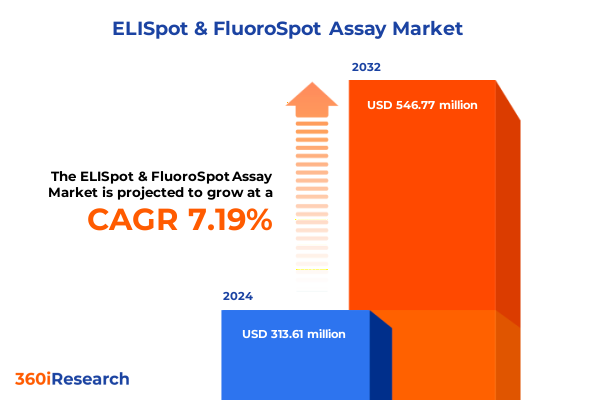

The ELISpot & FluoroSpot Assay Market size was estimated at USD 336.45 million in 2025 and expected to reach USD 360.03 million in 2026, at a CAGR of 7.18% to reach USD 546.77 million by 2032.

A concise strategic primer on ELISpot and FluoroSpot assays highlighting scope, value drivers, and immediate priorities for laboratory decision-makers

ELISpot and FluoroSpot assays occupy a pivotal role in immunology research and translational programs, offering sensitive functional readouts of cellular immune responses that inform vaccine development, oncology immunotherapy research, and infectious disease surveillance. These assays are prized for their ability to detect single-cell cytokine secretion, enabling researchers to link cellular phenotype to function and to derive mechanistic insights that complement flow cytometry, single-cell sequencing, and multiplexed immunoassays. As a result, laboratories, contract research organizations, and clinical groups use ELISpot and FluoroSpot to validate candidate therapeutics, profile immune correlates, and support biomarker discovery across preclinical and early clinical pipelines.

Across the ecosystem, the balance between instruments, consumables, and services determines practical adoption. Instruments and readers provide throughput and data quality, while kits and reagents standardize assay performance and reduce intra-laboratory variability. Services and CRO partnerships meanwhile accelerate timelines for organizations that prefer outsourced testing or require GLP-compliant workflows. Given the growing emphasis on functional immune monitoring in areas such as checkpoint inhibitor studies, personalized cancer vaccines, and emerging infectious disease preparedness, laboratories now prioritize platforms that integrate automation, robust assay kits, and reproducible reagent supplies. In turn, procurement teams and R&D leaders seek clarity on supplier reliability, assay sensitivity, and operational cost components to inform capital investment and vendor selection.

How scientific innovation, automation, and shifting therapeutic priorities are reshaping the global ELISpot and FluoroSpot assay landscape and research workflows

The ELISpot and FluoroSpot landscape is being transformed by a confluence of scientific, technological, and commercial forces that are changing how assays are run, interpreted, and scaled. First, advances in assay chemistry and reagent design have improved specificity and reduced background noise, enabling more reliable detection of low-frequency antigen-specific cells. This has coincided with greater industry investment in monoclonal antibody reagents and enzyme chemistries that enhance dynamic range and reproducibility in both manual and automated workflows.

Second, automation and digital-readout platforms are shifting the operational calculus for many laboratories. Bench-top automated systems that can plate, wash, and image ELISpot/FluoroSpot plates are lowering operator variability and increasing throughput for studies that require large sample cohorts or repeated longitudinal sampling. High-throughput automated solutions extend these benefits for multi-site studies and commercial screening programs. As laboratories migrate from manual pipetting to semi- and fully automated workflows, assay standardization improves and throughput bottlenecks decline, enabling immunology teams to integrate functional assay readouts into larger multi-omic studies.

Third, application demand is evolving. Oncology programs increasingly rely on functional cellular readouts to validate immune activation by novel modalities such as neoantigen vaccines and adoptive cell therapies. Simultaneously, infectious disease research-both viral and bacterial-continues to require robust readouts for vaccine candidate evaluation and correlates of protection. Autoimmune and allergy research likewise benefit from the ability to detect antigen-specific T cell responses to inform mechanism-of-action studies. These shifting therapeutic priorities are prompting kit and reagent providers to diversify offerings, improve lot-to-lot consistency, and support multiplexed cytokine detection strategies.

Finally, the partnership model between instrument vendors, reagent suppliers, and CROs is intensifying. Vendors that offer integrated solutions-validated kits paired with compatible readers and analytic software-are gaining preference among institutions seeking turnkey solutions that reduce validation time. As a result, collaborations that combine assay development expertise, supply-chain assurance, and data analytics are emerging as a primary vector for commercial differentiation.

Assessing the cumulative operational and cost consequences of United States tariff actions in 2025 on ELISpot and FluoroSpot supply chains, procurement, and strategies

The cumulative impact of United States tariff actions in 2025 on ELISpot and FluoroSpot supply chains is multifaceted and asymmetric across product categories. Broadly speaking, tariffs implemented or adjusted under Section 301 and related trade measures have increased the cost and complexity of importing certain classes of medical supplies and strategic components; however, many core immunological reagents and diagnostic-specific products remain outside the narrowest tariff designations. Policymakers’ modifications following the four-year Section 301 review resulted in new or higher additional duties for several product groups, and those changes became effective in staged phases from late 2024 into 2025. These policy decisions were intended to protect targeted domestic industries and to incentivize supply-chain diversification, but they have also introduced additional compliance steps and cost uncertainty for instrument makers and consumables suppliers that source components globally.

In parallel, the elimination of the de minimis exemption for low-value shipments and related executive actions in 2025 have materially altered the economics of small, frequent imports. Where previously low-value reagent kits, spare parts, or single-package purchases could enter under a simplified, duty-free regime, the new rules require formal customs entry and duty assessment for many of those shipments. This change has immediate operational implications for laboratories and small suppliers that relied on low-value cross-border shipments to maintain lean inventories. Carriers and mail operators have faced sudden operational burdens to collect duties and manage customs clearance, which has in some cases led to shipment delays and temporary suspension of postal flows from certain regions. For buyers and procurement teams, the effect is a higher total landed cost for many items and a need to re-evaluate ordering frequency, vendor location, and inventory buffers.

Taken together, enhanced Section 301 rates on specific product categories, the winding down of many tariff exclusions, and the suspension of de minimis treatment have generated three practical outcomes for ELISpot and FluoroSpot stakeholders. First, procurement margins have narrowed for organizations that import instruments, specialized components, or consumables from tariffed origins. Second, supply-chain strategies have shifted from “just-in-time” to “just-in-case” as laboratories and suppliers build buffer inventories to insulate operations from customs delays and variable duty exposure. Third, corporate responses include accelerated onshoring or nearshoring of critical manufacturing steps, strategic stockpiling of key reagents, and selective supplier consolidation to reduce the number of cross-border transactions. These responses have been visible across the life sciences sector as companies seek to preserve program timelines and protect clinical supply commitments.

It is important to emphasize that the tariff impact is not uniform. Many immunological reagents that are classified under HTS headings for immunological products or monoclonal antibodies may continue to be eligible for duty-free treatment at the baseline tariff schedule, whereas instruments and electrical components often fall under HTS chapters subject to machinery exclusions or elevated Section 301 rates depending on their country of origin and specific subheading. Consequently, procurement teams must apply detailed classification diligence to each SKU and engage customs counsel or trade specialists to evaluate eligibility for existing exclusions or for machinery-specific exclusion processes. In short, the 2025 tariff environment increases administrative burden, elevates landed costs for certain imports, and favors firms that can rapidly adapt sourcing geography, manufacture domestically, or internalize critical reagent production.

Segmentation-led insights that reveal which product, application, end-user, assay, and platform combinations will drive adoption and strategic investments

Segment-level dynamics provide clarity on where investment, adoption, and risk concentrate across the ELISpot and FluoroSpot ecosystem. When considered through the lens of product type, instruments remain the anchor of capital expenditure decisions because they set throughput, data fidelity, and compatibility constraints; kits serve as the primary mechanism for standardizing assay performance, with separate development tracks for ELISpot kits and FluoroSpot kits that reflect differences in multiplexing and detection chemistry; reagents such as enzymes, monoclonal antibodies, and substrates are the biochemical foundation of assay sensitivity and specificity; and services-including CRO-managed testing and validation-address capacity and regulatory-compliance needs that many in-house labs cannot scale to alone.

Framing the market by application clarifies demand drivers. Autoimmune and allergy research require nuanced antigen stimulation panels and reagents tailored to low-frequency autoreactive responses, while oncology assays emphasize detection sensitivity and reproducibility to support therapeutic decision gates. Infectious disease work creates variable demand that spans bacterial and viral use cases, with viral vaccine programs often demanding rapid scale-up of kit and reagent supply during outbreak response or large clinical studies. These application distinctions influence which kit formats, reagent formulations, and platform types laboratories prioritize when balancing throughput, cost, and analytical resolution.

Understanding end-user behavior sharpens commercial strategy. Academic and research institutes value flexibility, validated protocols, and cost-effective reagents for method development and exploratory studies. Contract research organizations prioritize throughput, traceability, and validated SOPs that can align with sponsor requirements across multiple therapeutic areas. Pharma and biotech entities-both smaller biotech firms and large pharmaceutical companies-seek integrated solutions that reduce validation time, provide commercial-scale reagent supply agreements, and ensure contractually guaranteed lot-to-lot consistency to support pivotal studies. Vendor partnerships and service models therefore vary by end-user: research labs may prefer open-system consumables, CROs favor scalable automation and managed services, and biopharma groups often negotiate bespoke reagent supply and co-development relationships.

The assay-type and platform-type lenses further refine opportunity spaces. ELISpot remains the established assay in many labs for single-cytokine readouts and conservative validation paths, while FluoroSpot’s multiplexing capability increasingly attracts studies that require simultaneous profiling of multiple cytokines with a smaller sample volume. Platforms bifurcate between manual workflows preferred by low-throughput laboratories and automated solutions-bench-top or high-throughput-that serve multi-site studies and high-volume CRO operations. The combined segmentation view highlights clear product-market fit pathways: simpler manual kits and antibodies are critical for early-stage labs and academic groups, whereas validated kits paired with automated readers and managed services address the commercial and regulatory needs of sponsor-driven studies.

This comprehensive research report categorizes the ELISpot & FluoroSpot Assay market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- End User

- Platform Type

Regional dynamics and divergence in demand, procurement policy, and supply resilience across the Americas, Europe Middle East & Africa, and Asia-Pacific markets

Regional dynamics influence procurement strategy, capacity planning, and commercialization priorities across the ELISpot and FluoroSpot landscape. In the Americas, demand is driven by a dense concentration of biotech firms, large pharmaceutical sponsors, and academic centers that conduct late-stage translational research and sponsor multicenter clinical programs. This concentration translates to strong demand for integrated instrument–kit solutions and for service providers capable of scaling to support large clinical sample volumes. Regulatory expectations and a sophisticated CRO network in the region also support the commercial viability of validated kits and automated platforms.

In Europe, Middle East & Africa, the region presents heterogeneous adoption patterns influenced by variable public funding, diverse regulatory regimes, and a mix of mature biopharma clusters alongside emerging research hubs. Western Europe tends to mirror North American practice in prioritizing validated workflows and automation for industry-sponsored studies, while parts of the Middle East and Africa are focused on building local capacity and training to support regional infectious-disease and vaccine programs. Cross-border procurement and supply resilience are common commercial themes in this region, where multi-jurisdictional logistics and tariff treatment can complicate vendor selection.

Across the Asia-Pacific region, rapid expansion of biotech research, an active contract-research services market, and a broad manufacturing base shape a different set of dynamics. Local reagent production and instrument manufacturing capacity can lower landed costs for many buyers, while regulatory harmonization and investment in translational research are creating substantial demand for both manual and automated platforms. At the same time, geopolitical trade measures and export controls can create sourcing risk, which drives both multinational suppliers and local firms to offer country-specific supply arrangements and regional distribution strategies. Taken together, these regional differences mean that commercial approaches should be tailored: Americas-focused vendors emphasize integrated support and GLP-capable services; EMEA strategies must accommodate regulatory diversity and capacity building; and Asia-Pacific plans should leverage local manufacturing while managing export-control and tariff exposure.

This comprehensive research report examines key regions that drive the evolution of the ELISpot & FluoroSpot Assay market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive and capability snapshot of leading instrument, kit, reagent, and service providers shaping innovation, partnerships, and commercialization strategies

Competitive positioning in ELISpot and FluoroSpot is defined by a combination of technological capability, supply-chain reliability, and commercial flexibility. Leading instrument providers differentiate on image resolution, throughput, and software analytics that translate raw plate reads into validated, auditable datasets. Kit and reagent manufacturers differentiate through reagent formulation, lot consistency, and the breadth of validated protocols that reduce lab validation time. Service providers and CROs distinguish themselves by offering turn-key solutions, standardized reporting, regulatory-compliant workflows, and the capacity to integrate functional immune readouts into multi-assay study designs.

Strategic partnerships and co-development agreements are becoming more frequent as companies seek to accelerate adoption of multiplexed functional assays. Vendors that provide end-to-end solutions-engineered instruments, validated kits, and analytics suites-are increasingly attractive to large pharmaceutical sponsors who need consistent performance across global studies. At the same time, niche suppliers focused on high-quality monoclonal antibodies or specialized substrates maintain strong relevance because their reagents are often critical path items that dictate assay sensitivity and specificity. The competitive environment therefore rewards both breadth of offering and depth of technical validation.

Investments in localized manufacturing, dual-sourcing strategies, and customer-support footprints are further shaping differentiation. Firms that can guarantee uninterrupted reagent supply, rapid technical support, and flexible commercial terms gain trust from procurement teams operating under tighter inventory policies. Additionally, vendors that facilitate verification studies, provide open documentation for regulatory submissions, and support cross-site standardization are better positioned to win long-term engagements with biotech and large pharma customers.

This comprehensive research report delivers an in-depth overview of the principal market players in the ELISpot & FluoroSpot Assay market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abcam plc

- Abnova Corporation

- ALPCO

- Anogen-Yes Biotech Laboratories Ltd.

- Autoimmun Diagnostika GmbH (AID)

- Becton, Dickinson and Company

- Bio-Connect B.V.

- Bio-Rad Laboratories, Inc.

- Bio-Techne Corporation

- Biorbyt Ltd.

- Cellular Technology Limited (CTL)

- Enzo Life Sciences, Inc.

- GenScript Biotech Corporation

- Lophius Biosciences GmbH

- Mabtech AB

- Medix Biochemica

- Merck KGaA

- Oxford Immunotec Ltd.

- STEMCELL Technologies Inc.

- U-Cytech Biosciences

Actionable, near-term recommendations for industry leaders to protect margins, secure supply, and accelerate adoption of ELISpot and FluoroSpot technologies

Leaders in the field should pursue a pragmatic mix of procurement, manufacturing, and commercial tactics to protect program continuity and accelerate adoption of ELISpot and FluoroSpot technologies. First, companies should prioritize SKU-level classification and customs diligence to understand tariff exposure for critical instruments, kits, and reagents; this work should include engagement with customs specialists to determine eligibility for any machinery or product-specific exclusions and to identify whether reclassification or origin documentation can materially reduce duty exposure. By taking these steps early, procurement teams can mitigate surprises and stabilize landed costs.

Second, build redundancy into reagent and component sourcing through dual-sourcing and regional partnerships. Nearshoring critical reagent production or negotiating partner manufacturing agreements can reduce reliance on single-country supply and shorten lead times for urgent shipments. When possible, negotiate multi-year supply agreements with committed minimum volumes to secure priority manufacturing slots and consistent lot-to-lot quality, which are especially valuable for sponsors running longitudinal studies.

Third, accelerate validation of automated bench-top solutions in parallel with manual protocols to create scalable workflows that retain analytical comparability. Automation reduces operator variability and increases throughput, but successful rollout demands upfront validation and staff training. Facility leaders should plan pilot programs that assess assay performance across manual and automated platforms and document equivalency to satisfy internal quality and external regulatory demands.

Fourth, adopt inventory strategies that reflect the new trade environment. Transition from lean, frequent ordering to a hybrid model that maintains strategic safety stocks of long-lead reagents and critical spare parts while optimizing working capital for less critical items. This change requires updated inventory policies, revised reorder points, and closer collaboration with finance to balance cash flow against program risk.

Finally, vendors and buyers should invest in transparent commercial agreements that include contingency clauses for tariff-driven cost fluctuations, agreed-upon lead times, and defined escalation pathways for quality or supply disruptions. These contractual mechanisms reduce ambiguity, preserve relationships during periods of geopolitical change, and support predictable program execution.

Transparent research methodology describing data sources, primary interviews, triangulation approaches, and validation steps used to assemble this executive summary

This executive summary is grounded in a mixed-method research approach designed to deliver defensible, operationally relevant conclusions. Primary research included structured interviews with procurement leads in academic laboratories, heads of immunology at biotech firms, and directors of assay development at contract research organizations to capture firsthand operational impacts and sourcing strategies. Secondary research reviewed policy documents, Federal Register notices, regulatory updates, customs guidance, and reputable legal and trade analyses to ensure that the assessment of tariff and de minimis changes aligns with official guidance and industry interpretation.

Data triangulation combined primary insights with publicly available regulatory notices and trade analyses, and with product classification frameworks such as Harmonized Tariff Schedule groupings to evaluate potential duty exposure. Quality assurance involved cross-validation of interview themes across multiple end-user types and scrutiny of classification assumptions with trade counsel. Any statements referencing specific trade policy actions or implementation dates were corroborated with official USTR notices and legal-technical analyses to maintain factual accuracy.

Limitations include the dynamic nature of trade policy and the potential for ongoing exclusion requests or litigation to alter the immediate tariff landscape. To accommodate this, the methodology emphasizes scenario-based sensitivity analysis and recommends that decision-makers supplement these findings with periodic customs and legal reviews when making long-range procurement commitments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our ELISpot & FluoroSpot Assay market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- ELISpot & FluoroSpot Assay Market, by Product Type

- ELISpot & FluoroSpot Assay Market, by Application

- ELISpot & FluoroSpot Assay Market, by End User

- ELISpot & FluoroSpot Assay Market, by Platform Type

- ELISpot & FluoroSpot Assay Market, by Region

- ELISpot & FluoroSpot Assay Market, by Group

- ELISpot & FluoroSpot Assay Market, by Country

- United States ELISpot & FluoroSpot Assay Market

- China ELISpot & FluoroSpot Assay Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Convergent conclusions synthesizing strategic imperatives for R&D, procurement, and commercial teams engaged with ELISpot and FluoroSpot assays

In synthesis, ELISpot and FluoroSpot assays remain indispensable tools for functional immune monitoring, and their strategic importance will grow as immunotherapy, vaccine development, and infectious disease surveillance continue to demand robust single-cell functional readouts. Scientific advances, coupled with the spread of automation and integrated solutions, are creating clear pathways for scaling these assays from exploratory research into regulated, sponsor-driven programs. At the same time, the 2025 trade environment-characterized by modified Section 301 measures, the winding down of many exclusions, and the elimination of de minimis treatment for low-value parcels-has raised the operational bar for procurement and supply-chain teams. Organizations that proactively address SKU-level tariff classification, diversify sourcing, and validate automated workflows will be better positioned to preserve program timelines and programmatic budgets.

Looking forward, the organizations best equipped to benefit from ELISpot and FluoroSpot technologies will be those that combine rigorous technical validation with pragmatic supply-chain governance. In this environment, collaborations between instrument vendors, reagent specialists, and CROs that explicitly address supply assurance, validation documentation, and contingency planning will capture outsized commercial value and reduce execution risk.

Direct purchase pathway and executive engagement steps to obtain the full ELISpot & FluoroSpot market research report through Ketan Rohom, Associate Director, Sales & Marketing

To acquire the comprehensive ELISpot & FluoroSpot market research report and receive a tailored briefing, please contact Ketan Rohom, Associate Director, Sales & Marketing. Ketan will coordinate a confidential consultation to align the report deliverables with your organization’s priorities, highlight bespoke sections of interest such as supply-chain resilience, segmentation deep dives, and competitor benchmarking, and outline available licensing and enterprise distribution options.

Following your request, Ketan will arrange a secure sample of the report’s table of contents and methodology appendix, schedule a demonstration of the interactive data tools, and present pricing and delivery timelines that suit your procurement cycle. This direct engagement ensures you obtain the most relevant insights and actionable tools for accelerating programmatic decisions across assay procurement, platform investments, and partner selection.

Requesting the full report through Ketan also unlocks optional add-ons including custom data extracts, competitor tracking alerts, and a facilitated workshop to translate findings into execution plans. Reach out to Ketan to initiate the purchase process and to secure a tailored briefing that expedites executive decision-making and operational implementation.

- How big is the ELISpot & FluoroSpot Assay Market?

- What is the ELISpot & FluoroSpot Assay Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?