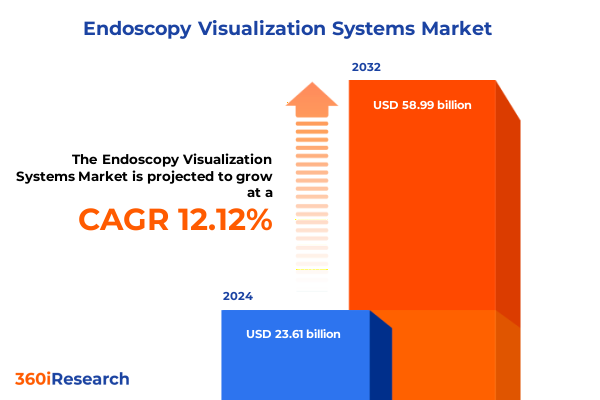

The Endoscopy Visualization Systems Market size was estimated at USD 26.41 billion in 2025 and expected to reach USD 29.54 billion in 2026, at a CAGR of 12.16% to reach USD 58.99 billion by 2032.

Introducing a New Era of Clarity and Precision: Exploring the Emerging Opportunities and Challenges in Endoscopy Visualization Systems

In recent years, endoscopy visualization systems have undergone a profound evolution, transitioning from analog optics to sophisticated digital platforms that deliver unprecedented image clarity and procedural precision. The adoption of ultra-high-definition technologies, including 4K and 3D imaging modalities, has empowered clinicians to discern sub-millimeter anatomical details and subtle tissue variations, thereby enhancing diagnostic accuracy and procedural safety. As more healthcare facilities integrate advanced visualization platforms into minimally invasive suites, providers are witnessing streamlined workflows, reduced procedure times, and improved patient outcomes, particularly in complex gastrointestinal, urological, and gynecological interventions.

Concurrently, the melding of artificial intelligence and machine learning with endoscopic systems has unlocked new potential for real-time lesion detection, automated image enhancement, and decision support. Edge AI processors built into medical-grade hardware are now capable of analyzing visual data mid-procedure, alerting endoscopists to anomalies that may be imperceptible to the human eye. Moreover, the industry is embracing miniaturized and disposable formats-ranging from capsule endoscopes to single-use bronchoscopes-to address stringent infection control requirements and operational efficiency imperatives. This shift not only reduces cross-contamination risks but also accelerates turnover between cases, enabling outpatient and clinic-based settings to expand procedural capacity.

Unveiling Breakthrough Transformations: How Technological, Clinical, and Regulatory Forces Are Reshaping Endoscopy Visualization Practices

The landscape of endoscopy visualization is being transformed by converging technological, clinical, and regulatory forces that are redefining procedural standards. One of the most significant shifts has been the transition from two-dimensional imaging to immersive 3D and ultra-high-definition platforms, which provide surgeons with enhanced depth perception and finer spatial resolution during minimally invasive procedures. This technological leap is complemented by the proliferation of hybrid systems that integrate robotics, navigation, and data analytics directly into the endoscopic workflow, enabling precision-guided interventions and more effective sub-millimeter tissue resections.

At the same time, regulatory agencies are intensifying their focus on device safety and infection control. In response, manufacturers are accelerating development of single-use endoscope systems and disposable sheathing solutions that eliminate reprocessing concerns and comply with evolving sterilization guidelines. These clinical imperatives are driving a broader shift toward outpatient and ambulatory surgical center adoption, where compact, portable visualization units can be deployed rapidly and cost-effectively. As a result, traditional hospital-centric models are giving way to more decentralized procedural pathways, unleashing new market opportunities in ambulatory environments and specialty clinics.

Assessing the Comprehensive Ripple Effects of 2025 US Tariffs on Endoscopy Visualization Equipment Supply Chains and Costs

The introduction of new U.S. tariffs in 2025 on imported medical devices has posed significant challenges for endoscopy visualization equipment manufacturers and healthcare providers alike. Tariff rates of up to 25% on critical components, including semiconductors, optics, and metal alloys, have disrupted established supply chains and introduced cost pressures across the product lifecycle. Manufacturers reliant on Asian and European suppliers have reported elevated production expenses and logistical complexities as they navigate customs duties and inventory rebalancing efforts.

Market reactions have been swift: publicly traded medical device companies experienced notable stock price declines following tariff announcements, with firms such as Boston Scientific and Medtronic citing tariff-induced earnings adjustments in their quarterly disclosures. In parallel, endoscopy system providers that source components internationally are evaluating in-country assembly options and supplier diversification strategies to mitigate tariff exposure. Legal and trade advisors warn that prolonged tariff measures could exacerbate supply volatility, potentially leading to procurement delays and higher procedural costs for hospitals and clinics. Industry stakeholders continue advocating for targeted exclusions and reciprocal trade agreements to safeguard access to critical visualization technologies and maintain procedural quality standards.

Decoding Market Segmentation Insights: Understanding How Endoscope Types, Clinical Applications, Settings, and Modalities Define Industry Dynamics

The endoscopy visualization market encompasses a diverse array of product types that address distinct clinical and operational requirements. From capsule endoscope systems and flexible endoscopy platforms to hybrid and rigid configurations, each product category fulfills specialized use cases; flexible endoscopes further subdivide into reusable and single-use models, while rigid scopes mirror this duality in design. Across clinical specialties, applications range from otolaryngology and gynecology to gastroenterology, orthopedics, and urology, reflecting the versatility of these visualization solutions in both diagnostic and therapeutic contexts.

Beyond product and application distinctions, end users span ambulatory surgical centers, which prioritize compact, portable systems for same-day procedures, as well as clinics-both general and specialty-that demand streamlined imaging workflows and rapid room turnover. In parallel, hospitals-public and private alike-seek scalable visualization ecosystems that integrate with electronic health records and support cross-disciplinary collaboration. Finally, with advances in display technology, modalities such as two-dimensional, three-dimensional, and four-K imaging offer providers a continuum of visualization fidelity options, enabling tailored procedural strategies and optimized resource allocation.

This comprehensive research report categorizes the Endoscopy Visualization Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- End User

- Modality

Mapping Regional Growth Patterns: Evaluating Strategic Drivers and Emerging Opportunities Across Americas, EMEA, and Asia-Pacific Endoscopy Markets

Regional market dynamics for endoscopy visualization systems display marked variation across the Americas, Europe, the Middle East & Africa (EMEA), and Asia-Pacific. In North America, robust healthcare infrastructures and substantial procedure volumes have sustained a dominant position, driven by high adoption of cutting-edge 4K and 3D imaging platforms. Leading hospital systems continue to invest in digital endoscopy suites that feature integrated AI analytics and remote proctoring capabilities, cementing North America’s status as the innovation bellwether in global endoscopy practice.

Meanwhile, EMEA markets face dual pressures of regulatory standardization and competitive pricing. European exporters have expressed concern over the financial strain imposed by U.S. tariff measures, prompting some manufacturers to evaluate local production and diversified export strategies. Healthcare providers in this region are balancing cost-containment initiatives with the need for advanced imaging systems that comply with stringent safety directives. In Asia-Pacific, expanding healthcare access and rising procedural demand have fueled rapid uptake of both portable and fixed visualization models, particularly in emerging economies where ambulatory and specialty clinics seek high-definition and AI-enhanced solutions to address growing caseloads.

This comprehensive research report examines key regions that drive the evolution of the Endoscopy Visualization Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators: Strategic Positioning and Competitive Strengths of Top Endoscopy Visualization System Manufacturers and Developers

Key players in the endoscopy visualization systems space are deploying multifaceted strategies to consolidate their market positions and foster sustainable growth. Established leaders like Olympus and Karl Storz differentiate through ongoing platform enhancements, incorporating adaptive lighting, spectral imaging, and cloud-based video management to create end-to-end procedural ecosystems. These incumbents invest heavily in software integration with hospital information systems, enabling seamless data capture, archiving, and analytics-driven performance insights that support clinical decision-making.

Simultaneously, competitors such as Stryker, Boston Scientific, Medtronic, and Fujifilm are leveraging strategic collaborations with AI innovators and semiconductor partners to embed edge-computing capabilities within their visualization hardware. This convergence of hardware and software expertise has led to the deployment of real-time anomaly detection modules, augmented reality overlays, and robotics interfaces that enhance procedural accuracy and workflow efficiency. Moreover, several emerging vendors focus on niche applications-such as single-use flexible bronchoscopes and capsule endoscopes-to address infection control imperatives and expand access in ambulatory and remote care settings. As competitive differentiation shifts toward platform interoperability and AI-driven clinical support, leadership in innovation pipelines and ecosystem partnerships is now a critical determinant of long-term market success.

This comprehensive research report delivers an in-depth overview of the principal market players in the Endoscopy Visualization Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Boston Scientific Corporation

- CONMED Corporation

- Fujifilm Holdings Corporation

- HOYA CORPORATION

- Johnson & Johnson

- KARL STORZ SE & Co. KG

- Medtronic plc

- Olympus Corporation

- Richard Wolf GmbH

- Stryker Corporation

Driving Strategic Excellence: Actionable Roadmap for Endoscopy Visualization System Leaders to Capitalize on Emerging Opportunities and Mitigate Risks

Industry leaders should prioritize a balanced approach to innovation, supply chain resilience, and strategic partnerships. First, accelerating integration of artificial intelligence and machine learning into visualization platforms will differentiate product portfolios and improve diagnostic accuracy; early investment in edge-computing and certified AI frameworks can yield a sustainable competitive edge. Concurrently, companies must pursue geographic diversification of manufacturing and assembly operations to mitigate tariff exposure and logistical disruptions, ensuring consistent supply for critical endoscopy components.

Moreover, establishing collaborative alliances with healthcare providers, regulatory bodies, and technology partners will streamline validation pathways and accelerate time-to-market. Co-development initiatives focusing on single-use device safety, AI-enabled decision support, and augmented reality procedural guidance can unlock new revenue streams while addressing evolving clinical protocols. Finally, a steadfast commitment to clinician education and outcomes-based evidence collection will reinforce product adoption, as rigorous training programs and real-world performance data strengthen customer confidence and support value-based procurement.

Outlining a Rigorous Research Framework: Methodological Approaches, Data Sources, and Analytical Techniques Underpinning the Endoscopy Visualization Systems Study

This study employs a robust blend of secondary and primary research methodologies. Initially, comprehensive secondary data analysis was conducted, encompassing peer-reviewed journals, regulatory filings, clinical trial repositories, and public financial disclosures. Trade association reports and technical white papers provided context on regulatory trends, technology roadmaps, and regional policy developments. Secondary insights were triangulated with proprietary databases to validate key parameters.

Primary research involved structured interviews with stakeholders across the endoscopy value chain, including senior procurement officers at hospitals and ambulatory centers, clinical endoscopists, device engineers, and regulatory experts. Quantitative survey data were collected to gauge adoption patterns and technology preferences. Collected data underwent rigorous validation through cross-referencing and consistency checks. Finally, analytical frameworks such as SWOT, Porter’s Five Forces, and scenario modeling were applied to synthesize insights, assess competitive intensity, and identify strategic inflection points for the endoscopy visualization systems market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Endoscopy Visualization Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Endoscopy Visualization Systems Market, by Product Type

- Endoscopy Visualization Systems Market, by Application

- Endoscopy Visualization Systems Market, by End User

- Endoscopy Visualization Systems Market, by Modality

- Endoscopy Visualization Systems Market, by Region

- Endoscopy Visualization Systems Market, by Group

- Endoscopy Visualization Systems Market, by Country

- United States Endoscopy Visualization Systems Market

- China Endoscopy Visualization Systems Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Concluding Insights and Future Pathways: Synthesizing Key Findings and Anticipating Next Generation Trends in Endoscopy Visualization Systems

The endoscopy visualization systems market stands at the intersection of rapid technological progression and evolving clinical imperatives. This analysis reveals that high-definition imaging, AI-enhanced diagnostics, and single-use device adoption are reshaping procedural workflows and elevating patient care standards. Concurrently, external factors such as trade policy shifts and regulatory advancements are influencing supply chain strategies and cost structures, underscoring the importance of adaptive business models.

Looking ahead, sustained innovation in visualization fidelity, real-time analytics, and cross-platform interoperability will define the competitive landscape. Manufacturers that effectively balance R&D investment with agile operational frameworks and collaborative ecosystems will be best positioned to meet the growing demand for precise, efficient, and safe endoscopic interventions. By synthesizing these insights, stakeholders can chart informed pathways for product development, market entry, and strategic partnerships in this dynamic segment.

Connect with Ketan Rohom to Secure Your Comprehensive Endoscopy Visualization Systems Market Research Report and Elevate Your Strategic Planning

Elevate your strategic initiatives and gain a competitive edge by acquiring the comprehensive Endoscopy Visualization Systems market research report. Ketan Rohom, Associate Director of Sales & Marketing, is ready to guide you through this detailed analysis and help you secure deeper insights tailored to your business needs. Connect with Ketan to explore tailored packages, discuss licensing options, and unlock exclusive data that will inform your decision-making and drive sustainable growth.

Don’t miss the opportunity to leverage this authoritative resource. Reach out to Ketan Rohom today and embark on a path toward informed investments and enhanced operational performance.

- How big is the Endoscopy Visualization Systems Market?

- What is the Endoscopy Visualization Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?