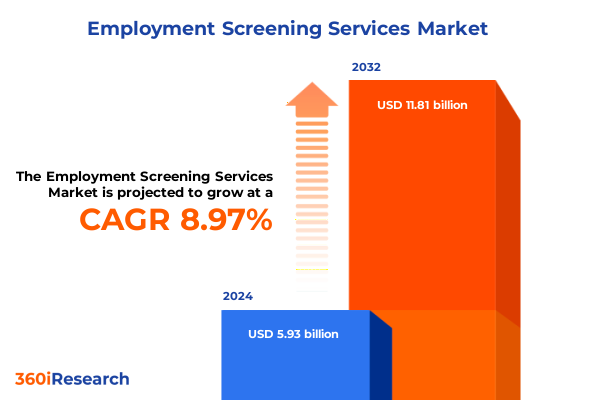

The Employment Screening Services Market size was estimated at USD 6.47 billion in 2025 and expected to reach USD 6.99 billion in 2026, at a CAGR of 8.97% to reach USD 11.81 billion by 2032.

Revealing the Foundation and Critical Strategic Scope of Modern Employment Screening Services to Empower Informed Decision Making Across Industries

In today’s dynamic business environment, organizations of all sizes face the critical task of ensuring that every new hire aligns with their values, culture, and risk tolerance. This introductory overview delves into the essential drivers behind the accelerating demand for robust employment screening services. Rapid technological innovation, evolving regulatory expectations, and the heightened emphasis on workforce safety have converged to position screening solutions as a strategic necessity rather than a discretionary expense. Moreover, heightened public scrutiny and the growing prevalence of remote and hybrid work models have underscored the importance of thorough background validation to uphold organizational integrity and protect brand reputation. As a result, decision makers are increasingly investing in solutions that not only verify candidate credentials but also deliver actionable intelligence through seamless integration with existing HR systems.

Transitioning from traditional manual processes to advanced automated platforms has transformed the speed and scope of screening activities. This introductory section sets the stage for a deeper exploration of the market’s transformative shifts, the cascading impact of recent geopolitical measures, and the strategic segmentation that drives targeted adoption. By understanding this foundational context, industry leaders and stakeholders can appreciate the forces shaping the industry, anticipate emerging challenges, and identify high-impact opportunities to optimize their talent acquisition strategies.

Examining the Convergence of Advanced Technology, Regulatory Evolution, and Integrated Platforms Reshaping the Screening Industry

The employment screening landscape has undergone a profound transformation, driven by technological breakthroughs and shifting regulatory paradigms. Artificial intelligence and machine learning have elevated the accuracy of criminal record checks, identity verification, and global watchlist monitoring, rapidly replacing legacy manual approaches. This shift has enabled organizations to reduce turnaround times from days to mere hours while concurrently mitigating compliance risks with real time data validation. Furthermore, the surge in cyber threats and data privacy concerns has prompted more stringent data governance frameworks, compelling providers to embed encryption, multi factor authentication, and advanced access controls into their platforms.

Concurrently, the demand for end to end integration has intensified, with clients seeking unified suites that consolidate criminal background checks, employment and education verifications, as well as drug and credit screenings. This convergence has propelled the development of platform ecosystems that feature API connectivity and portal access, enabling seamless data exchange with applicant tracking systems and human capital management platforms. As employers embrace distributed workforces and contingent talent, these platforms must adapt to global compliance standards and diverse verification requirements. Together, these transformative shifts underscore an industry in the midst of rapid innovation, where agility and interoperability are emerging as critical differentiators for both service providers and end users.

Analyzing How 2025 United States Import Tariffs on Hardware and Infrastructure Are Reshaping Cost Structures and Vendor Strategies

Tariffs implemented by the United States in 2025 have reverberated across the global employment screening ecosystem, influencing the cost structure and operational strategies of both providers and end users. Increased levies on imported hardware components, such as biometric scanners and secure document readers, have elevated procurement costs for service providers who rely on these devices to capture accurate identity verifications. In response, many vendors have negotiated volume based agreements with hardware manufacturers or shifted portions of their supply chains to tariff exempt jurisdictions to preserve margins and maintain pricing competitiveness.

Moreover, the impact of tariffs on cloud hosting and data center equipment has subtly shifted the economics of back end infrastructure deployment. Regional data residency requirements have exacerbated this effect, prompting some vendors to establish new hosting partnerships or invest in in house data center capacity to avoid steep import duties. Employers, particularly those with multinational operations, are recalibrating their vendor selection criteria to account for potential price volatility. These strategic adjustments highlight the cumulative effect of trade policies on the global delivery of screening services, reinforcing the need for supply chain resilience and flexibility in vendor agreements.

Unveiling Comprehensive Service Category Differentiators That Drive Client Adoption and Portfolio Optimization in Screening Solutions

A nuanced view of the screening services market reveals distinct service categories that cater to varied client requirements. Criminal background check offerings now span both automated and manual workflows, where automation leverages API integration for seamless system-to-system verification while portal access empowers users with direct entry and real time status updates, and manual processes blend in house expertise with outsourced specialist partners to handle complex legal jurisdictions. Meanwhile, employment verification services address the unique risk profiles of contractor, full time, intern, and part time personnel, adapting proof of previous job history and tenure checks to each work arrangement. Education verification evolves with each credential type, from certificate and diploma authentication to professional license validation and university degree confirmation, ensuring educational claims meet industry and regulatory standards. Drug testing solutions diversify across specimen types including blood, hair, saliva, and urine screenings, each method chosen based on detection window and regulatory preference. Identity verification solutions incorporate biometric verification and database checks alongside document verification workflows that authenticate government issued IDs and passport credentials. Financial risk assessments are fulfilled through business and consumer credit checks, while global watchlist integrations screen adverse media, politically exposed individuals, and sanctioned entities to guard against reputational and compliance risks. Together, this segmentation framework informs strategic portfolio development and targeted go-to-market planning.

This comprehensive research report categorizes the Employment Screening Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Criminal Background Check

- Employment Verification

- Education Verification

- Drug Testing

- Identity Verification

- Credit Check

- Global Watchlist Check

Revealing How Divergent Regulatory Regimes and Economic Maturity in the Americas, EMEA, and Asia Pacific Shape Screening Service Adoption

Regional dynamics shape the deployment and uptake of screening services, driven by disparate regulatory frameworks, cultural attitudes towards privacy, and economic development levels. In the Americas, jurisdictions such as the United States and Canada emphasize rigorous data protection statutes alongside candidate consent protocols, driving demand for advanced encryption and consent management modules. Meanwhile, Latin America’s emerging economies prioritize cost effective manual verifications, though digital adoption is rising in metropolitan centers. Across Europe, Middle East and Africa, the European Union’s GDPR has established a stringent baseline for data processing practices, encouraging pan European providers to design unified compliance models that seamlessly extend into Middle Eastern free trade zones and African economic hubs. This region also sees a growing emphasis on language localization and multi currency billing to address diverse client needs. In the Asia Pacific, rapid urbanization coupled with expanding labor markets has spurred significant investments in automated screening platforms. Countries with complex regulatory ecosystems, such as India and China, drive demand for hybrid approaches that combine local manual expertise with global technology platforms. Collectively, these regional insights guide vendors and employers in tailoring service offerings and pricing strategies that resonate with local market dynamics.

This comprehensive research report examines key regions that drive the evolution of the Employment Screening Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Detailing the Diverse Competitive Landscape of Global Innovators, Regional Specialists, and Niche Providers Driving Service Differentiation

The competitive landscape of employment screening is characterized by a blend of global technology innovators, regional specialists, and emerging niche players. Leading providers differentiate themselves through proprietary data sourcing channels, strategic partnerships with academic and government institutions, and deep investments in artificial intelligence to enhance verification accuracy. Regional specialists leverage local legal expertise and linguistic capabilities to serve multinational clients operating within specific geographies, while niche operators focus on high growth verticals such as gig economy platforms, healthcare staffing, and financial services. Collaboration between technology vendors and background data aggregators has intensified, as service providers seek to bolster data coverage and expand into adjacent verification areas like social media screening and continuous monitoring. Additionally, emerging players are carving out space by offering fully embedded screening modules within overarching human capital management suites, promising a frictionless user experience. This evolving competitive landscape underscores the importance of differentiation through data breadth, platform interoperability, and specialized domain knowledge.

This comprehensive research report delivers an in-depth overview of the principal market players in the Employment Screening Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accurate Background, LLC

- AuthBridge Research Services Private Limited

- Automatic Data Processing, Inc.

- Checkr, Inc.

- Cisive

- DataFlow Group

- Employment Screening Services, Inc

- Experian PLC

- First Advantage Corporation

- HireRight, LLC

- InfoMart, Inc.

- PeopleFacts

- Peopletrail, LLC

- Pinkerton Consulting & Investigations, Inc. by Securitas AB

- Private Eyes Screening Group

- S2Verify LLC

- SAP SE

- Sentinel Background Checks

- True Hire

- Verified Credentials, LLC

Driving Growth Through Platform Interoperability, Supply Chain Resilience, and Enhanced Data Privacy Capabilities

Industry leaders should prioritize strategic investments in platform interoperability, ensuring seamless connectivity with applicant tracking systems, human capital management platforms, and workforce analytics tools to eliminate data silos and accelerate time to hire. Building resilient supply chains by diversifying hardware partnerships and exploring localized manufacturing options can mitigate the impact of trade policy fluctuations on service costs. Furthermore, embedding advanced data privacy features such as dynamic consent management, encryption at rest and in transit, and continuous compliance monitoring will address growing stakeholder demands for transparency and security. Leaders must also consider expanding their service portfolios to include continuous monitoring and social media analysis, catering to clients seeking real time risk intelligence. Finally, cultivating partnerships with academic institutions and regulatory bodies can enhance data credibility and facilitate entry into highly regulated verticals, providing a competitive edge.

Detailing a Rigorous Multi Stage Research Framework That Integrates Primary Interviews, Secondary Analysis, and Regional Case Studies

This report’s findings are grounded in a rigorous multi stage research approach that combines primary interviews with senior stakeholders across the screening value chain, in depth surveys of corporate end users, and expert consultations with regulatory authorities. Secondary research encompassed analysis of legal frameworks, white papers, trade journals, and vendor literature to contextualize technological trends and policy developments. Quantitative data validation was performed through cross referencing of publicly available financial disclosures and industry benchmarks, while thematic analysis identified recurring challenges and best practices. Regional case studies were employed to validate segmentation frameworks and regional insights, ensuring applicability across diverse markets. This methodology ensures a balanced integration of qualitative insights and empirical evidence, providing actionable intelligence for decision makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Employment Screening Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Employment Screening Services Market, by Criminal Background Check

- Employment Screening Services Market, by Employment Verification

- Employment Screening Services Market, by Education Verification

- Employment Screening Services Market, by Drug Testing

- Employment Screening Services Market, by Identity Verification

- Employment Screening Services Market, by Credit Check

- Employment Screening Services Market, by Global Watchlist Check

- Employment Screening Services Market, by Region

- Employment Screening Services Market, by Group

- Employment Screening Services Market, by Country

- United States Employment Screening Services Market

- China Employment Screening Services Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Summarizing the Strategic Imperatives and Technological Drivers That Will Shape the Future of Workforce Verification Services

The evolution of employment screening services reflects the intersection of technological innovation, regulatory transformation, and shifting workforce dynamics. As organizations navigate an increasingly complex global landscape, robust screening solutions will be pivotal in managing risk, ensuring compliance, and safeguarding brand reputation. The industry’s future will be defined by the integration of artificial intelligence, real time monitoring, and modular platform architectures that adapt to evolving client needs. By leveraging the strategic insights outlined in this summary-from the influence of tariffs to the critical segmentation of services and regions-stakeholders can craft agile strategies that capitalize on emerging trends. Ultimately, employment screening will continue to evolve from a back office support function into a strategic enabler of workforce integrity and organizational resilience.

Unlock Personalized Access to the Definitive Employment Screening Services Research Report with Direct Engagement for Unparalleled Insights

Are you prepared to harness comprehensive market intelligence that will drive strategic growth and competitive advantage in the rapidly expanding employment screening services landscape Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to secure your exclusive copy of this in-depth market research report tailored to meet your organization’s unique needs and propel your decision making to the next level

- How big is the Employment Screening Services Market?

- What is the Employment Screening Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?