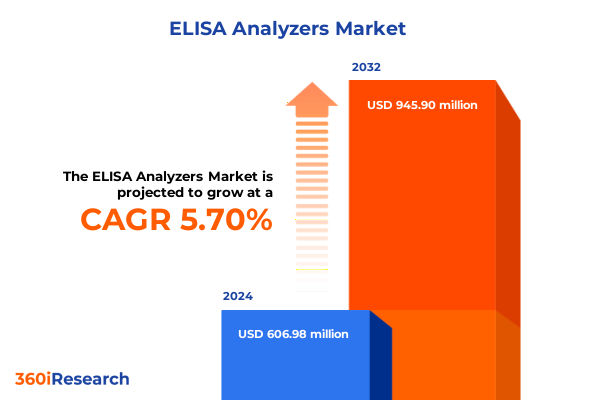

The ELISA Analyzers Market size was estimated at USD 639.88 million in 2025 and expected to reach USD 675.01 million in 2026, at a CAGR of 5.74% to reach USD 945.90 million by 2032.

Navigating the Evolving ELISA Analyzer Market Landscape with Key Drivers, Emerging Technologies, and Strategic Outlooks for Informed Decision-Making

The ELISA analyzer market stands at the intersection of clinical necessity and technological innovation, propelled by rising demand for precise immunodiagnostic solutions across diverse healthcare and research settings. In recent years, developments in assay automation, software integration, and miniaturization have redefined the capabilities of modern ELISA platforms, enabling laboratories to process higher throughputs with enhanced reproducibility and reduced manual intervention. Concurrently, shifting priorities in personalized medicine and biomarker-driven therapies have elevated the importance of sensitive, quantitative immunoassays for disease monitoring, drug development, and population health initiatives.

As healthcare systems grapple with an aging population and the increasing burden of chronic diseases, stakeholders are prioritizing diagnostics that deliver rapid, reliable results without compromising quality. Emerging end-user preferences for portable and point-of-care platforms are complementing traditional high-throughput benchtop systems, expanding the application spectrum from centralized diagnostic laboratories to decentralized clinical environments and field research. Against this backdrop, strategic investments in R&D and collaborative partnerships between instrument manufacturers, reagent suppliers, and software developers are shaping a more integrated ecosystem. This section introduces the fundamental drivers, technological inflection points, and stakeholder demands that form the foundation of subsequent analyses.

Transformative Shifts Reshaping the Global ELISA Analyzer Market Dynamics Driven by Technological Breakthroughs and Evolving Healthcare Demands

Over the past few years, the ELISA analyzer landscape has undergone transformative shifts driven by breakthroughs in automation, data analytics, and assay chemistry. Traditionally manual processes have been progressively supplanted by fully automated workstations, allowing laboratories to achieve unprecedented efficiencies in sample throughput and result consistency. Simultaneously, advancements in microfluidics and lab-on-a-chip technologies have paved the way for portable analyzers capable of executing complex immunoassays at the point of care, reducing dependence on centralized facilities and improving access in remote or resource-limited settings.

Parallel to these hardware innovations, the integration of artificial intelligence and machine learning into assay interpretation is redefining data reliability and predictive insights. Intelligent software algorithms now facilitate real-time quality control, anomaly detection, and result normalization across diverse assay conditions. Moreover, the proliferation of multiplex ELISA platforms capable of analyzing multiple analytes in a single run is reshaping the scope of diagnostic panels for oncology, infectious diseases, and autoimmune disorders. These converging trends underscore a market in flux, where continuous technological refinement and strategic alliances will determine competitive positioning and value creation for both suppliers and end users.

Assessing the Cumulative Impact of 2025 United States Tariff Policies on the ELISA Analyzer Supply Chain, Costs, and Market Resilience

In 2025, the United States implemented a series of tariff policies that have cumulatively influenced the cost structure, procurement strategies, and supply chain resilience of ELISA analyzer stakeholders. Initially, a universal import tariff introduced baseline duties across a broad spectrum of scientific equipment, followed by country-specific escalations that targeted instruments, reagents, and consumables sourced from key manufacturing hubs. The most pronounced impact has been felt by suppliers reliant on Chinese manufacturing, where stacked tariffs now elevate landed costs, prompting procurement managers to reassess sourcing frameworks.

These tariff measures have exerted upward pressure on the total cost of ownership for ELISA systems, extending to critical components such as microplates, antibodies, and assay kits. As a result, laboratories have explored alternative supply channels, including domestic manufacturing partners and regional distributors within USMCA and European free-trade frameworks. Meanwhile, manufacturers have accelerated localization efforts for high-volume consumables, forging strategic partnerships with North American and European polymer and reagent producers to mitigate duty burdens. This reconfiguration not only alleviates immediate cost constraints but also fosters a more diversified and resilient supply chain. Ultimately, the tariff landscape of 2025 serves as a catalyst for innovation in procurement strategies and regional value-chain integration across the ELISA analyzer market.

Holistic Segmentation Insights into the ELISA Analyzer Market: Product Platforms, Modes, Analyte Targets, Assay Types, Components, Applications, and End User Dynamics

An in-depth segmentation of the ELISA analyzer market reveals nuanced distinctions that inform targeted product development and go-to-market strategies. Product platform configurations range from high-capacity benchtop systems, favored by diagnostic laboratories for their throughput capabilities, to compact portable analyzers designed for field diagnostics and point-of-care testing. Operational modes are bifurcated between fully automated ELISA workstations, which streamline workflows through integrated robotics and software controls, and semi-automated systems that balance manual dexterity with partial automation for laboratories transitioning from traditional methods.

Analyte specificity drives critical design considerations, with analytes including antibodies, hormones, pathogen antigens, protein biomarkers, and small molecules each demanding tailored detection chemistries and sensitivity thresholds. Assay formats further diversify the landscape, as competitive, direct, indirect, and sandwich assays offer complementary approaches to quantification and specificity based on the target molecule’s characteristics. Key components such as consumables, microplates, reagents and kits, and software solutions underpin system performance and user experience. Application domains span clinical diagnostics, drug development, and food and beverage testing, each with unique regulatory, throughput, and validation requirements. Finally, end-user profiles encompass academic and research institutions, diagnostic laboratories, food and beverage industry operations, hospitals and clinics, and pharmaceutical and biotechnology companies. These combined segmentation insights illuminate the multifaceted nature of market demands and investment priorities.

This comprehensive research report categorizes the ELISA Analyzers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Mode

- Analytes

- Assay Type

- Component

- Application

- End User

Pivotal Regional Dynamics Shaping the ELISA Analyzer Market Growth Trajectories across the Americas, Europe Middle East & Africa, and Asia-Pacific Regions

Regional dynamics play a critical role in shaping the ELISA analyzer market, as economic conditions, regulatory environments, and healthcare infrastructures vary significantly across the globe. In the Americas, robust healthcare funding combined with strong biotechnology and pharmaceutical sectors drives adoption of advanced systems. The presence of major instrument manufacturers and reagent suppliers in North America also fosters a competitive landscape, accelerating product launches and aftermarket support initiatives.

In Europe, Middle East, and Africa, heterogeneity in regulatory frameworks and healthcare reimbursement policies presents both opportunities and challenges. Western Europe’s mature diagnostic market emphasizes stringent quality standards and interoperability, while emerging economies in the Middle East and Africa are gradually expanding their laboratory capacities to meet rising demands for infectious disease testing and biomarker monitoring. Collaborative projects between regional health authorities and international relief organizations further stimulate growth in decentralized settings.

The Asia-Pacific region exhibits some of the fastest growth rates, fueled by rising public health expenditures, expanding research and development investments, and government-led initiatives to bolster domestic manufacturing capabilities. Countries such as China, Japan, India, and Australia have accelerated regulatory approvals for innovative diagnostic tools, creating a conducive environment for both international vendors and local players. These regional insights underscore the importance of tailored market entry strategies that align with specific economic, regulatory, and clinical adoption contexts.

This comprehensive research report examines key regions that drive the evolution of the ELISA Analyzers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Company Strategies and Competitive Insights Driving Innovation, Collaboration, and Market Positioning among Leading ELISA Analyzer Manufacturers

Leading manufacturers of ELISA analyzers are deploying multifaceted strategies to secure competitive advantages, drive innovation, and expand global footprint. Thermo Fisher Scientific continues to consolidate its market leadership through targeted acquisitions, integration of digital workflow solutions, and expansion of reagent manufacturing capacities in strategic regions. By aligning instrument development with software-driven analytics platforms, the company enhances data integrity and facilitates seamless integration with laboratory information management systems.

Agilent Technologies leverages its legacy in analytical chemistry to offer hybrid platforms that combine ELISA capabilities with multiplexing and automation, catering to drug development pipelines and translational research applications. The company’s focus on modular design enables end users to customize workflows based on specific assay requirements. Danaher Corporation and its subsidiaries, including Bio-Rad Laboratories, emphasize iterative product improvements and customer support services, investing in training programs and service networks to reduce instrument downtime and optimize lifecycle value.

Smaller specialized players, such as PerkinElmer and Tecan, differentiate themselves through niche innovation in microfluidics and high-speed processing, targeting emerging applications in immuno-toxicology and personalized medicine. Collaborative partnerships with academic institutions and biotech firms further accelerate the commercialization of next-generation platforms. Collectively, these competitive insights highlight how strategic investments in R&D, customer engagement, and ecosystem partnerships are reshaping the ELISA analyzer market and elevating value propositions for diverse end users.

This comprehensive research report delivers an in-depth overview of the principal market players in the ELISA Analyzers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abcam Limited

- ADALTIS Srl.

- Agilent Technologies, Inc.

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- Bio-Techne Corporation

- BioChek BV

- Creative Diagnostics

- Danaher Corporation

- Diagnostic Automation/Cortez Diagnostics Inc.

- Enzo Biochem Inc.

- Epitope Diagnostics, Inc.

- Erba Mannheim

- EUROIMMUN Medizinische Labordiagnostika AG

- Gold Standard Diagnostics Frankfurt GmbH

- Merck KGaA

- Monobind Inc.

- MyBioSource, Inc.

- PerkinElmer AES

- R&D Systems, Inc.

- Randox Laboratories Ltd.

- RayBiotech, Inc.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Tecan Group Ltd.

- Thermo Fisher Scientific Inc.

Actionable Recommendations for Industry Leaders to Capitalize on Market Opportunities, Mitigate Risks, and Drive Sustainable Growth in ELISA Analyzer Development

To navigate the complexities of the ELISA analyzer market and capitalize on emerging opportunities, industry leaders should adopt a proactive, integrated approach. First, strengthening supply chain agility through diversified sourcing and local partnerships will mitigate the risks posed by tariff fluctuations and geopolitical uncertainties. Establishing regional hubs for reagent and consumable production can reduce lead times and enhance cost predictability.

Second, investing in interoperable software solutions and predictive analytics will differentiate offerings by enabling laboratories to harness real-time data insights for enhanced quality control and operational efficiency. Prioritizing user experience through intuitive interfaces and robust customer training programs will further drive adoption among both novice and advanced end users.

Third, fostering collaborative ecosystems with academic researchers, clinical laboratories, and regulatory bodies can expedite the validation and commercialization of novel assay formats. Co-development partnerships focused on multiplex immunoassays and emerging biomarker targets will position companies at the forefront of personalized medicine initiatives.

Finally, aligning product portfolios with evolving application needs in drug development, infectious disease surveillance, and food safety testing will unlock new revenue streams. By continuously monitoring market trends and regulatory changes, leaders can refine their strategic roadmaps and maintain resilient, growth-oriented pathways within the dynamic ELISA analyzer landscape.

Rigorous Research Methodology Underpinning the ELISA Analyzer Market Study through Comprehensive Qualitative and Quantitative Analyses and Data Triangulation

The research methodology underpinning this ELISA analyzer market study combines comprehensive secondary research with targeted primary investigations to ensure data robustness and analytical depth. Secondary data sources include peer-reviewed journals, regulatory agency publications, industry white papers, and company filings. These sources inform the macroeconomic, regulatory, and technological contexts, providing baseline inputs for segmentation frameworks and trend analyses.

Primary research incorporates structured interviews and surveys with key stakeholders such as laboratory directors, procurement managers, regulatory specialists, and technology developers across major geographic regions. Insights from these interactions shed light on real-world challenges, adoption drivers, and unmet needs. Quantitative data from shipment records, trade statistics, and financial disclosures are triangulated with qualitative feedback to validate assumptions and refine market narratives.

Data synthesis involves iterative cross-validation techniques to reconcile discrepancies and enhance the credibility of findings. Market segmentation is rigorously defined through a combination of top-down and bottom-up approaches, ensuring that product, mode, analyte, assay type, component, application, and end-user categorizations accurately reflect current industry practices. This multi-method framework delivers a nuanced, evidence-based perspective on the ELISA analyzer landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our ELISA Analyzers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- ELISA Analyzers Market, by Product Type

- ELISA Analyzers Market, by Mode

- ELISA Analyzers Market, by Analytes

- ELISA Analyzers Market, by Assay Type

- ELISA Analyzers Market, by Component

- ELISA Analyzers Market, by Application

- ELISA Analyzers Market, by End User

- ELISA Analyzers Market, by Region

- ELISA Analyzers Market, by Group

- ELISA Analyzers Market, by Country

- United States ELISA Analyzers Market

- China ELISA Analyzers Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1272 ]

Conclusion Emphasizing Strategic Imperatives, Key Insights, and Future Outlook to Guide Stakeholder Decision-Making in the Dynamic ELISA Analyzer Marketplace

This executive summary encapsulates critical insights into the ELISA analyzer market, underscoring the interplay of technological innovation, regulatory influences, and evolving application demands. Stakeholders are encouraged to leverage the identified transformational shifts in automation, multiplexing, and data analytics to inform strategic investment and product development roadmaps. The cumulative impact of tariff policies in 2025 has reinforced the imperative for supply chain diversification and regional manufacturing partnerships.

The segmentation analysis highlights distinct market segments from benchtop platforms to portable systems, across diverse analyte categories and assay formats, each presenting unique value propositions. Regional insights reveal heterogeneous growth trajectories, with the Americas maintaining leadership, Europe, Middle East & Africa evolving through collaborative health initiatives, and Asia-Pacific exhibiting rapid expansion driven by public and private sector commitments. Competitive intelligence illustrates how leading manufacturers are innovating through acquisitions, R&D partnerships, and customer-centric service models.

As the market continues to mature, actionable recommendations emphasize supply chain resilience, software integration, collaborative co-development, and targeted application alignment. By adopting these strategic imperatives, industry players can navigate market complexities, capitalize on emerging opportunities, and contribute to improved diagnostic outcomes globally. This conclusion reinforces a forward-looking perspective, guiding decision-makers toward sustainable growth in the dynamic ELISA analyzer landscape.

Unlock Comprehensive ELISA Analyzer Market Intelligence Today: Contact Ketan Rohom for Exclusive Insights and Customized Strategic Consulting Solutions

To explore comprehensive market dynamics, strategic imperatives, and tailored growth pathways in the ELISA analyzer industry, we invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. His expert guidance will facilitate an in-depth understanding of the report’s findings, customized insights, and targeted recommendations designed to align with your organizational goals. Engage with Ketan to discuss bespoke research packages, licensing options, and collaborative opportunities that unlock actionable intelligence for optimized decision-making. Elevate your market strategy and secure a competitive edge by leveraging exclusive data, trend analyses, and scenario planning encapsulated within this specialized report. Contact Ketan today to initiate a partnership that drives innovation and accelerates growth in the dynamic ELISA analyzer landscape.

- How big is the ELISA Analyzers Market?

- What is the ELISA Analyzers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?