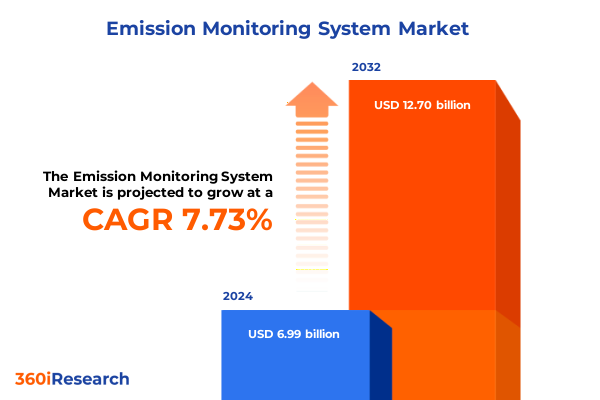

The Emission Monitoring System Market size was estimated at USD 7.53 billion in 2025 and expected to reach USD 8.10 billion in 2026, at a CAGR of 7.75% to reach USD 12.70 billion by 2032.

Unveiling the critical importance of comprehensive emission monitoring systems in achieving environmental accountability and regulatory compliance

Emission monitoring systems have emerged as indispensable pillars for organizations striving to meet increasingly stringent environmental regulations while demonstrating corporate responsibility. As global frameworks intensify requirements for reporting and mitigating greenhouse gases, the capacity to deliver accurate, continuous emissions data is vital not only for legal compliance but also for sustaining a social license to operate. These systems underpin transparent communication with regulators, investors, and communities, establishing trust in corporate emissions performance.

Moreover, rapid technological advancements are transforming how companies approach emissions management. Modern platforms integrate real-time analytics, predictive insights, and cloud-based accessibility, enabling proactive adjustments to operational processes that minimize environmental impacts. This convergence of hardware intelligence and software sophistication empowers stakeholders to make data-driven decisions that improve energy efficiency and reduce the risk of costly regulatory penalties. In essence, emission monitoring is no longer a passive reporting mechanism but a strategic asset in the pursuit of sustainable growth.

Exploring how digitalization, AI integration, and collaborative ecosystems are reshaping emission monitoring from reactive to proactive stewardship

The landscape of emission monitoring is undergoing a profound transformation driven by digitalization, the proliferation of Internet of Things sensors, and breakthroughs in artificial intelligence. Traditional continuous monitoring hardware is now augmented by portable instruments capable of spot-checks in remote areas, while predictive platforms leverage machine learning to forecast potential exceedances before they occur. This shift from reactive reporting to proactive prevention is reshaping the way industrial operators manage their environmental footprint.

Concurrent with this technological evolution, collaborative ecosystems are taking shape. Equipment manufacturers, software developers, and third-party service providers are forging partnerships to deliver turnkey monitoring solutions that blend analytics, consulting services, and maintenance support. These alliances enable seamless integration of on-premise systems with cloud-based platforms, ensuring data integrity and scalability. As interoperability standards mature, we can expect increased convergence across formerly siloed segments, driving efficiencies in deployment and underwriting the next generation of emission monitoring innovations.

Analyzing the ripple effects of newly implemented 2025 U.S. tariffs on supply chains and cost structures in emission monitoring

Recent tariff adjustments enacted by the United States administration in early 2025 have introduced new dynamics for suppliers and end-users of emission monitoring components and services. Equipment imported from regions subject to heightened duties now incurs incremental costs, compelling original equipment manufacturers to reevaluate sourcing strategies. Some have responded by localizing assembly operations within North America or by negotiating with regional suppliers to mitigate exposure to tariff escalations.

End users, meanwhile, face pressure to absorb or pass on these additional expenses. This has accelerated interest in software-intensive solutions that rely more on data processing and remote analytics than on physical components, offering a buffer against hardware cost inflation. Furthermore, the shifts have catalyzed conversations around supply chain resilience, prompting many firms to explore dual-sourcing models or to increase inventory buffers. Ultimately, the cumulative impact of these tariffs is driving a recalibration of cost structures and strategic priorities across the emission monitoring value chain.

Unpacking how type, component, deployment mode, and end-user distinctions reveal tailored opportunities within the emission monitoring ecosystem

Diving into the market through the lens of type reveals three distinct pathways: continuous monitoring systems remain the backbone for large-scale industrial facilities requiring uninterrupted data streams; portable instruments address episodic testing needs and facilitate regulatory sampling in remote or decentralized sites; and predictive solutions are gaining traction by offering foresight into emission trends and potential non-compliance events. This multi-modal approach allows operators to tailor investments to their specific operational profiles.

A component-oriented view underscores the symbiosis between hardware, service, and software offerings. Analyzer units and advanced sensors form the foundation of any robust solution, while consulting and maintenance services ensure optimal system performance over time. Complementing these are software modules-ranging from real-time monitoring platforms to analytics engines and compliance reporting tools-that translate raw measurements into actionable intelligence.

The mode of deployment further stratifies options into cloud-centric platforms and traditional on-premise infrastructure. Cloud-based models deliver scalability and remote accessibility, enabling cross-site aggregation of emissions data, whereas on-premise installations offer greater control for organizations with stringent cybersecurity requirements.

End users span from chemical manufacturers that demand precise control over process emissions to the oil and gas sector-encompassing upstream exploration, midstream transportation, and downstream processing-where monitoring is critical to both environmental stewardship and operational safety. Pharmaceuticals leverage monitoring to maintain clean-room integrity and minimize fugitive leaks, while power generators across coal-based, gas-based, nuclear, and renewable segments rely on tailored monitoring suites to satisfy regulatory thresholds and optimize combustion processes.

This comprehensive research report categorizes the Emission Monitoring System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Component

- Deployment Mode

- End User

Revealing how evolving regulations and incentives across the Americas, EMEA, and Asia-Pacific are shaping emission monitoring adoption

Across the Americas, adoption is driven by a combination of federal environmental mandates and state-level initiatives that often exceed national requirements. Mature markets in the United States and Canada prioritize integrating advanced analytics into their emission monitoring frameworks, reflecting an emphasis on operational efficiency and sustainability reporting.

In Europe, Middle East, and Africa, regulatory harmonization under protocols such as the EU’s Industrial Emissions Directive and emerging carbon pricing mechanisms in EMEA markets are catalysts for technology uptake. Regional OEMs are responding by developing systems optimized for local pollutant thresholds and by expanding service networks to support cross-border installations.

The Asia-Pacific region demonstrates varied maturity, with leading countries in East Asia deploying sophisticated continuous monitoring infrastructures, while emerging economies focus first on portable and modular predictive systems to achieve compliance cost-effectively. Notably, government incentives in key APAC markets are accelerating investment in monitoring platforms that integrate renewable energy plant data and grid emissions profiles.

This comprehensive research report examines key regions that drive the evolution of the Emission Monitoring System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting how leading emission monitoring providers are leveraging innovation, partnerships, and service models to gain competitive advantage

Key market participants are differentiating themselves through investments in R&D, strategic alliances, and expanded service portfolios. Leading technology providers are integrating AI-driven analytics directly into hardware devices, reducing latency between data acquisition and insight generation. Others are forging partnerships with cloud service operators to deliver scalable platforms with enhanced cybersecurity safeguards.

Additionally, an increasing number of firms are offering bundled consulting and maintenance packages to facilitate seamless deployments and to ensure sustained compliance. Some providers have also adopted pay-per-use models that align costs with actual monitoring volumes, appealing to organizations seeking predictable operational expenditures. Collectively, these strategic moves are intensifying competition and stimulating innovation, ultimately benefiting end users with a wider range of flexible, tailored offerings.

This comprehensive research report delivers an in-depth overview of the principal market players in the Emission Monitoring System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- AMETEK, Inc.

- Emerson Electric Co.

- Environnement S.A.

- Fuji Electric Co., Ltd.

- General Electric Company

- Honeywell International Inc.

- HORIBA, Ltd.

- Rockwell Automation, Inc.

- SICK AG

- Siemens AG

- Teledyne Technologies Incorporated

- Thermo Fisher Scientific Inc.

- Yokogawa Electric Corporation

Driving strategic growth by integrating predictive analytics, supply chain diversification, and cross-functional collaboration

Industry leaders should prioritize the integration of predictive analytics into existing monitoring portfolios to shift from compliance-centric initiatives toward performance enhancement. By harnessing machine learning models trained on historical emissions data, organizations can forecast deviations and implement corrective actions before regulatory breaches occur.

Further, companies should evaluate the merits of diversifying their supply chains to balance cost efficiency with tariff exposure. Engaging with regional component manufacturers or adopting localized assembly can reduce lead times and mitigate the financial impact of import duties. Concurrently, investing in modular hardware architectures can simplify upgrades and support interoperability across legacy and next-generation platforms.

Finally, establishing cross-functional teams that bridge environmental compliance, IT, and operations can foster holistic emission management strategies. Aligning these teams around shared key performance indicators drives accountability and ensures that emission monitoring systems are embedded into broader digital transformation agendas.

Ensuring robust conclusions through a triangulated methodology of secondary analysis, expert interviews, and multi-tiered validation

This analysis is grounded in a rigorous methodology that combines secondary research, primary interviews, and multi-tiered validation. The secondary phase entailed an exhaustive review of regulatory filings, white papers, and publicly available technical documentation to map the evolution of emission monitoring standards and technology roadmaps.

In parallel, the primary research phase engaged subject-matter experts spanning industry executives, system integrators, and regulatory authorities. These dialogues provided nuanced perspectives on deployment challenges, emerging use cases, and future technology trajectories. All qualitative insights were cross-referenced and corroborated against multiple sources to ensure consistency.

Finally, the data synthesis phase leveraged both quantitative and qualitative analyses. While quantitative inputs were confined to industry-agnostic performance benchmarks and regulatory thresholds, qualitative assessments focused on vendor positioning, technological differentiators, and market maturity. This triangulated approach ensures that the findings offer a balanced, reliable foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Emission Monitoring System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Emission Monitoring System Market, by Type

- Emission Monitoring System Market, by Component

- Emission Monitoring System Market, by Deployment Mode

- Emission Monitoring System Market, by End User

- Emission Monitoring System Market, by Region

- Emission Monitoring System Market, by Group

- Emission Monitoring System Market, by Country

- United States Emission Monitoring System Market

- China Emission Monitoring System Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesizing how policy, technology, and service innovations converge to position emission monitoring as a strategic enabler in modern industry

As industries grapple with escalating environmental obligations and the imperative of operational excellence, emission monitoring systems have transcended their traditional compliance role to become strategic enablers. The convergence of advanced analytics, flexible deployment architectures, and service-driven models provides organizations with the tools to not only meet regulatory mandates but also to optimize processes and unlock efficiency gains.

Going forward, the interplay between policy developments, tariff landscapes, and technological innovations will continue to shape investment priorities. Stakeholders that proactively adopt predictive capabilities, strengthen supply chain resilience, and pursue collaborative partnerships will be best positioned to capture long-term value. Ultimately, the emission monitoring ecosystem stands at the nexus of sustainability and performance, offering a compelling opportunity for those ready to embrace next-generation solutions.

Empower your organization with customized market intelligence on emission monitoring by engaging with our Associate Director of Sales & Marketing

To access an in-depth exploration of emission monitoring technologies, regulatory dynamics, and strategic pathways, connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. His expertise in aligning research insights with organizational objectives can help you tailor the findings to your operational requirements. Engage directly to explore customized service options, delivery timelines, and pricing structures designed to empower decision-makers in harnessing the full potential of comprehensive emission monitoring solutions. Reach out to schedule a briefing or request a personalized proposal that addresses your unique industry challenges and positions your organization at the forefront of environmental compliance and operational excellence.

- How big is the Emission Monitoring System Market?

- What is the Emission Monitoring System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?