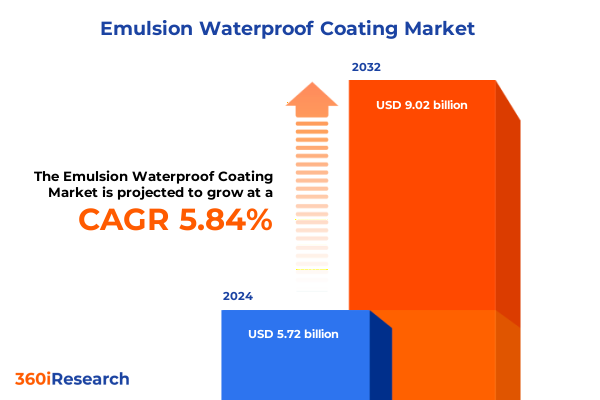

The Emulsion Waterproof Coating Market size was estimated at USD 6.05 billion in 2025 and expected to reach USD 6.37 billion in 2026, at a CAGR of 5.85% to reach USD 9.02 billion by 2032.

Understanding the Evolution, Strategic Relevance, and Market Dynamics of Emulsion Waterproof Coating in Modern Infrastructure Applications

The emulsion waterproof coating market has evolved significantly over the past decade, driven by growing demands for long-lasting protection across residential, commercial, and industrial structures. Advances in polymer science have enabled the development of formulations that combine superior adhesion, flexibility, and durability with ease of application and environmental compliance. As construction and infrastructure projects worldwide emphasize sustainability and resilience, these coatings have become integral to safeguarding concrete, masonry, and steel substrates from moisture ingress and structural degradation.

Amid heightened awareness of climate-related risks, stakeholders increasingly prioritize coatings that not only prevent leaks and dampness but also withstand thermal cycling, UV exposure, and chemical attack. The transition to water-based emulsions has reduced volatile organic compound (VOC) emissions, addressing stringent environmental regulations and shifting consumer preferences toward greener solutions. Consequently, formulators continue to innovate by incorporating nanomaterials, biopolymers, and advanced pigments to enhance performance while minimizing ecological footprints.

Looking ahead, industry participants must balance cost competitiveness with product differentiation, leveraging digital tools for predictive maintenance and real-time performance monitoring. Strategic partnerships between raw material suppliers, applicators, and specification engineers will accelerate the adoption of next-generation emulsions that meet the dual imperatives of sustainability and durability. This report provides a comprehensive examination of these trends, offering executives actionable insights to navigate a rapidly changing market.

Identifying Key Technological Innovations, Regulatory Developments, and Sustainability Drivers Shaping the Emulsion Waterproof Coating Market

Technological breakthroughs have reshaped the emulsion waterproof coating landscape, ushering in transformative shifts that span raw material innovation, manufacturing processes, and end-user interactions. Waterborne polymer blends now outperform traditional solvent-based systems, balancing eco-friendly profiles with mechanical toughness. Emerging nano-reinforcement strategies have further elevated barrier properties, sealing micro-cracks and prolonging service life under cyclical stress. These enhancements underscore the sector’s pivot toward high-value formulations tailored to niche applications, from underground substructures to rooftop terraces.

Regulatory frameworks are also redefining competitive parameters. Across North America and Europe, VOC limits are tightening, spurring manufacturers to retrofit production lines and reformulate products to comply with new emission caps. Simultaneously, incentive programs for green building certifications, such as LEED and BREEAM, are amplifying demand for low-emission coatings. This confluence of regulation and market incentives has compelled industry players to embrace lifecycle assessments, harnessing digital twin simulations to predict long-term performance and environmental impact.

At the distribution frontier, e-commerce platforms and digital specification tools have revolutionized customer engagement. Contractors and facility managers can now compare product attributes, access technical datasheets, and place bulk orders online, streamlining procurement cycles. Integrated mobile applications facilitate on-site testing and quality assurance, reducing application errors and enhancing warranty compliance. These shifts collectively signify a maturing ecosystem where data-driven decision-making and sustainability converge to redefine market leadership.

Assessing the Compound Effects of Recent United States Tariffs on Raw Materials, Supply Chains, and Pricing in the Emulsion Waterproof Coating Sector

The introduction of new tariffs in early 2025 has exerted a multifaceted impact on the emulsion waterproof coating industry, reverberating across raw material sourcing, production costs, and supply chain stability. Tariffs of 25% on imports from Canada and Mexico have disrupted the North American value chain, given the region’s historical reliance on cross-border transfers of specialty polymers and pigments. Meanwhile, a 10% surcharge on materials sourced from China has compounded cost pressures for manufacturers dependent on titanium dioxide, epoxy resins, and performance additives. These levies have prompted companies to reassess sourcing strategies, balancing near-term price increases against long-term supply security.

Manufacturers and distributors have responded with a range of mitigation tactics. Some firms have absorbed incremental costs through internal efficiency gains, optimizing mixing and batching operations to reduce waste. Others have renegotiated contracts with domestic suppliers or established joint ventures to localize critical feedstock production. Despite these efforts, surcharge pass-through has been inevitable in certain segments, leading to selective price adjustments for end users in high-performance and specialty applications. Industry associations have lobbied for tariff exemptions on strategic materials, arguing that the coatings sector’s positive trade balance and domestic value creation justify relief measures.

Looking forward, the cumulative impact of tariff policies underscores the necessity for diversified procurement, resilient logistics networks, and agile pricing models. Organizations that can pivot rapidly-leveraging data analytics to forecast tariff scenarios and optimize inventory buffers-will be best positioned to maintain margins and customer loyalty. As global trade dynamics continue to shift, a proactive stance toward supply chain innovation will be critical to sustaining growth in an increasingly protectionist environment.

Unveiling Critical Market Segmentation Trends Across Product Types, Applications, End Uses, Distribution Channels, and Packaging Formats

A nuanced understanding of the emulsion waterproof coating market emerges when one examines its segmentation by type, application, end use, distribution channel, and packaging. Acrylic emulsions retain widespread appeal due to their cost-effectiveness and versatile performance, while polyurethane-based systems command attention for high-durability applications such as industrial containment and bridge decks. Styrene-butadiene emulsions continue to serve as a reliable mid-tier offering, balancing adhesion and flexibility, and vinyl acetate emulsions remain a specialized choice for substrate adhesion in challenging environments.

On the application front, basement waterproofing underscores the emphasis on moisture mitigation in subterranean spaces, whereas bathroom waterproofing highlights the need for mold-resistant and slip-resistant properties in humid interiors. Infrastructure waterproofing demands formulations that can endure heavy traffic loads and environmental fluctuations, and roof waterproofing focuses on UV-stable and reflective coatings to enhance energy efficiency. Each use case drives distinct performance requirements, encouraging formulators to tailor polymer blends and additive packages accordingly.

End-use segmentation reveals that residential construction benefits from ease of application and low-VOC attributes, while commercial projects prioritize extended warranty periods and customization options. Industrial customers often require chemically resistant and abrasion-resistant systems, whereas large-scale infrastructure endeavors lean on validated performance data and lifecycle analysis. Distribution channels illustrate a continued reliance on dealers and distributors for technical support and bulk procurement; direct sales models cater to strategic accounts, and online platforms offer rapid access for smaller contractors. Retail presence remains vital for do-it-yourself enthusiasts, who favor smaller pail sizes for convenient, localized projects.

Packaging formats further refine market dynamics: bulk bags enable high-volume batching in manufacturing facilities, drums are preferred for continuous-process plants, and pails in a variety of liter sizes accommodate on-site applications ranging from small repairs to extensive coatings projects. Each packaging choice reflects operational efficiency, logistics constraints, and end-user convenience in diverse market segments.

This comprehensive research report categorizes the Emulsion Waterproof Coating market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Packaging

- Distribution Channel

- Application

- End Use

Analyzing Regional Dynamics and Growth Patterns Across Americas, Europe Middle East Africa, and Asia Pacific for Emulsion Waterproof Coating Demand

Regional dynamics play a pivotal role in shaping demand patterns and competitive strategies for emulsion waterproof coatings. In the Americas, robust renovation and repair activities in mature construction markets underpin steady consumption, with retrofit projects in aging infrastructure and residential refurbishments driving consistent volumes. North America’s stringent environmental regulations have also spurred the adoption of advanced low-VOC formulations, positioning regional manufacturers to lead on sustainability initiatives.

Across Europe, the Middle East, and Africa, regulatory harmonization around green building standards and circular economy principles is accelerating the uptake of sustainable waterproofing solutions. Major infrastructure investments in transportation and energy sectors call for coatings that withstand harsh climates and extended service intervals. Manufacturers in these markets often collaborate closely with specifiers and EPC contractors to deliver integrated solutions that comply with evolving performance criteria and regional durability norms.

Asia-Pacific stands out as the fastest-growing region, fueled by rapid urbanization, large-scale infrastructure projects, and government-led housing programs. The deployment of emulsion waterproof coatings in tunnel liners, metro stations, and high-rise developments has surged, reflecting strong public sector support for resilient construction. Furthermore, local raw material producers are scaling up capacity, offering competitively priced intermediates that enable formulators to tailor products for region-specific challenges such as monsoonal humidity and seismic activity.

Collectively, these regional insights underscore the importance of localized strategies-combining global formulation expertise with on-the-ground market knowledge-to capture growth opportunities and maintain competitive differentiation in diverse regulatory and climatic contexts.

This comprehensive research report examines key regions that drive the evolution of the Emulsion Waterproof Coating market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Industry Players’ Strategic Initiatives, Innovation Portfolios, and Competitive Advantages in Emulsion Waterproof Coatings

Leading companies in the emulsion waterproof coating arena are distinguishing themselves through innovation, strategic partnerships, and sustainability commitments. Sika leverages its global R&D network to introduce hybrid polymer systems that blend acrylic and polyurethane benefits, targeting high-risk applications such as water treatment facilities and marine structures. The company’s robust technical support infrastructure and digital monitoring platforms enhance project execution and long-term asset performance.

BASF has focused on bio-based polymer technologies, unveiling emulsion formulations incorporating renewable feedstocks that reduce reliance on petrochemical inputs. Through alliances with chemical startups, the company accelerates the development of proprietary rheology modifiers and crosslinking agents that enhance crack-bridging capabilities and elongation under freeze-thaw cycles. Concurrently, BASF’s investment in circular economy programs emphasizes the recovery and reuse of polymeric waste from demolition sites.

RPM International pursues growth through targeted acquisitions of regional specialists, augmenting its portfolio with waterproofing brands known for niche applications such as tunnel lining and industrial flooring. This strategy broadens RPM’s market footprint and enables localized service models that address specific customer requirements in emerging markets. Furthermore, the firm’s integrated sustainability roadmap outlines ambitious goals for reducing carbon emissions and improving supply chain transparency by 2030.

GCP Applied Technologies and Pidilite Industries round out the competitive landscape by emphasizing performance additives and customer-centric application training. GCP’s proprietary wetting agents and film-forming enhancers improve adhesion on challenging substrates, while Pidilite’s extensive dealer network delivers customized coating kits tailored to regional building practices. Together, these players illustrate the sector’s drive toward multifunctional solutions, operational excellence, and ESG alignment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Emulsion Waterproof Coating market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akzo Nobel N.V.

- Asian Paints Limited

- BASF SE

- Beijing Oriental Yuhong Waterproof Technology Co., Ltd.

- Berger Paints India Ltd.

- China National Materials Group

- Fujian Ruisen New Materials Co., Ltd.

- Grupo Puma, S.L.

- Henkel AG & Co. KGaA

- Indigo Paints Ltd.

- Kansai Paint Co., Ltd.

- KÖSTER Group

- MAPEI S.p.A.

- Nippon Paint Holdings Co., Ltd.

- PPG Industries, Inc.

- Saint-Gobain Group

- Shandong Changtai Polymer Materials Co., Ltd.

- Sherwin-Williams Company

- Sika AG

Strategic Imperatives and Tactical Recommendations for Emulsion Waterproof Coating Manufacturers to Enhance Resilience and Market Positioning

To thrive in an evolving marketplace, industry leaders should pursue a three-pronged strategic agenda that emphasizes agility, innovation, and sustainability. First, companies must diversify their supply chains by establishing multiple sourcing partnerships and inventory buffers for critical raw materials. This approach mitigates the risk of future tariff fluctuations and geopolitical disruptions, ensuring continuity in production and stable input costs.

Second, investment in next-generation R&D platforms is essential. By combining computational modeling, accelerated weathering chambers, and real-world pilot installations, firms can reduce time to market for breakthrough formulations. Collaborations with academic institutions and materials consortia will also broaden access to emerging technologies, from nanostructured polymers to self-healing chemistries, enabling differentiated offerings that command premium positioning.

Finally, embedding sustainability within product life cycles will resonate with regulators, project owners, and end users. Emphasizing circular design principles-such as reclaimable binders and recyclable packaging-aligns with global decarbonization goals and enhances brand reputation. Complementing product innovation with digital services, including mobile-enabled performance tracking and predictive maintenance insights, will further strengthen customer relationships and drive long-term loyalty.

By integrating these imperatives into corporate roadmaps, industry players can solidify competitive advantages, capture emerging opportunities, and navigate the complexities of a dynamic global environment.

Detailing the Comprehensive Research Approach Incorporating Primary Interviews, Secondary Sources, and Data Triangulation for Market Analysis

This analysis leverages a robust research methodology combining primary and secondary intelligence to deliver actionable insights. The secondary phase involved a systematic review of regulatory filings, patent databases, technical journals, and industry publications to map historical trends and innovation trajectories. Supplier catalogs and conference proceedings provided granular details on emerging polymer technologies and application best practices.

Primary research encompassed structured interviews with over 25 stakeholders, including formulation chemists, application contractors, procurement managers, and specification engineers across key regions. These discussions yielded qualitative perspectives on product performance, pricing dynamics, and procurement challenges. Additionally, on-site site visits to coating application projects offered first-hand observations of installation workflows and field testing protocols.

Data triangulation techniques were applied to resolve discrepancies and validate findings, integrating quantitative matrices such as tariff schedules, regional investment volumes, and sustainability indices. Analytical frameworks, including SWOT and Porter’s Five Forces, were utilized to assess competitive positioning and market entry barriers. Finally, expert validation workshops ensured that conclusions and recommendations reflect the nuanced realities of both mature and emerging markets.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Emulsion Waterproof Coating market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Emulsion Waterproof Coating Market, by Type

- Emulsion Waterproof Coating Market, by Packaging

- Emulsion Waterproof Coating Market, by Distribution Channel

- Emulsion Waterproof Coating Market, by Application

- Emulsion Waterproof Coating Market, by End Use

- Emulsion Waterproof Coating Market, by Region

- Emulsion Waterproof Coating Market, by Group

- Emulsion Waterproof Coating Market, by Country

- United States Emulsion Waterproof Coating Market

- China Emulsion Waterproof Coating Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Concluding Insights on Market Evolution, Strategic Opportunities, and Future Outlook for the Global Emulsion Waterproof Coating Industry

In summary, the emulsion waterproof coating sector is undergoing a period of strategic renewal, driven by technological innovation, regulatory evolution, and shifting trade dynamics. Manufacturers that harness advances in polymer science, comply with tightening environmental standards, and adapt to the repercussions of tariff policies will shape the competitive frontier. A nuanced segmentation analysis underscores the bespoke requirements of diverse applications and customer segments, while regional insights highlight the imperative for localized market strategies.

Leading companies demonstrate that success rests on an integrated approach-combining product differentiation, sustainable practices, and digital enablement. By prioritizing supply chain resilience, investing in next-generation R&D, and embedding circularity into product design, industry stakeholders can anticipate and respond to emerging challenges. This report illuminates pathways for strategic growth and offers a blueprint for decision-makers seeking to capitalize on the evolving emulsion waterproof coating landscape.

Connect with Ketan Rohom to Unlock Detailed Insights and Drive Strategic Decisions in the Emulsion Waterproof Coating Market

Ready to gain a competitive edge? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your comprehensive emulsion waterproof coating market research report and unlock strategic insights tailored for your business objectives.

- How big is the Emulsion Waterproof Coating Market?

- What is the Emulsion Waterproof Coating Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?