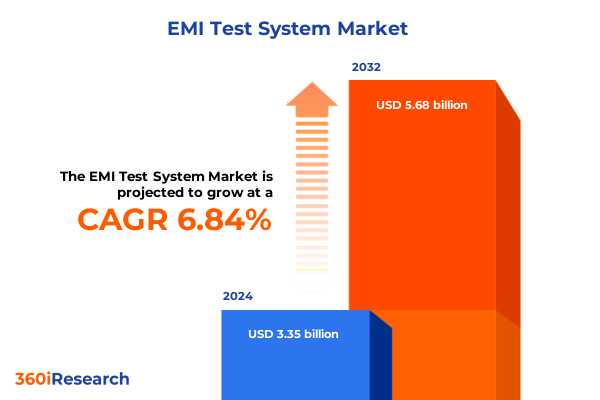

The EMI Test System Market size was estimated at USD 3.56 billion in 2025 and expected to reach USD 3.79 billion in 2026, at a CAGR of 6.90% to reach USD 5.68 billion by 2032.

Exploring the Crucial Role and Expansive Scope of EMI Test Systems Across Modern Industries to Establish Context and Objectives

Electromagnetic interference test systems serve as the backbone of modern engineering validation processes by guaranteeing that electronic assemblies coexist without harmful crosstalk or emissions. As devices across the automotive, consumer electronics, aerospace, and telecommunications sectors become increasingly sophisticated and densely packed with multifunctional components, the precision and reliability of EMI testing equipment assume paramount importance. This executive summary outlines the primary objectives, scope, and underlying rationale for a comprehensive examination of the EMI test system ecosystem. It articulates the critical need for robust measurement frameworks to meet evolving performance benchmarks and ensure compliance with stringent regulatory thresholds.

Against the backdrop of rapid technological convergence, this study interrogates how EMI test systems must adapt to novel signal architectures, high-speed digital interfaces, and emergent wireless bands. It establishes the foundational questions that guide our analysis, centering on system capabilities, segmentation dynamics, tariff-induced disruptions, regional differentiators, and competitive positioning. Readers will gain a holistic view of market drivers, challenges, and strategic imperatives that collectively shape the trajectory of EMI test system adoption.

By anchoring our research in primary insights gathered from industry practitioners and synthesizing them with secondary technical literature, we deliver a nuanced narrative that balances conceptual depth with actionable clarity. We prioritize transparency in methodology, rigor in data collection, and relevance to decision makers who oversee product qualification, supply chain planning, and standards compliance. Ultimately, this introduction seeks to orient stakeholders to the critical intersections between technological innovation, regulatory evolution, and market strategy that define the EMI test system domain today.

Analyzing the Rapid Technological Innovations and Regulatory Transformations Reshaping the EMI Test System Landscape Worldwide

The EMI test system landscape is undergoing a period of transformative change driven by rapid technological innovations and evolving regulatory mandates. In recent years, the proliferation of electric vehicles, 5G telecommunications infrastructure, and advanced driver assistance systems has spurred demand for test platforms that can accommodate wider frequency ranges, higher bandwidths, and increasingly complex modulation schemes. Consequently, manufacturers are integrating software-defined measurement capabilities, modular hardware architectures, and cloud-based analysis suites to support scalable, automated testing workflows.

Moreover, regulatory bodies worldwide have introduced stricter emissions limits and certification standards to address spectrum congestion and mitigate electromagnetic hazards. For instance, updates to international guidelines such as CISPR 32 and FCC Part 15 revisions necessitate more granular measurement granularity and real-time monitoring. These compliance shifts compel equipment vendors to enhance system sensitivity, improve dynamic range, and embed adaptive filtering technologies. As a result, stakeholders must navigate a rapidly shifting confluence of technical and regulatory requirements to maintain product certification and market access.

In addition, the maturation of digital twin methodologies and virtual prototyping has reshaped how design teams engage with EMI concerns during early development cycles. By integrating simulation software with hardware-in-the-loop test benches, organizations can predict interference patterns, optimize component placement, and reduce iteration costs. This fusion of physical and virtual testing paradigms underscores the critical importance of interoperable software solutions and agile hardware platforms that evolve in lockstep with emerging use cases and industry standards.

Examining the Far reaching Consequences of 2025 United States Tariff Policies on Global Supply Chains and Testing System Economics

The implementation of United States tariffs in 2025 has introduced significant complexities across global supply chains for EMI test system components and equipment. With higher duties imposed on critical semiconductors, specialized amplifiers, and precision filters, many manufacturers have experienced increased production costs and protracted lead times. These disruptions have compelled buyers to reevaluate sourcing strategies, pivoting from traditional low-cost regions to geographically diversified suppliers in Southeast Asia, Eastern Europe, and Latin America.

In addition to material cost inflation, the tariff regime has led to a notable shift in inventory management practices. Several organizations have expanded buffer stocks for critical hardware elements, such as antennas and oscilloscopes, to hedge against further import duties or logistics bottlenecks. However, elevated inventory levels have introduced working capital constraints, accelerating the imperative for just-in-time delivery models once tariff-related uncertainties subside. Consequently, procurement teams are balancing the trade-off between cost containment and supply resilience.

Furthermore, the tariff policies have reshaped competitive dynamics within the testing equipment landscape. Domestic producers have gained relative advantage due to reduced exposure to import levies, enabling them to invest more aggressively in research and development and localized service networks. At the same time, multinational vendors have responded by reconfiguring regional manufacturing hubs, forging strategic alliances, and offering bundled maintenance contracts to mitigate end-user price sensitivity. These adaptations illustrate how trade policy can serve as a catalyst for structural realignment and innovation across the EMI test system value chain.

Uncovering Actionable Insights from Component, Testing Type, and Industry Segmentation to Inform Strategic Decision Making in EMI Testing

A granular understanding of market segmentation reveals critical levers for strategic investment and product development. When evaluating components, the hardware segment encompasses core instruments such as amplifiers, analyzers, antennas, filters, oscilloscopes, and sensors, each fulfilling distinct roles in signal measurement and interference mitigation. These physical test assets coexist alongside software offerings, notably data analysis suites and simulation platforms, which provide the computational horsepower necessary to interpret raw measurements and forecast electromagnetic behavior under diverse operating conditions.

In parallel, test system adoption varies considerably by testing type. Compliance testing remains foundational for certifying adherence to established emission limits, while developmental testing addresses interference concerns during the design phase. Pre-compliance testing serves as a cost-effective validation step prior to formal certification, and production testing ensures that each manufactured unit consistently meets quality benchmarks. The nuanced requirements of each testing category influence instrument selection, lab workflows, and service offerings that vendors prioritize.

Industry verticals further diversify the EMI test system landscape. In the automotive sphere, advanced driver assistance systems and infotainment subsystems demand precise interference analysis to guarantee passenger safety and in-vehicle user experience. Consumer electronics manufacturers focus on both home devices and wearable technologies, driving the need for compact test form factors and rapid throughput. Industrial contexts such as automation and machinery control emphasize robust durability and long-term calibration stability, whereas medical environments require specialized protocols for imaging equipment and wearable healthcare monitors. Telecommunications applications span network infrastructure components and wireless devices, while defense, research, academic, and semiconductor sectors bring specialized use cases that underscore the breadth of market opportunities and technical challenges.

This comprehensive research report categorizes the EMI Test System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Components

- Testing Type

- Industry

Illuminating Regional Dynamics and Demand Drivers Across the Americas, Europe Middle East Africa, and Asia Pacific in the EMI Testing Domain

Regional dynamics play a decisive role in shaping demand patterns and infrastructure investments for EMI test systems. Across the Americas, strong growth in automotive electrification, satellite communications, and industrial automation is driving capital expenditure in both laboratory-grade instruments and portable test units. North American OEMs and service labs are increasingly adopting turnkey solutions that bundle hardware, software, and maintenance, while Latin American markets show rising interest in cost-effective pre-compliance test benches to support burgeoning consumer electronics manufacturing.

In Europe, Middle East, and Africa, stringent regional regulations and a robust aerospace sector underpin investments in high-precision measurement platforms. The European Union’s emphasis on green mobility and next-generation 6G research has generated demand for agile test architectures capable of evaluating novel materials and complex system-level interactions. Meanwhile, Middle Eastern initiatives in smart cities and defense modernization programs have spurred procurement of mobile EMI test trailers and integrated spectrum monitoring suites. African research institutions also demonstrate growing interest in academic and industrial test infrastructure, reflecting broader modernization efforts.

The Asia-Pacific region continues to lead in volume-driven manufacturing of electronics and telecommunications hardware, with China, Japan, South Korea, and India at the forefront of R&D spending. Domestic vendors in these markets have developed cost-competitive test modules, while multinational suppliers leverage local research partnerships to co-develop customized solutions. The rapid rollout of 5G and early explorations of 6G have particularly elevated the need for test systems that can accommodate mmWave frequencies and massive MIMO configurations, making the region a crucible for innovation in electromagnetic compatibility testing.

This comprehensive research report examines key regions that drive the evolution of the EMI Test System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Market Participants Pioneering Innovation, Partnerships, and Competitive Positioning in the EMI Test System Industry

Leading participants in the EMI test system market demonstrate distinct approaches to product innovation, global expansion, and service differentiation. One prominent provider has built a reputation on precision RF instrumentation, continually enhancing its hardware lineup with ultra-low noise amplifiers and high-channel-count analyzers. Another established firm offers an integrated platform that seamlessly marries hardware measurements with cloud-connected analytics, enabling remote collaboration and automated compliance reporting. A third key player leverages a modular architecture, allowing end users to retrofit legacy test setups with new interface cards and software modules to support emerging frequency bands and test methodologies.

Beyond core instrumentation, several market players have forged strategic alliances with semiconductor manufacturers, automotive OEMs, and telecommunications operators to co-develop test protocols for next-generation standards. These partnerships often include joint validation labs and shared R&D roadmaps, accelerating time-to-market for both test solutions and the systems they certify. Additionally, a subset of vendors has differentiated itself by offering comprehensive service portfolios, spanning calibration, on-site support, software subscription updates, and training programs that elevate end-user proficiency and equipment uptime.

Competitive positioning also reflects geographic strategies. Some firms have expanded their manufacturing footprints to mitigate tariff exposures and optimize logistics, while others have established regional sales offices and demonstration centers to strengthen customer engagement. Collectively, these approaches underscore the multifaceted nature of competition in the EMI test system space, where technological leadership, service excellence, and supply-chain agility each contribute to sustained market relevance.

This comprehensive research report delivers an in-depth overview of the principal market players in the EMI Test System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aaronia AG

- Anritsu Corporation

- Astra Microwave Products Ltd.

- Com-Power Corporation

- DT&C Vina

- Extreme Engineering Solutions, Inc

- Frankonia Group

- GAUSS INSTRUMENTS GmbH

- Intertek Group PLC

- Keysight Technologies, Inc.

- Lisun group

- Nemko

- NexorTest Techonogies Pvt Ltd.

- Rohde & Schwarz GmbH & Co. KG

- Schaffner Group

- Scientific Mes-Technik Pvt. Ltd

- Tata Advanced Systems Limited

- TDK Corporation

- Tehencom company

- Tektronix, Inc.

- Testforce USA Inc.

Delivering Targeted and Practical Strategic Recommendations to Empower Industry Leaders to Navigate Complex Challenges and Capitalize on Emerging Opportunities

To gain an edge in the evolving EMI test system landscape, organizations should prioritize investment in modular test platforms that support rapid reconfiguration for diverse frequency ranges and test standards. By adopting open-architecture hardware with hot-swappable modules, engineering teams can accelerate time to validation and reduce total cost of ownership. In addition, integrating automated test sequence generation and AI-driven anomaly detection will enhance throughput while improving measurement repeatability and reducing manual intervention.

Procurement and supply-chain leaders must also strengthen regional supplier networks to mitigate the risks associated with import tariffs and logistical disruptions. Establishing multi-sourced partnerships in low-cost manufacturing hubs, coupled with strategic buffer stocking of critical components, will provide both cost efficiency and resiliency. Concurrently, aligning product development roadmaps with emerging global regulations-such as new emission limits or radio-protocol specifications-will ensure that test offerings remain compliant and future-proof.

Finally, stakeholders should foster cross-industry collaborations to co-create testing standards, share best practices, and accelerate innovation cycles. By participating in industry consortia and standards bodies, organizations can shape regulatory requirements, secure early access to protocol drafts, and influence the development of interoperable test methodologies. These collaborative initiatives will not only drive technical excellence but also cement reputational leadership in the EMI test system ecosystem.

Detailing a Rigorous Research Methodology That Integrates Primary Engagements and Diverse Secondary Intelligence to Validate EMI Test System Insights

This study employs a rigorous, multi-tiered research methodology designed to validate findings and enhance reliability. Primary research consisted of in-depth interviews with a cross-section of industry stakeholders, including test engineers, compliance officers, procurement executives, and research scientists. These engagements provided firsthand perspectives on operational workflows, pain points, and emerging requirements in diverse application environments. Additionally, targeted surveys captured quantitative metrics related to equipment utilization, feature prioritization, and investment horizons.

Complementing primary inputs, secondary research encompassed a thorough review of technical standards, regulatory documents, academic publications, and industry whitepapers. This body of knowledge illuminated the latest advancements in electromagnetic measurement techniques, hardware design innovations, and software analytics. Publicly available financial reports, press releases, and corporate presentations further informed our understanding of competitive positioning and partnership strategies.

To ensure analytical rigor, data triangulation methods reconciled insights from multiple sources, while peer reviews by subject matter experts validated key assumptions. Statistical normalization techniques addressed potential biases in survey responses, and trend analysis tools highlighted emergent patterns across different geographies and application domains. By integrating these diverse data streams, the research delivers a coherent, evidence-based narrative that stakeholders can rely on for strategic decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our EMI Test System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- EMI Test System Market, by Components

- EMI Test System Market, by Testing Type

- EMI Test System Market, by Industry

- EMI Test System Market, by Region

- EMI Test System Market, by Group

- EMI Test System Market, by Country

- United States EMI Test System Market

- China EMI Test System Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1749 ]

Synthesis of Key Findings and Strategic Implications to Solidify Understanding and Drive Stakeholder Alignment in EMI Test System Initiatives

In closing, the synthesis of technological trends, tariff impacts, and segmentation dynamics underscores the multifaceted nature of the EMI test system market. Stakeholders must balance investment in advanced hardware and software capabilities with an acute awareness of regulatory shifts and geopolitical influences. Regional nuances further complicate deployment strategies, requiring tailored approaches in the Americas, EMEA, and Asia-Pacific to address local standards and supply-chain conditions.

Key findings reveal that modular architectures, automated analytics, and collaborative standard-setting initiatives will define competitive differentiation in the years ahead. Firms that proactively adapt to tariff-driven supply-chain realignments and invest in resilient procurement frameworks will emerge as durable market leaders. Moreover, targeted R&D partnerships and integrated service offerings will enhance customer value and foster long-term loyalty.

Ultimately, this executive summary serves as a strategic compass, guiding decision makers through an intricate landscape of technological innovation, regulatory complexity, and competitive rivalry. By leveraging the insights and recommendations presented herein, organizations can optimize their EMI test system strategies, accelerate product certification cycles, and achieve superior performance in an increasingly electrified, connectivity-driven world.

Connect Directly with Ketan Rohom to Access Comprehensive EMI Test System Research and Unlock Critical Market Intelligence for Your Organization

We invite you to engage directly with Ketan Rohom, whose expertise as Associate Director of Sales & Marketing can provide tailored insights and facilitate access to the full EMI test system research report. With a deep understanding of market dynamics and buyer requirements, Ketan will guide you through our comprehensive data, enabling you to align the study’s findings with your organization’s strategic priorities. By collaborating closely with Ketan, you can secure executive briefings, obtain extended analyses, and explore customized deliverables that address your unique applications and compliance needs. Reach out today to unlock critical market intelligence and empower your team with the actionable guidance necessary to drive innovation and competitive advantage in the electromagnetic compatibility landscape.

- How big is the EMI Test System Market?

- What is the EMI Test System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?