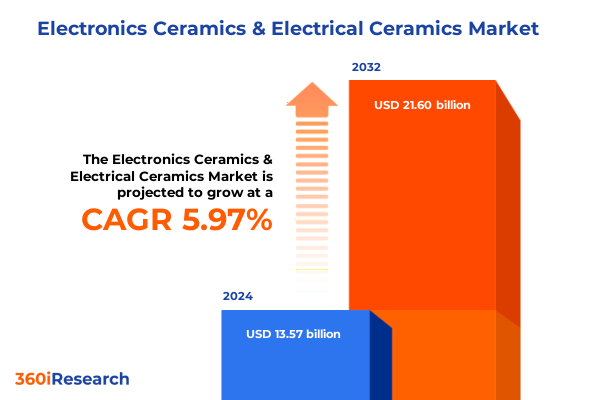

The Electronics Ceramics & Electrical Ceramics Market size was estimated at USD 14.38 billion in 2025 and expected to reach USD 15.24 billion in 2026, at a CAGR of 5.98% to reach USD 21.60 billion by 2032.

Gaining Insights into the Critical Foundations and Market Dynamics Driving Innovation and Growth within the Electronics and Electrical Ceramics Sector

The electronics and electrical ceramics industry stands at the forefront of modern technological progression, underpinning everything from communication infrastructure to emerging mobility solutions. A synthesis of high-performance materials science and advanced manufacturing has propelled ceramics to a central role in next-generation applications, including 5G telecommunications, electric and autonomous vehicles, and miniaturized consumer gadgets. As demand intensifies for components that deliver superior dielectric properties, thermal stability, and miniaturization, industry participants must navigate a complex ecosystem of raw material sourcing, production processes, and end-use requirements.

Against this backdrop, our exploration begins by defining the fundamental landscape of electronics ceramics. By examining the convergence of materials innovations-such as high-purity alumina, stabilized zirconia, and silicon carbide-with breakthroughs in ceramic fabrication techniques, stakeholders can appreciate the layered complexity of technology adoption cycles. Establishing a shared understanding of these foundational drivers is essential for decision-makers seeking to position their portfolios for sustained growth and resilience in an era marked by rapid disruption and fierce global competition.

Examining How Technological Innovation and Supply Chain Evolution Are Redefining the Electronics Ceramics Value Chain for Next-Generation Applications

Shifts in global supply chains and accelerating technological demands have catalyzed transformative change in the electronics ceramics landscape. Advanced packaging requirements for consumer electronics and telecom devices have driven uptake of multilayer ceramic substrates, while surging electrification in automotive and energy sectors has heightened the importance of high-voltage capacitors and robust piezoelectric materials. Concurrently, manufacturers have embraced digitalization and automation in high-volume production, enabling tighter quality control and reduced per-unit costs.

Recent breakthroughs in material chemistry-such as yttria-stabilized zirconia for tougher ceramic cores and boron nitride composites for improved thermal management-underscore the industry’s commitment to performance optimization. Moreover, the convergence of additive manufacturing with traditional tape casting and injection molding techniques has unlocked new design freedoms, accelerating prototyping cycles and enabling complex geometries that were previously cost prohibitive. These shifts, coupled with a heightened focus on sustainability and circular economy principles, are redefining value chains and positioning ceramics as a vital enabler of cutting-edge technologies.

Analyzing the Far-Reaching Consequences of Extended United States Tariffs on Electronics Ceramics Supply Chains and Cost Structures

The imposition and extension of United States trade tariffs in 2025 have exerted significant influence on cost structures, supply reliability, and sourcing strategies across the electronics ceramics domain. While aimed at protecting domestic industries, the additional duties on imported ceramic substrates and raw materials have prompted manufacturers to reassess supplier networks, explore alternative sourcing regions, and absorb incremental cost pressures. In response, some leading producers have accelerated investments in local production facilities to mitigate tariff exposure and enhance supply chain resilience.

These shifts have had ripple effects throughout the value chain, affecting not only end producers of capacitors, substrates, and piezoelectric elements but also tier-2 and tier-3 suppliers of raw materials like alumina, silicon nitride, and magnesia stabilized zirconia. To preserve margin stability, many companies have locked in longer-term contractual agreements and pursued vertical integration strategies. At the same time, end users have sought design optimizations and material substitutions-such as moving from high cost HTCC substrates to lower cost LTCC alternatives-to maintain product affordability without sacrificing performance.

Unveiling Deep Segmentation Nuances Across Product Types, Raw Materials, Applications, and Manufacturing Routes in Electronics Ceramics

Segmenting the electronics ceramics market reveals a nuanced tapestry of product categories, material bases, manufacturing approaches, and application end-uses. Based on Product Type, the ecosystem encompasses capacitors including high-voltage, multilayer ceramic, and RF variants, as well as ferrites, insulators, piezoelectric ceramics, resistors, and substrates such as alumina, aluminum nitride, HTCC, and LTCC, the latter further distinguished by high-layer-count and low-layer-count configurations. This breadth demands that component designers calibrate performance attributes-dielectric constant, temperature coefficient, mechanical robustness-against form factor and cost considerations.

Shifting to raw materials, the market spans alumina, boron nitride, silicon carbide, silicon nitride, and zirconia, which subdivides into ceramic cores, magnesia stabilized, and yttria stabilized grades. These material choices directly influence electrical, thermal, and mechanical properties, driving selection criteria for applications from consumer electronics to medical devices. The application landscape itself covers automotive-encompassing autonomous, electric, and internal combustion platforms-alongside consumer, industrial, and telecom electronics, with the consumer electronics segment further defined by computers and tablets, home appliances, smartphones, and wearables. Finally, manufacturing methods including chemical vapor deposition, dry pressing, injection molding, sol-gel, and tape casting, the latter realized through doctor blade and slot die processes, underscore the critical role of process innovation in achieving scale and consistency.

This comprehensive research report categorizes the Electronics Ceramics & Electrical Ceramics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Raw Material

- Manufacturing Process

- Application

Highlighting Regional Dynamics and Investment Drivers Shaping the Global Electronics Ceramics Competitive Landscape

Geographic dynamics shape the competitive contours of the electronics ceramics market, with distinct regional trajectories driven by local demand patterns, production capabilities, and policy frameworks. In the Americas, a robust presence of automotive and aerospace OEMs fuels demand for high-reliability capacitors and piezoelectric materials, while domestic incentives for reshoring advanced manufacturing have accelerated investment in local substrate fabrication. In Europe, Middle East, and Africa, stringent environmental regulations combined with a strong industrial electronics base have catalyzed adoption of eco-friendly production methods and sustainable raw material sourcing.

Asia-Pacific remains the largest hub for electronics ceramics, driven by scale manufacturing in countries such as China, Japan, and South Korea. Rapid growth in consumer electronics, expansion of 5G infrastructure, and leadership in electric vehicle production have propelled demand for multilayer substrates, high-performance alumina, and advanced ferrite components. Regional trade agreements and government subsidies continue to incentivize capacity expansions, while rising labor costs in traditional manufacturing centers are prompting some enterprises to diversify into adjacent markets within Southeast Asia.

This comprehensive research report examines key regions that drive the evolution of the Electronics Ceramics & Electrical Ceramics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Discerning the Strategic Postures of Leading Conglomerates and Agile Innovators within the Electronics Ceramics Ecosystem

The electronics ceramics arena features a blend of established conglomerates and specialized innovators, each carving out distinct competitive positions. Industry leaders have leveraged integrated operations to capture upstream and downstream margin pools, combining raw material refining, ceramic synthesis, and component assembly under unified corporate structures. These strategic configurations enable rapid scaling of emerging product families-such as high-layer-count LTCC substrates for 5G front-end modules-while preserving quality benchmarks essential for mission-critical applications.

Simultaneously, nimble pure-play ceramic manufacturers and niche technology providers are carving growth pathways through agile R&D cycles and focused application expertise. By partnering closely with end-users in sectors like medical devices and renewable energy, these specialists rapidly iterate formulations for biocompatibility or high-temperature endurance. Joint ventures between raw material suppliers and electronics ceramics producers have further deepened collaboration, enhancing feedstock availability and aligning product roadmaps with evolving performance demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electronics Ceramics & Electrical Ceramics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- AdValue Technology LLC

- Aum Techno Ceramics

- CeramTec GmbH

- CoorsTek, Inc.

- Corning Incorporated

- Ferro Corporation

- H.C. Starck GmbH

- Heraeus Holding GmbH

- IBIDEN Co., Ltd.

- KCM Corporation Co. Ltd.

- KEMET Electronics Corporation

- Kyocera Corporation

- Maruwa Co., Ltd.

- Morgan Advanced Materials plc

- Murata Manufacturing Co., Ltd.

- NGK Insulators, Ltd.

- Noritake Co., Ltd.

- PI Ceramic GmbH

- Rauschert Steinbach GmbH

- Saint-Gobain

- Samsung Electro-Mechanics Co., Ltd.

- Taiyo Yuden Co., Ltd.

- TDK Corporation

- Yageo Corporation

Implementing Integrated Supply Chain, Advanced Manufacturing, and Collaboration Strategies to Accelerate Growth in Electronics Ceramics

Industry leaders can fortify their market standing and capitalize on emerging opportunities by executing a multipronged set of strategic initiatives. Prioritizing vertical integration through targeted acquisitions or joint ventures can secure critical raw material streams and buffer against geopolitical supply disruptions. Concurrently, accelerating development of advanced manufacturing capabilities-such as additive ceramic printing and real-time digital quality inspection-will unlock cost efficiencies and bolster product differentiation.

To address evolving end-market requirements, organizations should deepen collaborative engagement with key users in automotive electrification, telecom infrastructure, and health-tech, co-developing tailored ceramic solutions. Embedding sustainability at every stage-from raw material selection to end-of-life recyclability-will resonate with environmentally conscious OEMs and policy makers. Finally, proactive workforce upskilling in data-driven process control and materials informatics will ensure that talent pipelines remain aligned with next-generation innovation imperatives.

Combining Robust Primary Insights and Comprehensive Secondary Analysis to Ensure Accurate and Actionable Market Intelligence

The research methodology underpinning this analysis combines rigorous primary and secondary data collection, triangulated through both quantitative and qualitative lenses. Primary inputs were gathered via structured interviews with senior executives, engineers, and procurement specialists across the ceramics value chain, supplemented by surveys capturing real-world adoption timelines and cost pressures. Secondary research encompassed a comprehensive review of industry whitepapers, peer-reviewed journals, patent filings, and publicly available corporate disclosures.

Data synthesis followed a bottom-up approach, validating component-level consumption metrics against macroeconomic indicators and end-use market dynamics. Forecast assumptions were stress-tested through scenario analysis to account for policy shifts, raw material price volatility, and disruptive technology adoption. Rigor was further ensured through peer review by external academic and industry experts, ensuring that findings are both robust and reflective of the latest technological advances and market realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electronics Ceramics & Electrical Ceramics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electronics Ceramics & Electrical Ceramics Market, by Product Type

- Electronics Ceramics & Electrical Ceramics Market, by Raw Material

- Electronics Ceramics & Electrical Ceramics Market, by Manufacturing Process

- Electronics Ceramics & Electrical Ceramics Market, by Application

- Electronics Ceramics & Electrical Ceramics Market, by Region

- Electronics Ceramics & Electrical Ceramics Market, by Group

- Electronics Ceramics & Electrical Ceramics Market, by Country

- United States Electronics Ceramics & Electrical Ceramics Market

- China Electronics Ceramics & Electrical Ceramics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Synthesizing Market Complexities and Future Drivers to Equip Stakeholders with Strategic Clarity

In an era defined by rapid electrification, digitization, and sustainability imperatives, electronics ceramics stand as foundational enablers of modern innovation. The market’s intricate segmentation across product types, raw materials, applications, and manufacturing techniques underscores the multifaceted opportunities and challenges facing industry stakeholders. Navigating complexity requires a blend of strategic foresight, operational excellence, and collaborative ecosystems that bridge raw material science with end-use application engineering.

Looking ahead, the interplay between geopolitical trade policies, emerging material breakthroughs, and shifting end-market demands will continue to reshape competitive landscapes. Organizations that proactively integrate advanced manufacturing technologies, secure resilient supply chains, and align with the sustainability priorities of OEMs will be best positioned to capture growth. By maintaining a holistic view of the evolving ceramics ecosystem and committing to agile adaptation, companies can drive both performance and profitability in this high-impact sector.

Engage with a Dedicated Specialist to Access Comprehensive Electronics Ceramics Insights and Propel Strategic Business Growth

To gain deeper insights and secure a competitive edge in the rapidly evolving electronics and electrical ceramics market, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to explore customized solutions that align with your organization’s strategic objectives. Harness our extensive expertise and comprehensive market analysis to inform investment decisions, optimize supply chain strategies, and accelerate innovation pipelines. Engage with a dedicated specialist to obtain tailored guidance on market entry, product positioning, and partnership opportunities. Secure your access to the full report today and transform insights into lasting business impact by contacting Ketan Rohom.

- How big is the Electronics Ceramics & Electrical Ceramics Market?

- What is the Electronics Ceramics & Electrical Ceramics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?