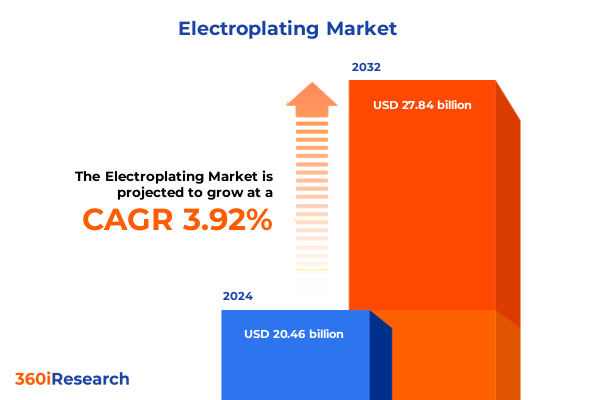

The Electroplating Market size was estimated at USD 19.74 billion in 2025 and expected to reach USD 20.41 billion in 2026, at a CAGR of 3.51% to reach USD 25.15 billion by 2032.

Unveiling the Driving Forces Shaping Today's Electroplating Industry Landscape and Core Dynamics Influencing Stakeholders' Strategic Decisions

The electroplating industry has evolved into a pivotal component of modern manufacturing, underpinning the enhanced performance and aesthetic qualities of a myriad of products. From consumer electronics to aerospace components, the application of metallic coatings has become an essential enabler for improving durability, corrosion resistance, and electrical conductivity. Advances in materials science and process engineering have driven the industry toward unprecedented levels of precision and efficiency, while sustainability considerations have prompted the development of greener chemistries and closed‐loop recycling systems.

As the global economy continues to recover and industrial production scales up, the electroplating sector is positioned for renewed momentum. However, the interplay of regulatory pressures, raw material volatility, and geopolitical shifts necessitates a strategic approach. Decision makers are increasingly focused on selecting optimal plating methods, metals, and application pathways to balance cost, performance, and environmental impact. In this context, a comprehensive understanding of market drivers, technological innovations, and regulatory frameworks becomes imperative for staying ahead of the curve.

Exploring the Revolutionary Technological, Regulatory, and Market Transformations That Are Redefining the Electroplating Value Chain Globally

Electroplating is undergoing transformative shifts as digitalization intersects with advanced manufacturing. The integration of Industry 4.0 technologies such as real‐time process monitoring, robotics, and data analytics is enabling tighter control over bath composition, deposition rates, and coating uniformity. These advancements are reducing defects and enhancing throughput, ushering in an era of smart plating lines that adapt dynamically to process variables.

Regulatory modernization is another critical pivot point. Stricter environmental standards are incentivizing the adoption of chromium trioxide replacements and low-cyanide chemistries, while water reuse mandates are driving investment in wastewater treatment solutions. In parallel, the emergence of additive manufacturing has expanded possibilities for conformal coatings on complex geometries, blurring the lines between traditional plating and novel surface engineering. Together, these technological, regulatory, and market forces are redefining the competitive landscape and compelling industry players to innovate at an accelerated pace.

Analyzing How the 2025 United States Tariff Regime Is Reshaping Supply Chains, Cost Structures, and Competitive Dynamics in Electroplating

In 2025, the United States implemented a series of tariffs targeting specific metal and electroplated components imported from key global suppliers. These measures have altered cost dynamics, prompting manufacturers to reassess sourcing strategies and negotiate revised terms with domestic and alternate international vendors. The heightened import duties have translated into increased input costs for businesses relying on chromium, copper, and nickel‐based coatings.

Consequently, supply chains are diversifying as companies pursue nearshoring opportunities to mitigate tariff exposure. Domestic plating facilities have experienced a surge in inquiries, yet capacity constraints and workforce skill gaps have emerged as challenges. Downstream industries, particularly automotive and aerospace, are feeling the ripple effects, with procurement teams balancing tariff-induced cost pressures against quality and lead‐time considerations. The cumulative impact of these trade policies underscores the need for agile planning and robust supplier partnerships to sustain operational resilience.

Deciphering Segment-Specific Trends Across Methods, Metals, Applications, and End Users to Illuminate Emerging Growth Pathways in Electroplating

Segment‐specific trends reveal distinctive growth trajectories across process methods, metal types, application areas, and end‐user sectors. When evaluating plating methods, barrel and rack approaches remain staples for high‐volume components, while brush electroplating and vibratory techniques are gaining traction for localized repairs and complex surface finishes. Continuous and in‐line plating lines are capturing attention for their capacity to integrate seamlessly with automated assembly stations.

Regarding plating metals, the enduring demand for nickel and chromium is complemented by rising interest in specialty finishes such as palladium and silver for high‐performance electronics. Copper continues to underpin electrical conductivity applications, whereas zinc and tin plating maintain their roles in corrosion protection. Decorative gold finishes persist in luxury goods and jewelry, driving specialized process development. Application needs differ, with corrosion protection dominating in heavy‐industrials, decorative coatings in consumer‐facing products, and electrical conductivity essentials in semiconductor and telecommunications devices. Wear resistance coatings are increasingly specified for machinery parts and tools.

End‐user segmentation highlights divergent priorities: aerospace and defense mandates ultra‐precise, certifiable finishes; automotive focuses on mass‐production efficiency paired with durability; the electrical and electronics sector demands micron‐level control for conductivity; energy and telecommunications require anti‐corrosive barriers in harsh environments; healthcare plating emphasizes biocompatibility; jewelry seeks unmatched luster and purity; machinery components rely on robust wear resistance to maximize service life.

This comprehensive research report categorizes the Electroplating market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Methods

- Plating Metal

- Automation Level

- Thickness Range

- Application

- End-User

Examining Geographic Variations in Demand, Regulatory Environments, and Innovation Adoption to Reveal Regional Strengths and Opportunities in Electroplating

Regional dynamics in electroplating reflect the distinctive economic drivers and regulatory frameworks of the Americas, Europe Middle East & Africa, and Asia‐Pacific. In the Americas, strong demand from automotive hubs in North America and growing oil and gas infrastructure projects in South America are bolstering investment in corrosion protection and high-volume plating solutions. Environmental compliance directives in Canada and the United States are influencing the adoption of advanced wastewater treatment technologies alongside process optimization initiatives.

Across Europe, Middle East & Africa, stringent EU regulations on hexavalent chromium and volatile organic compounds are accelerating the transition to trivalent alternatives and closed‐loop systems. The Middle East’s emphasis on infrastructure development and renewable energy projects is fostering specialized plating services for large‐scale components, while Africa’s nascent manufacturing sector shows promise in localized vibratory and brush plating applications.

Asia-Pacific remains the largest electroplating market, powered by robust electronics manufacturing in Southeast Asia, automotive production in Japan and South Korea, and expanding industrial capacity in India and China. Supply chain realignments are underway as tariff policies and sustainability imperatives lead to capacity shifts from coastal production centers to inland facilities with access to cleaner energy and skilled labor pools.

This comprehensive research report examines key regions that drive the evolution of the Electroplating market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders' Strategic Moves, Innovation Portfolios, and Collaborative Endeavors That Are Driving Electroplating Market Competition

Industry leaders are pursuing multifaceted strategies to strengthen their positions. Strategic partnerships between metal suppliers and plating service providers are streamlining raw material procurement and fostering co-development of tailored chemistries. Mergers and acquisitions are consolidating specialized capabilities, particularly in surface treatment and waste management technologies. Companies with robust research and development pipelines are launching next-generation coating solutions with enhanced durability and reduced environmental impact.

In addition, several key players are expanding global footprints by establishing new finishing facilities closer to major automotive and electronics clusters. Investment in digital process control platforms is enabling real-time parameter adjustments and predictive maintenance, reducing downtime and improving yield. Sustainability credentials have become critical differentiators, prompting firms to achieve third-party certifications and publicize carbon footprint reductions across their plating operations. Collectively, these competitive maneuvers are shaping a dynamic ecosystem where innovation and operational excellence define market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electroplating market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aalberts Surface Technologies GmbH

- Accurate Precision Plating, LLC

- Advanced Plating Technologies

- Alleima AB

- Allenchrome Electroplating Ltd.

- Allied Finishing Inc.

- AOTCO Metal Finishing LLC

- Bajaj Electroplaters

- Cherng Yi Hsing Plastic Plating Factory Co., Ltd..

- Collini Holding AG

- Dr.-Ing. Max Schlötter GmbH & Co. KG

- DuPont de Nemours, Inc

- ELCOM Co., Ltd.

- Electro-Spec Inc.

- Elmet Technologies

- ENS Technology by Havis, Inc.

- Interplex Holdings Pte. Ltd.

- Jing Mei Industrial Ltd.

- Klein Plating Works, Inc.

- Kuntz Electroplating, Inc.

- Kyodo International, Inc.

- MacDermid, Inc. by Element Solutions Inc.

- METALOR Technologies SA by Tanaka Kikinzoku Group

- Mitsubishi Electric Corporation

- MKS Instruments, Inc.

- New Method Plating Company, Inc.

- Nihon Dento Kougyo Co., Ltd.

- PAVCO, Inc.

- Pioneer Metal Finishing, LLC

- PPG Industries, Inc.

- Professional Plating, Inc.

- Sharretts Plating Company, Inc.

- Sheen Electroplaters Pvt Ltd.

- Technic Inc.

- THERMOCOMPACT

- Toho Zinc Co., Ltd.

- Umicore

Outlining Actionable Strategies for Industry Executives to Navigate Disruption, Enhance Sustainability, and Foster Competitive Advantage in Electroplating

To navigate evolving market conditions and secure a competitive edge, industry executives should prioritize supply chain diversification by engaging with alternate metal sources and exploring nearshore plating partnerships. Investing in environmentally friendly chemistries and advanced effluent treatment systems will not only ensure compliance but also enhance brand reputation among stakeholders who value sustainability.

Building digital capabilities across plating lines is essential for agility; implementing sensors, analytics, and closed-loop controls can optimize bath chemistry and streamline maintenance schedules. Collaboration with equipment manufacturers and research institutes will accelerate the development of high-performance coatings tailored to emerging applications such as electric vehicle components and 5G infrastructure. Furthermore, fostering a skilled workforce through targeted training programs in process engineering and environmental safety will address labor shortages and support long-term operational excellence.

Detailing Rigorous Research Frameworks and Data Collection Approaches Underpinning This Comprehensive Electroplating Market Analysis for Stakeholder Confidence

This analysis is grounded in a robust research methodology that integrates comprehensive secondary research on industry publications, regulatory databases, and patent filings with primary interviews conducted with plating engineers, materials scientists, and procurement leaders. Data quality is assured through a multi-tiered validation process, combining cross-verification of reported trends with direct feedback from industry practitioners.

Regional case studies were developed to contextualize macro-level dynamics, while process-level insights were derived from site visits to advanced plating facilities. Custom data models were employed to map technology adoption curves and regulatory timelines, ensuring that the findings presented here reflect both current realities and near-term inflection points. This framework provides stakeholders with a transparent, evidence-based foundation for strategic decision making in the electroplating sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electroplating market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electroplating Market, by Methods

- Electroplating Market, by Plating Metal

- Electroplating Market, by Automation Level

- Electroplating Market, by Thickness Range

- Electroplating Market, by Application

- Electroplating Market, by End-User

- Electroplating Market, by Region

- Electroplating Market, by Group

- Electroplating Market, by Country

- United States Electroplating Market

- China Electroplating Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesizing Key Insights and Strategic Imperatives to Illuminate the Future Trajectory of the Electroplating Industry for Informed Decision Making

The electroplating industry stands at a crossroads defined by technological innovation, regulatory evolution, and shifting trade policies. As companies adapt to smarter manufacturing processes, greener chemistries, and tariff-induced cost adjustments, those that proactively align strategy with emerging trends will be best positioned to capture value. Segment-specific opportunities in methods, metal choices, and end-use applications underscore the importance of targeted investments in both core capabilities and adjacent innovations.

Regional disparities highlight the necessity of localized approaches, whether navigating stringent European environmental mandates or capitalizing on Asia-Pacific’s manufacturing scale. The competitive landscape is being reshaped by partnerships, digital transformation, and sustainability commitments. Ultimately, resilient supply chains, continuous process improvement, and an open innovation mindset will determine which players excel in the next phase of electroplating’s evolution.

Engage with Ketan Rohom to Secure the Complete Electroplating Market Research Report and Unlock Tailored Intelligence for Strategic Investment Decisions

If you are seeking in-depth insights and strategic intelligence to drive your next move in the electroplating industry, reach out to Ketan Rohom, Associate Director, Sales & Marketing, to secure the complete electroplating market research report. Ketan’s expertise will help tailor the findings to your unique business objectives, offering customized data packages and advisory support to inform investment decisions and competitive strategy. Connect today to unlock access to exclusive analysis, detailed segment breakdowns, and actionable recommendations that can empower your organization to capitalize on emerging trends and navigate evolving regulatory landscapes with confidence.

- How big is the Electroplating Market?

- What is the Electroplating Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?