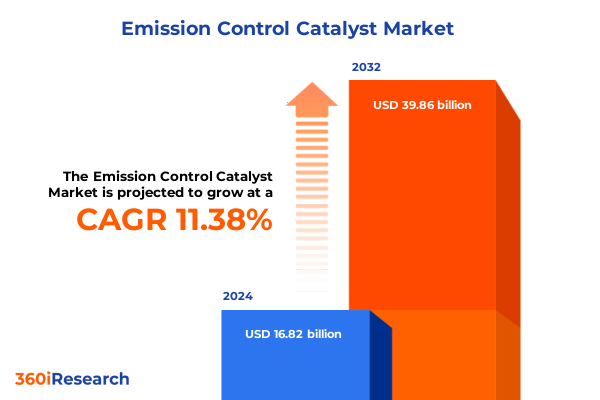

The Emission Control Catalyst Market size was estimated at USD 18.67 billion in 2025 and expected to reach USD 20.72 billion in 2026, at a CAGR of 11.44% to reach USD 39.86 billion by 2032.

Unveiling the Critical Role of Emission Control Catalysts in Shaping Cleaner, Sustainable Industrial and Transportation Systems Amid Regulatory and Technological Evolutions

Emission control catalysts play a pivotal role in reducing harmful pollutants from industrial processes and vehicular emissions, representing a cornerstone in efforts to achieve cleaner air and regulatory compliance. These advanced materials facilitate chemical reactions that convert nitrogen oxides, carbon monoxide, and unburned hydrocarbons into less harmful substances, thereby helping industries and automotive manufacturers meet stringent environmental standards. As global concerns about air quality and climate change intensify, catalysts have transitioned from niche technological components to essential enablers of sustainable growth across multiple sectors.

The urgency of addressing air pollution has prompted governments worldwide to impose increasingly rigorous emission regulations. In response, catalyst developers are advancing novel formulations and materials that deliver superior performance under diverse operating conditions, from heavy-duty diesel engines to chemical processing plants. This wave of innovation is also fueled by the rising demand for heavy commercial vehicles and off-road equipment in emerging markets, further driving investment in next-generation catalyst solutions.

Meanwhile, collaboration among stakeholders-including original equipment manufacturers, aftermarket distributors, and material suppliers-has intensified to optimize supply chains, streamline product development, and ensure robust quality control. These partnerships are instrumental in accelerating the adoption of cutting-edge catalysts capable of meeting evolving regulatory requirements. Collectively, these dynamics underscore the transformative potential of emission control catalysts in shaping a more sustainable, compliant industrial landscape.

Navigating Dramatic Technological, Regulatory, and Market Transformations That Are Redefining the Emission Control Catalyst Landscape for Future Mobility

From tightened global emission standards to breakthroughs in catalytic materials science, the emission control catalyst landscape is undergoing far-reaching transformation. Regulatory bodies in Europe have proposed the Euro 7 norms, compelling automakers to achieve unprecedented reductions in particulate matter and nitrogen oxide emissions. Simultaneously, the U.S. Environmental Protection Agency is advancing Tier 4 regulations for heavy-duty vehicles, prompting manufacturers to integrate highly efficient selective catalytic reduction and diesel oxidation catalysts into their powertrains. These regulatory shifts have elevated the importance of catalyst performance, durability, and cost-effectiveness.

Technological innovations have mirrored regulatory imperatives, with research focusing on advanced formulations such as metal-organic frameworks and nanostructured washcoats that enhance active surface area and thermal resilience. Furthermore, integration of digital monitoring and predictive maintenance systems allows for real-time performance tracking, reducing downtime and extending catalyst life. As a result, industry participants are exploring hybrid catalyst systems that combine multiple functionalities-for example, integrating lean NOx trap technology with three-way catalysts-to optimize emission control under varying engine loads and temperatures.

Market dynamics are also reshaping competitive landscapes, as key players invest in strategic collaborations and vertical integration to secure raw material supplies, particularly for palladium, platinum, and rhodium. Concurrently, aftermarket channels are embracing e-commerce platforms, enabling faster delivery and localized inventory management. Taken together, these transformative shifts are redefining how emission control catalysts are developed, manufactured, and delivered, driving a new era of cleaner mobility and industrial operations.

Analyzing the Layered Impact of 2025 United States Tariff Measures on Catalyst Materials and Supply Chain Resilience Within Emission Control Markets

The momentum of U.S. trade policy in 2025 has introduced deeper layers of complexity to emission control catalyst supply chains, with cumulative tariff measures impacting the availability and cost of critical catalyst materials. Early in the year, proposals for a 25% tariff on imported passenger vehicles threatened to dampen demand for platinum group metals, key constituents of diesel oxidation and three-way catalysts, by potentially reducing vehicle imports from primary manufacturing hubs such as Mexico and Canada. Analysts projected that such tariffs could decrease global palladium demand by approximately 4% and platinum demand by around 1% if implemented, reflecting a contraction of about 364,000 ounces of palladium and 102,000 ounces of platinum in annual markets.

In February 2025, the restoration of Section 232 tariffs to a uniform 25% on steel and aluminum imports further escalated raw material costs for catalyst manufacturers, who rely on these base metals for structural substrates and washcoat supports. Within weeks, the Government eliminated all country exemptions and product exclusions, mandating strict “melted and poured” and “smelted and cast” origin requirements that intensified administrative burdens on importers and distributors.

Subsequently, a presidential proclamation in early June 2025 doubled these rates, jumping steel and aluminum duties from 25% to 50% and sweeping away remaining exemptions-except for a limited allowance for the United Kingdom pending its Economic Prosperity Deal. This escalation not only amplified per-unit costs for catalyst substrates but also prompted many manufacturers to reevaluate supply chain strategies, including increased stockpiling of raw materials and negotiations for long-term contracts with domestic producers, to mitigate price volatility.

The possible introduction of a 25% tariff on copper imports, anticipated in late 2025, adds further strain, given copper’s role in electronic actuation systems used in advanced selective catalytic reduction installations. With U.S. buyers potentially facing a forward COMEX premium reflecting tariff anxiety, short-term stockpiling could drive copper prices upward, feeding through to the overall cost of emission control modules. Collectively, these cumulative tariff measures have encouraged industry participants to explore alternative materials, boost domestic sourcing, and enhance recycling initiatives to preserve margin integrity while sustaining compliance with emergent environmental regulations.

Illuminating Segmentation-Driven Opportunities Across End Use Industries, Distribution Channels, Catalyst Types, Applications, and Material Preferences in Emission Control Catalysts

Segmentation analysis reveals nuanced demand drivers and value pools that map directly to emission control catalyst solutions. For example, in the automotive sector, demand for selective catalytic reduction catalysts is surging in response to fleet electrification’s temporary reliance on diesel engines for range extension, while chemical processing plants increasingly adopt lean NOx trap catalysts to manage nitric acid production emissions. In industrial manufacturing, three-way catalysts remain essential for stationary engines powering on-site generation, and in marine applications, diesel oxidation catalysts are critical for meeting International Maritime Organization tier III standards. Meanwhile, power generation facilities are exploring hybrid catalyst systems that integrate both particulate and gaseous emission controls to optimize performance across seasonal load variations.

Different distribution pathways underscore further strategic considerations. Original equipment manufacturers are consolidating supply agreements with catalyst producers to lock in pricing and ensure design integration, whereas the aftermarket segment-divided across both traditional offline distribution networks and rapidly growing online platforms-is witnessing a shift toward e-commerce and just-in-time delivery models that emphasize fast replacement cycles and inventory optimization. This bifurcation highlights the importance of flexible logistics and digital order fulfillment capabilities.

Within catalyst typologies, diesel oxidation catalysts lead growth in heavy-duty applications due to stringent nitrogen oxide mandates, while three-way catalysts continue to dominate passenger vehicle markets under gasoline engine architectures. Selective catalytic reduction catalysts are gaining traction across both segments, as lean-burn technologies are optimized for lower temperatures. Lean NOx trap catalysts serve niche roles in off-road equipment where space constraints preclude full SCR installations. Across applications, heavy commercial vehicles demand robust SCR systems, light commercial vehicles benefit from compact three-way configurations, off-road equipment relies on integrated trap catalysts, and passenger cars exploit high-performance three-way units.

Material preference remains a critical lever for performance and cost management. Although base metals provide cost-effective options for substrate structures, palladium’s rising use in gasoline applications balances cost and durability, while platinum’s resilience under high-temperature conditions secures its position in diesel-based systems. Rhodium, with its superior ability to facilitate NOx reduction reactions, remains indispensable despite price volatility, driving ongoing efforts to optimize precious metal loading levels and explore alternative washcoat chemistries.

This comprehensive research report categorizes the Emission Control Catalyst market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Catalyst Type

- Application

- Material

- End Use Industry

- Distribution Channel

Exploring Regional Dynamics and Growth Drivers Across the Americas, Europe Middle East & Africa, and Asia-Pacific in the Global Emission Control Catalyst Arena

Regional dynamics significantly influence emission control catalyst adoption, with each geography offering distinct growth drivers and challenges. In the Americas, regulatory agencies such as the U.S. Environmental Protection Agency and Transport Canada have phased in stringent limits for passenger cars and heavy-duty diesel engines, incentivizing catalyst upgrades and retrofit programs. Trade policy shifts, including elevated tariffs on imported catalyst materials, have spurred manufacturers to establish localized production facilities and secure domestic partnerships to maintain supply continuity.

In Europe, Middle East, and Africa, the progression towards Euro 7 standards across the European Union heralds a new era of ultra-low emission requirements, prompting major OEMs to co-develop advanced three-way and SCR catalysts with local suppliers. Middle Eastern refining hubs are investing in marine emission reduction technologies to comply with International Maritime Organization sulfur regulations, while South African mining operations are exploring on-site emission control solutions in response to local air quality concerns.

Across the Asia-Pacific region, the staggered implementation of Bharat Stage VI emissions norms in India parallels China’s tightening of National VI regulations, driving significant aftermarket demand for retrofittable diesel oxidation and particulate filter catalysts. Japan and South Korea are leveraging technological leadership in nanomaterials to enhance washcoat formulations, while Southeast Asian economies are increasing investments in public transportation electrification complemented by diesel backup generators equipped with lean NOx trap catalysts. These regional distinctions underscore the need for tailored market strategies that align product portfolios with regulatory timelines, infrastructure capacities, and procurement channels.

This comprehensive research report examines key regions that drive the evolution of the Emission Control Catalyst market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Movers Shaping the Competitive Emission Control Catalyst Market Through Technological Advancements and Collaborations

The competitive landscape of the emission control catalyst market is defined by established leaders and agile challengers, each advancing proprietary technologies and strategic collaborations. Johnson Matthey remains a flagship innovator with its high-surface-area washcoats and proprietary rhodium-enhanced formulations that deliver exceptional NOx conversion rates under variable operating conditions. Umicore, with a diversified precious metals business, has ramped up integrated recycling services, securing a steady supply of platinum group metals for its diesel oxidation and three-way catalyst lines. BASF leverages cross-industry synergies to introduce hybrid catalysts combining SCR and oxidation functions, targeting heavy-duty and marine applications.

Clariant has strengthened its market position through the acquisition of specialty materials firms, enhancing its portfolio of metal-organic frameworks and advanced washcoat chemistries. Faurecia, historically an automotive seating producer, has rapidly expanded its emission control footprint via partnerships that integrate digital performance monitoring into exhaust aftertreatment systems. Emerging players, including focused technology startups, are challenging norms by exploring base metal alternatives and metal-free catalysts that reduce reliance on palladium and platinum.

Collaborative alliances between catalyst suppliers and original equipment manufacturers have become commonplace, as evidenced by joint development agreements with global automakers to co-design custom catalyst solutions that meet next-generation emission standards. Additionally, a growing number of public-private initiatives are funding pilot programs for circular economy approaches, reclaiming spent catalysts and extracting valuable metals to mitigate raw material scarcity and price volatility. These dynamics illustrate a market where innovation, vertical integration, and sustainability converge to define competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Emission Control Catalyst market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BASF SE

- Cataler Corporation

- Clariant AG

- Clariant AG

- Cormetech Inc.

- Corning Incorporated

- Evonik Industries AG

- Evonik Industries AG

- Haldor Topsoe A/S

- Heraeus Holding GmbH

- Heraeus Holding GmbH

- Johnson Matthey PLC

- NOF Corporation

- Tenneco Inc.

- Umicore SA

- W. R. Grace & Co.

Actionable Strategic Recommendations Empowering Industry Leaders to Navigate Market Complexity, Regulatory Pressures, and Technological Disruption in Emission Control Catalysts

As emission control catalyst market dynamics accelerate, industry leaders must adopt targeted strategies to navigate regulatory pressures, supply chain uncertainties, and shifting customer requirements. Investment in advanced catalyst formulations, such as nanostructured washcoats and hybrid SCR-DOC configurations, will be critical for maintaining compliance across diverse operating environments and unlocking new revenue streams in emerging applications like stationary generators and marine propulsion.

Diversifying raw material sourcing through strategic partnerships and long-term supply contracts can mitigate the impact of fluctuating tariffs and precious metal price volatility. Simultaneously, expanding recycling and remanufacturing capabilities-either independently or via joint ventures-will secure a circular supply chain that reduces dependency on newly mined resources and strengthens environmental credentials.

Enhancing aftermarket engagement through digital platforms enables rapid order fulfillment, predictive maintenance services, and customer-centric value propositions that foster loyalty and recurring revenue. Collaboration with original equipment manufacturers to integrate real-time performance monitoring and data analytics into catalyst systems can drive continuous improvement and provide differentiated service offerings.

Finally, proactive dialogue with regulatory bodies and participation in standards-setting forums will position organizations to anticipate policy shifts and co-develop solutions that align with future emission targets. By executing these actionable recommendations, industry leaders can reinforce their market positions, unlock operational efficiencies, and contribute to global sustainability objectives.

Detailing Rigorous Mixed Method Research Approaches Combining Primary Interviews, Secondary Data, and Analytical Modeling to Ensure Robust Market Insights

Our research methodology integrates a robust combination of primary and secondary data collection techniques to ensure comprehensive, accurate insights. Primary research involved in-depth interviews with executives from original equipment manufacturers, tier-one catalyst producers, and key raw material suppliers to capture firsthand perspectives on market dynamics, technology trends, and regulatory impacts. Supplementing these discussions, consultations with industry associations, trade compliance experts, and regulatory agencies provided clarity on evolving standards and policy frameworks.

Secondary research encompassed meticulous review of governmental publications, customs and trade databases, and reputable industry periodicals to gather historical data and validate market signals. We analyzed regulatory filings, white papers, and technical journals to assess material innovations and performance benchmarks. Advanced analytical modeling, including market mapping and supply chain network analysis, allowed us to quantify material flows and identify critical bottlenecks.

Triangulation techniques were employed throughout to cross-verify proprietary findings against multiple data sources, incorporating both top-down and bottom-up approaches. Segmentation analysis was rigorously validated through scenario testing and sensitivity analysis to ensure that end-use industry demand, distribution channel preferences, catalyst typologies, application segments, and material selections reflect real-world adoption patterns. This multifaceted methodology underpins our confidence in delivering strategic intelligence that is both actionable and future-proof.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Emission Control Catalyst market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Emission Control Catalyst Market, by Catalyst Type

- Emission Control Catalyst Market, by Application

- Emission Control Catalyst Market, by Material

- Emission Control Catalyst Market, by End Use Industry

- Emission Control Catalyst Market, by Distribution Channel

- Emission Control Catalyst Market, by Region

- Emission Control Catalyst Market, by Group

- Emission Control Catalyst Market, by Country

- United States Emission Control Catalyst Market

- China Emission Control Catalyst Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Concluding Reflections Uniting Strategic Imperatives, Stakeholder Collaboration, and Innovation Pathways for Advancing the Emission Control Catalyst Ecosystem

In summary, emission control catalysts stand at the intersection of environmental stewardship, regulatory evolution, and technological progress, driving pivotal advancements in industrial and automotive sectors. The confluence of stringent emission norms, from Euro 7 and EPA Tier 4 to global maritime standards, has catalyzed innovation in catalyst design, from enhanced washcoat architectures to integrated digital monitoring solutions. Concurrently, trade policy shifts and tariff escalations underscore the importance of resilient supply chain strategies and strategic raw material sourcing.

Segmentation analysis has highlighted differentiated growth pathways across end-use industries, distribution channels, catalyst types, applications, and materials, revealing multiple avenues for targeted investment and portfolio optimization. Regional insights underscore the need for adaptive strategies that align with distinct regulatory milestones in the Americas, Europe Middle East & Africa, and Asia-Pacific. Meanwhile, the competitive landscape is defined by established leaders and disruptive newcomers collaborating to advance performance, sustainability, and circularity.

To thrive amidst market complexity, stakeholders must embrace innovation, forge strategic collaborations, and maintain proactive engagement with regulators and supply partners. By executing the recommended strategies-ranging from advanced catalyst technology development and raw material diversification to digital aftermarket engagement and circular economy initiatives-organizations can secure resilience, unlock new value pools, and contribute meaningfully to global sustainability targets. This executive summary offers the critical insights and strategic imperatives guiding stakeholders toward a future of cleaner air and efficient emissions control.

Connect with Ketan Rohom to Unlock Comprehensive Emission Control Catalyst Market Insights and Drive Strategic Growth in Your Business

To explore comprehensive insights and gain a strategic edge in the evolving emission control catalyst market, reach out to Associate Director of Sales & Marketing, Ketan Rohom. Ketan brings deep expertise in guiding industry leaders through market complexities and can tailor our research offerings to your specific needs. By partnering with Ketan, you will access detailed analyses, strategic roadmaps, and actionable intelligence that drive smart investment decisions and sustainable growth. Take the next step toward outpacing competitors and capitalizing on emerging opportunities by connecting with Ketan Rohom today to secure your copy of the full market research report.

- How big is the Emission Control Catalyst Market?

- What is the Emission Control Catalyst Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?