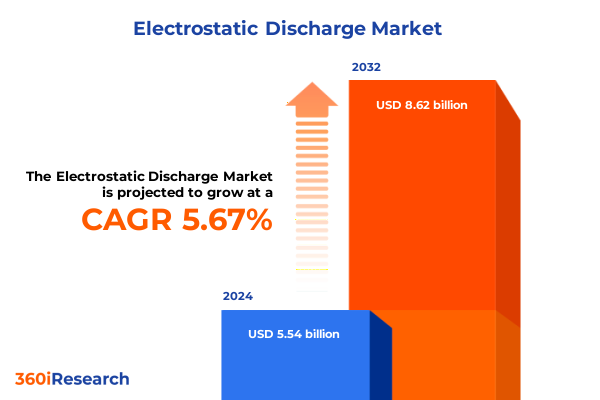

The Electrostatic Discharge Market size was estimated at USD 5.84 billion in 2025 and expected to reach USD 6.16 billion in 2026, at a CAGR of 5.71% to reach USD 8.62 billion by 2032.

Unveiling the Imperative of Electrostatic Discharge Management to Protect Advanced Technologies Amid Heightened Risk and Supply Chain Vulnerabilities

Electrostatic discharge (ESD) represents a silent but potent threat to the integrity of sensitive electronics, disrupting operations and eroding reliability across multiple sectors. As devices become increasingly miniaturized and high-speed data processing becomes ubiquitous, even minute voltage differentials can trigger catastrophic failures, prompting manufacturers to elevate protective measures.

The convergence of advanced semiconductor fabrication, the proliferation of interconnected devices, and stringent regulatory frameworks has amplified the stakes of effective ESD management. In parallel, global supply-chain pressures have exposed material and equipment vulnerabilities, compelling organizations to reassess traditional protection protocols. Consequently, proactive ESD strategies have transitioned from cost centers to strategic imperatives, underpinning both product quality and brand reputation.

This executive summary illuminates the multifaceted landscape of ESD control, charting the technological advances, policy influences, and market drivers that are reshaping the environment. By unraveling the key dynamics at play, decision-makers can align investments, refine risk mitigation tactics, and capitalize on emerging opportunities in an era where static electricity is more than a nuisance-it is a critical operational consideration.

Witnessing a Paradigm Shift as Digitalization, Miniaturization, and Sustainability Drive Next-Generation Electrostatic Discharge Control Strategies

The electrostatic discharge arena is undergoing a fundamental transformation as Industry 4.0 architectures, sustainability imperatives, and advanced materials redefine protection philosophies. Automation platforms now integrate real-time ionization and environmental monitoring modules, enabling granular control over charge accumulation and discharge events. Such systems not only enhance precision but also deliver data-driven insights for continuous process optimization.

Miniaturization trends in semiconductors and consumer electronics have intensified the demand for ultra-low discharge thresholds, propelling investment into innovative control materials and protective device arrays. At the same time, regulatory regimes across North America and Europe are tightening permissible discharge tolerances, compelling manufacturers to adopt comprehensive ESD control materials, from conductive garments to advanced workstation accessories.

Sustainability goals have prompted a shift toward recyclable packaging solutions and non-toxic conductive fibers, aligning ESD safeguards with circular-economy principles. Moreover, the growing footprint of Internet of Things deployments and high-frequency communication infrastructure underscores the need for robust shielding strategies. In this milieu, cross-functional collaboration between R&D, operations, and procurement teams is vital to harness emerging technologies and navigate evolving compliance landscapes.

Analyzing the Layered Effects of 2025 United States Tariffs on Electrostatic Discharge Equipment and Components Across the Supply Chain

In 2025, United States trade policy adjustments have exerted successive impacts on the cost structure and availability of ESD control equipment and components. On January 1, semiconductors and related devices saw tariffs rise from 25% to 50%, creating an immediate uptick in procurement costs for critical protective devices and testing instruments. A further layer emerged on February 4 when an additional 10% duty was imposed on all imports from China and Hong Kong, compounding existing Section 301 levies and inflating landed costs for ionization systems and sensitive packaging materials.

The escalation continued into April, as reciprocal tariffs on China-origin goods surged to 125% effective April 9, further stretching supply chains and prompting some distributors to absorb partial tariff burdens to preserve customer relationships. However, a brief respite arrived on May 14 under a negotiated trade accord that temporarily reduced reciprocal duties to 10% for 90 days, excluding fentanyl-related tariffs and Section 232 aluminum and steel measures. This temporary relief, while welcome, underscored the volatile nature of tariff policy and its direct influence on ESD control pricing, inventory planning, and contractual lead times.

Collectively, these policy shifts have driven end users to reevaluate supplier portfolios, explore near-shore manufacturing partnerships, and accelerate inventory buffering strategies. The cumulative effect is a recalibration of cost models, leading many organizations to prioritize domestic supply and modular system designs that mitigate exposure to future tariff escalations.

Dissecting Market Dynamics Through Product, Component, End-Use, and Channel Segmentation to Uncover Strategic Electrostatic Discharge Opportunities

Strategic segmentation reveals that ESD control materials, particularly conductive garments, floor mats, and workstation accessories, are central to comprehensive protection regimes. These materials serve as foundational elements upon which more advanced devices-such as transient voltage suppressors and array devices-are deployed to shield sensitive electronics. Concurrently, the surging demand for ESD packaging solutions has spotlighted foam cushioning and shielding bags as vital for transport resilience, with integrated systems combining monitoring and ionization technologies emerging as preferred solutions in high-value manufacturing environments.

Component segmentation highlights the ascendancy of integrated systems, where control units and ionization modules converge with real-time monitoring to deliver predictive discharge prevention. Materials innovations, especially carbon and conductive fiber composites, are generating new pathways for lightweight, durable protection in both fixed installations and portable configurations. End-use analysis underscores robust uptake in electronics manufacturing segments-spanning consumer device assembly, PCB production, and semiconductor fabrication-while aerospace and defense sectors place a premium on avionics-grade reliability. Parallel growth in healthcare manufacturing and telecommunications infrastructure further diversifies demand, compelling suppliers to tailor solutions for medical device clean-rooms and fiber-optic production lines.

Distribution channel evolution is characterized by a balanced mix of offline direct sales and distributor networks, augmented by a rapid expansion of online portals and e-commerce platforms. This hybrid model enables precise configuration of ESD control solutions, ensuring that enterprises can integrate both standardized and customized protective measures through streamlined procurement pathways.

This comprehensive research report categorizes the Electrostatic Discharge market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Component Type

- End Use

- Distribution Channel

Mapping Regional Variations in Electrostatic Discharge Adoption and Innovation Across the Americas, Europe Middle East & Africa, and Asia-Pacific Regions

Regionally, the Americas maintain leadership in ESD adoption, driven by a combination of advanced semiconductor clusters, automotive electronics hubs, and proactive regulatory bodies enforcing ANSI/ESD S20.20 standards. This environment has cultivated vibrant supplier ecosystems specializing in both fundamental control materials and sophisticated testing equipment. Meanwhile, Europe, Middle East & Africa reflect a dual focus on compliance and innovation, where stringent EU directives on equipment safety intersect with a growing emphasis on recyclable packaging and non-hazardous materials.

Asia-Pacific stands out as the manufacturing powerhouse for ESD solutions, hosting major production facilities for packaging, control materials, and protective devices. Rapid industrialization in Southeast Asia and renewed infrastructure investments in Japan and South Korea have propelled demand for next-generation ionization and control systems. However, this region also grapples with supply-chain fragility, accentuating the importance of diversified sourcing strategies and regional inventory buffers.

Across all regions, cross-border collaboration and knowledge-sharing initiatives are strengthening local capabilities, while digital platforms are facilitating global distribution. This mosaic of regional strengths and challenges underscores the need for agile strategies that align product road maps with localized market dynamics and regulatory nuances.

This comprehensive research report examines key regions that drive the evolution of the Electrostatic Discharge market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Electrostatic Discharge Industry Players and Their Strategic Innovations Reshaping Control Solutions in a Competitive Landscape

The competitive landscape of ESD solutions is anchored by companies that blend deep technical expertise with broad distribution footprints. Leading players have expanded beyond core offerings to develop integrated systems that unite ionization, monitoring, and control under unified interfaces. Partnerships with electronics OEMs and semiconductor foundries have fueled co-development of customized protective devices optimized for specific process environments.

Innovation pipelines are particularly robust in the realm of smart materials, where next-generation conductive fibers and carbon-based composites are enabling semi-permanent static dissipation on production floors and workstations. Meanwhile, diagnostics and testing equipment firms are embedding artificial intelligence to interpret discharge event data, enabling predictive maintenance and minimizing downtime. This emphasis on data-driven solutions has become a key differentiator, reinforcing the strategic value of analytics-enabled service offerings.

Moreover, collaborations between packaging specialists and materials scientists are yielding eco-friendly shielding solutions that meet both performance and sustainability criteria. These cross-sector alliances illustrate a broader trend of ecosystem consolidation, as end users seek turnkey solutions that integrate seamlessly into automated manufacturing lines. Companies that can orchestrate these multi-layered offerings while maintaining supply-chain resilience are positioned to capture the lion’s share of future growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electrostatic Discharge market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Achilles Corporation

- BASF SE

- Bondline Electronics Ltd.

- Desco Industries Inc.

- DS Smith PLC

- DuPont de Nemours, Inc.

- Elcom Ltd. by Averna Technologies Inc.

- ElectroStatics, Inc.

- Global Statclean Systems

- Highstar Technoloogy Private Limited

- Kiva Containers

- Nefab Group

- PPG Industries, Inc.

- Pregis LLC

- RS Group plc

- Sealed Air Corporation

- Shanghai Anping Static Technology Co.,Ltd.

- Smurfit Kappa Group

- Spartech Solutions Private Limited

- STMicroelectronics N.V.

- Storopack Hans Reichenecker GmbH

- Techno Stat Industory Co., Ltd.

- Teknis Limited

- Wolfgang Warmbier GmbH & Co. KG

- Zhejiang CONCO Antistatic Technology Co.,Ltd

Crafting Forward-Looking Strategies to Empower Industry Leaders with Actionable Measures for Strengthening Electrostatic Discharge Resilience

To fortify ESD defenses, industry leaders should prioritize the deployment of integrated ionization and monitoring systems that provide real-time insights into environmental charge levels and discharge events. Embedding predictive analytics will enable proactive maintenance schedules, reducing unplanned downtime and enhancing process reliability.

Diversification of the supply chain is essential to mitigate the lingering impacts of tariff volatility. Establishing regional manufacturing partnerships and leveraging near-shore production hubs can curtail lead times and insulate operations from future trade disruptions. Concurrently, modular system architectures that accommodate interchangeable materials and components will foster flexibility in response to evolving regulatory requirements and material availability.

Organizations must also engage with regulatory bodies to align emerging standards with practical implementation frameworks. By contributing to industry working groups and consortia, manufacturers can influence guidelines that balance performance, safety, and environmental sustainability. Finally, comprehensive training programs for engineering and operations personnel are crucial to embed ESD best practices throughout the organization, ensuring consistent application of protective protocols and elevating overall risk awareness.

Detailing Rigorous Research Processes and Analytical Frameworks Employed to Generate Robust Insights on Electrostatic Discharge Market Trends

This research synthesis is grounded in a rigorous methodology combining primary interviews with ESD specialists, procurement directors, and end-use executives, alongside secondary data sourced from tariff databases, industry association publications, and standards bodies. Quantitative data was corroborated through supply-chain surveys conducted across North America, Europe, and Asia-Pacific, ensuring a balanced representation of market perspectives.

Analytical frameworks included segmentation modeling, tariff impact simulations, and sustainability scoring to evaluate materials and packaging innovations. Triangulation of insights from competing data sources reinforced the validity of key trends, while iterative validation workshops with sector experts refined the interpretation of emerging patterns.

Quality assurance protocols were applied at each stage to verify source credibility, maintain consistency in terminology, and ensure alignment with the latest regulatory updates. This structured approach yields a comprehensive, multi-dimensional understanding of the electrostatic discharge landscape, equipping decision-makers with actionable intelligence underpinned by transparent research processes.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electrostatic Discharge market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electrostatic Discharge Market, by Product Type

- Electrostatic Discharge Market, by Component Type

- Electrostatic Discharge Market, by End Use

- Electrostatic Discharge Market, by Distribution Channel

- Electrostatic Discharge Market, by Region

- Electrostatic Discharge Market, by Group

- Electrostatic Discharge Market, by Country

- United States Electrostatic Discharge Market

- China Electrostatic Discharge Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2703 ]

Consolidating Core Findings to Illuminate the Critical Pathway for Navigating Evolving Electrostatic Discharge Challenges and Opportunities

In synthesizing these insights, it is evident that electrostatic discharge management has evolved into a cornerstone of technology reliability and operational excellence. The interplay of technological innovation, shifting trade policies, and regional market dynamics underscores the need for holistic approaches that integrate materials science, system design, and process analytics.

Organizations that proactively adapt to tariff fluctuations by diversifying supply chains and embracing modular architectures will build resilience against future disruptions. Concurrently, investments in smart materials and integrated control systems will drive both performance enhancements and sustainability ambitions, aligning ESD strategies with broader corporate goals.

Ultimately, the ability to navigate this complex environment hinges on cross-functional collaboration, data-driven decision making, and continuous engagement with evolving standards. By capitalizing on these core tenets, stakeholders can safeguard sensitive technologies, minimize risk exposure, and unlock new avenues for competitive differentiation in an increasingly static-charged world.

Empowering Stakeholders with Exclusive Access to Comprehensive Electrostatic Discharge Market Intelligence by Ketan Rohom to Drive Informed Decisions

For a comprehensive exploration of the electrostatic discharge market’s evolving dynamics, strategic segmentation insights, and actionable recommendations, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. His expertise will guide you through tailored intelligence designed to safeguard critical assets and unlock new growth horizons. Secure your organization’s competitive edge by partnering with Ketan to obtain the full market research report and transform insights into impactful decisions

- How big is the Electrostatic Discharge Market?

- What is the Electrostatic Discharge Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?