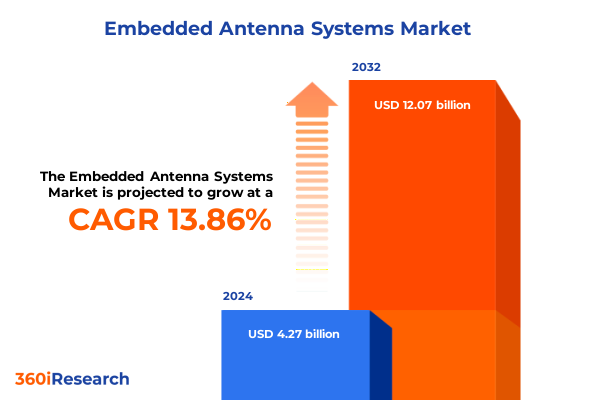

The Embedded Antenna Systems Market size was estimated at USD 4.81 billion in 2025 and expected to reach USD 5.44 billion in 2026, at a CAGR of 14.02% to reach USD 12.07 billion by 2032.

Pioneering the Future of Wireless Connectivity with Compact Embedded Antenna Solutions Driving Performance Improvements and Seamless Integration Across Industry Verticals

Embedded antenna systems have emerged as a critical enabler of seamless wireless communication, offering integrated solutions that transcend the limitations of traditional discrete antenna components. As devices continue to shrink and connectivity demands intensify, the role of embedded antennas in delivering high-performance radio frequency functionality has become ever more pronounced. They serve as the invisible backbone within a broad array of applications, spanning the consumer electronics used in everyday life to the advanced sensor networks propelling smart cities and industrial IoT deployments.

Over recent years, dramatic advancements in materials science, miniaturized manufacturing techniques, and computational modeling have converged to accelerate the evolution of embedded antenna architectures. Engineers are leveraging novel dielectric substrates, multi-layered circuit board designs, and advanced simulation tools to achieve multi-band, multi-protocol support within confined spatial footprints. This dynamic landscape is shaped by the imperative to balance form factor constraints, regulatory requirements, and performance targets, while accommodating the proliferation of next-generation networks such as 5G and the anticipated arrival of 6G.

This executive summary offers a strategic overview of these developments, positioning readers to understand how embedded antenna systems are redefining connectivity across key market segments and geographic regions. By highlighting recent transformative trends, regulatory influences, critical segmentation perspectives, and tangible recommendations, this introduction lays the groundwork for an informed exploration of embedded antenna opportunities and challenges facing industry leaders.

Uncovering the Convergence of Advanced Materials Innovation and Evolving Regulatory Standards Reshaping Embedded Antenna Architectures Worldwide

The embedded antenna landscape is undergoing a series of transformative shifts driven by breakthroughs in materials innovation, design methodologies, and regulatory alignment. Emerging technologies like metamaterials and additive manufacturing techniques are enabling antenna structures with unprecedented bandwidth and efficiency characteristics. Engineers are now capable of sculpting intricate geometries at the micron scale, leveraging 3D printing to fabricate conformal elements that were previously unattainable with standard printed circuit board processes.

Concurrently, the adoption of advanced simulation and machine learning algorithms has revolutionized the design workflow, significantly reducing development cycles while optimizing antenna performance across multiple frequency bands. These computational tools facilitate rapid iteration, automated tuning, and predictive modeling of electromagnetic behavior in complex device enclosures. As a result, product manufacturers can bring refined embedded antenna solutions to market more swiftly, bolstering competitiveness in high-growth sectors such as wearable electronics and smart home devices.

Moreover, regulatory landscapes are evolving in parallel to accommodate higher frequency allocations and stricter electromagnetic compatibility standards. Policy bodies are harmonizing certification processes for 5G New Radio deployments and preparing for the spectrum requirements of future wireless generations. This alignment reduces cross-border compliance barriers, enabling faster global rollouts of next-generation connectivity devices. Through these converging shifts, the embedded antenna ecosystem is redefining the frontier of wireless design and setting new benchmarks for integration and performance.

Analyzing the Far-Reaching Consequences of Recent United States Trade Tariffs on Embedded Antenna Component Sourcing and Supply Chain Resilience

The imposition of new trade tariffs by the United States in 2025 has introduced significant complexity into the embedded antenna supply chain, particularly for components and raw materials sourced from key international manufacturing hubs. Cumulative duties on imported dielectric substrates, copper claddings, and specialized RF components have elevated input costs for original equipment manufacturers, compelling them to reassess sourcing strategies and cost structures.

In response to escalating tariffs, myriad industry participants have pursued supply chain diversification through regional supplier partnerships and localized assembly operations. Some firms have accelerated nearshoring initiatives to establish production footprints in Mexico and other Americas regions with preferential trade agreements. Others have intensified collaboration with domestic material suppliers to mitigate exposure to cross-border tariffs and logistical bottlenecks.

Despite these adaptive efforts, heightened input costs have exerted downward pressure on profit margins, prompting a reassessment of design specifications and material choices. This environment has catalyzed innovation in cost-effective substrate alternatives and streamlined manufacturing workflows aimed at offsetting tariff-related expenses. As the cumulative impact of these trade measures continues to unfold, industry leaders are prioritizing resilience in procurement strategies, while remaining vigilant to potential policy shifts that could further influence embedded antenna economics.

Deriving Critical Insights from Consumer Electronics and Automotive Segmentation Trends Highlighting User Preferences and Technological Demands in Embedded Antenna Markets

Insight into the consumer electronics segmentation reveals that embedded antenna adoption patterns vary significantly by device class, reflecting unique performance demands and form factor constraints. In laptops, the imperative for thin, low-profile antennas that support high-speed Wi-Fi and Bluetooth connectivity has driven the integration of multi-band planar inverted-F antennas, often embedded within display bezels to maximize usable real estate. Transitioning to mobile phones, the evolution from feature phones to sophisticated smartphones exemplifies the importance of multi-element MIMO arrays capable of handling diverse cellular bands, carrier aggregation schemes, and NFC functionality, all within millimeter-scale enclosures.

Meanwhile, smart home devices such as voice assistants and security cameras demand embedded antennas that balance range, reliability, and aesthetic integration into consumer-facing enclosures. In tablets, the convergence of high-resolution displays and cellular connectivity has sparked demand for wideband antennas that seamlessly transition between Wi-Fi, GPS, and LTE bands without sacrificing device thinness. Wearables, characterized by their proximity to the human body and exposure to dynamic usage conditions, necessitate flexible antenna substrates and body-influence compensation techniques to maintain stable links for health monitoring and fitness tracking.

In the automotive realm, the growing prevalence of advanced driver assistance systems has placed significant emphasis on diverse RF modalities. Camera-based ADAS systems rely on embedded antennas to support high-bandwidth sensor fusion, while Lidar and radar subsystems require highly directional arrays calibrated for precise object detection. Ultrasonic sensors, used for close-range parking assistance, integrate low-profile antennas to minimize signal interference within bumper assemblies. Beyond safety, infotainment systems leverage embedded antennas to deliver seamless streaming and navigation services, and telematics units depend on cellular connectivity for over-the-air updates, fleet management, and emergency calling. Keyless entry mechanisms, often utilizing ultra-wideband or NFC technologies, further underscore the criticality of tailored antenna designs within vehicle door handles and secure access modules.

This comprehensive research report categorizes the Embedded Antenna Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Antenna Type

- Material Type

- End-Use Industry

- Sales Channel

Revealing Regional Dynamics and Growth Drivers Across the Americas, Europe Middle East and Africa, and Asia Pacific Embedded Antenna Ecosystems

Regional dynamics in the Americas are shaped by the dual influences of robust 5G network rollouts and a mature automotive manufacturing sector. North American device makers are pursuing embedded antenna solutions that meet stringent industry certifications and consumer expectations for high throughput and low latency. Latin American markets, while at varied stages of network modernization, present growth opportunities for cost-optimized antennas that support dual-SIM mobile phones and IoT sensors tailored to agricultural and smart city projects.

Across Europe, Middle East, and Africa, regulatory harmonization efforts around the CE marking and Gulf Cooperation Council standards are facilitating cross-border deployment of devices incorporating embedded antennas. Western European nations lead in adoption of smart home technologies and connected vehicles, demanding integrated antenna modules that comply with local environmental and safety directives. In Middle Eastern and African regions, the expansion of renewable energy microgrids and remote infrastructure monitoring has spurred demand for long-range embedded antenna designs capable of operating in harsh climate conditions and over vast geographic distances.

In the Asia Pacific, stringent component quality requirements and high-volume consumer electronics production converge to make this region a critical manufacturing hub. China, South Korea, and Japan are at the forefront of 5G NR and emerging 6G research, driving antenna innovations that leverage advanced materials and precision fabrication. Southeast Asian economies contribute to expanding IoT networks in logistics, retail, and urban mobility, fostering embedded antenna solutions optimized for wireless sensor nodes and industrial telemetry.

This comprehensive research report examines key regions that drive the evolution of the Embedded Antenna Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Moves and Innovative Collaborations among Leading Embedded Antenna Manufacturers and Emerging Technology Startups

The competitive landscape of embedded antenna systems is defined by established multinational corporations and nimble technology startups alike. Key players have pursued strategic collaborations with chipset vendors to ensure antenna-to-radio co-design integration, reducing time-to-market and optimizing overall system performance. Leading manufacturers are investing heavily in proprietary design automation platforms that accelerate development cycles and enable rapid customization for diverse end uses.

Recent merger and acquisition activity has brought together complementary capabilities, such as substrate fabrication expertise and high-power Lidar antenna design. Some firms have forged partnerships with material science innovators to commercialize next-generation low-loss dielectric substrates, while others have entered alliance with network operators to conduct over-the-air performance testing in live network environments. Emerging technology ventures have concentrated on software-defined antenna concepts, aiming to introduce real-time beam-steering and dynamic frequency-tuning features into compact form factors.

This dynamic interplay of collaboration, consolidation, and startup innovation underscores a broader industry trend toward integrated solutions that address both signal integrity and manufacturability. Companies that can deliver holistic embedded antenna offerings-encompassing design tools, materials, and system-level testing-are poised to secure leadership positions as demand for sophisticated wireless capabilities continues to accelerate.

This comprehensive research report delivers an in-depth overview of the principal market players in the Embedded Antenna Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 2J Antennas, s.r.o.

- Abracon LLC

- Airgain, Inc.

- Amphenol Corporation

- Antenova Ltd.

- AVX Corporation

- Ethertronics

- Fractus Antennas, S.L.

- Ignion, S.L.

- INPAQ Technology Co., Ltd.

- Johanson Technology, Inc.

- Kyocera AVX Components Corporation

- Laird Connectivity

- Linx Technologies, Inc.

- Maxtena, Inc.

- Mitsubishi Materials Corporation

- Mobile Mark, Inc.

- Molex, LLC

- Murata Manufacturing Co., Ltd.

- Panorama Antennas Ltd.

- Partron Co., Ltd.

- Pulse Electronics Corporation

- Qorvo, Inc.

- Skycross, Inc.

- Taoglas Limited

- TDK Corporation

- TE Connectivity plc

- Yageo Corporation

Actionable Strategies for Industry Leaders to Capitalize on Evolving Technologies and Strengthen Market Position in Embedded Antenna Development

Industry leaders seeking to capitalize on the accelerating evolution of embedded antenna systems should prioritize investment in advanced R&D initiatives, particularly in metamaterials and additive manufacturing processes. Cultivating partnerships with semiconductor and RF front-end vendors will accelerate co-design efforts, yielding optimized antenna-radio assemblies that streamline integration and certification. Equally important is the establishment of resilient, multi-regional supply chains that mitigate exposure to trade policy fluctuations while ensuring consistent access to critical substrates and electronic components.

To differentiate in mature markets, organizations must adopt agile design workflows supported by AI-driven simulation platforms that drastically shorten prototyping timelines. Embedding sustainability considerations into material selection and production processes will not only reduce environmental impact but also align with evolving regulatory and consumer expectations. Companies should also explore the incorporation of digital twin frameworks and over-the-air performance analytics to monitor real-world antenna behavior, enabling continuous optimization after product launch.

Finally, leaders should adopt a market-centric approach, tailoring antenna solutions to the specific requirements of key verticals such as automotive, consumer electronics, and industrial IoT. By developing modular, scalable antenna architectures and offering flexible licensing or design-as-a-service models, suppliers can address diverse customer needs and secure long-term partnerships in an increasingly competitive ecosystem.

Comprehensive Research Framework Integrating Primary Expert Interviews and Secondary Data Analysis to Deliver Robust Embedded Antenna Market Insights

This research employs a rigorous, multi-step methodology designed to deliver robust insights into the embedded antenna sector. Primary data was gathered through structured interviews with RF engineers, materials scientists, and strategic sourcing executives at leading device manufacturers. These discussions provided first-hand perspectives on design challenges, regulatory compliance hurdles, and emerging technology adoption patterns.

Complementing these qualitative insights, a comprehensive secondary research phase incorporated an analysis of technical literature, patent filings, conference proceedings, and regulatory filings. Trade association reports and industry benchmark studies were reviewed to contextualize technology trends and supply chain dynamics. Quantitative data was triangulated by cross-referencing public financial disclosures, customs trade data, and supplier directories to validate the prevalence of various antenna architectures and material platforms.

To ensure data integrity, findings were subjected to peer review by an internal panel of industry experts, followed by consistency checks against live network performance case studies and prototype testing reports. This layered approach guarantees that the resulting insights are both actionable and reflective of current market realities, enabling stakeholders to make informed strategic decisions in the embedded antenna arena.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Embedded Antenna Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Embedded Antenna Systems Market, by Antenna Type

- Embedded Antenna Systems Market, by Material Type

- Embedded Antenna Systems Market, by End-Use Industry

- Embedded Antenna Systems Market, by Sales Channel

- Embedded Antenna Systems Market, by Region

- Embedded Antenna Systems Market, by Group

- Embedded Antenna Systems Market, by Country

- United States Embedded Antenna Systems Market

- China Embedded Antenna Systems Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Summarizing the Critical Findings and Future Outlook for Embedded Antenna Technologies in a Rapidly Shifting Connectivity Landscape

The analysis reveals a dynamic embedded antenna ecosystem propelled by material science breakthroughs, computational design advancements, and shifting trade policies. Transformative shifts such as additive manufacturing and metamaterials are redefining performance benchmarks, while evolving regulatory standards streamline global device certification. At the same time, new United States tariffs have galvanized supply chain resilience efforts, prompting a reconfiguration of sourcing strategies and localized production models.

Segmentation insights underscore the nuanced demands within consumer electronics and automotive markets, where device classes and application requirements dictate specialized antenna designs. Regional perspectives highlight differentiated growth drivers across the Americas, EMEA, and Asia Pacific, emphasizing the interplay between network rollouts, regulatory harmonization, and manufacturing capabilities. Leading companies are forging collaborative ecosystems that integrate materials innovation, software-driven design tools, and system-level testing to accelerate time-to-market.

Looking ahead, the industry is poised to embrace further convergence of AI-enabled design, sustainable materials, and 6G research, creating new avenues for performance optimization and form factor miniaturization. By implementing the actionable recommendations outlined in this summary, stakeholders can navigate the complexities of the embedded antenna landscape and secure competitive advantage in an era defined by ubiquitous wireless connectivity.

Contact Associate Director Sales Marketing Ketan Rohom to Unlock Comprehensive Embedded Antenna Market Research Insights and Empower Your Strategic Decisions

Engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, opens the door to a tailored deep dive into the complexities and opportunities of the embedded antenna industry. By connecting with his team, stakeholders can gain privileged insights into strategic supply chain considerations, emerging technological breakthroughs, and competitive intelligence that empower precise decision making. This direct partnership ensures that executives receive a customized briefing aligned with their unique product roadmaps, regulatory environments, and end-market requirements. To secure the full market research report and begin implementing data-driven strategies that drive innovation, revenue growth, and operational resilience, reach out to Ketan today and elevate your embedded antenna solutions to new heights

- How big is the Embedded Antenna Systems Market?

- What is the Embedded Antenna Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?