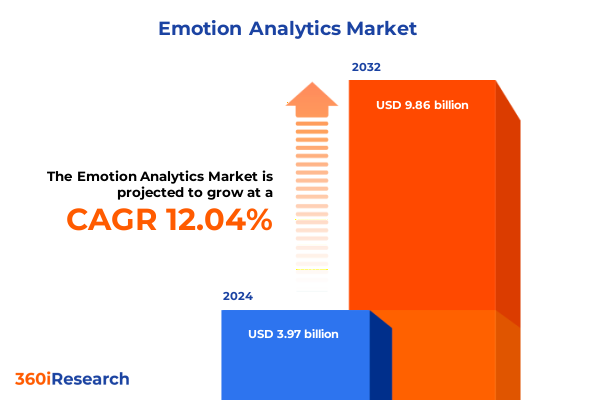

The Emotion Analytics Market size was estimated at USD 4.44 billion in 2025 and expected to reach USD 4.97 billion in 2026, at a CAGR of 12.06% to reach USD 9.86 billion by 2032.

Unveiling the Power of Emotion Analytics to Drive Human-Centric Decision Making and Strategic Insights Across Industries

Emotion analytics has emerged as a transformative field that bridges advanced technology with nuanced human behavior to drive deeper customer and stakeholder understanding. At its core, the discipline harnesses data across multiple modalities to uncover emotional responses, offering a human-centric dimension to decision making that transcends conventional analytics approaches. Fueled by the maturation of artificial intelligence and machine learning, emotion analytics now delivers real-time insights that inform product design, customer support, marketing effectiveness, and organizational culture initiatives.

The convergence of high-resolution imaging, physiological sensors, voice signal processing, and natural language processing has expanded the scope and accuracy of emotion analytics solutions. With organizations seeking to differentiate through emotionally intelligent interactions, the market has evolved from proof-of-concept pilots to fully integrated platforms that deliver enterprise-grade performance. As a result, emotion analytics has become a strategic imperative for businesses striving to foster authentic engagement and drive measurable outcomes in an increasingly competitive landscape.

Looking ahead, the discipline is set to advance further through the integration of edge computing, enhanced data privacy measures, and regulatory compliance frameworks that protect individual rights while enabling innovation. This introduction sets the stage for a deep dive into the key shifts, constraints, segmentation frameworks, and strategic imperatives that define the current and future state of emotion analytics.

Exploring the Emergence of AI-Fueled Multimodal Emotion Analytics That Reshape Customer Experience and Operational Efficiency Worldwide

Artificial intelligence advancements have catalyzed a paradigm shift in emotion analytics, enabling multimodal solutions that integrate facial expression, voice intonation, physiological signals, and natural language data into cohesive insights. These capabilities have transcended traditional human–computer interfaces, empowering applications ranging from customer journey optimization to predictive maintenance of high-value equipment. As organizations deploy more sophisticated models, the focus is shifting toward scalable architectures that can process vast streams of unstructured data without sacrificing latency or accuracy.

Simultaneously, emerging edge computing frameworks are decentralizing analytics, allowing sensors and devices to perform initial emotional inference locally before transmitting aggregated insights to centralized platforms. This evolution not only addresses bandwidth and latency challenges but also enhances data security by minimizing raw data exposure. Additionally, open-source contributions and interoperability standards are fostering a collaborative ecosystem in which disparate tools and modules can be integrated seamlessly, accelerating innovation cycles.

Regulatory and ethical considerations have also become central to market development. With data privacy regulations multiplying globally, vendors are embedding consent management, anonymization, and explainable AI protocols to ensure responsible deployment. By balancing technical progress with governance frameworks, the industry is navigating a transformative era that promises to redefine how organizations engage with human emotion data.

Analyzing How the 2025 United States Tariff Measures Increase Input Costs and Drive Strategic Reconfiguration in Emotion Analytics Supply Chains

In 2025, the United States introduced additional tariff measures targeting imported hardware and semiconductor components integral to emotion analytics platforms. These escalated duties have increased the cost basis for cameras, depth sensors, biometric modules, and specialized processors, compelling solution providers to reassess sourcing strategies and negotiate new supply chain partnerships. The resulting cost pressures have underscored the need for resilient procurement practices that can absorb tariff fluctuations without compromising deployment timelines or overall project economics.

Consequently, many vendors are accelerating investments in domestic manufacturing relationships and local contract manufacturers to mitigate the effects of imported component surcharges. This strategic pivot has not only helped stabilize pricing but also opened avenues for co-development initiatives with U.S.-based electronics firms. However, shifting production domestically can extend lead times and requires close collaboration with customs and regulatory bodies to ensure compliance with origin rules under the new tariff schedules.

Moreover, clients are increasingly seeking modular, sensor-agnostic architectures that can integrate a variety of interchangeable hardware components. By decoupling analytics software from proprietary hardware dependencies, organizations retain the flexibility to switch suppliers in response to tariff-induced cost changes. As a result, the tariff environment is driving a broader transformation in platform design philosophy, favoring open standards, plug-and-play interoperability, and dynamic cost optimization strategies.

Revealing Critical Segmentation Perspectives That Illuminate Diverse Use Cases and Technology Pathways Within the Evolving Emotion Analytics Ecosystem

The emotion analytics landscape is structured by a series of interrelated segmentation paradigms that span technology, component, deployment model, and end-user dimensions. From the technology perspective, facial expression analysis leads in proving nonintrusive, camera-based emotional inference while physiological monitoring provides deep biometric insights through sensors that detect heart rate variability and galvanic skin response. Speech and voice analysis, subdivided into paralinguistic analysis and voice biometrics, decodes tone and vocal characteristics to discern emotional states. Meanwhile, text analysis, through both semantic analysis and sentiment analysis, transforms written content into quantifiable emotional measures.

On the component front, solutions are categorized into services and software. The services segment encompasses consulting and maintenance, which includes predictive maintenance capabilities, along with implementation, integration, training, and support offerings that ensure successful rollout and ongoing optimization. Software delivery models bifurcate into cloud and on-premises environments, where cloud solutions further differentiate into hybrid cloud, private cloud, and public cloud options that cater to diverse security, scalability, and customization requirements.

Deployment models themselves are characterized by cloud, hybrid, and on-premises approaches. Hybrid architectures, spanning inter-cloud and multi-cloud configurations, allow organizations to balance performance, cost, and data sovereignty considerations. Finally, adoption by end users is remarkably broad, covering automotive, where applications span aftermarket, dealerships, and original equipment manufacturers; BFSI firms leveraging these insights in banking, capital markets, and insurance; and education stakeholders ranging from e-learning platforms to higher education institutions and K-12 districts. Government entities apply emotion analytics across defense, public safety, and smart city initiatives, while healthcare systems, including hospitals, clinics, research institutes, and telehealth providers, integrate these solutions to improve patient outcomes. IT and telecom firms leverage the technology within data centers, service providers, and network operators, and media and entertainment companies deploy it for broadcasting, gaming, and social media sentiment. Retailers, both offline and online, utilize emotion analytics to optimize customer experiences, merchandising, and store operations.

This comprehensive research report categorizes the Emotion Analytics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Component

- Deployment Model

- End User

Decoding Regional Dynamics and Adoption Trends Across the Americas, Europe Middle East Africa, and Asia Pacific Emotion Analytics Markets

Geographic dynamics continue to shape the adoption and innovation trajectories of emotion analytics technologies. In the Americas, the United States sustains its leadership through robust R&D expenditure, a favorable regulatory climate for AI experimentation, and a thriving startup ecosystem. Canada contributes through privacy-first research initiatives and cross-border collaborations that emphasize ethical AI implementations. Within Latin America, incremental infrastructure improvements and rising venture capital interest are accelerating pilot deployments in contact centers and retail environments.

In Europe, Middle East & Africa, the regulatory backdrop of the General Data Protection Regulation has catalyzed privacy-centric approaches, prompting vendors to invest heavily in anonymization, consent management, and audit trail capabilities. The United Kingdom maintains momentum through cross-industry consortia focused on responsible innovation, while the Middle East invests in smart city projects that incorporate emotion analytics for public safety and urban planning. In Africa, limited bandwidth and infrastructure are being addressed through low-latency edge solutions that enable remote healthcare assessments and agricultural stakeholder sentiment analysis.

The Asia-Pacific region is experiencing some of the fastest growth, driven by government-led AI initiatives in China, Japan’s automation ambitions, South Korea’s smart factory rollouts, and Australia’s telehealth and customer service modernization. Southeast Asian markets, such as Singapore and Malaysia, serve as regional hubs for pilot projects in retail and hospitality, while India’s combination of large user populations and digital readiness continues to attract investments in emotion-driven marketing and education platforms. Across these three regions, local regulations, infrastructure maturity, and cultural attitudes toward surveillance and data privacy are critical determinants of adoption pace and solution design.

This comprehensive research report examines key regions that drive the evolution of the Emotion Analytics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Assessing Leading Innovators and Solution Providers Shaping the Competitive Landscape of Emotion Analytics with Differentiated Offerings and Capabilities

A mix of established technology firms and specialized startups are driving innovation and competition within the emotion analytics domain. Large cloud providers have integrated emotion APIs into their broader AI portfolios, offering turnkey text, voice, and vision analytics services that benefit from global scalability and extensive developer ecosystems. These platforms are complemented by specialized vendors that differentiate themselves through proprietary algorithms, domain-specific data sets, and consulting expertise tailored to vertical use cases.

Key innovators have introduced industry-optimized solutions for customer experience management, leveraging real-time dashboards, predictive emotional trend analysis, and integration with CRM and ERP systems. Others focus on high-security environments, providing on-premises offerings with advanced encryption, zero-trust access controls, and offline processing capabilities. Still, more challengers emphasize lightweight edge deployments that enable emotion inference on mobile and IoT devices, supporting applications from wearable health monitors to in-vehicle driver monitoring systems.

Collaborations and strategic partnerships are becoming increasingly common as vendors seek to fill gaps in their portfolios. Alliances between sensor manufacturers and analytics software houses facilitate the development of turnkey kits, while integrations with talent management and customer support platforms extend emotional insights into workforce engagement and service quality pipelines. This diversified competitive landscape underscores the importance of both vertical focus and technical interoperability as differentiating factors for buyers evaluating emotion analytics solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Emotion Analytics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adoreboard Limited

- Affectiva, Inc.

- Alphabet Inc.

- Apple, Inc.

- Clarifai Inc.

- Deloitte Touche Tohmatsu Ltd.

- Eyeris

- HCL Technologies Limited

- Honeywell International, Inc.

- iMotions A/S

- InMoment, Inc.

- Intelex Technologies

- International Business Machines Corporation

- INX Software

- Kairos AR Inc.

- Microsoft Corporation

- Neuromore Inc.

- Noldus Information Technology BV

- NVISO SA

- RealEyes OU

- SAP SE

- SAS Institute Inc.

- Sensum d.o.o.

- Sentiance NV

- Wolters Kluwer N.V.

Empowering Industry Leaders with Actionable Strategies to Harness Multimodal Emotion Analytics and Navigate Evolving Regulatory Privacy Challenges

Industry leaders should consider implementing a structured, multimodal analytics strategy that unifies facial, vocal, physiological, and textual emotional indicators into a single decision framework. By orchestrating data fusion processes and leveraging cloud-native microservices architectures, organizations can achieve real-time emotional intelligence while preserving agility and cost efficiency. To ensure long-term success, executives must prioritize the integration of privacy and ethical safeguards, embedding consent management, anonymization protocols, and explainable AI features from project inception.

Developing strategic partnerships across the technology and research ecosystem will accelerate time to value. Collaboration with academic institutions can provide access to cutting-edge algorithmic breakthroughs, while alliances with telecommunications and hardware firms mitigate supply chain risks exacerbated by tariff fluctuations. Building an internal center of excellence with cross-functional teams-including data scientists, ethicists, user experience designers, and business analysts-will foster a shared understanding of emotional intelligence objectives and drive internal adoption.

Finally, investing in talent development and change management is critical. Emotion analytics initiatives often challenge traditional decision-making paradigms, requiring stakeholders to interpret and act on nuanced insights. Providing targeted training programs that cover AI literacy, emotional data ethics, and user interface considerations will empower employees to leverage these tools effectively. Through this holistic approach, industry leaders can harness the full potential of emotion analytics, delivering differentiated customer experiences and operational efficiencies at scale.

Outlining a Rigorous Mixed Methodology Integrating Secondary Research, Expert Validation, and Quantitative Triangulation to Ensure Robust Insights

The research underpinning this analysis followed a rigorous mixed methodology that combined comprehensive secondary research, primary expert interactions, and quantitative triangulation. Initially, an extensive review of academic publications, patent filings, white papers, and publicly available company materials established a foundational understanding of technological capabilities, evolving use cases, and regulatory frameworks.

This secondary intelligence was then validated through structured interviews with a cross-section of industry participants, including solution architects, data privacy officers, procurement leads, and end-user executives. These interactions provided real-world context for the influence of 2025 U.S. tariff measures, the operational challenges of hybrid deployments, and the nuanced requirements of vertical markets such as healthcare and automotive.

Finally, quantitative data points were integrated through a triangulation process, comparing vendor report archives, procurement records, and survey feedback to ensure coherence and reliability. This iterative validation approach ensured that the insights presented are both robust and actionable, offering stakeholders a high degree of confidence in strategic decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Emotion Analytics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Emotion Analytics Market, by Technology

- Emotion Analytics Market, by Component

- Emotion Analytics Market, by Deployment Model

- Emotion Analytics Market, by End User

- Emotion Analytics Market, by Region

- Emotion Analytics Market, by Group

- Emotion Analytics Market, by Country

- United States Emotion Analytics Market

- China Emotion Analytics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3021 ]

Synthesizing Key Perspectives on Technological Innovation, Market Dynamics, and Strategic Imperatives That Drive the Future of Emotion Analytics

Emotion analytics stands at the intersection of artificial intelligence, human behavior research, and enterprise transformation, offering a compelling pathway to deeper, more empathetic interactions. Throughout this summary, we have explored how AI-powered multimodal platforms, ethical governance frameworks, and tariff-driven supply chain strategies are collectively reshaping the landscape. The segmentation analysis reveals the breadth of technological and deployment options available, while the regional insights highlight geographic nuances that influence adoption and investment patterns.

Moreover, the competitive assessment underscores the diverse set of providers-from hyperscale cloud vendors to nimble startups-each bringing unique strengths in algorithmic precision, vertical specialization, or edge computing. The actionable recommendations emphasize the importance of integrating privacy by design, fostering interoperable architectures, and investing in talent development to translate emotional insights into tangible business outcomes.

As organizations continue to seek differentiation through data-driven human engagement, the trajectories outlined here will inform strategic planning, vendor selection, and implementation roadmaps. By synthesizing technological advances with pragmatic business considerations, emotion analytics will evolve from a niche capability into a mainstream strategic asset that drives customer loyalty, operational resilience, and sustainable growth.

Engage with Ketan Rohom to Secure Comprehensive Emotion Analytics Insights and Customized Solutions That Elevate Strategic Decision Making and Growth

To explore the full depth of emotion analytics, including detailed use cases, advanced methodologies, and tailored deployment options, engage directly with Ketan Rohom, Associate Director, Sales & Marketing. By reaching out, you will gain access to bespoke consultancy that will align data-driven emotional insights with your strategic growth objectives. A structured engagement will deliver comprehensive guidance on integrating multimodal analytics into your existing environment, ensuring you leverage the latest technological advancements and maintain competitive differentiation in your market. Begin a personalized dialogue today to secure your organization’s future capabilities and transform customer experiences through cutting-edge emotion analytics.

- How big is the Emotion Analytics Market?

- What is the Emotion Analytics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?