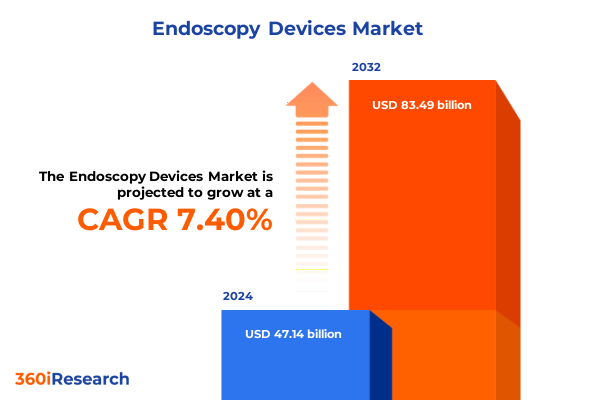

The Endoscopy Devices Market size was estimated at USD 50.61 billion in 2025 and expected to reach USD 54.33 billion in 2026, at a CAGR of 7.41% to reach USD 83.49 billion by 2032.

Exploring the Dynamic Evolution of Endoscopy Devices in Modern Healthcare: Unveiling Market Drivers, Technological Advancements, and Emerging Opportunities

In an era defined by continual advancements in medical technology, endoscopy devices have emerged as a cornerstone of minimally invasive diagnostics and therapies. The transition from conventional open surgeries to endoscopic procedures has not only transformed patient care but also redefined clinical workflows across healthcare systems globally. With enhanced imaging capabilities and reduced patient trauma, these devices now play a pivotal role in improving surgical precision, shortening hospital stays, and lowering overall treatment costs. As we navigate complex demographic shifts and rising chronic disease prevalence, the demand for versatile endoscopy solutions continues to accelerate. Furthermore, increasing adoption in emerging economies and the rising focus on outpatient care settings have broadened market accessibility and fueled competitive innovation.

Against this backdrop, our executive summary delves into the key forces shaping the endoscopy devices landscape, presenting a holistic view of technological breakthroughs, policy developments, and market dynamics. This introduction lays the foundation for understanding how stakeholders-from device manufacturers and distributors to healthcare providers and regulatory bodies-are responding to evolving expectations for patient safety, procedural efficiency, and cost containment. By examining critical trends and strategic imperatives, this analysis aims to equip industry decision-makers with the insights needed to anticipate change, leverage new opportunities, and sustain long-term growth in this vibrant sector.

Unraveling the Pivotal Technological and Strategic Shifts Redefining the Endoscopy Devices Landscape and Shaping Future Healthcare Delivery Models

Over the past decade, the endoscopy devices sector has undergone transformative shifts that extend far beyond incremental product upgrades. The integration of advanced imaging modalities, such as high-definition and narrow-band technologies, has dramatically enhanced lesion detection and procedural accuracy. Parallel to this, the advent of artificial intelligence–driven image analysis and real-time diagnostic support has opened new frontiers in early disease identification and personalized treatment planning. Robotics and flexible instrumentation have also redefined procedural possibilities, enabling surgeons to operate with unprecedented dexterity and control within complex anatomical regions.

Simultaneously, the industry has witnessed a paradigm shift toward single-use endoscopes, driven by concerns over cross-contamination, device reprocessing costs, and logistical inefficiencies. This trend has prompted legacy manufacturers to expand their product portfolios, while new entrants leverage lighter, disposable designs to gain market traction. Telemedicine has further accelerated this transformation by facilitating remote endoscopic consultations and training, effectively bridging geographic barriers and democratizing access to specialized expertise. As these disruptive forces converge, companies are forging strategic collaborations, investing heavily in R&D partnerships, and exploring subscription-based service models to stay ahead. The true measure of success in this evolving landscape will hinge on an organization’s ability to integrate technological innovation with sustainable business strategies that address both provider demands and patient outcomes.

Assessing the Far-Reaching Impact of 2025 United States Tariffs on Endoscopy Devices Supply Chains, Cost Structures, and Competitive Strategies

In early 2025, newly enacted United States tariffs targeting select imported medical devices, including endoscopy systems and accessories, began to influence cost structures and supply chain strategies across the industry. While the additional duties aimed to bolster domestic manufacturing capabilities, they simultaneously introduced pricing pressures for hospitals, ambulatory surgery centers, and specialty clinics. Many endoscope producers responded by diversifying procurement channels, negotiating long-term contracts to secure favorable terms, and, in some cases, relocating certain assembly operations to domestic or alternate low-tariff regions.

Beyond immediate cost implications, these tariff measures have reshaped competitive dynamics by raising barriers to entry for smaller foreign manufacturers that lack the scale to absorb increased duties. Conversely, established industry leaders with robust in-house manufacturing infrastructures and vertically integrated supply chains have managed to mitigate the impact, leveraging economies of scale and strategic inventory management. From a broader perspective, the tariffs have accelerated ongoing initiatives to localize production, strengthen supplier partnerships, and enhance transparency in raw material sourcing. As a result, healthcare providers are now reassessing procurement frameworks to balance clinical requirements with evolving trade policies, catalyzing a renewed focus on vendor consolidation and risk-averse supply chain planning.

Illuminating Critical Market Segments in Endoscopy Devices Through Type, Application, Usage Patterns, End User Dynamics, and Distribution Channels

A nuanced understanding of market segmentation reveals critical insights across various dimensions. Analysis by endoscope type highlights differentiated use cases for capsule endoscopes, which offer non-invasive imaging of the gastrointestinal tract, and the versatility of flexible endoscopes, favored in both diagnostic and therapeutic applications for their maneuverability. Rigid endoscopes continue to serve specialized procedures that demand superior image stability and working channel access, particularly in urological and arthroscopic contexts. When examining application segments, arthroscopy subdivides into hip, knee, and shoulder procedures, each presenting unique mechanical and optical requirements, while gastrointestinal endoscopy encompasses colonoscopy, endoscopic ultrasound, ERCP, and gastroscopy, each demanding specialized features for lesion detection and intervention. Laparoscopic techniques, spanning general, gynecological, and pediatric interventions, rely heavily on illumination and instrument compatibility, whereas urological endoscopy-including cystolithotripsy, cystoscopy, and ureteroscopy-places a premium on irrigation control and distal tip flexibility.

Shifting to usage type, the contrast between reusable endoscopes-with their long-term cost efficiencies supplemented by rigorous reprocessing protocols-and single-use variants-valued for sterility assurance and operational simplicity-underscores the trade-off facing healthcare facilities. End user analysis indicates that ambulatory surgery centers prize cost-effective disposables to streamline outpatient workflows, while hospitals leverage versatile systems that support multiple specialties. Specialty clinics often balance these factors, selecting devices optimized for specific procedural volume and case mix. Finally, distribution channels, whether direct sales agreements that enable tailored service bundles or distributor partnerships that offer broader geographic reach, play a defining role in shaping procurement cycles and aftermarket support models.

This comprehensive research report categorizes the Endoscopy Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Endoscope Type

- Application

- Usage Type

- End User

- Distribution Channel

Comparative Regional Perspectives Highlighting Growth Drivers and Challenges Across the Americas, Europe Middle East Africa, and Asia-Pacific Markets

Regional disparities in market dynamics reflect a blend of economic maturity, regulatory environments, and healthcare infrastructure development. In the Americas, established reimbursement frameworks and high per capita healthcare spending drive rapid adoption of cutting-edge endoscopy devices, with emphasis on single-use disposables to address patient safety concerns. Nevertheless, stakeholders remain vigilant about cost containment, fostering partnerships between device providers and large integrated delivery networks to optimize value-based procurement strategies.

Within Europe, the Middle East, and Africa, regulatory harmonization under the European Medical Device Regulation has raised the bar for device safety and performance, while emerging markets in the Middle East and Africa demonstrate significant upside potential as regional governments invest in healthcare infrastructure. These markets increasingly seek scalable endoscopy solutions that align with local training and maintenance capabilities. Contrastingly, the Asia-Pacific region exhibits robust growth fueled by expanding hospital networks, growing medical tourism, and supportive government initiatives to localize production. China, Japan, and India remain focal points for both multinational and domestic players, who are competing to address rising chronic disease burdens and improve outpatient procedural access through innovative device offerings.

This comprehensive research report examines key regions that drive the evolution of the Endoscopy Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Endoscopy Device Manufacturers: Strategic Innovations, Collaborative Alliances, and Competitive Positioning in a Rapidly Evolving Market

A review of leading endoscopy device manufacturers highlights diverse strategies aimed at maintaining technological leadership and expanding global reach. Industry frontrunners continually invest in next-generation imaging platforms and integrated workflow solutions that connect endoscopy suites to broader hospital networks. Many have entered strategic alliances with software firms to develop AI-enhanced visualization tools, which augment clinical decision-making and deliver real-time procedural insights. Concurrently, several companies have pursued targeted acquisitions to build complementary portfolios, secure critical components, or enhance geographic distribution capabilities.

Innovation pipelines frequently feature modular endoscope systems designed for rapid upgrades, as well as single-use endoscope lines that cater to infection control imperatives. Market leaders also differentiate through comprehensive service offerings-ranging from training and maintenance to flexible financing models-that address the full lifecycle of devices. These multifaceted approaches reflect a recognition that sustained competitive advantage will depend equally on technological prowess, operational excellence, and the ability to anticipate and respond to shifting stakeholder priorities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Endoscopy Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ambu A/S

- Asensus Surgical, Inc.

- Auris Health, Inc.

- avateramedical GmbH

- Boston Scientific Corporation

- Brainlab AG

- CMR Surgical Ltd.

- Conmed Corporation

- Cook Group Incorporated

- Endocontrol SA by Canady Life Sciences, Inc.

- EndoMaster Pte Ltd

- Endotics

- FUJIFILM Holdings Corporation

- Globus Medical, Inc.

- HOYA Corporation

- Intuitive Surgical, Inc.

- Johnson & Johnson

- Karl Storz SE & Co. KG

- Medtronic plc

- MicroPort Scientific Corporation

- Olympus Corporation

- Otsuka Holdings Co., Ltd.

- Renishaw PLC

- Smith & Nephew plc

- Stryker Corporation

- Virtuoso Surgical, Inc.

Strategic Imperatives and Actionable Pathways for Endoscopy Device Industry Leaders to Navigate Disruption and Capitalize on Emerging Opportunities

To thrive amid intensifying competition and regulatory complexity, industry leaders must embrace a series of strategic imperatives. Integrating advanced analytics and AI-driven decision support into endoscopy platforms will not only enhance diagnostic accuracy but also create new service-based revenue streams. At the same time, diversifying manufacturing footprints and forging resilient supplier networks can mitigate the impact of trade policy fluctuations and logistical disruptions. Prioritizing sustainability by developing eco-friendly materials and optimizing packaging designs can strengthen brand reputations while addressing growing environmental concerns.

Moreover, forging collaborative partnerships with healthcare providers to co-develop tailored solutions can deepen market penetration and accelerate adoption curves. Investing in robust training programs and virtual reality–based simulation tools will also ensure that end users can rapidly master complex procedures, thereby enhancing procedural throughput and patient outcomes. Finally, aligning commercialization strategies with value-based care initiatives-demonstrating clinical efficacy and cost containment-will be essential for securing favorable reimbursement and forging long-term customer relationships.

Comprehensive Research Methodology Framework Leveraging Robust Primary and Secondary Data Sources, Expert Interviews, and Rigorous Analytical Techniques

This analysis is underpinned by a rigorous research framework combining primary and secondary methodologies. In the primary phase, structured interviews were conducted with a cross-section of healthcare professionals, procurement executives, and device engineers to capture firsthand perspectives on clinical needs, procurement challenges, and technology adoption drivers. Secondary research involved an extensive review of peer-reviewed journals, industry white papers, regulatory filings, and corporate press releases to validate market trends and track product developments. Publicly available databases and trade association reports supplemented these insights with quantitative data on procedural volumes, capital equipment spending patterns, and regional healthcare infrastructure investments.

Data triangulation was applied throughout to reconcile disparate data points, ensuring robust conclusions and minimizing bias. Advanced analytical techniques, including scenario modeling and sensitivity analysis, were employed to explore the potential impact of key variables such as regulatory shifts, tariff changes, and technology disruptions. Finally, expert reviews by clinical specialists and market strategists were integrated at successive stages to ensure that findings reflect real-world practice environments and strategic imperatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Endoscopy Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Endoscopy Devices Market, by Endoscope Type

- Endoscopy Devices Market, by Application

- Endoscopy Devices Market, by Usage Type

- Endoscopy Devices Market, by End User

- Endoscopy Devices Market, by Distribution Channel

- Endoscopy Devices Market, by Region

- Endoscopy Devices Market, by Group

- Endoscopy Devices Market, by Country

- United States Endoscopy Devices Market

- China Endoscopy Devices Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding Perspectives on the Future Trajectory of the Endoscopy Devices Market: Synthesizing Insights and Charting the Path Forward for Stakeholders

As the endoscopy devices market continues to evolve, the convergence of technological innovation, regulatory change, and shifting care delivery models will create both opportunities and challenges for stakeholders. The maturation of AI-powered imaging, the rise of single-use platforms, and the imperative for resilient supply chains will shape strategic priorities in the years ahead. Stakeholders who proactively align product development with clinical workflows, cultivate agile manufacturing strategies, and demonstrate clear value propositions in a value-based care environment will be best positioned to capture growth.

In sum, navigating the intricate interplay of innovation and regulation requires a holistic approach that balances short-term operational agility with long-term strategic planning. By drawing on the insights presented herein, decision-makers can chart a course that leverages emerging trends, anticipates market disruptions, and ultimately delivers superior patient outcomes alongside sustainable business performance.

Engage with Ketan Rohom to Unlock Detailed Endoscopy Devices Market Insights and Seize Strategic Growth Opportunities with a Comprehensive Research Report

To secure a comprehensive understanding of the endoscopy devices market and gain actionable intelligence tailored to your organization’s strategic objectives, reach out to Ketan Rohom, Associate Director of Sales & Marketing. His expertise in medical device research can guide you through the nuances of technological trends, competitive landscapes, and evolving regulatory frameworks. Engaging with Ketan will provide you with exclusive access to the full market research report, featuring in-depth analyses, data-driven recommendations, and customized insights that empower you to make informed decisions and drive growth in this dynamic sector. Contact Ketan Rohom today to unlock the detailed findings and position your organization at the forefront of endoscopy device innovation and commercialization.

- How big is the Endoscopy Devices Market?

- What is the Endoscopy Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?