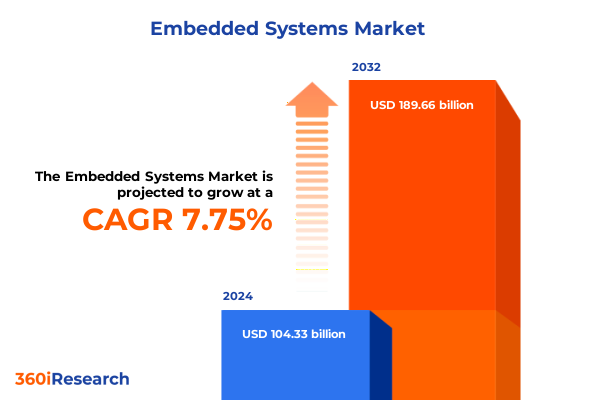

The Embedded Systems Market size was estimated at USD 112.04 billion in 2025 and expected to reach USD 120.43 billion in 2026, at a CAGR of 7.80% to reach USD 189.66 billion by 2032.

Unveiling the Strategic Role of Embedded Systems in Shaping Tomorrow’s Digital Infrastructure Across Diverse Industries Through Intelligent Integration

Embedded systems have evolved from specialized controllers embedded within singular devices to pivotal enablers of modern digital ecosystems. Far beyond mere hardware components, these systems now embody the convergence of sensors, processors, and intelligent software that collectively orchestrate complex functionalities in applications ranging from industrial automation to consumer electronics. As industries undergo rapid digital transformation, embedded solutions form the critical connective tissue that bridges real-world processes with high-level analytics, enabling real-time decision-making, predictive maintenance, and autonomous operations.

This introduction sets the stage by highlighting the essentiality of embedded architectures in driving innovation across verticals. From the smallest microcontroller-driven wearables to robust, multi-processor safety-critical platforms, embedded systems underpin everything from autonomous vehicles to smart healthcare devices. Their design considerations-encompassing performance, power efficiency, security, and form factor-dictate not only product capabilities but also the user experiences and business models they support. By exploring these foundational concepts, this summary illuminates the strategic importance and transformative potential of embedded systems in shaping future digital infrastructures.

Exploring the Groundbreaking Technological Shifts Reshaping the Embedded Systems Landscape With AI, Edge Computing, and Next-Generation Connectivity

The embedded systems landscape is being reshaped by converging forces of artificial intelligence and edge computing, marking a departure from centralized processing toward distributed intelligence at the network edge. Generative AI models and neural processing units are being integrated directly into embedded platforms, empowering devices with on-device inferencing capabilities that reduce latency and protect data privacy. This paradigm shift allows use cases such as real-time image recognition in autonomous drones or localized anomaly detection in industrial machinery to operate with minimal cloud dependency, thereby enhancing reliability and responsiveness.

Simultaneously, next-generation connectivity technologies like 5G and LPWAN (including NB-IoT and LoRaWAN) are unlocking ultra-fast, low-latency communication channels between embedded endpoints and broader networks. These advancements facilitate seamless data exchange for time-critical applications such as real-time traffic management and remote healthcare monitoring. The confluence of robust wireless protocols and embedded intelligence establishes a resilient foundation for distributed control and predictive analytics, transforming how devices interact and adapt within dynamic environments.

Energy efficiency has emerged as a paramount design consideration as devices proliferate across battery-constrained and remote scenarios. Developers are leveraging ultra-low-power microcontrollers and sophisticated power management techniques-such as dynamic voltage scaling and event-driven processing-to extend device lifespans while maintaining performance. This focus supports a broad spectrum of applications, from wearable health monitors operating for months on a single charge to environmental sensors in precision agriculture that function autonomously for years.

In tandem, the adoption of open-source hardware and software architectures, most notably the RISC-V instruction set and community-driven real-time operating systems like Zephyr and Linux derivatives, is accelerating innovation. These open models offer design flexibility, cost efficiencies, and collaborative development ecosystems that foster rapid prototyping and customization. By reducing dependency on proprietary platforms, organizations can tailor embedded solutions to exacting specifications while benefiting from collective security audits and feature enhancements.

Finally, as embedded devices become increasingly interconnected, cybersecurity has transitioned from an optional feature to a foundational requirement. Regulatory frameworks such as the EU Cyber Resilience Act underscore the imperative for security-by-design principles, including secure boot processes, hardware root-of-trust, and runtime threat detection. Robust security architectures are now embedded throughout the device lifecycle, from initial design through over-the-air updates, mitigating risks associated with adversarial machine learning and evolving cyber-attack vectors.

These transformative shifts collectively redefine how embedded systems are conceived, developed, and deployed. By embracing distributed intelligence, next-generation connectivity, energy-efficient design, open architectures, and comprehensive security frameworks, organizations can harness the full potential of embedded technologies to drive innovation and competitive differentiation.

Assessing the Aggregate Effects of 2025 United States Trade Tariffs on Embedded Systems Supply Chains, Cost Structures, and Strategic Sourcing Decisions

In 2025, United States trade policy has introduced significant tariff measures targeting a broad array of imports, with pharmaceutical products and semiconductor goods among the most high-profile categories. Proposed under Section 232 of the Trade Expansion Act, these tariffs begin at moderate levels but are structured to escalate progressively, potentially reaching 200% on pharmaceuticals and a phased approach for semiconductors. These policy actions are explicitly aimed at bolstering domestic production by imposing initial, manageable duties that incentivize supply chain realignment while signaling the potential for more substantial barriers in subsequent years.

Although the White House guidance exempts raw and discrete semiconductors from the new tariff regime, the classification rules create ambiguity for embedded systems manufacturers. Products that integrate semiconductors-such as IoT devices, industrial controllers, or consumer electronics-may fall under broader finished goods tariffs, even if their individual components are technically exempt. This incongruity has generated confusion in the electronics industry, prompting companies to meticulously audit Harmonized Tariff Schedule codes and end-use classifications to determine eligibility. As a result, supply chain strategies have pivoted towards diversified sourcing, closer supplier partnerships, and validation processes to ensure accurate product categorization.

Beyond classification challenges, these tariff measures have catalyzed strategic shifts in global sourcing and manufacturing footprints. With even a 10% cost increase impacting margins in a sector defined by tight profitability, organizations are accelerating efforts in nearshoring and reshoring. Investments in domestic and regional production facilities aim to mitigate tariff exposure, reduce lead times, and enhance supply chain resilience. At the same time, the threat of further trade policy fluctuations has intensified calls for diversified supplier networks, inventory buffer strategies, and automation investments that can adapt rapidly to evolving duty structures.

Gaining Critical Insights From Multi-Dimensional Market Segmentations Covering Components, System Types, Sizes, and Industry Applications in Embedded Systems

Market segmentation offers a structured lens through which embedded system design and deployment strategies can be refined for maximum impact. When viewed by component type, the market divides into hardware and software domains. Hardware encompasses I/O interfaces, memory devices, power supply modules, and processors. Processor options further span digital signal processors, general-purpose processors, microcontrollers, and microprocessors, each catering to distinct performance and power requirements. On the software side, firmware, middleware, and operating systems coordinate low-level control, facilitate communication between modules, and deliver user-facing functionality, respectively.

An alternate segmentation by embedded system type distinguishes mobile, networked, real-time, and stand-alone architectures. Mobile solutions emphasize compact form factors and low power draw for wearable and handheld applications. Networked systems focus on connectivity, enabling distributed data aggregation and remote management. Real-time platforms prioritize deterministic response times, with hard real-time systems offering guaranteed worst-case execution constraints and soft real-time designs balancing latency with throughput. Stand-alone configurations operate independently of external networks, suitable for isolated or high-security environments.

Segmentation according to system size further refines deployment strategies. Complex embedded systems integrate multiple processors and subsystems to manage intricate tasks such as autonomous vehicle control or factory automation. Medium-scale systems address mid-level automation, robotics, and consumer applications, optimizing the balance between processing capability and resource cost. Small-scale embedded solutions deliver targeted functionality in low-power, space-constrained devices, including sensor nodes and simple control units.

Finally, application-based segmentation highlights vertical market dynamics. Aerospace and defense platforms demand stringent reliability and safety certifications. The automotive sector is driven by advanced driver assistance features, infotainment systems that enrich user experiences, and telematics units for real-time vehicle monitoring. Consumer electronics focus on user-centric devices that require seamless integration and aesthetic considerations. Energy and utilities emphasize grid monitoring and smart metering, while healthcare applications necessitate compliance with medical standards and patient data security. Industrial deployments range from factory automation to process control and robotics, requiring rugged designs and predictable operation. IT and telecommunications solutions underpin network infrastructure and data center operations, where scalability and uptime are paramount.

This comprehensive research report categorizes the Embedded Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Embedded Systems Type

- System Size

- Application

Uncovering Regional Dynamics Driving Embedded Systems Adoption and Growth Patterns Across the Americas, Europe Middle East Africa, and Asia Pacific Markets

The Americas region maintains a leadership position in embedded systems, fueled by robust innovation hubs and significant R&D investments. The presence of leading semiconductor fabs and mixed-signal processor design centers propels advancements in automotive electronics, aerospace controls, and healthcare monitoring devices. In addition, collaborative programs between industry consortia and government agencies continue to drive next-generation connectivity deployments, with pilot projects in smart cities and intelligent transportation laying the groundwork for broader adoption.

Europe, Middle East & Africa (EMEA) presents a varied landscape shaped by regulatory rigor and sustainability mandates. In Western Europe, stringent environmental and safety standards have catalyzed the development of energy-efficient embedded platforms in the automotive and industrial sectors. Governments in the Middle East are investing in IoT-enabled infrastructure to diversify economic bases, while African markets prioritize scalable, cost-effective embedded solutions to support telecommunications expansion and resource management.

Asia-Pacific demonstrates the fastest growth trajectory, driven by expansive manufacturing ecosystems and aggressive technology adoption. China’s extensive electronics supply chain, combined with state support for semiconductor self-sufficiency, fuels rapid development of IoT endpoints and edge computing modules. Taiwan and South Korea continue to lead in advanced process nodes, underpinning global supply of high-performance microcontrollers and AI accelerators. Southeast Asian nations are emerging as nearshoring hubs, offering competitive labor rates and favorable trade agreements that bolster their appeal for regional production and assembly.

This comprehensive research report examines key regions that drive the evolution of the Embedded Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Major Industry Players’ Strategic Initiatives Unveiling How Leading Companies Are Innovating and Competing in the Embedded Systems Domain

The competitive landscape of the embedded systems market is dominated by a select group of technology providers, each leveraging unique strengths to capture market share. Integrated device manufacturers specializing in mixed-signal processor design continue to expand their portfolios with edge AI accelerators and microcontrollers optimized for ultra-low-power operation. Meanwhile, software vendors are enhancing real-time operating systems with extended security modules and over-the-air update capabilities.

Strategic partnerships between chipset suppliers and systems integrators are shaping the next wave of embedded innovation. Collaborations focused on co-developing reference designs for automotive and industrial applications accelerate time to market, while joint ventures in emerging regions address local compliance and localization requirements. Additionally, several leading players have announced open-source alliances to standardize firmware interfaces and reduce fragmentation in the developer community.

Investment patterns reveal a dual emphasis on broadening product lines and deepening domain-specific expertise. Companies with established footprints in consumer electronics are extending their reach into healthcare and energy applications, adapting existing platforms to meet stringent regulatory criteria. Conversely, traditional industrial automation vendors are integrating advanced connectivity features and AI-enabled diagnostics to modernize legacy systems and drive after-market service opportunities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Embedded Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advantech Co., Ltd.

- Analog Devices, Inc.

- Arm Limited

- Broadcom Inc.

- Cisco Systems, Inc

- Honeywell International Inc.

- Infineon Technologies AG

- Intel Corporation

- Kontron AG

- Microchip Technology Incorporated

- Mitsubishi Electric Corporation

- NVIDIA Corporation

- NXP Semiconductors N.V.

- Panasonic Holdings Corporation

- Qualcomm Incorporated

- Real-Time Systems GmbH

- Renesas Electronics Corporation

- Samsung Electronics Co., Ltd.

- Siemens Aktiengesellschaft

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- Wind River Systems, Inc.

- WIPRO LIMITED

Delivering Actionable Strategic Guidance for Industry Leaders to Capitalize on Emerging Embedded System Opportunities and Navigate Evolving Market Complexities

To thrive in a rapidly evolving embedded systems arena, industry leaders must embrace comprehensive supply chain diversification and localized manufacturing strategies. By establishing regional production hubs and nurturing multi-tier supplier ecosystems, organizations can shield operations from abrupt policy shifts while optimizing logistics and lead times. Concurrently, securing strategic alliances with semiconductor foundries and material suppliers ensures preferred access to critical components and collaborative roadmap alignment.

Embedding security at every phase of product development is non-negotiable. Implementing security-by-design practices, from secure boot through encrypted firmware updates, fortifies devices against emerging threats. Adhering to evolving regulatory frameworks and conducting rigorous penetration testing further enhances trust and enables expedited certification processes in safety-critical domains such as automotive and healthcare.

Investing in AI-driven edge architectures and modular software frameworks will unlock new capabilities and revenue streams. Companies should allocate resources toward prototype incubators that co-develop end-to-end solutions with early adopter customers, facilitating rapid feedback loops and iterative refinement. Additionally, cultivating open-source communities around key platforms can stimulate ecosystem growth, drive standards convergence, and lower barriers to entry.

Upskilling technical and managerial talent through targeted training programs is vital to sustain innovation momentum. Cross-functional teams versed in hardware design, embedded software, data analytics, and cybersecurity foster holistic product vision. Leadership should prioritize continuous learning avenues-such as certification in safety standards and AI model optimization-to ensure competitive positioning in high-growth segments.

Detailing a Robust Research Framework Illustrating the Methodological Approach Underpinning Embedded Systems Market Analysis and Insights Validation

This research leverages a hybrid methodology combining extensive secondary research and primary validation to ensure robust and actionable insights. Secondary sources include industry publications, technology whitepapers, patent databases, and public financial disclosures. Key data points were triangulated across multiple repositories to mitigate bias and enhance reliability.

Primary research comprised in-depth interviews with senior engineers, product managers, and supply chain executives. These discussions provided qualitative perspectives on evolving design priorities, regulatory impacts, and procurement strategies. Insights from expert panels further informed assumptions regarding adoption timelines and competitive positioning.

Quantitative analysis employed structured frameworks to classify segmentation variables, define addressable market categories, and assess technology penetration rates. Data modeling techniques incorporated historical trends and supply chain constraints, without extrapolating into explicit market sizing or forecasts. Segment definitions and driver-challenge matrices were iteratively refined through stakeholder workshops to align with real-world dynamics.

Finally, a rigorous validation process, including peer reviews and feedback loops with industry participants, ensured the findings reflect current market realities and emerging trajectories. This methodological approach guarantees that conclusions and recommendations are grounded in empirically verified evidence and strategic foresight.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Embedded Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Embedded Systems Market, by Component

- Embedded Systems Market, by Embedded Systems Type

- Embedded Systems Market, by System Size

- Embedded Systems Market, by Application

- Embedded Systems Market, by Region

- Embedded Systems Market, by Group

- Embedded Systems Market, by Country

- United States Embedded Systems Market

- China Embedded Systems Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Synthesizing Key Findings Emphasizing the Transformative Trends, Market Drivers, and Strategic Implications for the Future of Embedded Systems

This executive summary has highlighted the pivotal role of embedded systems as the foundational backbone of digital transformation across industries. The landscape is being redefined by advancements in edge AI, next-generation connectivity, energy-efficient design, open-source architectures, and comprehensive security frameworks. Market segmentation analysis underscores the diversity of solutions tailored to distinct component types, system architectures, application domains, and geographical contexts.

Amidst these technological and structural shifts, trade policy developments-particularly the 2025 United States tariff measures-have exerted a tangible influence on supply chain resilience and sourcing strategies. Companies are adapting through classification audits, localized manufacturing initiatives, and enhanced supplier partnerships to mitigate cost pressures and maintain competitive agility.

By synthesizing these insights, industry leaders are equipped to navigate an environment characterized by rapid innovation cycles and complex regulatory landscapes. Strategic investments in manufacturing footprints, security integration, modular development frameworks, and talent development will be essential to capitalize on emerging opportunities and sustain long-term growth in the embedded systems arena.

Connect Directly With Ketan Rohom to Secure Your Comprehensive Embedded Systems Market Report and Drive Informed Strategic Decisions Today

For decision-makers aiming to deepen their understanding of the embedded systems market and drive competitive advantage, Ketan Rohom (Associate Director, Sales & Marketing) offers personalized consultations and access to the full market research report. Engage directly to explore tailored insights, clarify strategic implications, and secure the comprehensive data package that will inform your next steps. Reach out today to schedule a briefing with Ketan Rohom and take decisive action towards leveraging embedded systems innovations for sustainable growth.

- How big is the Embedded Systems Market?

- What is the Embedded Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?