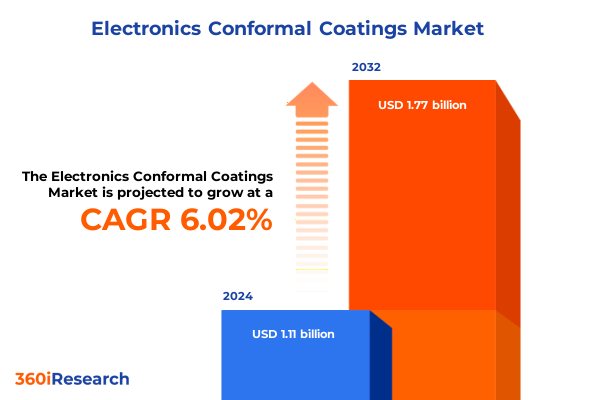

The Electronics Conformal Coatings Market size was estimated at USD 501.10 million in 2025 and expected to reach USD 527.46 million in 2026, at a CAGR of 5.27% to reach USD 718.20 million by 2032.

Pioneering Protective Solutions to Safeguard Electronics against Environmental Stressors and Enhance Device Reliability across Industries

Electronics conformal coatings play a pivotal role in protecting sensitive circuitry and components from environmental stressors such as moisture, dust, chemicals, and temperature extremes. By forming an ultra-thin, protective barrier over printed circuit boards and other assemblies, these specialized coatings preserve the integrity of electronic devices deployed in sectors ranging from aerospace and defense to consumer electronics and medical devices. Their selective application ensures long-term reliability and mitigates the risk of corrosion, electrical shorts, and mechanical wear, which are critical considerations as devices become smaller and more complex.

Rapid advancements in miniaturization and high-density packaging have intensified the need for precision coating technologies. As device architectures evolve to accommodate emerging applications in Industrial Internet of Things (IIoT), 5G infrastructure, and autonomous vehicles, the performance demands placed on conformal coatings have risen accordingly. Heightened regulatory scrutiny around hazardous substances, alongside growing emphasis on sustainable and low-VOC formulations, has further driven innovation. Consequently, manufacturers and end users alike are prioritizing coatings that deliver superior adhesion, dielectric strength, and thermal stability while aligning with environmental and health compliance standards.

Emerging Technological Breakthroughs and Sustainability Imperatives Accelerating Digitalization Reshaping the Electronics Conformal Coatings Landscape Globally

The landscape of electronics conformal coatings is undergoing transformative shifts driven by technological breakthroughs and evolving sustainability mandates. Advanced material science innovations, such as fluorinated chemistries and nanocomposite additives, are unlocking new levels of moisture resistance, thermal management, and mechanical flexibility. Simultaneously, the push toward environmentally conscious production has catalyzed the adoption of water-based and solvent-free systems, reducing volatile organic compound emissions without compromising performance. Manufacturers are increasingly integrating digital monitoring and data-analytic capabilities within curing and application equipment, enabling real-time quality control that minimizes defects and accelerates cycle times.

Emerging end-use segments are further reshaping market priorities. The rapid proliferation of electric and autonomous vehicles demands coatings capable of withstanding high-voltage environments and frequent thermal cycling. Likewise, the expansion of wearable medical devices and portable diagnostics has placed a premium on biocompatible, UV-curable formulations that cure at room temperature and extend battery life by improving dielectric properties. By aligning product development roadmaps with these cross-industry drivers, coating formulators and service providers are redefining the value proposition of conformal coatings from mere protectants to integral enablers of next-generation electronic systems.

Assessing How 2025 U.S. Tariff Policies Have Reshaped Input Costs Supply Chains and Innovation Pathways in Conformal Coatings

In early 2025, the United States introduced a series of reciprocal and Section 301 tariffs that significantly impacted raw materials and intermediate chemicals crucial to conformal coatings production. These measures targeted resin precursors, specialized solvents, and catalyst compounds, leading to elevated input costs that reverberated throughout the supply chain. Resin suppliers responded by adjusting pricing structures, and original equipment manufacturers began renegotiating long-term contracts in a bid to manage budgetary pressures. Concurrently, procurement teams accelerated efforts to diversify sourcing across alternative geographies, including Southeast Asia and Latin America, to mitigate exposure to tariff-driven cost volatility.

The ramifications extend beyond immediate cost inflation, prompting strategic shifts in near-shoring and domestic capacity expansion. In response to heightened trade barriers, several materials houses have invested in local production facilities and expanded their R&D footprint to develop formulations that rely less on tariff-affected inputs. Process engineering teams have also prioritized efficiency improvements, such as integrating adjunct curing technologies and implementing inline thickness monitoring systems, to offset rising overhead. The aftermarket segment has felt margin compression, driving service providers to differentiate through value-added offerings like customized coating blends and predictive maintenance platforms that enhance coated assemblies’ lifespan.

Unveiling Market Dynamics across Material Types Application Methods Thickness Ranges Curing Systems and End-User Demands Driving Segmentation Insights

Segmentation by coating material reveals distinct performance and value propositions. Acrylic and polyurethane variants continue to dominate applications requiring cost-effective moisture protection, while epoxy chemistries are preferred for their robust chemical resistance and mechanical adhesion. Silicone and styrenated block-copolymer systems excel in high-flexibility and high-temperature environments, and parylene coatings offer unparalleled conformality for microelectronic and MEMS applications. As formulators refine their portfolios, balancing cost with specialized performance attributes remains a strategic imperative.

Application method segmentation underscores the importance of process selection based on part geometry, throughput, and quality requirements. Brush coating delivers precision for small-batch or repair operations, whereas dip coating enables uniform coverage for complex assemblies in volume manufacturing. Selective coating techniques, including robotic spray and dispensing systems, are gaining traction for their ability to target critical areas without excess masking, and spray coating remains a versatile solution for large-scale and intricate substrates. Thickness range considerations further refine these choices: sub-25-micron films cater to fine-pitch electronics, mid-range coatings between 25 and 100 microns serve general protection needs, and thicker films exceeding 100 microns provide added mechanical resilience. Finally, curing system selection-from evaporative and thermal curing to UV and moisture-activated crosslinking-aligns with throughput goals and energy efficiency targets. End-user segmentation highlights the tailored demands of diverse industries: aerospace and defense require stringent reliability under extreme conditions, automotive and transportation focus on high-voltage and electromagnetic compatibility, consumer electronics seek sleek form factors and rapid cycle times, energy and utilities emphasize long-term durability in harsh environments, healthcare and life sciences demand biocompatibility and sterilization resistance, IT and telecommunication prioritize dielectric performance in high-frequency applications, and manufacturing leverages conformal coatings as a value-add to extend machinery uptime and reduce maintenance costs.

This comprehensive research report categorizes the Electronics Conformal Coatings market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Coating Material

- Application Method

- Thickness Range

- Curing System

- End-User

Examining Regional Variations Market Drivers and Growth Opportunities across the Americas Europe Middle East Africa and Asia-Pacific Regions

The Americas region continues to lead in advanced coatings adoption, fueled by a strong presence of aerospace, automotive, and consumer electronics OEMs. Stringent environmental regulations in the United States and Canada have accelerated the shift toward low-VOC and waterborne conformal coatings, while robust R&D investments have given rise to novel formulations tailored for electric vehicle power electronics and ruggedized military systems. Supply-chain diversification efforts in the Americas also include near-shoring initiatives to reduce lead times and buffer against geopolitical uncertainties, reinforcing the region’s competitive positioning in specialized coating technologies.

In Europe, the Middle East, and Africa, regulatory drivers such as REACH and the Machinery Regulation are shaping product development, encouraging suppliers to innovate with bio-based resins and solvent-free systems. Demand from industrial automation, renewable energy infrastructure, and smart grid applications has risen sharply, prompting regional coating formulators to expand production capacity and form strategic partnerships. In the Asia-Pacific, rapid industrialization and expansive electronics manufacturing ecosystems in China, South Korea, Japan, and Southeast Asian nations underpin strong growth in conformal coatings usage. Cost-sensitive end users in this region are driving volumes in conventional acrylic and epoxy products, while tier-one suppliers are concurrently piloting high-performance parylene and silicone coatings for next-generation 5G network equipment and offshore energy applications.

This comprehensive research report examines key regions that drive the evolution of the Electronics Conformal Coatings market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves and Innovation Initiatives of Market-Leading Entities Shaping the Conformal Coatings Competitive Landscape

Leading players in the conformal coatings market are advancing through a combination of product innovation, strategic partnerships, and targeted acquisitions. Formulation specialists have diversified their product lines by introducing hybrid chemistries that deliver multi-functional performance, such as combined corrosion resistance and thermal management. Several companies have forged alliances with equipment manufacturers to integrate automated application and inline inspection solutions, enhancing end-to-end process consistency for high-reliability industries.

In addition to organic growth, mergers and acquisitions have been instrumental in expanding geographic reach and consolidating key raw material supply chains. Some global coating formulators have acquired regional producers to secure production capacity closer to major end-user clusters, reducing logistical complexity and improving service responsiveness. Collaborative R&D ventures between materials suppliers and end users have also yielded customized coatings platforms, underscoring the value of co-development in addressing unique performance requirements and accelerating time to market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electronics Conformal Coatings market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aalpha Conformal Coatings

- AI Technology, Inc.

- Avantor, Inc.

- Chase Corporation

- CHT Germany GmbH

- Conins Pune

- CSL Silicones Inc. by PETRONAS Chemicals Group Berhad

- Dymax Corporation

- ELANTAS GmbH by ALTANA Group

- Electrolube

- H.B Fuller Company

- Henkel AG & Co. KGaA

- Illinois Tool Works Inc.

- MG Chemicals

- Micron Aerosol by Deepak Industries

- Miller-Stephenson Chemical, Inc.

- Momentive Performance Materials Inc.

- MR BOND POLYCHEM

- RS Components & Controls (I) Ltd.

- Shanghai Huitian New Material Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- Specialty Coating Systems Inc. by KISCO Ltd.

- The Dow Chemical Company

- Vinsa Chemicals Private Limited

Charting a Strategic Roadmap to Drive Growth Enhance Resilience Foster Innovation and Sustainable Practices in Electronics Conformal Coatings

Industry leaders should prioritize investment in advanced material R&D to stay ahead of evolving performance demands. Focusing on next-generation chemistries-such as self-healing and intrinsically flame-retardant coatings-will differentiate product offerings and open new application verticals. Concurrently, integrating digital technologies across the production workflow, from automated dispensing to AI-driven quality analytics, can drive operational efficiency and yield improvements.

To fortify supply-chain resilience, executives are advised to diversify sourcing for critical raw materials and consider regional manufacturing footprint expansion. Establishing strategic partnerships with suppliers and exploring joint ventures can offset tariff exposures and ensure continuity of supply. Moreover, adopting sustainable practices-ranging from green solvent substitution to closed-loop recycling of waste solvents-will align with regulatory expectations and bolster corporate responsibility objectives. Engaging with cross-industry consortiums and participating in standards development will further position organizations as thought leaders and enable proactive navigation of emerging compliance landscapes.

Detailing a Comprehensive Research Framework Combining Primary Expert Engagement Rigorous Secondary Analysis and Data Triangulation for Robust Insights

This study employed a two-pronged research framework, beginning with rigorous secondary analysis of industry publications, technical journals, patent filings, and regulatory documents to map the competitive and regulatory environment. Market dynamics were further validated through supply-chain assessments evaluating raw material flows, tariff structures, and regional manufacturing capacities.

Primary research comprised in-depth interviews with senior executives, R&D specialists, and procurement leaders across the coatings ecosystem. Insights from these engagements were triangulated with proprietary data sets to ensure consistency and accuracy. Quality control measures included cross-verification of proprietary survey data against publicly available financial reports, as well as iterative validation rounds with subject-matter experts. The resulting methodology combines quantitative rigor with qualitative depth to deliver a holistic view of the electronics conformal coatings sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electronics Conformal Coatings market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electronics Conformal Coatings Market, by Coating Material

- Electronics Conformal Coatings Market, by Application Method

- Electronics Conformal Coatings Market, by Thickness Range

- Electronics Conformal Coatings Market, by Curing System

- Electronics Conformal Coatings Market, by End-User

- Electronics Conformal Coatings Market, by Region

- Electronics Conformal Coatings Market, by Group

- Electronics Conformal Coatings Market, by Country

- United States Electronics Conformal Coatings Market

- China Electronics Conformal Coatings Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Concluding Reflections on Current Trends Strategic Imperatives and Emerging Directions Shaping the Future of Electronics Conformal Coatings

The electronics conformal coatings market is at a pivotal juncture, characterized by accelerating technological complexity, dynamic regulatory landscapes, and heightened sustainability expectations. By weaving together segmentation insights, regional analyses, and the real-world impacts of tariff policies, this executive summary illuminates the strategic imperatives shaping the future of protective coatings for electronics. Market participants must balance agility with forward-thinking innovation to capitalize on emerging opportunities and mitigate evolving risks.

As the industry progresses, stakeholders who embrace collaborative R&D, digital transformation, and supply-chain diversification will be best positioned to deliver resilient, high-performance solutions. Leveraging the insights presented herein will enable decision-makers to navigate the intricacies of material selection, process optimization, and market expansion in a rapidly evolving global landscape.

Connect with Associate Director of Sales and Marketing to Acquire In-Depth Electronics Conformal Coatings Market Intelligence Today

To uncover the comprehensive analysis, in-depth data, and strategic guidance covered in this executive summary, reach out directly to Ketan Rohom, the Associate Director of Sales and Marketing at 360iResearch. By connecting with Ketan, you can explore tailored licensing options, request a detailed report overview, and secure the full electronics conformal coatings market intelligence package. Engage today to leverage actionable insights, enhance your strategic decision-making, and stay ahead in a rapidly evolving industry landscape.

- How big is the Electronics Conformal Coatings Market?

- What is the Electronics Conformal Coatings Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?