EMEA, and Asia-Pacific underscore the necessity for flexible business models and localized partnerships. Leading companies that integrate advanced analytics, digital-twin simulations, and targeted manufacturing investments are best positioned to outpace competitors and deliver next-generation capabilities on compressed timelines. As the electromagnetic spectrum becomes increasingly contested, the ability to anticipate emerging threat vectors and rapidly adapt technologies will determine battlefield effectiveness.

Ultimately, this executive summary highlights that sustained investment in R&D, strategic supply-chain diversification, and collaborative innovation ecosystems will be imperative for organizations seeking to navigate the complex matrix of technical, regulatory, and geopolitical forces shaping electronic warfare. By aligning strategic initiatives with these imperatives, defense stakeholders can secure decisive advantage in the spectrum battles of tomorrow.

Contact Associate Director of Sales & Marketing Ketan Rohom Today to Secure Comprehensive Electronic Warfare Market Research and Strategic Advantage

Ready to accelerate your strategic decision-making with authoritative data on electronic warfare markets? Connect directly with Associate Director of Sales & Marketing Ketan Rohom to secure access to our in-depth research report that decodes emerging technologies, evolving supply chain dynamics, and competitive intelligence. By partnering with Ketan, you’ll receive personalized guidance on tailoring our insights to your organization’s unique needs, ensuring you harness actionable intelligence for procurement planning, capability development, and market entry strategies. Don’t miss the opportunity to leverage comprehensive analysis and expert consultation to drive superior outcomes in a rapidly intensifying defense landscape - reach out today to transform insights into impact.

- How big is the Electronic Warfare Market?

- What is the Electronic Warfare Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?