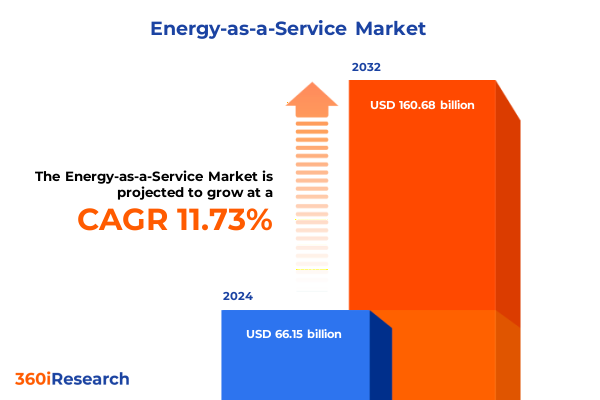

The Energy-as-a-Service Market size was estimated at USD 73.38 billion in 2025 and expected to reach USD 81.57 billion in 2026, at a CAGR of 11.84% to reach USD 160.68 billion by 2032.

Setting the Stage for Energy-as-a-Service as a Catalyst for Sustainable Transformation and Operational Efficiency across Industries

The global energy landscape is undergoing a profound transformation under the weight of decarbonization imperatives, evolving regulatory frameworks, and the rapid adoption of digital technologies. Electrification, once confined to power generation and transmission, is now extending across end-use sectors, reshaping demand profiles and grid operations. At the same time, the proliferation of distributed energy resources - including rooftop solar, behind-the-meter batteries, and electric vehicle fleets - is redefining the traditional one-way flow of electricity, empowering consumers to become active participants in energy production and trading. Digitalization continues to penetrate every node of the energy value chain, with investments in network monitoring devices, smart meters, and analytics doubling in recent years to support real-time control and optimize asset utilization.

Against this backdrop, the Energy-as-a-Service (EaaS) model has emerged as a compelling alternative to conventional energy procurement and management. By packaging infrastructure deployment, operations and maintenance, and performance guarantees into service contracts, EaaS allows organizations to shift capital-intensive asset ownership into predictable operational expenditures while gaining immediate access to advanced energy technologies and expertise. This OPEX-centric approach reduces financial barriers to entry, accelerates project timelines, and aligns provider incentives with customer outcomes, driving measurable improvements in efficiency, reliability, and sustainability.

This executive summary delves into the critical forces propelling the EaaS market forward, examines the transformative shifts shaping energy delivery, evaluates the ripple effects of U.S. tariff policies, and distills segmentation, regional, and competitive insights. The following sections offer a clear, actionable narrative designed for executives and decision-makers seeking to harness the full potential of Energy-as-a-Service solutions in an increasingly complex energy ecosystem.

Exploring the Pivotal Transformations Reshaping Energy Delivery from Centralized Grids to Agile Decentralized and Digital Platforms

Centralized power generation and unidirectional grids are yielding to agile, decentralized architectures where distributed energy resources (DERs) - from rooftop photovoltaics to grid-edge storage - play an indispensable role in balancing supply and demand. These DERs enable bidirectional electricity flows, allowing consumers not only to draw from the grid but also to inject surplus generation, thereby creating new revenue streams and resilience benefits for end users and system operators alike.

Concurrently, the integration of digital twin technologies, advanced analytics, and Internet of Things (IoT) platforms is transforming passive network assets into smart, self-optimizing systems. Real-time monitoring and predictive maintenance reduce unplanned downtime, while algorithmic demand-response orchestration aligns consumption patterns with renewable availability, enhancing grid stability and lowering overall system costs.

Electrification of transport and heating is further accelerating the shift, spawning specialized service offerings such as EV Charging-as-a-Service, Microgrid-as-a-Service, and Storage-as-a-Service. Strategic partnerships between technology developers and infrastructure investors - exemplified by Siemens’ DER management alliance and Mitsubishi’s AI-driven optimization venture with Google Cloud - underscore the move toward integrated, outcome-focused energy solutions that span deployment, financing, and operations under unified service agreements.

These pivotal shifts reinforce a broader industry trend: stakeholders increasingly favor flexible, performance-based contracts over capital-intensive ownership, driven by the dual goals of decarbonization and resilience. As a result, Energy-as-a-Service is rapidly evolving from a niche offering into a mainstream modality across commercial, industrial, and utility segments.

Analyzing the Cumulative Disruption Wrought by 2025 United States Tariff Measures on Energy Supply Chains and Infrastructure Investment Dynamics

The U.S. administration’s 2025 tariff measures have created a complex policy environment with far-reaching implications for energy supply chains and infrastructure investments. In early March, the enactment of a 10 percent levy on Canadian crude oil and natural gas imports, alongside a 25 percent tariff on equivalent Mexican products, signaled a strategic shift to bolster domestic energy production and reduce reliance on proximate neighbors - a move projected to add roughly $6.5 billion in annual costs to cross-border trade in its first year.

Mid-March saw the imposition of a blanket 25 percent tariff on all steel and aluminum imports, directly affecting the procurement costs of critical materials for transformers, switchgear, solar panel frames, and wind turbine components. Although intended to rejuvenate domestic metals manufacturing, these duties have introduced significant price inflation and supply constraints, complicating project planning for distributed and utility-scale endeavors.

On March 24, 2025, Executive Order 14245 expanded punitive trade measures by imposing 25 percent tariffs on goods from any nation importing Venezuelan oil, amplifying uncertainty in energy commodity flows and straining diplomatic relations with key oil-trading partners. In parallel, preliminary antidumping duties of 93.5 percent on Chinese anode-grade graphite, announced by the Commerce Department, have disrupted battery cell supply chains, escalating costs for energy storage project rollouts and threatening schedule overruns for grid-scale deployments.

Collectively, these policies have prompted trade partners such as Petrobras to redirect exports toward Asia, reduced component availability for solar and wind developers, and introduced regulatory ambiguity that is delaying financing decisions. The cumulative effect underscores the importance of supply chain resilience strategies and adaptive contracting to mitigate cost volatility and maintain project momentum in the Energy-as-a-Service arena.

Unveiling Critical Insights Derived from Service Model, Business Model, End User, and Service Provider Segmentation Perspectives for Tailored Energy-as-a-Service Strategies

A nuanced understanding of market segmentation is essential for tailoring Energy-as-a-Service offerings to diverse client needs and operational contexts. Within the Service Model dimension, the market divides into four primary domains: Energy Infrastructure Services, encompassing EV Charging-as-a-Service, Microgrid-as-a-Service, and Storage-as-a-Service; Energy Management Services, which include Demand Response, Energy Audit, and Energy Efficiency Services; Energy Supply Services, delivered through Biomass, Solar, and Wind-as-a-Service models; and Financing Services, structured via Energy Performance Contracting, Lease Services, and Power Purchase Agreements. Each sub-segment caters to unique deployment scales and performance requirements, enabling providers to craft customized solutions that align asset capabilities with customer priorities.

Examining the Business Model lens reveals four distinct contract frameworks shaping market dynamics: leasing agreements provide hardware access without ownership, pay-per-use schemes align costs with consumption events, performance contracting ties provider remuneration to outcome metrics, and subscription-based models offer fixed-fee access to comprehensive service bundles. This evolution from capex-heavy acquisitions to outcome-oriented contracts reflects a broader shift toward predictable operational expenditures and performance risk transfer.

In the End User category, the market spans Commercial environments - including corporate offices, hospitality, and retail; Industrial operations such as food and beverage, manufacturing, metallurgical, and textile production sites; Institutional segments covering education, government, and healthcare facilities; Residential applications in apartment buildings and single-family homes; and Utility Companies, which encompass regional utilities and transmission operators. Deployments across these verticals demonstrate the versatility of EaaS solutions, from reducing energy bills in multi-tenant buildings to ensuring reliability at mission-critical industrial sites.

Finally, Service Provider types influence contracting and delivery models. In-House Services teams leverage existing customer relationships and asset bases to deploy EaaS solutions as extensions of core offerings, while Independent Service Providers differentiate through niche expertise, agility, and innovative pricing structures. These provider archetypes shape competitive positioning and inform partnership strategies as the market matures.

This comprehensive research report categorizes the Energy-as-a-Service market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Model

- Business Model

- End User

- Service Provider

Mapping Regional Dynamics and Growth Drivers in the Energy-as-a-Service Market across the Americas, EMEA, and Asia-Pacific Territories

Regional dynamics exert a profound influence on the adoption and evolution of Energy-as-a-Service models. In the Americas, the United States leads with state-level renewable portfolio requirements, decarbonization mandates, and corporate clean-energy commitments that are accelerating investments in commercial microgrids and EV charging networks. Distributed energy resource deployments are further supported by digitalization initiatives that improve visibility and operational control, enabling rapid scaling of behind-the-meter assets. Latin American markets, while still emerging, are harnessing public-private partnerships to roll out solar-as-a-service offerings, evidenced by major enterprises redirecting oil exports and exploring integrated renewables trade corridors amid shifting tariff landscapes.

Across Europe, the Middle East, and Africa, regulatory frameworks are evolving to incentivize clean energy procurement and performance-based contracting. The European Commission’s Digitalisation of Energy Action Plan is fostering common data practices and streamlined grid integration, while pioneering projects such as ENGIE’s partnership with OCP Group in Morocco illustrate the potential of microgrid-as-a-service to bolster energy security in arid regions. In the Gulf Cooperation Council, utilities are exploring hybrid solar-storage offerings under long-term service agreements to balance peak demand and enhance resilience against temperature extremes.

In the Asia-Pacific, burgeoning energy demand and capital constraints are catalyzing innovative business models such as pay-per-use and subscription frameworks to democratize access. Startups like Singapore-based Oyika are deploying battery-swapping infrastructure for electric two-wheelers on a battery-as-a-service basis, financing asset rollouts through growth equity and public-private collaborations to reach under-served segments. Meanwhile, Southeast Asian utilities are partnering with independent service providers to introduce biomass and solar-as-a-service solutions for industrial parks, advancing rural electrification and decarbonization goals through usage-based fee structures that mirror telecom top-up models.

This comprehensive research report examines key regions that drive the evolution of the Energy-as-a-Service market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Moves, Differentiation Tactics, and Partnership Models among Leading Energy-as-a-Service Providers to Capture Value in a Rapidly Evolving Market

The competitive landscape of Energy-as-a-Service is characterized by a mix of global conglomerates, specialized technology firms, and emerging startups, each leveraging unique strengths to capture market share. Leading providers such as Ameresco, Schneider Electric, Enel X, and ENGIE have solidified their positions through comprehensive service portfolios, robust financing capabilities, and strategic go-to-market alliances that address sustainability, resilience, and deferred maintenance requirements for commercial, industrial, and public sector clients.

Technology incumbents like Siemens and Honeywell are differentiating through the integration of digital twins, advanced analytics, and industrial AI into their EaaS offerings, enabling predictive maintenance, dynamic load balancing, and real-time asset optimization. These capabilities enhance operational performance and create new revenue streams linked to value-added services.

Strategic partnerships are reshaping deployment and financing paradigms. In April 2024, BlackRock’s Global Infrastructure Fund and EDF formed a $3.2 billion joint platform aimed at commissioning 480 distributed-energy systems across five continents, exemplifying how asset-management expertise and concessional debt can scale project pipelines rapidly. Simultaneously, Mitsubishi’s venture with Google Cloud embeds AI optimization into service contracts, allowing assets to self-tune to weather and price signals without human intervention.

Consolidation has also emerged as a key dynamic, with Schneider Electric’s acquisition of AutoGrid and Centrica’s purchase of ENER-G Cogen International adding gigawatts of customer-sited generation and advanced grid orchestration capabilities to their service ledgers. These moves not only expand technical offerings but also raise entry barriers for smaller independent providers, underscoring the importance of scale and ecosystem partnerships in delivering end-to-end EaaS solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Energy-as-a-Service market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Alpiq Holding Ltd.

- Ameresco, Inc.

- Berkeley Energy Group

- Bernhard

- Centrica plc

- EDF Renewables SA

- Emerson Electric Company

- Enel S.p.A.

- ENEL X INTERNATIONAL S.R.L.

- Engie Group

- Entegrity Energy Partners, LLC

- GE Vernova Inc.

- Hitachi India Limited

- Honeywell International Inc.

- Johnson Controls International PLC

- Mitsubishi Electric Corporation

- Redaptive, Inc.

- Rockwell Automation, Inc.

- Schneider Electric SE

- Siemens AG

- SMA Solar Technology AG

- Veolia Environnement SA

- Wärtsilä Oyj Abp

- Ørsted A/S

Outlining Actionable Recommendations for Industry Leaders to Accelerate Adoption, Drive Innovation, and Secure Competitive Advantage in Energy-as-a-Service

Industry leaders should expand their service portfolios beyond traditional offerings by integrating infrastructure deployment, management services, supply options, and financing solutions under unified contracts that meet diverse customer needs. Focusing on emerging applications - such as EV charging networks, microgrid resilience services, and bundled renewable supply - will unlock new revenue streams and strengthen value propositions.

Adopting outcome-based contracting structures, including performance guarantees and subscription-based models, aligns provider compensation with client objectives, fostering transparency and trust. By guaranteeing energy savings, uptime, or emissions reductions, providers can differentiate through tangible commitments that resonate with sustainability goals and budgetary constraints.

Forging cross-industry partnerships with technology vendors, financial institutions, insurance underwriters, and cybersecurity firms is essential to de-risk deployments, secure green financing, and offer warranty-backed resilience guarantees that exceed traditional force majeure clauses. These alliances also facilitate bundled value propositions that address holistic client requirements, from deployment to ongoing risk management.

Investing in digital ecosystem integration is critical. Deploying IoT sensors, AI-driven digital twins, and advanced analytics platforms enables predictive maintenance, real-time pricing, and seamless aggregation of distributed energy resources. This digital backbone not only improves operational efficiency but also delivers insights that fuel continuous service innovation.

To navigate escalating component costs and supply chain disruptions, providers must diversify sourcing strategies, cultivate local manufacturing partnerships, and negotiate long-term off-take agreements with equipment suppliers. Such measures mitigate exposure to tariff-induced volatility and ensure project timelines remain on track.

Finally, tailoring approaches to regional market conditions and policy landscapes will drive adoption. Engaging with regulators on incentive structures, performance-based tariffs, and digital grid initiatives - as seen in the EU’s digitalisation roadmap and Australia’s DER aggregation pilots - ensures solutions are fit-for-purpose and supported by enabling frameworks.

Detailing Rigorous Research Methodology, Data Collection Approaches, and Analytical Frameworks Underpinning the Energy-as-a-Service Market Analysis

This analysis draws on a comprehensive research methodology combining primary and secondary data sources. Primary research included in-depth interviews with C-suite executives, project developers, regulatory officials, and technology providers to capture firsthand insights into strategic priorities, operational challenges, and emerging business models. Supplementing these dialogues, vendor briefings and participant observation at industry events provided context on solution capabilities and partnership ecosystems.

Secondary research incorporated rigorous desk analysis of policy documents, technical standards, and published reports from authoritative institutions, including the International Energy Agency and trade associations. Data was triangulated through cross-validation across multiple sources to ensure consistency and reliability. Key tariff measures and regulatory developments were verified against official government publications and credible news outlets.

Analytical frameworks employed include segmentation mapping, SWOT assessment, and scenario analysis to evaluate market dynamics under varying policy and technology adoption trajectories. Regional deep dives were informed by macroeconomic indicators, incentive structures, and infrastructure development plans. Competitive positioning was assessed through market share estimations, partnership networks, and M&A activity tracking.

Quality assurance protocols involved multiple rounds of internal review by subject matter experts and editorial oversight to maintain factual accuracy, clarity, and coherence. All findings and recommendations are underpinned by verifiable sources, ensuring robust support for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Energy-as-a-Service market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Energy-as-a-Service Market, by Service Model

- Energy-as-a-Service Market, by Business Model

- Energy-as-a-Service Market, by End User

- Energy-as-a-Service Market, by Service Provider

- Energy-as-a-Service Market, by Region

- Energy-as-a-Service Market, by Group

- Energy-as-a-Service Market, by Country

- United States Energy-as-a-Service Market

- China Energy-as-a-Service Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2226 ]

Concluding Reflections on the Imperatives, Opportunities, and Strategic Pathways Shaping the Future of Energy-as-a-Service Adoption and Growth

Energy-as-a-Service has transcended early adopter phases to emerge as a foundational paradigm in the quest for resilient, low-carbon energy systems. By abstracting complex asset lifecycles into performance-driven service agreements, EaaS enables organizations to access advanced technologies, optimize capital deployment, and align operational incentives with sustainability objectives.

The convergence of decentralization, digitalization, and novel financing structures has created a fertile environment for EaaS innovations, yet navigating tariff volatility, supply chain uncertainties, and regulatory diversity remains critical. Stakeholders that integrate robust segmentation strategies, invest in digital capabilities, and cultivate strategic partnerships will be best positioned to capture the market’s growth potential.

As regional drivers vary - from incentive-rich North American jurisdictions to emerging Asia-Pacific markets and evolving EMEA frameworks - tailored approaches anchored in local policy engagement and ecosystem collaboration will drive competitive differentiation. Leading providers that embrace outcome-based contracts, expand their service scope, and embed resilience into their offerings will shape the trajectory of energy transformation.

Ultimately, the maturation of Energy-as-a-Service hinges on stakeholder collaboration across technology, finance, and policy domains. By implementing the recommendations outlined herein and leveraging the detailed insights into segmentation, regional dynamics, and competitive positioning, industry leaders can forge the strategic pathways needed to realize the full promise of EaaS and accelerate the global energy transition.

Empowering Your Strategic Decisions with Expert Guidance from Ketan Rohom to Secure the Detailed Energy-as-a-Service Market Research Report and Unlock Critical Intelligence

Ready to Turn Insight into Impact?

Elevate your strategic planning with the most comprehensive and actionable intelligence in the Energy-as-a-Service market. Ketan Rohom, Associate Director, Sales & Marketing, brings unparalleled expertise and personalized guidance to help you navigate complex service models, evolving business frameworks, and regional dynamics. Through a collaborative consultation, you will uncover high-value opportunities, assess competitive positioning, and fine-tune your go-to-market strategies to achieve rapid returns and sustainable growth.

Secure your detailed Energy-as-a-Service market research report today and unlock critical intelligence that empowers decisive action and transforms your energy initiatives into measurable successes. Reach out to Ketan Rohom for a tailored briefing and embark on a data-driven journey that shapes the future of your organization’s energy strategy.

- How big is the Energy-as-a-Service Market?

- What is the Energy-as-a-Service Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?