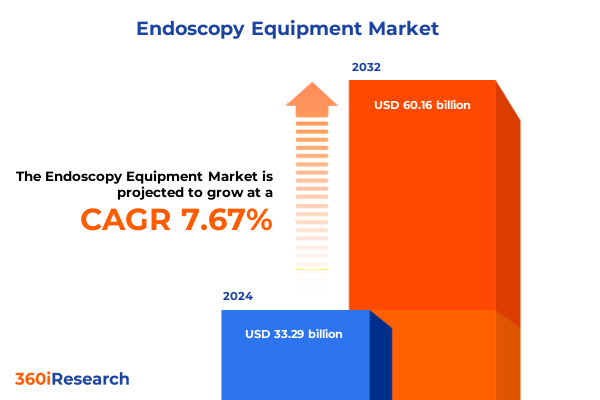

The Endoscopy Equipment Market size was estimated at USD 35.90 billion in 2025 and expected to reach USD 38.40 billion in 2026, at a CAGR of 7.65% to reach USD 60.16 billion by 2032.

Understanding the evolving technology landscape driving endoscopy equipment forward to enhance diagnostic precision, therapeutic efficacy, and patient outcomes across diverse medical specialties

Endoscopy equipment stands at the forefront of a dynamic convergence between engineering innovation and clinical necessity, ushering in an era where minimally invasive diagnostics and therapies are rapidly redefining patient care. In recent years, this field has moved beyond basic visualization to embrace sophisticated imaging platforms and ergonomic enhancements that support broader indications across specialties. As healthcare systems worldwide strive to optimize outcomes while containing costs, advanced endoscopy tools have become integral in early disease detection, precision intervention, and streamlined procedural workflows.

With the prevalence of gastrointestinal disorders, respiratory conditions, and urological challenges on the rise, demand for versatile endoscopes continues to intensify. Moreover, the healthcare community is increasingly valuing solutions that improve patient comfort and reduce procedural risk. In this environment, manufacturers and clinical practitioners are collaborating more closely than ever to refine device functionality, leverage data analytics for procedural insights, and integrate seamless connectivity into clinical ecosystems. By clarifying the technological underpinnings and clinical applications of contemporary endoscopy equipment, this overview lays the groundwork for understanding how next-generation platforms are poised to impact both clinician proficiency and patient outcomes.

Examining the pivotal technological and clinical shifts that are redefining endoscopy procedures, driving patient care improvements, and setting new standards in healthcare practice

As the medical community embraces digital transformation, endoscopy has experienced several profound shifts that collectively elevate the standard of care. First, artificial intelligence algorithms now augment real-time image analysis, enabling automatic lesion detection and characterization. These machine-assisted tools enhance procedural accuracy, reduce operator variability, and expedite clinical decision-making. At the same time, the introduction of high-resolution 4K and 3D imaging modalities has transformed visual clarity during procedures, allowing physicians to discern subtle mucosal changes and vascular patterns with unprecedented fidelity.

Additionally, rapid advancements in materials science have led to the development of lightweight, disposable endoscopes that address concerns around cross-contamination and reprocessing costs. This trend aligns with heightened scrutiny around infection control and regulatory demands for single-use solutions. Parallel to this, the emergence of robotic-assisted endoscopic platforms is enabling remote navigation and enhanced dexterity, broadening the scope of minimally invasive interventions. Taken together, these transformative shifts are reshaping clinical protocols, influencing training requirements, and redefining how healthcare systems approach endoscopy services.

Analyzing how the implementation of 2025 United States tariffs has reshaped supply chains, influenced cost structures, and driven strategic adaptation in the endoscopy equipment sector

In 2025, the United States introduced a series of tariffs targeting imported medical devices, including components crucial to endoscopy equipment manufacturing. These duties have prompted device makers to reassess established sourcing models, given the elevated cost of key elements such as specialty optics, imaging sensors, and advanced polymers. Many suppliers have responded by diversifying their supply bases, pursuing alternative partnerships in allied markets, and accelerating domestic production capabilities to mitigate tariff-related expenses.

Consequently, procurement strategies have shifted toward regionalization, with manufacturers exploring nearshore and onshore facilities to preserve margin structures and ensure supply chain resilience. Healthcare providers have also felt the impact, as cost pressures cascade through purchasing decisions and may influence device selection priorities. In response, several endoscopy system developers have adopted creative pricing models, bundled service packages, and value-based contracting to ease transitional challenges. As industry stakeholders navigate this evolving tariff landscape, strategic flexibility and collaborative supplier relationships have emerged as essential components of successful adaptation.

Revealing critical market segmentation insights to guide strategic decision-making across device types, clinical applications, modalities, end users, and product types

An in-depth examination of device-based segmentation reveals that capsule endoscopes continue to make inroads in noninvasive gastrointestinal diagnostics, whereas flexible endoscopes dominate both pulmonary and GI indications through specialized bronchoscopy and gastrointestinal applications. Within the flexible endoscope category, manufacturers maintain robust platforms for gastroenterology procedures, including colonoscopes, duodenoscopes, and gastroscopes, while also addressing niche areas in gynecology and urology. Rigid endoscopes remain pivotal for arthroscopy, laparoscopic interventions, and selected gynecological and urological examinations.

When viewed through the lens of clinical application, distinct patterns emerge: ENT, gastrointestinal, gynecology, laparoscopy, and urology each demand tailored optics, illumination, and instrumentation to meet unique anatomical challenges. A modality perspective further underscores this differentiation, with diagnostic endoscopy focusing on high-definition visualization and therapeutic endoscopy emphasizing integrated working channels for instrument passage. End users also shape product requirements, as ambulatory surgical centers value portable, rapid-turnover systems, clinics prioritize ease of use and cost control, and hospitals seek scalable platforms that support broad service lines. Finally, the product-type dimension highlights the ongoing debate between reusable and single-use endoscopes, balancing sterility assurance and lifecycle economics against environmental and operational considerations.

This comprehensive research report categorizes the Endoscopy Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Device Type

- Application

- Modality

- End User

- Product Type

Highlighting unique regional market dynamics, regulatory influences, and growth drivers across the Americas, Europe Middle East & Africa, and Asia-Pacific endoscopy equipment markets

Regional dynamics in the endoscopy equipment market are influenced by healthcare infrastructure maturity, regulatory frameworks, and demographic trends. In the Americas, robust capital expenditure capabilities and widespread reimbursement models have accelerated adoption of cutting-edge endoscopy platforms. Providers in the United States and Canada frequently lead early technology rollouts, investing in integrated solutions that support data analytics, procedural connectivity, and remote collaboration.

In Europe, the Middle East, and Africa, heterogeneous regulatory environments and varying levels of economic development have created a complex landscape. Western Europe shows strong uptake of single-use devices and AI-enabled diagnostics, while emerging economies in the region emphasize cost-effective, durable instruments. The regulatory convergence efforts within the European Union have further shaped product qualification processes. Meanwhile, Asia-Pacific markets are buoyed by growing healthcare expenditure, an expanding patient population, and government initiatives to bolster local manufacturing. Countries such as China, India, and Japan are both major demand centers and rising sources of innovation, often collaborating with global partners to deliver tailored endoscopy solutions under diverse budgetary constraints.

This comprehensive research report examines key regions that drive the evolution of the Endoscopy Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading industry participants and assessing their strategic initiatives, innovations, and partnerships shaping the competitive landscape in endoscopy equipment

Leading players in the endoscopy equipment sector continue to pursue strategic investments in innovation, partnerships, and service offerings to secure competitive differentiation. One prominent global manufacturer has extended its portfolio to include AI-driven image analysis modules, while another has entered into alliances with robotics specialists to co-develop next-generation navigational systems. A prominent optics pioneer has also introduced a flagship single-use flexible endoscope, leveraging advanced polymer engineering to balance performance and disposability.

Furthermore, several companies have launched integrated software platforms that unify device control, image storage, and analytics across procedure suites. Strategic acquisitions have enabled some organizations to expand their footprint in high-growth regions, augmenting local production and distribution networks. Meanwhile, specialized service providers have carved out niche positions by offering comprehensive reprocessing and maintenance contracts. Together, these strategic initiatives reflect a concerted effort among industry leaders to address evolving clinical needs, regulatory requirements, and sustainability objectives through diversified portfolios and collaborative ecosystems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Endoscopy Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Advin Healthcare Pvt. Ltd.

- Allengers Medical Systems Ltd.

- Boston Scientific Corporation

- Brainlab AG

- Cook Medical LLC

- Deep Corporation

- Devesh Meditech Pvt. Ltd.

- Ethicon, Inc.

- FUJIFILM Holdings Corporation

- Genuine Medica Pvt. Ltd.

- Golden Nimbus International Pvt. Ltd.

- Hoya Corporation

- KARL STORZ SE & Co. KG

- Medtronic plc

- Olympus Corporation

- Pioneer Healthcare Technologies Pvt. Ltd.

- Richard Wolf GmbH

- Shaili Endoscopy Pvt. Ltd.

- Stryker Corporation

Providing actionable recommendations to industry leaders for capitalizing on emerging trends, navigating regulatory complexities, and optimizing endoscopy equipment strategies

Industry leaders should prioritize investment in artificial intelligence and machine learning capabilities to enhance real-time diagnostic accuracy and procedural efficiency. By collaborating with software developers and clinical research organizations, device makers can integrate advanced analytics into their platforms, creating differentiated offerings that appeal to value-focused healthcare systems. In parallel, developing a balanced portfolio that includes both reusable and single-use endoscopes can provide flexibility to diverse end users, enabling providers to align device selection with procedural complexity, cost constraints, and infection control protocols.

Moreover, diversifying the supply chain through regional manufacturing partnerships and alternative sourcing strategies will help mitigate the impact of trade policies and material shortages. Establishing value-based contracting models and outcome-oriented service agreements can also strengthen customer relationships and support long-term revenue streams. Finally, fostering closer engagement with key opinion leaders, healthcare associations, and regulatory bodies will facilitate faster adoption of innovative technologies and smoother market entries, ultimately driving sustainable growth in the evolving endoscopy sector.

Outlining the rigorous research methodology and analytical framework underpinning the comprehensive endoscopy equipment market insights and findings

This analysis is grounded in a comprehensive research methodology that combines rigorous secondary research with extensive primary validation. Initially, a wide range of public and proprietary databases were reviewed to gather product specifications, clinical trial outcomes, and regulatory filings relevant to endoscopy technology development. Peer-reviewed journals, conference proceedings, and white papers provided insights into emerging scientific advances and clinical best practices. Additionally, industry reports and financial disclosures were examined to understand broader investment patterns and corporate strategies.

To ensure data accuracy and contextual relevance, structured interviews were conducted with experienced clinicians, procurement specialists, and biomedical engineers across geographies. These primary interviews were supplemented by discussions with manufacturing executives, supply chain managers, and regulatory consultants, offering a holistic view of operational and strategic considerations. Collected information was triangulated through cross-referencing multiple sources, and qualitative insights were coded to identify recurring themes. The final report presents balanced and validated perspectives, offering both quantitative trends and interpretative analysis to support informed decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Endoscopy Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Endoscopy Equipment Market, by Device Type

- Endoscopy Equipment Market, by Application

- Endoscopy Equipment Market, by Modality

- Endoscopy Equipment Market, by End User

- Endoscopy Equipment Market, by Product Type

- Endoscopy Equipment Market, by Region

- Endoscopy Equipment Market, by Group

- Endoscopy Equipment Market, by Country

- United States Endoscopy Equipment Market

- China Endoscopy Equipment Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Presenting a cohesive summation of key findings and strategic implications to inform decision making in the evolving endoscopy equipment market

This executive summary synthesizes the multifaceted shifts occurring within the endoscopy equipment landscape, from groundbreaking imaging enhancements and AI integration to evolving supply chain strategies influenced by recent tariff actions. Strategic segmentation insights illuminate how device types, clinical applications, modalities, end users, and product formats intersect to shape technology adoption and operational priorities. Regional analysis highlights distinct drivers in the Americas, EMEA, and Asia-Pacific that medical device leaders must navigate to capitalize on local opportunities.

Taken together, these findings underscore the importance of agility, collaboration, and innovation in maintaining competitive advantage. As endoscopy platforms become more interconnected, data-rich, and patient-centric, stakeholders who embrace digital integration, diversify supply networks, and develop flexible product portfolios will be best positioned to meet emerging clinical demands. By translating these insights into concrete strategies-such as AI-enabled solutions, value-based contracting, and regional production partnerships-organizations can drive superior clinical outcomes and achieve sustainable growth in this rapidly evolving sector.

Connect with Ketan Rohom to Obtain a Comprehensive Endoscopy Equipment Market Research Report That Drives Strategic Growth Initiatives

To explore the full depth of these findings and translate them into actionable strategic initiatives for your organization, please reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the comprehensive endoscopy equipment market research report. Ketan brings extensive expertise in guiding medical device leaders through data-driven decision making. Engaging with him will provide you with tailored insights, practical recommendations, and an exclusive opportunity to harness the research in your business planning and product development cycles. Connect with Ketan Rohom today to unlock the detailed analysis that will empower your strategic growth and innovation roadmap.

- How big is the Endoscopy Equipment Market?

- What is the Endoscopy Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?