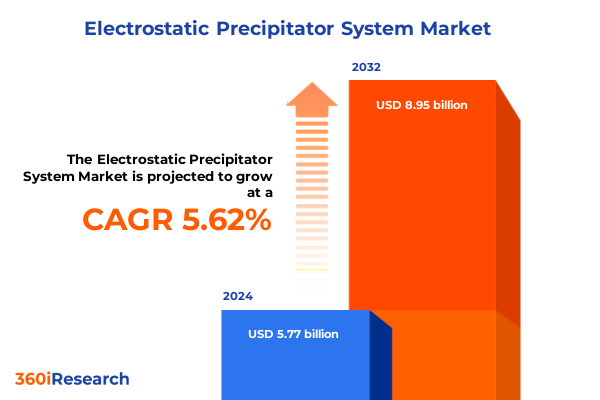

The Electrostatic Precipitator System Market size was estimated at USD 6.09 billion in 2025 and expected to reach USD 6.40 billion in 2026, at a CAGR of 5.63% to reach USD 8.95 billion by 2032.

Setting the Stage for Cleaner Air with Advanced Electrostatic Precipitator System Innovations and Emerging Market Dynamics Across Industries

Electrostatic precipitator systems stand at the forefront of industrial air pollution control, blending electrical engineering prowess with environmental stewardship. These systems, designed to remove fine particulate matter from flue gases and industrial emissions, have evolved from simple high-voltage electrodes to sophisticated, digitally enabled platforms that ensure regulatory compliance and operational efficiency.

As industries worldwide confront ever-stringent atmospheric emission standards, electrostatic precipitator technologies have become indispensable. From coal-fired power plants to cement kilns, each application demands tailored configurations that optimize particulate removal while minimizing energy consumption. This introduction explores how electrostatic precipitator systems have transitioned from foundational pollution control devices to integral components of holistic sustainability strategies.

We will examine the critical drivers shaping market dynamics, including the push for decarbonization, intensifying regulatory regimes, and the pursuit of cost-effective retrofitting solutions. By framing these systems within the larger context of global environmental objectives and industrial modernization efforts, this opening section establishes the groundwork for a deeper analysis of transformative trends, market segmentation, and actionable guidance for stakeholders.

Disruptive Technological Advancements and Regulatory Milestones Reshaping the Electrostatic Precipitator System Market Landscape

Over the past decade, electrostatic precipitator systems have undergone a dramatic metamorphosis, driven by rapid technological innovation and shifting regulatory landscapes. Traditional designs centered on basic plate and tubular configurations have given way to pulse jet and hybrid systems that deliver unparalleled particulate removal efficiency. Concurrently, digital monitoring and predictive analytics have emerged as game-changing enablers. These solutions leverage Internet of Things connectivity and machine learning algorithms to optimize corona discharge health, detect plate fouling in real time, and reduce unplanned downtime, ultimately driving higher throughput and lower operational costs.

Regulatory bodies have also accelerated change by imposing more rigorous emission limits and by incentivizing the adoption of best available techniques. In response, equipment vendors have introduced modular precipitator units that simplify retrofits and accommodate incremental capacity growth. Furthermore, materials science advancements-such as corrosion-resistant titanium electrodes and enhanced ceramic coatings-have extended maintenance intervals and improved overall system resilience. These collective shifts underscore a broader transformation: electrostatic precipitator systems are no longer static end-of-pipe solutions but dynamic assets embedded within intelligent process control ecosystems.

Analyzing the Layered Effects of 2025 Section 232 Steel and Aluminum Tariff Adjustments on Electrostatic Precipitator System Supply Chains and Costs

In 2025, the United States implemented a sequence of tariff modifications under Section 232 of the Trade Expansion Act, aimed at fortifying domestic steel and aluminum producers. In February, the administration restored the full 25% tariff on steel imports and elevated the aluminum tariff to 25%, closing loopholes and revoking many country exemptions. By March 12, exemptions for imports from Canada, Mexico, the European Union, Japan, South Korea, and the United Kingdom were terminated, subjecting all affected steel articles to additional duties and curtailing transshipment practices that had previously undermined U.S. national security objectives.

Subsequently, on June 4, 2025, the steel and aluminum tariffs were doubled to 50%-excluding certain United Kingdom imports-further intensifying input cost pressures across industries reliant on metallic components. This layered treatment of derivative products under Proclamation 10947 expanded coverage to include downstream articles ranging from HVAC coils to heavy-equipment components, raising procurement costs and complicating supply chain planning for precipitator manufacturers and end-users alike.

The cumulative effect of these tariff actions has been two-fold: domestic steelmakers have seen improved capacity utilization and pricing leverage, while precipitator system suppliers must reassess sourcing strategies, renegotiate vendor contracts, and evaluate potential relocation of manufacturing footprints. In turn, end-users face heightened capital expenditure for retrofits and new installations, underscoring the critical importance of total cost of ownership analyses in equipment selection processes.

Unveiling Critical End-User, Technological, and Operational Segmentation Patterns Driving Differentiated Demand within the Electrostatic Precipitator System Market

Market participants continue to segment electrostatic precipitator systems across multiple analytical dimensions to tailor solutions and prioritize investments. End-user industries such as cement production, heavy steel processing, and pulp and paper manufacturing each impose unique particulate profiles and flow rates, necessitating customized precipitator designs that balance filtration performance with plant throughput. In parallel, the choice between plate, pulse jet, tubular, and wet technologies hinges on the interplay of dust resistivity, moisture content, and site-specific installation constraints.

Further refinement emerges through the lens of gas type. Flue gas applications in power generation demand high-capacity systems with robust spark-suppression features, whereas industrial gas streams in chemical plants may require specialized electrode materials like stainless steel or titanium to resist corrosive effluents. Mining operations introduce high-abrasion particulate, prompting the integration of reinforced carbon steel components and pre-filtration cyclonic stages.

Operational parameters such as power rating, phase configuration, and duct orientation further segment the market. Compact precipitators under 50 kW and single-phase units serve small-scale installations or retrofit scenarios, while high-power three-phase systems above 200 kW drive performance in large industrial plants. Finally, the orientation of ductwork-horizontal versus vertical-dictates internal collection plate arrangement and gas residence time, influencing overall removal efficiency. Through this multifaceted segmentation approach, manufacturers and end-users align technology investments with performance requirements and budgetary considerations.

This comprehensive research report categorizes the Electrostatic Precipitator System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- End-User Industry

- Technology Type

- Gas Type

- Electrode Material

- Power Rating

- Phase

- Duct Orientation

Comparing Regional Demand Drivers and Regulatory Frameworks Shaping the Electrostatic Precipitator System Market Growth across Americas, EMEA, and Asia-Pacific

Across global regions, distinct drivers and regulatory frameworks shape electrostatic precipitator system adoption. In the Americas, the U.S. Environmental Protection Agency has tightened the national ambient air quality standard for fine particulate matter from 12 to 9 µg/m³, a move anticipated to prevent thousands of premature deaths and deliver significant public health benefits by 2032. Simultaneously, proposed Clean Air Act exemptions and revisions to NESHAP regulations have altered compliance timelines for coal-fired power plants, influencing demand for both new installations and advanced spark-suppression technologies.

In Europe, the modernized Industrial Emissions Directive entered into force in August 2024, enshrining stricter emission limit values and mandating best available technique implementation across 75,000 industrial installations. The directive’s zero pollution ambition is underpinned by provisions for electronic permitting and a unified Industrial Emissions Portal, enabling more transparent data reporting and public participation. These measures are driving upgrade cycles for precipitator systems, particularly within metal extraction and large-scale battery manufacturing complexes.

Meanwhile, the Asia-Pacific region continues to experience rapid industrialization, with demand for electrostatic precipitators surging in thermal power, cement, and steel sectors. APAC’s leading position reflects not only regulatory catch-up but also significant capital investments in capacity expansion, as evidenced by the region accounting for the largest share of global market activity between 2018 and 2023. This regional mosaic underscores the necessity for manufacturers to adapt solution portfolios to varied emission standards and environmental goals across the Americas, EMEA, and APAC.

This comprehensive research report examines key regions that drive the evolution of the Electrostatic Precipitator System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Innovations and Competitive Positioning of Leading Electrostatic Precipitator System Manufacturers in a Dynamic Global Market

A select group of legacy and diversified industrial equipment providers dominate the electrostatic precipitator landscape, each leveraging differentiated capabilities to capture market share. General Electric’s Grid Solutions division leads with high-performance dry and wet ESP offerings, embedding real-time emission monitoring and automated fault diagnostics that streamline maintenance and ensure continuous compliance across power generation and cement applications. Siemens distinguishes its portfolio through IoT-enabled precipitator systems, integrating cloud-based analytics and energy-efficient high-voltage power supplies that address both operational cost reduction and environmental targets.

Mitsubishi Hitachi Power Systems (a collaboration between Mitsubishi Heavy Industries and Hitachi) focuses on large-scale installations for coal-fired plants and heavy industrial sites, emphasizing turnkey solutions and robust service networks. Babcock & Wilcox has carved a niche in retrofit and modernization projects, supplying upgrade kits that enhance collection efficiency and extend equipment lifecycle in aging facilities. Global specialists such as Thermax and Ducon Technologies complement the competitive field by offering tailored hybrid filtration technologies and modular precipitator units designed for rapid deployment.

Emerging players and engineering firms continue to introduce niche innovations-ranging from compact precipitators for HVAC exhaust to marine-grade wet ESPs-underscoring the market’s dynamism. Collectively, these companies shape the competitive environment through strategic alliances, sustained R&D investment, and region-specific manufacturing footprints that align with tariff, regulatory, and customer requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electrostatic Precipitator System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alstom SA

- Babcock & Wilcox Enterprises Inc

- Bharat Heavy Electricals Limited

- Bionomic Industries Inc

- Ducon Technologies Inc

- Durr AG

- ELEX AG

- Envirex India Pvt Ltd

- FLSmidth & Co A/S

- Fujian Longking Co Ltd

- GEA Group AG

- General Electric Company

- Hamon Group

- Hitachi Ltd

- KC Cottrell Co Ltd

- L&T Special Steels and Heavy Forgings Pvt Ltd

- Mitsubishi Heavy Industries Ltd

- Pennar Industries Ltd

- Rieco Industries Ltd

- Siemens AG

- Sitson India Pvt Ltd

- Sumitomo Heavy Industries Ltd

- Thermax Limited

- Trion Inc

- Valmet Oyj

- VT Corp Pvt Ltd

- Wood Plc

- Zeta4

Strategic Roadmap for Industry Leaders to Capitalize on Emerging Opportunities and Navigate Challenges in the Electrostatic Precipitator System Sector

To thrive amid evolving regulations, cost pressures, and technological disruptions, industry leaders must pursue a multifaceted growth strategy. Firstly, diversifying the supply base for critical components-particularly steel and high-voltage transformers-mitigates exposure to fluctuating tariff regimes and ensures continuity of production. Secondly, accelerating adoption of digital twins and predictive maintenance tools enhances uptime and optimizes energy consumption by preempting performance degradation.

Moreover, partnering with environmental consultancies and regulatory bodies can inform product roadmaps that preempt future emission limit changes, positioning manufacturers as proactive compliance enablers. Investing in modular precipitator architectures further allows for rapid scalability, enabling clients to incrementally expand capacity without full system overhauls. In addition, fostering talent development through cross-disciplinary training in both electrical engineering and environmental science cultivates a workforce capable of designing next-generation precipitator solutions.

Finally, embracing circular economy principles-such as remanufacturing worn electrode components and recycling insulating ceramics-can reduce raw material dependency and deliver compelling sustainability narratives to end-users. By integrating these strategic levers, companies can maintain competitive advantage, support customer decarbonization goals, and sculpt a resilient value chain in an increasingly dynamic market.

Robust Methodological Framework Combining Primary Intelligence, Secondary Research, and Data Triangulation for In-Depth Electrostatic Precipitator System Analysis

This report’s analytical foundation rests on a rigorous methodology that blends comprehensive secondary research with targeted primary validation. Initially, we conducted an exhaustive review of industry journals, regulatory filings, and corporate disclosures to map the competitive landscape and document recent regulatory changes. Subsequently, in-depth interviews with senior executives, plant engineers, and environmental compliance officers provided nuanced perspectives on technology adoption, procurement challenges, and operational priorities.

Quantitative data collection leveraged both bottom-up and top-down approaches. Vendor shipment statistics and trade data were triangulated against macroeconomic indicators and end-user expenditure patterns to ensure robust revenue modeling and segmentation accuracy. We applied a data triangulation framework to reconcile disparate sources, validate key assumptions, and minimize forecast uncertainty. Advanced statistical tools facilitated sensitivity analyses, identifying high-impact variables across tariff scenarios, regulatory tightening, and technology penetration rates.

Finally, an iterative review process, involving cross-functional input from environmental scientists, mechanical engineers, and market strategists, ensured the report’s findings align with real-world applications and future-proof insights. This methodological rigor enables stakeholders to navigate complex market dynamics with confidence and precision.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electrostatic Precipitator System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electrostatic Precipitator System Market, by End-User Industry

- Electrostatic Precipitator System Market, by Technology Type

- Electrostatic Precipitator System Market, by Gas Type

- Electrostatic Precipitator System Market, by Electrode Material

- Electrostatic Precipitator System Market, by Power Rating

- Electrostatic Precipitator System Market, by Phase

- Electrostatic Precipitator System Market, by Duct Orientation

- Electrostatic Precipitator System Market, by Region

- Electrostatic Precipitator System Market, by Group

- Electrostatic Precipitator System Market, by Country

- United States Electrostatic Precipitator System Market

- China Electrostatic Precipitator System Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1272 ]

Synthesis of Market Insights Highlighting Growth Trajectories, Regulatory Pressures, and Technological Drivers Impacting Electrostatic Precipitator Systems

Electrostatic precipitator systems occupy a pivotal role in enabling industries to meet stringent air quality standards while maintaining operational productivity. Our analysis reveals a market in transition, characterized by digital integration, modular design innovation, and heightened regulatory scrutiny across global regions. Tariff fluctuations and evolving environmental policies have intensified the need for agile supply chain strategies and adaptable engineering solutions.

Segmentation insights demonstrate that no single technology or application dominates; rather, nuanced end-user requirements drive a spectrum of solutions tailored to specific particulate characteristics, flow rates, and installation constraints. Regional disparities-from the U.S. EPA’s tighter PM₂.₅ standards to the EU’s revamped Industrial Emissions Directive and Asia-Pacific’s industrial expansion-underscore the importance of localized product strategies.

Key industry players continue to invest in R&D and strategic partnerships, vying to deliver differentiated offerings that combine energy efficiency with compliance. Meanwhile, emerging entrants challenge incumbents with niche applications and advanced materials. Looking forward, success will hinge on the ability to anticipate regulatory shifts, leverage digital ecosystems, and foster collaborative innovation. By embracing these imperatives, stakeholders can capture growth opportunities, optimize environmental performance, and drive sustainable industrial transformation.

Engage with Ketan Rohom to Secure the Comprehensive Electrostatic Precipitator Systems Market Report and Drive Informed Strategic Decision-Making

Don't miss the chance to elevate your strategic initiatives by accessing the full Electrostatic Precipitator Systems Market report. This comprehensive research delves into key trends, regulatory developments, and competitive landscapes, providing you with an authoritative foundation for decision-making. Connect with Ketan Rohom, Associate Director of Sales & Marketing, to explore tailored solutions, secure detailed insights, and gain a competitive edge. Reach out today to purchase your copy and unlock actionable intelligence that powers smarter investments and operational excellence.

- How big is the Electrostatic Precipitator System Market?

- What is the Electrostatic Precipitator System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?