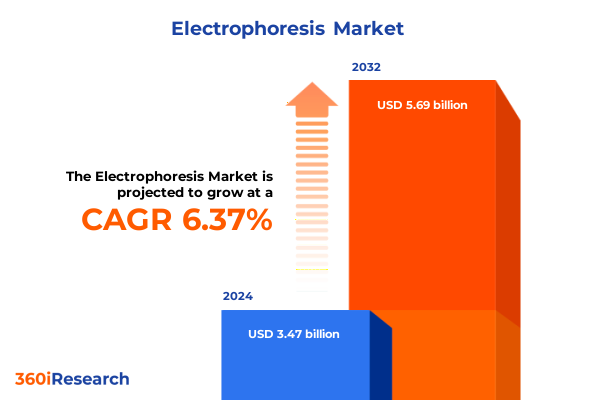

The Electrophoresis Market size was estimated at USD 3.68 billion in 2025 and expected to reach USD 3.90 billion in 2026, at a CAGR of 6.42% to reach USD 5.69 billion by 2032.

Strategic Overview of Electrophoresis Innovations Shaping Laboratory Workflows and Analytical Precision in Contemporary Research Environments

Electrophoresis continues to stand as a cornerstone analytical technique across life sciences laboratories, offering unparalleled resolution for the separation and analysis of biomolecules. From its origins in early twentieth century research to its modern applications, the technique has evolved through continuous innovation, enabling researchers to delve deeper into molecular biology, genomics, and proteomics. Today, as the complexity of biological data grows exponentially, electrophoresis serves as both a practical workhorse and a platform for cutting-edge advancements that bridge fundamental research with clinical and industrial applications.

In contemporary research environments, the demand for high throughput, automation, and digital integration has reshaped electrophoresis workflows. Laboratory professionals are increasingly seeking systems that not only deliver precision and reproducibility but also integrate seamlessly into data management ecosystems. This shift has spurred the development of novel consumables, from optimized gels and buffer systems to pre-formulated reagent kits, accompanied by advanced instruments such as capillary and pulsed field electrophoresis units. In parallel, software solutions capable of sophisticated image analysis, data interpretation, and cloud-based collaboration have become integral to modern electrophoresis platforms.

By examining this trajectory through the lens of technological innovation, regulatory influences, and evolving end user needs, this introduction sets the stage for an in-depth exploration of the electrophoresis landscape, capturing both established best practices and emerging trends critical to informed decision making.

Transformative Technological Shifts Redefining the Electrophoresis Landscape and Fueling Next Generation Molecular Separation Approaches

The electrophoresis landscape has experienced transformative shifts driven by advancements in materials science, automation, and digital integration. Traditional gel systems have been re-engineered with novel polymer chemistries to deliver faster run times and enhanced resolution, while microfluidic and lab-on-a-chip technologies are redefining sample throughput and reducing reagent consumption. These developments have enabled parallel processing of multiple samples, catering to the increasing demands of high-volume genomics and proteomics studies.

Moreover, the integration of robotics and automated sample handling has significantly reduced manual intervention, minimizing variability and accelerating workflow throughput. Instruments outfitted with sensors and real-time monitoring capabilities now provide continuous feedback, allowing scientists to adjust run parameters dynamically and ensure optimal separation conditions. Complementing these hardware innovations, software platforms leveraging machine learning algorithms facilitate automated band detection, quantitation, and even predictive troubleshooting.

Another pivotal shift is the convergence between electrophoresis and digital data management. Cloud-enabled platforms are transforming how data is stored, accessed, and shared across research networks, promoting collaborative analysis and cross-laboratory standardization. This convergence not only enhances data integrity and reproducibility but also supports regulatory compliance in clinical and pharmaceutical settings. Collectively, these technological and digital transformations are reshaping the foundations of electrophoresis, empowering laboratories to pursue increasingly ambitious research objectives with confidence and efficiency.

Comprehensive Examination of the United States 2025 Tariff Revisions Impacting Supply Chains Distribution Costs and Strategic Planning in Electrophoresis Market

In 2025, the United States implemented revised tariff schedules affecting a broad array of laboratory equipment and consumables, including critical electrophoresis components. These adjustments have injected a level of uncertainty into supply chains, with increased costs for imported polymer precursors, specialized reagents, and advanced instrumentation. Consequently, manufacturers and end users alike have been prompted to revisit sourcing strategies and cost structures to maintain operational continuity.

Due to these higher import duties, some suppliers have responded by diversifying their production footprints, establishing manufacturing facilities domestically or in tariff-neutral jurisdictions. This strategic realignment seeks to mitigate the financial impact of the revised duty schedules while safeguarding delivery timelines. At the same time, distributors and procurement teams are exploring long-term contracts and bulk procurement agreements to achieve price stability and hedge against further regulatory changes.

Furthermore, these tariff revisions have accelerated conversations around supply chain resilience. Companies are increasingly emphasizing supplier qualification processes, dual-sourcing strategies, and local inventory stocking models. In parallel, there is a renewed focus on alternative reagent chemistries and polymer sources that may fall outside the scope of tariff classifications. Through these adaptive measures, stakeholders are striving to strike a balance between cost management and the uninterrupted availability of high-performance electrophoresis solutions.

Insightful Analysis of Core Electrophoresis Market Segmentation Dynamics Illuminating Product Application and End User Trends Driving Industry Adoption

A nuanced understanding of market segmentation is critical to identifying growth vectors and tailoring solutions to meet diverse user needs. When viewed through the lens of product categories, it becomes evident that consumables-encompassing buffers, gels, kits, and reagents-remain the backbone of routine laboratory operations, offering recurring revenue opportunities and high customer engagement. Equipment segments-ranging from agarose gel rigs to capillary electrophoresis systems, polyacrylamide gel platforms, and pulsed field units-enable specialized applications and command significant capital investments. Meanwhile, services including instrument maintenance, calibration, and technical support underpin customer retention, and software offerings enhance data analysis, compliance, and workflow automation.

From an application standpoint, clinical diagnostics and forensic laboratories demand stringent validation and reproducibility, driving customized solutions for DNA profiling and protein analysis in regulated environments. In pharmaceutical development, electrophoresis plays a central role in characterizing biologics and quality control, while academic and industrial research settings leverage the technique for exploratory studies in genomics, proteomics, and metabolomics. Each application vertical presents unique requirements for throughput, sensitivity, and data management.

Finally, dissecting the market via end users reveals distinct purchasing behaviors and service expectations. Academic and research institutes often prioritize flexibility and cost-effective solutions, whereas forensic laboratories require robust chain-of-custody protocols and traceability. Hospitals and diagnostic laboratories emphasize rapid turnaround and regulatory compliance, and pharmaceutical and biotechnology companies focus on scalability, validation, and integration with upstream and downstream processes. This multi-dimensional segmentation framework lays the groundwork for targeted product development, optimized service portfolios, and strategic marketing initiatives.

This comprehensive research report categorizes the Electrophoresis market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Application

- End User

In-Depth Appraisal of Regional Variations in Electrophoresis Adoption and Innovation Across the Americas Europe Middle East Africa and Asia Pacific

Regional dynamics exert a profound influence on the evolution of the electrophoresis ecosystem, with each geography presenting distinct drivers and challenges. In the Americas, a robust R&D infrastructure coupled with strong clinical diagnostics demand fosters steady growth in both established and emerging electrophoresis technologies. Regulatory harmonization, particularly in the United States, encourages adoption of advanced instrumentation while the Latin American market exhibits potential for expansion as public health initiatives ramp up genomics and infectious disease testing programs.

Europe, Middle East, and Africa (EMEA) bring a tapestry of mature markets alongside rapidly developing economies. Western Europe’s emphasis on precision medicine and integrated diagnostic workflows drives uptake of high-throughput capillary and microfluidic systems. The Middle East’s investments in research infrastructure and Africa’s growing public-private partnerships in healthcare and agriculture open avenues for entry-level solutions and training services. Across the EMEA region, collaboration between academic consortia and industry players is fostering localized innovation and customized product offerings.

In the Asia-Pacific arena, substantial investments in biotechnology hubs, life sciences parks, and health care modernization are fueling demand for both cost-effective bench-top systems and sophisticated automated platforms. China, India, Japan, and Australia are at the forefront, prioritizing clinical genomics, personalized medicine, and agricultural biotechnology. Meanwhile, Southeast Asian nations represent emerging markets seeking to enhance molecular diagnostics capabilities. This geographic segmentation underscores the importance of tailored go-to-market models, strategic partnerships, and localized service networks to capitalize on regional nuances and growth potential.

This comprehensive research report examines key regions that drive the evolution of the Electrophoresis market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Critical Assessment of Leading Electrophoresis Industry Players Spotlighting Strategic Partnerships Innovative Developments and Competitive Positioning Perspectives

Within the competitive landscape, a cohort of leading companies shapes the trajectory of electrophoresis innovation through strategic alliances, targeted acquisitions, and continuous product enhancements. Established instrumentation manufacturers invest heavily in research and development to expand their portfolio of automation-enabled capillary systems and pulsed field devices, while consumables specialists focus on higher-performance polymer formulations and pre-validated reagent kits. Through collaborative partnerships with academic centers and contract research organizations, these key players accelerate application-specific development, from next-generation sequencing sample prep to advanced protein purification workflows.

In addition, software developers are forging integrations with laboratory information management systems, enabling seamless data transfer and regulatory compliance for clinical and pharmaceutical users. Some industry leaders are piloting digital marketplaces that connect end users with service providers and consumable suppliers, cultivating ecosystem-driven value propositions. Meanwhile, regional players with deep market insights in emerging economies leverage local manufacturing and distribution networks to offer competitive pricing and training programs, thus democratizing access to electrophoresis technologies.

Consolidation activities among both global and regional stakeholders have intensified, reflecting a broader trend toward offering end-to-end solutions encompassing consumables, equipment, services, and software. This holistic approach not only enhances customer loyalty but also creates cross-selling opportunities and reinforces barriers to entry. Understanding the strategic positioning and innovation trajectories of these leading companies is fundamental for identifying partnership and investment opportunities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electrophoresis market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies, Inc.

- Analytik Jena AG

- Bio-Rad Laboratories, Inc.

- Bio-Techne Corporation

- Bio-Techne Corporation

- Cleaver Scientific Ltd.

- Danaher Corporation

- Eppendorf SE

- GE HealthCare Technologies Inc.

- Harvard Bioscience, Inc.

- Helena Laboratories Corporation

- Hitachi High-Tech Corporation

- Hoefer, Inc.

- Lumex Instruments Canada Ltd.

- Merck KGaA

- New England Biolabs, Inc.

- PerkinElmer, Inc.

- Promega Corporation

- Sebia Group

- SERVA Electrophoresis GmbH

- Shimadzu Corporation

- Takara Bio Inc.

- Thermo Fisher Scientific Inc.

- Waters Corporation

- Wyatt Technology Corporation

Actionable Strategic Recommendations Empowering Industry Leaders to Navigate Market Complexities Enhance Operational Efficiency and Capitalize on Emerging Electrophoresis Opportunities

To navigate the evolving electrophoresis landscape, industry leaders should prioritize end-to-end automation by investing in modular platforms that integrate sample preparation, separation, and data analysis. Embracing digitalization through cloud-enabled software will strengthen data integrity, facilitate remote collaboration, and support regulatory compliance in highly regulated sectors. Furthermore, fostering collaborative partnerships with academic institutions and contract research organizations will expedite application-driven innovation and expand the addressable market through co-development initiatives.

Additionally, sourcing strategies must be re-evaluated in light of dynamic tariff environments by cultivating dual-sourcing models and near-shoring production capabilities to ensure supply chain resilience. Diversifying the product portfolio to include value-added services such as training, maintenance, and consulting will deepen customer relationships and generate recurring revenue streams. From a regional perspective, tailoring go-to-market approaches to align with local regulatory frameworks, pricing sensitivities, and service expectations will unlock growth in emerging markets.

Finally, leadership teams should embed sustainability considerations into product development and manufacturing processes, reducing environmental impact through recyclable gels, reduced energy consumption, and eco-friendly packaging. By adopting these strategic imperatives, companies can maintain competitive advantage, drive operational excellence, and capitalize on the next wave of electrophoresis innovations.

Rigorous Research Methodology Overview Detailing Data Collection Analytical Frameworks Validation Processes and Quality Assurance Measures for the Electrophoresis Study

This study employs a mixed-method research design, combining primary and secondary data to ensure comprehensive coverage and rigorous validation. Primary inputs were gathered through structured interviews with senior executives from equipment manufacturers, consumable suppliers, and end users including academic institutions, forensic laboratories, hospitals, and pharmaceutical companies. In parallel, in-depth discussions with regulatory experts provided context for the implications of tariff changes and compliance requirements.

Secondary research encompassed analysis of company publications, peer-reviewed journals, patent databases, and industry white papers to chart technological advancements and market trends. Data triangulation was executed to cross-verify findings and resolve discrepancies. Quantitative data points related to equipment installation base, consumable usage patterns, and service contracts were analyzed to identify underlying growth drivers without extrapolating into market sizing or forecasting.

To uphold quality assurance, the research underwent multiple review cycles involving subject matter experts and methodological specialists. The analytical framework adopted encompasses segmentation mapping, competitive benchmarking, and scenario analysis to uncover strategic insights. This rigorous approach ensures that conclusions and recommendations are grounded in reliable evidence and reflect the latest developments across the electrophoresis domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electrophoresis market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electrophoresis Market, by Product

- Electrophoresis Market, by Application

- Electrophoresis Market, by End User

- Electrophoresis Market, by Region

- Electrophoresis Market, by Group

- Electrophoresis Market, by Country

- United States Electrophoresis Market

- China Electrophoresis Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 954 ]

Conclusive Synthesis Highlighting Key Insights Strategic Implications and Future Outlook for the Electrophoresis Industry Driving Informed Decision Making

The synthesis of technology trends, regulatory impacts, segmentation analysis, regional dynamics, and competitive positioning yields a coherent narrative of the electrophoresis market’s current state and future trajectory. Advancements in materials science and automation are redefining laboratory workflows, while digital integration is elevating data management and collaborative research capabilities. The 2025 tariff revisions have underscored the need for supply chain agility and localized production strategies without undermining innovation incentives.

Segmentation insights reveal that consumables maintain a pivotal role in sustaining recurring laboratory operations, while specialized equipment and software integration are pivotal for high-value applications. The distinct requirements of clinical diagnostics, forensic investigations, pharmaceutical development, and academic research emphasize the necessity for tailored solutions and regulatory alignment. Regional analyses demonstrate that while established markets continue to adopt sophisticated electrophoresis systems, emerging economies present untapped potential when approached with customized offerings and service models.

Finally, the competitive landscape is characterized by strategic alliances, product ecosystem expansions, and consolidation trends that coalesce around end-to-end solution delivery. By leveraging these integrated insights, decision makers are equipped to make informed, strategic choices, balance short-term operational priorities with long-term innovation goals, and position themselves for sustained leadership in the electrophoresis arena.

Engaging Call To Action Inviting Stakeholders to Connect with Associate Director Sales Marketing for Exclusive Access to the Comprehensive Electrophoresis Market Report

For a deeper exploration of these insights and a comprehensive understanding of the electrophoresis market trajectory, connect with Ketan Rohom, Associate Director, Sales & Marketing, whose expertise and guidance will ensure you harness the full potential of this report’s findings to drive strategic growth and innovation within your organization

- How big is the Electrophoresis Market?

- What is the Electrophoresis Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?