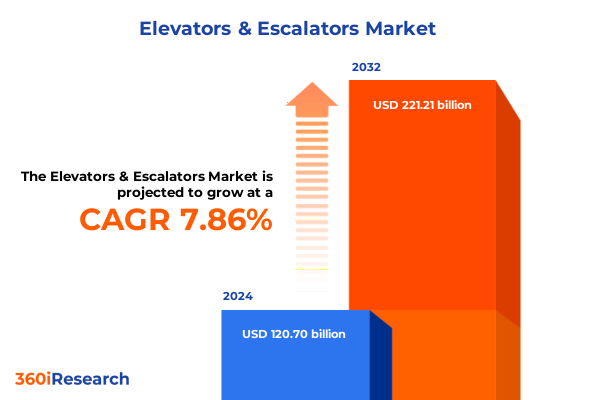

The Elevators & Escalators Market size was estimated at USD 130.22 billion in 2025 and expected to reach USD 138.35 billion in 2026, at a CAGR of 7.86% to reach USD 221.21 billion by 2032.

Exploring the Critical Role of Elevators and Escalators in Modern Infrastructure and the Dynamics Driving Future Growth and Innovation

Elevators and escalators serve as indispensable arteries in urban ecosystems, seamlessly connecting spaces from residential towers to commercial complexes. As metropolitan density intensifies and architectural ambitions reach new heights, the demand for efficient and reliable vertical mobility has become paramount. This introduction lays the groundwork for understanding how evolving urban landscapes and rising occupant expectations converge to shape the priorities of providers and end users alike.

In many mature markets, aging infrastructure is prompting building owners and operators to pursue modernization projects that address safety, ride quality, and compliance with contemporary accessibility standards. Meanwhile, greenfield developments in emerging regions are incorporating vertical transport solutions at the design phase, emphasizing seamless integration with building management systems and sustainable power systems. These parallel trends of retrofit and new-build investment underscore the industry’s dual focus on rejuvenation and innovation.

Moreover, the advent of digitalization is transforming the passenger journey through predictive maintenance algorithms, destination control systems, and remote monitoring platforms. Such technologies not only enhance service availability but also deliver data-driven insights that inform lifecycle management strategies. In anticipation of shifting regulatory, material, and technological paradigms, stakeholders must navigate a complex matrix of performance, safety, and environmental criteria. This executive summary crystallizes the critical drivers, emerging challenges, and strategic imperatives defining the future of elevators and escalators.

Uncovering the Disruptive Technological and Regulatory Shifts Transforming the Elevators and Escalators Landscape Worldwide

The elevators and escalators industry is undergoing a series of transformative shifts driven by an intersection of technological breakthroughs and evolving regulatory mandates. On the technological front, artificial intelligence–powered predictive maintenance platforms are enabling real-time diagnostics and remote fault detection, significantly reducing unplanned downtime and optimizing service schedules. In addition, the emergence of digital twin models allows stakeholders to simulate performance under various scenarios, accelerating design iterations and streamlining commissioning workflows.

Concurrent with these digital advances, hardware innovations such as machine-room-less traction systems, energy-regenerative drives, and contactless user interfaces are redefining both efficiency and user experience. Machine-room-less configurations, for instance, eliminate the need for dedicated machinery spaces, freeing up valuable floor area and reducing installation complexity. Energy regeneration during braking now feeds surplus power back into building grids, aligning vertical transportation with broader sustainability objectives.

Regulatory bodies worldwide are also reshaping the landscape through updated safety codes, accessibility guidelines, and environmental standards. Enhanced accessibility requirements, including those mandated by the Americans with Disabilities Act (ADA) and analogous legislation in other jurisdictions, are driving the adoption of wider doors, audible and tactile signaling systems, and improved leveling accuracy. At the same time, carbon reduction targets and stricter energy-efficiency benchmarks are spurring manufacturers to innovate across the lifecycle, from material selection to end-of-life recycling pathways. Together, these disruptive trends are recalibrating the competitive dynamics and investment priorities across the value chain.

Assessing the Far-Reaching Effects of 2025 United States Tariffs on Materials, Manufacturing Costs, and Supply Chain Strategies in Vertical Mobility

United States tariffs enacted in recent years continue to exert a profound influence on the elevators and escalators sector, particularly through increased raw material costs and altered trade flows. Steel and aluminum, which constitute the bulk of cabin structures, rails, and support frames, have faced tariffs under Section 232 since 2018, maintaining duties of up to 25 percent on steel and 10 percent on aluminum. These levies have driven domestic producers and international suppliers to renegotiate contracts and adjust procurement strategies, often passing incremental costs downstream to manufacturers and end users.

In addition, Section 301 measures targeting certain imports from China have encompassed control panels, drive systems, and electronic components essential to modern lift and escalator installations. As a result, original equipment manufacturers have pursued alternative sourcing pathways by diversifying supplier networks across Southeast Asia and Europe or by accelerating vertical integration of critical components. This supply chain realignment has alleviated some pricing pressure but has also introduced new complexities related to quality assurance and lead-time management.

Concurrently, tariff exemptions and product-specific carve-outs have offered conditional relief for select modernization and maintenance projects, though these concessions remain limited in scope and duration. Faced with persistent duties, many stakeholders are exploring reshoring or nearshoring strategies alongside long-term agreements with domestic mills. In doing so, they aim to stabilize input costs while bolstering supply resilience. The cumulative impact of these trade policies underscores the necessity for dynamic procurement models and strategic planning frameworks that can adapt to evolving tariff landscapes.

Deriving Actionable Segmentation Insights from Product Types, Installation Models, End-User Sectors, Technologies, Speeds, and Applications in Vertical Transport

The elevators and escalators market is characterized by a multi-dimensional segmentation framework that offers actionable insights into demand patterns and competitive positioning. Across product categories, the landscape spans elevators, escalators, and moving walkways. Within the elevator segment, differentiation emerges through specialized solutions such as freight elevators engineered for heavy loads, home elevators designed for residential convenience, hospital elevators optimized for medical transport, and passenger elevators focused on high-frequency operation in commercial environments. Escalator offerings, in turn, cater to diverse architectural needs with standard straight models and bespoke curved variants that enhance aesthetic appeal.

Installation modalities further influence market dynamics, encompassing ongoing maintenance services, modernization retrofits, and new construction projects. New installations bifurcate into commercial projects that demand high-capacity systems for office towers or hospitality venues, industrial facilities requiring durable, heavy-duty lifts, and residential developments where compact footprints and noise considerations are paramount. Each installation type carries distinct regulatory, logistical, and life cycle cost implications that shape project viability and supplier selection.

From an end-user perspective, the market spans commercial sectors-ranging from hospitality complexes to corporate office campuses and retail centers-to industrial settings, infrastructure applications such as transit stations and airports, and residential buildings. Commercial users often prioritize passenger throughput and branding alignment, whereas industrial and infrastructure stakeholders focus on robustness, safety redundancies, and compliance with sector-specific regulations.

Technological segmentation divides solutions into hydraulic and traction systems. Conventional hydraulic lifts remain a cost-effective option for low- to mid-rise buildings, while traction drives-including geared, gearless, and machine-room-less configurations-address requirements for speed, energy efficiency, and spatial optimization. Performance tiers are further refined by speed classifications-low, medium, and high speed-to align with building height and traffic volume. Finally, application contexts span indoor installations in climate-controlled environments and outdoor settings where weather resistance and corrosion protection become critical design considerations. Together, these interlocking segmentation layers inform targeted strategies for market entrants and incumbents alike.

This comprehensive research report categorizes the Elevators & Escalators market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Installation Type

- End User

- Technology

- Speed

- Application

Deciphering Regional Dynamics and Strategic Opportunities Across the Americas, Europe, Middle East & Africa, and Asia-Pacific Markets

Regional dynamics in the elevators and escalators sector vary substantially across the Americas, Europe, Middle East & Africa, and Asia-Pacific, reflecting distinct economic, demographic, and regulatory drivers. In the Americas, sustained growth of retrofit projects in North America is complemented by ongoing expansion in Latin American urban centers. Building owners prioritize modernization to extend equipment lifecycles, integrate smart building solutions, and comply with stringent energy-efficiency policies. Meanwhile, demand for predictive maintenance services is rising as operators seek to minimize service disruptions and optimize operating expenses.

Across Europe, Middle East & Africa, the market exhibits a dual focus on heritage retrofitting in historic European cities and large-scale new infrastructure projects in the Gulf region. Western European stakeholders are navigating tighter carbon emission mandates and advancing accessibility standards, resulting in a strong emphasis on energy-regenerative drives and advanced safety systems. In the Middle East, rapid development of mega-complexes and mixed-use districts spurs demand for high-capacity escalators and panoramic lift installations. Sub-Saharan African markets, in contrast, are gradually adopting elevator solutions as urbanization accelerates, though cost sensitivity and infrastructure constraints shape procurement decisions.

In Asia-Pacific, the confluence of megacity expansion, smart city initiatives, and high-rise residential tecture is generating robust demand. China and India are leading the charge in new installations, with a growing appetite for technologically advanced traction systems and integrated digital services. Southeast Asian economies are similarly investing in transit infrastructure and commercial hubs, driving orders for both standard escalators and specialized moving walkways. The region’s heterogeneous regulatory environment encourages global vendors to tailor offerings to local standards, creating opportunities for modular product platforms and flexible service models.

This comprehensive research report examines key regions that drive the evolution of the Elevators & Escalators market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Strategies and Core Capabilities of Leading Elevator and Escalator Providers Shaping Market Leadership Today

The competitive landscape of the elevators and escalators industry is dominated by a cohort of global and regional players employing differentiated strategies to capture market share and strengthen service portfolios. Legacy giants have reinforced their market positions by investing heavily in digital platforms that enable predictive maintenance, remote monitoring, and lifecycle management services. By leveraging proprietary software suites and extensive service networks, these incumbents are transitioning from pure equipment suppliers to integrated solutions providers.

At the same time, specialized manufacturers and agile new entrants are carving out niches by focusing on innovative hardware configurations, rapid installation methodologies, and tailored customer experiences. Strategic partnerships and joint ventures have also emerged as a conduit for local market access, particularly in regions with complex regulatory landscapes or localized safety standards. Meanwhile, cross-sector collaborations with building automation and IoT firms are accelerating the development of unified smart building ecosystems, where elevators and escalators function as key data nodes within broader energy management and occupant flow systems. This confluence of hardware, software, and service strategies shapes an increasingly intertwined competitive arena.

This comprehensive research report delivers an in-depth overview of the principal market players in the Elevators & Escalators market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Canny Elevator Co., Ltd.

- Fujitec Co., Ltd.

- Hitachi, Ltd.

- Hyundai Elevator Co., Ltd.

- KONE Corporation

- Mitsubishi Electric Corporation

- Otis Elevator Company

- Schindler Holding AG

- TK Elevator GmbH

- Toshiba Elevator and Building Systems Corporation

Formulating Strategic Recommendations for Industry Leaders to Capitalize on Technological Advances, Regulatory Changes, and Emerging Market Trends

Industry leaders seeking sustained growth must prioritize digital transformation initiatives that enhance service reliability and operational efficiency. Investing in advanced analytics platforms for predictive maintenance can drive significant reductions in unplanned downtime and optimize resource allocation across service teams. In addition, cultivating strategic supplier relationships and diversifying procurement channels for critical components will mitigate exposure to tariff fluctuations and supply chain disruptions.

Moreover, sustainability and energy-efficiency imperatives should be embedded within product development roadmaps and refurbishment programs. Adopting regenerative drive technologies, eco-friendly materials, and end-of-life recycling processes not only aligns with tightening regulatory frameworks but also resonates with environmentally conscious stakeholders. Concurrently, expanding presence in high-growth regional markets via localized partnerships and modular product lines can unlock new revenue streams. Finally, upskilling the workforce through targeted training in digital installation, remote diagnostics, and customer engagement will equip organizations to deliver differentiated value propositions and strengthen long-term client relationships.

Detailing Rigorous Research Methodology Including Data Collection, Validation Protocols, and Analytical Frameworks Underpinning Market Insights

This research framework integrates both primary and secondary methodologies to ensure robust and reliable insights. Primary data was gathered through structured interviews with industry executives, technical specialists, and procurement decision-makers, offering first-hand perspectives on market drivers, technology adoption, and competitive strategies. In parallel, a comprehensive review of publicly available sources-including regulatory filings, technical standards, and trade association reports-provided a contextual foundation for trend validation.

Quantitative analyses were conducted using a proprietary database of project-level installations, segmented by product type, geography, and end-user category. Data triangulation involved cross-referencing supplier shipment records, project tender notifications, and maintenance contract disclosures to validate market patterns. Quality control protocols encompassed consistency checks, outlier analysis, and peer review by sector experts. Analytical techniques such as PESTLE assessments, value chain mapping, and scenario planning were applied to uncover strategic implications and potential inflection points within the elevators and escalators landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Elevators & Escalators market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Elevators & Escalators Market, by Product Type

- Elevators & Escalators Market, by Installation Type

- Elevators & Escalators Market, by End User

- Elevators & Escalators Market, by Technology

- Elevators & Escalators Market, by Speed

- Elevators & Escalators Market, by Application

- Elevators & Escalators Market, by Region

- Elevators & Escalators Market, by Group

- Elevators & Escalators Market, by Country

- United States Elevators & Escalators Market

- China Elevators & Escalators Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Synthesizing Key Findings to Illuminate Future Pathways and Enduring Trends Guiding the Elevators and Escalators Sector

The confluence of urban densification, digital innovation, and evolving regulatory frameworks is redefining the elevators and escalators industry. Technological advances such as predictive analytics, machine-room-less configurations, and regenerative drives are enhancing performance and sustainability, while updated safety and accessibility mandates are raising the bar on compliance and user experience. At the same time, trade policies and tariffs continue to influence material sourcing, compelling stakeholders to adopt agile supply chain strategies.

Segmentation analysis reveals distinct pathways for growth across product types, installation models, end-user sectors, technology configurations, speed classes, and application contexts. Regional insights underscore the importance of tailored approaches in the Americas, Europe, Middle East & Africa, and Asia-Pacific, each with its own regulatory and investment dynamics. Competitive intelligence highlights a shift toward integrated service models and digital platforms, as market leaders vie to deliver holistic mobility solutions.

Collectively, these findings point to a future in which strategic adaptability, stakeholder collaboration, and end-to-end digitalization will determine market leadership. Organizations that harness data-driven decision-making, prioritize sustainability, and forge resilient supply chains will be best positioned to navigate the complexities of the evolving vertical transport landscape.

Engaging with Ketan Rohom to Secure Comprehensive Market Intelligence and Elevate Strategic Decision-Making in Vertical Transport Innovation

To obtain the full executive summary and gain in-depth perspectives on market dynamics, innovations, and strategic pathways, reach out to Ketan Rohom, Associate Director, Sales & Marketing. Engage directly to secure your copy of the comprehensive elevators and escalators market research report and empower your organization’s strategic planning with authoritative intelligence and actionable insights.

- How big is the Elevators & Escalators Market?

- What is the Elevators & Escalators Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?