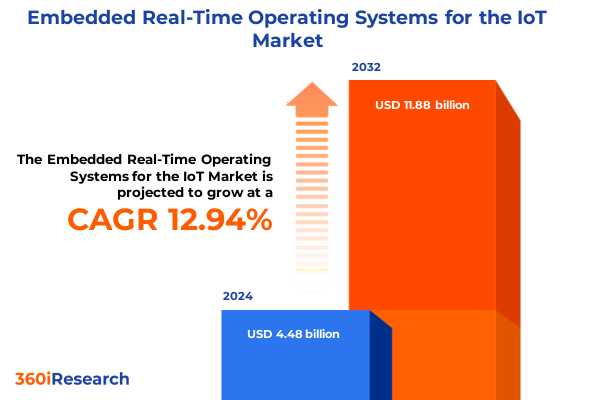

The Embedded Real-Time Operating Systems for the IoT Market size was estimated at USD 5.05 billion in 2025 and expected to reach USD 5.66 billion in 2026, at a CAGR of 12.97% to reach USD 11.88 billion by 2032.

Exploring How Embedded Real-Time Operating Systems Are Powering the Next Wave of Internet of Things Innovation Across Diverse Industry Verticals

Embedded real-time operating systems have emerged as the critical backbone underpinning the exponential growth of the Internet of Things, enabling devices to process data and execute tasks within stringent timing constraints. As the spectrum of IoT applications broadens from simple sensor networks to complex autonomous vehicles and industrial robotics, the need for deterministic scheduling, resource optimization, and low-power operation has never been greater. Embedded RTOS platforms deliver this by offering finely tuned kernels, priority-based task management, and predictable interrupt handling, ensuring that mission-critical operations execute reliably and on time.

Over the past decade, industry stakeholders have witnessed a paradigm shift from general-purpose operating environments to specialized real-time platforms designed specifically for constrained embedded hardware. This movement has been driven by the convergence of edge computing demands with the proliferation of connected devices, compelling developers to select operating systems that strike the right balance between functionality, performance, and footprint. Early-stage IoT deployments often relied on rudimentary firmware running on microcontrollers, but as applications evolved to require connectivity, security, and integration with cloud ecosystems, embedded real-time operating systems have become indispensable.

Today, ecosystem interoperability, modular middleware stacks, and vendor-supported security frameworks are core considerations guiding RTOS selection. Regulatory compliance for data privacy, safety certifications for automotive and medical use cases, and the emergence of over-the-air update mechanisms further underscore the importance of robust real-time operating environments. With the market poised for unprecedented expansion, this research examines the forces shaping the embedded RTOS landscape, offering decision-makers the clarity to navigate an increasingly complex technology domain.

Examining the Major Technological Advances and Security-Driven Transformations Reshaping Embedded RTOS in the IoT Era

The embedded RTOS ecosystem has undergone transformative shifts fueled by advancements in edge computing, artificial intelligence acceleration, and heightened security imperatives. As IoT networks expand to billions of devices, processing more data closer to the source reduces latency and dependence on centralized cloud infrastructure. This architectural evolution has pushed real-time operating systems to integrate native support for heterogeneous compute elements, such as AI-enabled microcontrollers and domain-specific accelerators, allowing sophisticated analytics and machine learning inference to occur at the edge.

Simultaneously, rising cybersecurity threats targeting connected devices have propelled secure-by-design principles to the forefront. RTOS providers are embedding hardware-backed trust anchors, secure boot processes, and runtime monitoring mechanisms to detect anomalies in real time. The shift toward containerized workloads and microservices on constrained hardware has further driven innovation in device virtualization, enabling isolated execution environments that bolster fault containment and simplify over-the-air updates.

Additionally, industry standards like IEC 61508 for functional safety and ISO 26262 for automotive safety-critical systems have influenced RTOS roadmaps, encouraging vendors to achieve safety certification and deterministic performance guarantees. The open source movement has also left its mark, with community-driven kernels gaining traction alongside commercial offerings, fostering greater transparency and extensibility. These cumulative technological shifts are redefining the capabilities of embedded real-time operating systems, setting new benchmarks for performance, security, and flexibility in next-generation IoT deployments.

Assessing the Widespread Consequences of 2025 United States Tariffs on Semiconductor Supply Chains and Embedded RTOS Adoption Patterns

In 2025, newly imposed United States tariffs on semiconductor components and related IoT hardware have triggered a ripple effect across the embedded real-time operating system market. Increased duties on imported microcontrollers, system-on-chips, and wireless modules have raised procurement costs for device manufacturers, prompting many to reevaluate their global sourcing strategies. This shift has accelerated initiatives to diversify supply chains, with firms exploring alternate manufacturing hubs in Southeast Asia, Latin America, and Eastern Europe to mitigate tariff impacts and avoid production delays.

These tariff-driven market dynamics have also influenced RTOS licensing decisions. Organizations seeking to preserve project budgets are gravitating toward open source kernels and community editions that curb royalty expenses, while proprietary vendors have responded by offering flexible commercial distribution packages and cloud-based subscription models that align costs with usage. The rising cost of hardware has compelled developers to optimize code footprints and performance more aggressively, leading to heightened collaboration between silicon vendors and RTOS providers to co-engineer tightly integrated platforms that deliver maximum efficiency.

Furthermore, regional policy shifts such as incentives for domestic chip fabrication and government-funded IoT testbeds have created new ecosystems for innovation. Countries with robust supply chain incentives and tariff exemptions are becoming hotspots for pilot deployments of real-time operating systems in sectors like smart grid management and connected mobility. Consequently, the cumulative impact of United States tariffs in 2025 extends beyond cost inflation-it is reshaping strategic partnerships, encouraging architectural consolidation, and catalyzing deeper integration across hardware and software domains.

Unveiling Key Market Segmentation Dynamics Shaping Embedded RTOS Deployment Across Application, Architecture, Connectivity, Licensing, and Deployment Models

Embedded real-time operating systems are deployed across a diverse array of applications, each with unique requirements for latency, reliability, and scalability. In the automotive sector, advanced driver assistance systems (ADAS) demand ultra-low-latency scheduling to process sensor fusion data in fractions of milliseconds, while powertrain and infotainment modules prioritize safety certification and rich user interfaces. Consumer electronics manufacturers leverage RTOS kernels in augmented and virtual reality headsets, wearables, and smart home devices, balancing responsiveness with compact memory footprints.

From an architectural standpoint, RTOS adoption spans multiple processor families, from resource-constrained 8-bit microcontrollers powering simple sensors to 64-bit multicore platforms tasked with edge AI inferencing. This broad processor coverage ensures that developers can match operating system features to performance and cost targets across embedded use cases. Connectivity technology further segments the landscape: wired protocols such as CAN Bus and Ethernet maintain dominance in industrial automation, while wireless standards including Bluetooth, Wi-Fi, and emerging LPWAN variants like LoRaWAN and NB-IoT unlock long-range low-power deployments in smart meter and remote monitoring applications.

Licensing models play a pivotal role in adoption strategies as enterprises weigh open source flexibility against proprietary vendor support. Cloud-based on-demand licensing appeals to businesses with fluctuating project scales, whereas on-premises deployments remain prevalent in sectors with stringent security and compliance mandates. This nuanced segmentation underscores how embedded RTOS solutions are tailored to specific industry demands, guiding vendors to refine product portfolios and service offerings accordingly.

This comprehensive research report categorizes the Embedded Real-Time Operating Systems for the IoT market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Processor Architecture

- Connectivity Technology

- Licensing Type

- Deployment Model

- Application

Analyzing Distinct Regional Drivers of Embedded RTOS Adoption in the Americas, EMEA, and Asia-Pacific IoT Ecosystems

Regional nuances profoundly influence the trajectory of embedded real-time operating system adoption as economic priorities, regulatory frameworks, and technological readiness vary across geographies. In the Americas, strong investment in automotive electrification and industrial modernization is driving demand for safety-certified kernels and high-performance connectivity stacks. North American firms are particularly focused on modular RTOS architectures that support rapid feature updates and lifecycle management in highly regulated environments.

Meanwhile, Europe, the Middle East, and Africa exhibit a dual focus on energy efficiency and functional safety, with smart grid modernization and autonomous mobility initiatives underpinning regional growth. Stringent data sovereignty regulations in European markets have fueled interest in on-premises deployment models and open source offerings that allow for localized customization and auditability. In the Middle East and Africa, strategic projects in smart cities are creating testbeds for IoT platforms underpinned by deterministic operating environments.

Across Asia-Pacific, a thriving electronics manufacturing ecosystem and government-led IoT innovation programs have accelerated RTOS adoption in consumer devices, healthcare systems, and factory automation. China’s push for indigenous semiconductor technologies has spurred collaborations between local RTOS vendors and fabs, while Japan and South Korea focus on integrating machine learning capabilities at the edge. This regional mosaic highlights the importance of tailoring real-time operating system strategies to localized market drivers and regulatory landscapes.

This comprehensive research report examines key regions that drive the evolution of the Embedded Real-Time Operating Systems for the IoT market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Charting the Competitive Landscape and Strategic Alliances Among Leading Embedded RTOS Providers Driving IoT Innovation

The competitive landscape for embedded real-time operating systems features a blend of established incumbents and agile innovators, each vying to address the evolving demands of IoT pioneers. Legacy providers with deeply integrated safety certification streams have fortified their positions in the automotive and medical device sectors by delivering deterministic kernels that comply with ISO 26262 and IEC 62304. At the same time, cloud-native vendors are extending their platforms to the edge, bundling middleware, security services, and analytics frameworks that simplify end-to-end IoT deployments.

Over the past year, strategic partnerships between semiconductor manufacturers and RTOS vendors have intensified, leading to co-developed reference platforms that accelerate time to market. Companies offering open source kernels have strengthened their community ecosystems through commercial distribution agreements and enterprise-grade support offerings, expanding their footprint in startup-driven segments. Meanwhile, providers of proprietary real-time operating systems are differentiating through specialized modules for AI inferencing, multi-network connectivity, and dynamic resource partitioning on multicore processors.

This dynamic interplay of alliances, product innovations, and support models underscores a market in rapid evolution. Firms that excel in tailoring solutions to niche verticals, while maintaining the scalability and reliability required by large-scale IoT rollouts, are poised to capture significant mindshare and revenue streams. Observing these competitive maneuvers provides invaluable insights for stakeholders seeking to align with leading RTOS technologies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Embedded Real-Time Operating Systems for the IoT market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Altreonic NV

- Amazon Web Services Inc.

- ARM Holdings plc

- CMX Systems Inc.

- Contiki-NG

- eCosCentric Limited

- ENEA AB

- Express Logic Inc.

- Google LLC

- Green Hills Software LLC

- Mbed OS

- Mentor Graphics Corporation

- Micrium Inc.

- Microsoft Corporation

- RIOT OS

- Sciopta Systems AG

- Siemens AG

- Wind River Systems Inc.

- Wittenstein SE

- Zephyr Project

Driving Strategic Partnerships, Modular Architectures, and Compliance-Focused Frameworks to Maximize Embedded RTOS Success in IoT Initiatives

Industry leaders aiming to navigate the complexities of embedded real-time operating system selection and deployment should prioritize strategic alignment with both technological and business objectives. To begin, establishing collaborative relationships with semiconductor vendors ensures early access to optimized board support packages and performance enhancements, reducing integration risk. Concurrently, companies should invest in cross-functional teams that bring together expertise in real-time scheduling, security architecture, and middleware development to enforce unified system design principles.

Risk mitigation strategies should include diversifying RTOS licensing models across project portfolios, blending open source community editions for experimental prototypes and commercial distributions for mission-critical applications. Organizations must also implement continuous compliance monitoring processes to stay ahead of evolving safety and data privacy regulations, leveraging automated certification toolchains where available. Additionally, developing modular software frameworks that abstract hardware dependencies will accelerate future migrations to next-generation processors and connectivity technologies.

Finally, cultivating strong partnerships within industry consortia and standards bodies will facilitate interoperability and influence emerging real-time operating system specifications. Embracing a culture of iterative innovation-through pilot programs and proof-of-concept trials-enables rapid validation of new features like edge AI pipelines and secure containerization, ensuring that your IoT deployments remain competitive and resilient in a dynamic market.

Outlining a Comprehensive Research Framework Featuring Secondary Analysis, Expert Interviews, and Qualitative Synthesis to Derive Embedded RTOS Market Insights

This research was conducted through a multi-tiered methodology combining secondary data aggregation, primary stakeholder engagement, and rigorous qualitative analysis. In the secondary phase, industry reports, technical white papers, and open standards documentation were reviewed to establish a comprehensive baseline on real-time operating system features, certification requirements, and technology roadmaps. Proprietary program memory usage studies and architectural benchmarks provided empirical performance comparisons across leading RTOS kernels.

The primary research phase involved in-depth interviews with senior engineers, product managers, and CTOs from device manufacturers, semiconductor vendors, and system integrators. These conversations illuminated real-world challenges in integrating real-time operating systems within constrained hardware, as well as emerging requirements for edge AI integration and over-the-air security updates. Additionally, targeted surveys captured sentiment on licensing preferences, preferred connectivity protocols, and the impact of regulatory dynamics.

Finally, qualitative insights from expert roundtables and panel discussions were synthesized to validate emerging trends and reconcile divergent viewpoints. Triangulating these findings with quantitative metrics allowed for balanced, actionable conclusions. This holistic approach ensures that the recommendations and insights presented herein reflect both the strategic imperatives and the technical realities shaping the future of embedded real-time operating systems in IoT landscapes.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Embedded Real-Time Operating Systems for the IoT market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Embedded Real-Time Operating Systems for the IoT Market, by Processor Architecture

- Embedded Real-Time Operating Systems for the IoT Market, by Connectivity Technology

- Embedded Real-Time Operating Systems for the IoT Market, by Licensing Type

- Embedded Real-Time Operating Systems for the IoT Market, by Deployment Model

- Embedded Real-Time Operating Systems for the IoT Market, by Application

- Embedded Real-Time Operating Systems for the IoT Market, by Region

- Embedded Real-Time Operating Systems for the IoT Market, by Group

- Embedded Real-Time Operating Systems for the IoT Market, by Country

- United States Embedded Real-Time Operating Systems for the IoT Market

- China Embedded Real-Time Operating Systems for the IoT Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Summarizing Critical Findings on Technological, Regulatory, and Competitive Forces Shaping the Future of Embedded RTOS in IoT

The landscape for embedded real-time operating systems in IoT is characterized by rapid technological convergence, evolving regulatory pressures, and shifting global supply chain dynamics. As edge computing and AI capabilities proliferate, the demand for deterministic, secure, and efficient operating platforms will continue to intensify across automotive, industrial, and consumer domains. Tariff-induced cost fluctuations and regional policy initiatives further complicate vendor selection and deployment strategies, underscoring the need for flexible licensing and robust partnership ecosystems.

Segmentation insights reveal that application-driven requirements, processor architecture choices, connectivity technologies, and deployment models must be aligned with broader business objectives for successful implementation. Regional analyses demonstrate that cultural, regulatory, and infrastructure factors influence the adoption curve, necessitating localized strategies. Competitive intelligence underscores the importance of co-engineered hardware-software platforms and differentiated value propositions centered around safety certification, security frameworks, and AI integration.

Together, these insights paint a picture of an industry at a pivotal juncture, where decisive investments in modular architectures, compliance automation, and strategic alliances will determine market leaders. The agility to adapt to shifting economic landscapes, technological innovations, and regulatory mandates will be the hallmark of successful organizations leveraging embedded real-time operating systems to unlock the full promise of the IoT.

Unlock Unparalleled IoT Growth Opportunities by Partnering with Ketan Rohom for In-Depth Embedded RTOS Market Research and Strategic Insights

Ready to Harness the Full Potential of Embedded Real-Time Operating Systems for Your IoT Applications Reach Out to Ketan Rohom to Secure Your Comprehensive Market Intelligence Today

- How big is the Embedded Real-Time Operating Systems for the IoT Market?

- What is the Embedded Real-Time Operating Systems for the IoT Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?