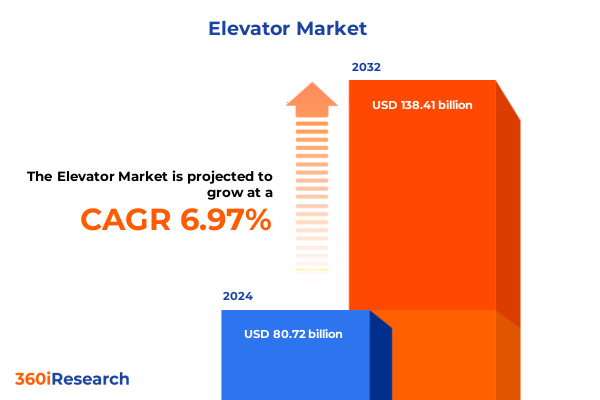

The Elevator Market size was estimated at USD 86.19 billion in 2025 and expected to reach USD 92.03 billion in 2026, at a CAGR of 7.00% to reach USD 138.41 billion by 2032.

An engaging introspective overview on how evolving infrastructural demands and innovative technologies are reshaping the global elevator landscape

The elevator industry stands at the intersection of urbanization, architectural innovation, and technological advancement, making it one of the most dynamic sectors in the built environment. Driving high-rise construction and retrofit projects worldwide, elevator systems play a critical role in addressing population density challenges and sustainability goals. In recent years, significant investments in smart building ecosystems and green infrastructure have accelerated the deployment of advanced lift solutions. As a result, stakeholders across property development, facilities management, and equipment manufacturing are navigating a rapidly evolving landscape characterized by digital integration, energy efficiency targets, and shifting end-user expectations.

In this context, industry participants must anticipate how macroeconomic drivers, regulatory changes, and evolving consumer demands influence elevator adoption and service offerings. From predictive maintenance powered by artificial intelligence to regenerative drive systems that reduce energy consumption, the sector is witnessing a wave of innovation aiming to enhance performance while minimizing environmental impact. This introduction sets the stage for understanding the key factors reshaping the elevator market and outlines the critical themes explored in this executive summary.

Capturing paradigm shifting forces driven by digitalization sustainability expectations and urban density challenges catalyzing the evolution of elevator systems worldwide

The elevator industry’s trajectory is being redefined by a confluence of transformative shifts that span digital, environmental, and societal domains. Advances in IoT connectivity and data analytics enable real-time monitoring of lift performance, permitting predictive maintenance strategies that reduce downtime and service costs. At the same time, stringent sustainability regulations and green building certifications are prompting manufacturers and building owners to integrate energy recuperation systems, low-emission materials, and eco-friendly protocols into elevator deployments. These developments not only improve operational efficiency but also align with corporate responsibility commitments and emerging ESG frameworks.

In parallel, demographic changes and the push for inclusive design are elevating the importance of accessibility and user experience. Touchless interfaces, voice-activated controls, and adaptive cabin configurations are becoming standard features to meet the needs of diverse passenger profiles. Furthermore, the rise of modular construction methods and prefabricated elevator shafts is reducing installation times and costs, accelerating project timelines in regions with rapid urban expansion. Together, these paradigm shifts are setting a new benchmark for elevator performance, reliability, and passenger satisfaction across both new builds and retrofit programs.

Assessing the far-reaching cumulative effects of newly imposed United States tariffs through 2025 on elevator manufacturing supply chain economics

The implementation of new United States tariffs through 2025 has imposed significant cost pressures on elevator manufacturers and component suppliers. Tariffs on steel and aluminum imports have increased the raw material expenses for elevator structures, rails, and enclosures, eroding margins and driving price adjustments for end customers. Additionally, levies on electronic modules sourced from key international markets have introduced supply chain complexities, prompting many original equipment manufacturers to reassess their sourcing strategies and negotiate long-term contracts to secure preferential rates or alternative procurement regions.

These trade measures have also influenced investment cycles for modernization and new installations. Facility managers are delaying non-critical upgrades in anticipation of stabilized input prices, while manufacturers are accelerating localized production capacity development to mitigate tariff exposure. Moreover, some stakeholders are exploring domestic partnerships and joint ventures to leverage local content advantages and qualify for potential tariff exemptions. Collectively, these tactics are reshaping the cost structure and operational planning of elevator projects across the United States.

Delivering deep insights into elevator market segmentation across type service scope technological architecture and end-user application spheres

Elevator market dynamics reveal nuanced performance patterns when examined through multiple segmentation lenses across product, service, and technology dimensions. Systems designed for passenger transport command a significant share of activity due to sustained demand in urban high-rise and commercial developments, while freight and service elevators benefit from the growing emphasis on material handling in logistics hubs and industrial facilities. Installations dedicated to residential applications remain critical, especially in emerging urban centers where mid- to high-rise housing is on the rise.

On the service front, maintenance and repair services account for recurring revenue streams as owners seek to optimize lifecycle costs and improve safety compliance, whereas modernization projects are increasingly prioritized to upgrade aging equipment with digital controls. Hydraulic lifts and machine room-less traction systems have gained traction for their space-saving footprints, contrasting with traditional traction elevators that continue to serve core heavy-duty applications. Geared machines are preferred for low- to mid-rise installations, while gearless configurations dominate premium high-speed elevator segments. Control methodologies vary between fully automated smart systems and manual override solutions to balance operational efficiency with cost considerations. End-users in institutional buildings emphasize reliability and compliance, while residential stakeholders focus on design integration and noise reduction.

This comprehensive research report categorizes the Elevator market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Service Type

- Technology

- Machine Type

- Control system

- End-User

Uncovering pivotal regional perspectives revealing divergent elevator adoption trends competitive dynamics and infrastructural priorities across major global territories

Regional variations in elevator adoption and market drivers showcase distinct opportunities and challenges across the Americas, EMEA, and Asia-Pacific territories. In the Americas, robust urban renewal programs and aging infrastructure upgrades underpin steady modernization activity, with a growing shift toward energy-efficient retrofits in North America. Latin American markets are witnessing new high-rise developments in key cities, fueling demand for passenger and service elevators that cater to commercial and hospitality projects.

Across Europe, the Middle East, and Africa, stringent safety regulations and green building incentives are propelling investments in smart elevator technologies and regeneration systems. Mideast skyscraper expansions continue to create high-value contracts, while African urban centers are in early stages of vertical development, focusing on entry-level passenger elevator solutions. In the Asia-Pacific region, rapid urbanization and government housing initiatives sustain a high volume of new installations, particularly in China and India, while Japan and South Korea concentrate on modernization and digitalization of legacy equipment. This regional analysis underscores how local policy frameworks, demographic shifts, and economic priorities shape elevator market trajectories.

This comprehensive research report examines key regions that drive the evolution of the Elevator market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating strategic moves and operational strengths of leading elevator manufacturers showcasing competitive positioning and innovation trajectories influencing market leadership

Leading elevator manufacturers are deploying multifaceted strategies to maintain competitive differentiation and capture emerging market opportunities. Some firms have intensified research and development efforts in IoT-enabled predictive maintenance platforms, partnering with technology providers to offer subscription-based monitoring services that ensure uptime and performance optimization. Others have pursued strategic acquisitions of specialized component suppliers to secure critical intellectual property in drive systems and cabin automation, thereby strengthening their vertical integration and cost control.

Moreover, key players are expanding into after-sales services through digital marketplaces that streamline maintenance scheduling and parts ordering. Joint ventures with local service providers in high-growth markets enhance geographic reach, while standardized production modules support rapid scaling of new installation capacity. Investment in sustainability certifications and certifications from international standards bodies serves both as a market differentiator and a response to increasingly stringent environmental mandates. Together, these corporate initiatives illustrate how market leaders are leveraging technology, partnerships, and operational excellence to reinforce their leadership positions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Elevator market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Blain Hydraulics GmbH

- Chuo Elevator Co., Ltd.

- Dong Yang Elevator Co., Ltd.

- EITA Resources Berhad

- Express Elevators Corporation

- Fain Ascensores S.A.

- Fujitec Co., Ltd.

- GMV Martini S.p.A.

- Gulf Elevator & Escalator Co. Ltd.

- Hitachi, Ltd.

- Hyundai Elevator Co., Ltd.

- Kleemann Hellas SA

- KONE Corporation

- Mitsubishi Electric Corporation

- OK Elevator PVT. LTD.

- Orona Group

- Otis Worldwide Corporation

- Schindler Group

- Sicher Elevator Co., Ltd.

- Sigma Elevator Company

- SJEC Corporation

- Stiltz Limited

- TK Elevator GmbH

- Toshiba Corporation

- Yungtay Engineering Co., Ltd.

- Zhejiang Meilun Elevator Co., Ltd.

Offering targeted strategic maneuvers and operational imperatives for industry executives to harness market potentials mitigate risks and drive sustained growth

Industry executives should prioritize the integration of digital maintenance platforms to reduce unscheduled downtime and extend equipment lifecycles, leveraging data analytics to transition from reactive to predictive servicing models. Establishing local supply chain partnerships and diversifying component sourcing can mitigate tariff exposure and supply disruptions while fostering resilience and cost stability. Investing in training programs for field technicians on advanced drive systems and IoT diagnostics ensures rapid adoption of new technologies and elevates service quality.

In addition, organizations are advised to embed sustainability criteria into product design and installation processes, adopting regenerative braking and energy-efficient lighting to meet green building benchmarks. Collaborative alliances with vertical construction firms enable the co-development of prefabricated elevator modules, shortening project timelines and lowering installation costs. Finally, cultivating a customer-centric sales strategy that emphasizes outcome-based service agreements and transparent performance metrics will differentiate offerings in a competitive market landscape.

Detailing rigorous multi-faceted research framework encompassing primary interviews secondary data triangulation and robust validation protocols ensuring analytical credibility

The research framework underpinning this executive summary is grounded in a rigorous four-step methodology, commencing with an extensive secondary data review of industry publications, regulatory filings, and company financial disclosures to map macroeconomic trends and competitive landscapes. This baseline was reinforced through primary interviews with senior executives, technical directors, and procurement managers across leading elevator businesses, equipment suppliers, and end-user organizations to gather qualitative insights and validate key themes.

Subsequently, data triangulation techniques were employed to reconcile findings from diverse sources, ensuring consistency and reliability in the analysis. Quantitative datasets were processed using a combination of top-down and bottom-up approaches to examine segment performance drivers, regional variations, and tariff implications. Finally, validation workshops with subject matter experts provided a critical review of draft conclusions and recommendations, ensuring that the final output reflects the most accurate and actionable intelligence for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Elevator market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Elevator Market, by Type

- Elevator Market, by Service Type

- Elevator Market, by Technology

- Elevator Market, by Machine Type

- Elevator Market, by Control system

- Elevator Market, by End-User

- Elevator Market, by Region

- Elevator Market, by Group

- Elevator Market, by Country

- United States Elevator Market

- China Elevator Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesizing critical insights and emergent themes from comprehensive market analysis to underscore strategic priorities and future focus areas for stakeholders

This analysis synthesizes the impact of evolving urban infrastructure needs, sustainability imperatives, and regulatory changes on the global elevator industry. It highlights how digitalization and modular construction are redefining service models and installation practices while tariffs and supply chain realignments influence cost structures and strategic sourcing. Segmentation insights reveal differentiated growth profiles across product types, service categories, technological platforms, and end-user applications, underscoring the importance of tailored market approaches.

Regional perspectives further demonstrate that localized policies and economic priorities drive divergent trajectories in modernization versus new installation demand. Leading companies are capitalizing on these trends through targeted innovation, strategic partnerships, and integrated service offerings. Moving forward, stakeholders who embrace advanced digital maintenance solutions, invest in sustainable technologies, and optimize supply chain resilience will be best positioned to capture value and sustain competitive advantage in this dynamic market environment.

Encouraging proactive engagement with Ketan Rohom Associate Director Sales Marketing to secure comprehensive elevator market intelligence empowering informed decision-making

Ready to transform your understanding of the elevator market landscape and unlock strategic advantage? Reach out now to Ketan Rohom, Associate Director of Sales & Marketing, to obtain the full report with in-depth competitive intelligence, segmentation analysis, regional breakdowns, and actionable recommendations. Empower your organization with the comprehensive data and expert insights needed to drive growth, optimize investments, and outpace competitors in this rapidly shifting industry. Contact Ketan today to secure your copy and position your team at the forefront of elevator market innovation.

- How big is the Elevator Market?

- What is the Elevator Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?