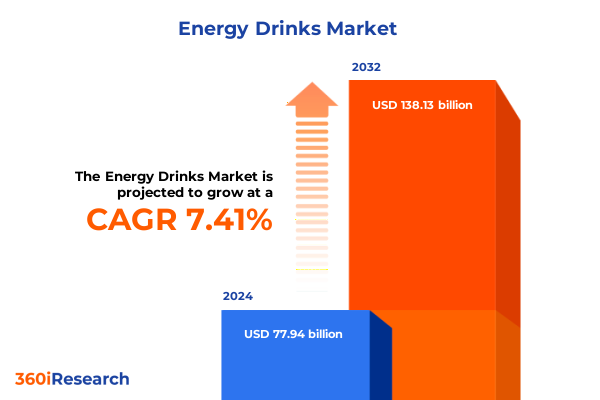

The Energy Drinks Market size was estimated at USD 83.36 billion in 2025 and expected to reach USD 89.17 billion in 2026, at a CAGR of 7.48% to reach USD 138.13 billion by 2032.

Groundbreaking Evolution of the Energy Drink Sphere Driven by Rapidly Shifting Consumer Preferences and Advanced Technological Innovations

The energy drink sector has experienced a seismic transformation over the past decade, driven by evolving consumer lifestyles and a relentless pursuit of functional enhancements. What began as a niche corner of the beverage industry catering primarily to athletes and students has expanded into a global phenomenon that intertwines health, convenience, and performance. Patrons no longer seek solely a rapid caffeine lift; instead, they demand formulations that align with holistic wellness trends, showcasing a preference for natural extracts, vitamins, and clean-label credentials. In parallel, technological advancements in formulation and production have enabled the creation of products that deliver sustained energy release without the crashes that once plagued the category.

Moreover, the proliferation of digital channels has redefined how brands connect with consumers. Social media platforms, influencer partnerships, and direct-to-consumer e-commerce have supplanted traditional retail-centric strategies, allowing brands to cultivate communities around lifestyle narratives rather than just ingredients. Consequently, the industry’s competitive landscape has expanded to include not only beverage titans but also agile start-ups adept at leveraging digital analytics to tailor product offerings in real time. As the category converges with wellness, nutrition, and technology, industry stakeholders must recalibrate their approaches to remain relevant and capture the attention of increasingly discerning consumers.

Transformational Tectonic Movements Reshaping the Energy Drink Industry Through Health Focus and Digital Engagement Strategies

A fundamental shift toward wellness-oriented products has prompted brands to adopt ingredient transparency and natural formulations. Consumers increasingly scrutinize labels, favoring formulations enriched with natural extracts such as ginseng, green tea, and yerba mate over artificial additives. Simultaneously, the emergence of novel stimulant combinations has challenged conventional caffeine-centric models, encouraging research into alternative botanicals and adaptogens that support cognitive clarity and sustained focus without jitters.

Concurrently, packaging innovations have reshaped the consumer experience, as brands experiment with lightweight aluminum cans, single-serve pouches, and functional shots designed for on-the-go convenience. These format adaptations reflect broader lifestyle shifts, catering to urban professionals, fitness enthusiasts, and remote workers who require portable solutions. Additionally, digital engagement has become a strategic imperative, with brands harnessing data analytics and social listening tools to anticipate consumer trends and launch hyper-targeted campaigns, fostering brand loyalty through personalized content and community-building initiatives.

Regulatory developments have further influenced market dynamics, as governments worldwide impose stricter labeling standards and maximum stimulant thresholds. These measures, while potentially increasing compliance costs, drive credibility and reassure consumers of product safety. Overall, the convergence of wellness narratives, packaging versatility, digital sophistication, and regulatory frameworks marks a transformative era for the energy drink industry.

Assessing the Aggregate Effects of Recent 2025 United States Tariff Policies on Energy Drink Supply Chains and Pricing Structures

In 2025, a series of tariff adjustments implemented by the United States government have materially impacted the energy drink value chain. Elevated duties on imported aluminum, which is a primary raw material for cans, have led to upward pressure on packaging costs, compelling manufacturers to re-evaluate supplier contracts and inventory strategies. This development has accelerated investments in domestic recycling initiatives aimed at reducing reliance on volatile global metal markets and mitigating cost fluctuations.

Moreover, increased import levies on certain botanical extracts and stimulants sourced from Asia have influenced recipe formulations. Brands are diversifying their ingredient portfolios by forging partnerships with domestic cultivators of natural extracts and exploring novel local alternatives, thereby strengthening supply chain resilience. In response to tariff-induced margin compression, several leading producers have engaged in price adjustments, albeit cautiously, to balance competitiveness with profitability. Some have also introduced premium lines with higher retail price points justified by enhanced ingredient quality and sustainability credentials.

Collectively, these tariff measures have catalyzed a strategic reorientation among energy drink stakeholders. Manufacturers are prioritizing vertical integration, local sourcing, and circular economy practices to mitigate external cost pressures. While tariff policies present short-term challenges, they also serve as a catalyst for innovation in sustainable packaging and ingredient sourcing, ultimately fostering a more robust, agile industry ecosystem.

In-depth Examination of Energy Drink Market Segmentation Illuminating Diverse Consumer Priorities and Ingredient Preferences

The energy drink market reveals distinct segments when examined through the lens of product classification, ingredient composition, and consumer use cases. A fundamental division emerges between conventional offerings, which rely on established stimulant blends and artificial sweeteners, and organic variants that emphasize plant-based extracts, natural sweeteners, and clean-label formulations. This dichotomy highlights divergent consumer priorities, with the former appealing to cost-conscious buyers seeking immediate efficacy and the latter resonating with health-driven individuals prioritizing ingredient provenance.

Ingredient-focused segmentation further illuminates consumer inclinations toward diverse functional attributes. Flavors range from classic cola bases to vibrant fruit infusions and nuanced herbal blends, while natural extracts like ginseng, green tea extract, and yerba mate underpin demand for botanical benefits. Stimulant categories encompass traditional caffeine sources alongside guarana and taurine, complemented by sweeteners that span artificial and natural alternatives, and nutrient profiles dominated by B vitamins and electrolytes. Packaging choices reflect lifestyle requirements, with bottles and cans serving everyday consumption, pouches and shots facilitating on-the-go use, and tetra packs offering multipack convenience for extended consumption occasions.

Functional segmentation underscores the multifaceted motivations driving purchases, spanning energy boosts, enhanced focus, hydration and recovery support, mental alertness, mood elevation, and physical endurance. Demographic segmentation illustrates adults and teenagers as core consumer cohorts, each engaging with the category for distinct purposes-young adults gravitate toward performance and social contexts, whereas adult professionals value sustained concentration. Distribution channels bifurcate into offline channels like convenience stores, pharmacies, specialty outlets, supermarkets, and hypermarkets, and online avenues comprising branded websites and e-commerce marketplaces. End-use segmentation highlights consumption across bars and clubs, cafes and restaurants, corporate environments, gyms and fitness centers, household retail use, and sports events arenas, reflecting the category’s versatility across social and functional contexts.

This comprehensive research report categorizes the Energy Drinks market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Ingredient Type

- Packaging Type

- Function

- Consumer

- Distribution Channel

- End Use

Exploring Regional Dynamics Unveiling Distinct Consumption Patterns Across the Americas, EMEA, and the Asia-Pacific Energy Drink Markets

Regional variations in energy drink consumption and innovation highlight unique market dynamics across the globe. In the Americas, consumer appetite remains robust, driven by entrenched brand loyalty and a well-established distribution infrastructure. The United States leads with a fragmented landscape where both global giants and regional craft brands compete vigorously, while Canada exhibits a growing penchant for natural and organic formulations. Throughout Latin America, urbanization and rising disposable incomes have spurred demand for affordable, on-the-go energy solutions.

Europe, the Middle East, and Africa present a mosaic of regulatory environments and consumer sensibilities. Western European markets show mature patterns, with growth concentrated in premium and organic segments and heightened scrutiny over ingredient transparency. In the Middle East, youthful demographics and lifestyle aspirations fuel demand for functional beverages, prompting brands to incorporate regional flavors and halal certifications. African markets, though nascent, reveal potential in key urban centers, where infrastructural challenges coexist with a rising middle class seeking aspirational products.

The Asia-Pacific region stands out for its rapid innovation cycles and diverse consumption rituals. Countries such as China and India exhibit exponential growth driven by mobile-first distribution models and local brand emergence, while Japan and South Korea favor smaller formats and functional shots. Southeast Asian markets blend global brand penetration with vibrant local favorites, often integrating traditional botanicals. Across the region, digital commerce and social media-driven product discovery accelerate market progression, making Asia-Pacific a dynamic frontier for energy drink evolution.

This comprehensive research report examines key regions that drive the evolution of the Energy Drinks market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Comprehensive Analysis of Leading Energy Drink Providers Highlighting Strategic Movements Innovations and Competitive Positioning in 2025

Leading energy drink providers continue to reshape the competitive landscape through strategic collaborations, product innovations, and sustainability commitments. Global market leader Red Bull sustains its dominance by expanding its functional portfolio and leveraging high-profile sports sponsorships, reinforcing brand association with extreme performance and lifestyle culture. Its investments in eco-friendly packaging and carbon offset initiatives further strengthen its market position among environmentally conscious consumers.

Monster Beverage Corporation leverages aggressive brand diversification, introducing sub-brands that target niche consumer segments, such as low-calorie formulas and herbal-infused variants. The company’s partnerships with music festivals and gaming events bolster engagement with younger demographics, while expanded distribution through non-traditional channels enhances accessibility. PepsiCo’s energy drink offerings benefit from its expansive beverage infrastructure, integrating energy formulations into established bottling networks and co-promoting with complementary snacks and hydration products.

Emerging challengers like Celsius and premium organic players have gained traction by capitalizing on health and wellness narratives, offering transparent ingredient lists and unique flavor profiles. Their success has prompted incumbents to accelerate R&D pipelines focused on adaptogens, cognitive enhancers, and personalized nutrition. Moreover, strategic alliances with fitness studios and digital fitness platforms underscore the growing intersection between energy drinks and active lifestyle ecosystems, compelling legacy brands to innovate consistently to maintain relevance.

This comprehensive research report delivers an in-depth overview of the principal market players in the Energy Drinks market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amway Corp

- AriZona Beverages USA, LLC

- Carabao Group Public Company Limited

- Celsius, Inc.

- DD USA ORGANIC LLC

- Global Functional Drinks AG

- Hell Energy Magyarország Kft.

- Hype Energy Drinks

- Keurig Dr Pepper, Inc

- Living Essentials Marketing, LLC

- Monster Beverage Corporation

- National Beverage Corp.

- Osotspa Public Company Limited

- PepsiCo, Inc.

- Red Bull GmbH

- Suntory Holdings Limited

- T.C. Pharmaceutical Industries Company Limited

- Taisho Pharmaceutical Holdings Co. Ltd.

- Tenzing Natural Energy Ltd

- The Coca-Cola Company

- Xyience, Inc.

Actionable Strategic Imperatives for Energy Drink Stakeholders to Navigate Emerging Trends and Capitalize on Growth Opportunities

Energy drink stakeholders seeking sustainable growth must prioritize ingredient innovation that aligns with evolving health paradigms. By expanding natural extract portfolios and reducing reliance on artificial additives, brands can capture health-driven consumer segments and differentiate their offerings. Simultaneously, packaging sustainability should be elevated from a compliance concern to a core brand narrative, integrating recycled materials and lightweight formats that enhance on-the-go convenience without compromising environmental goals.

In addition, cultivating direct-to-consumer relationships through proprietary e-commerce platforms and social media communities will yield actionable insights and foster brand loyalty. Tailored subscription models and personalized product recommendations can drive repeat purchases and unlock incremental revenue streams. Diversification of distribution strategies, including partnerships with fitness centers, corporate wellness programs, and experiential events, will further broaden touchpoints and embed products within targeted lifestyle contexts.

Navigating tariff-driven cost pressures necessitates supply chain agility and risk mitigation tactics. Developing strategic alliances with domestic ingredient suppliers and investing in local production capacities can buffer against import levies while reinforcing quality assurance. Finally, leveraging advanced analytics and consumer intelligence tools will enable precise segmentation and market forecasting, ensuring that product innovations and marketing initiatives resonate with distinct audience cohorts and maximize ROI across channels.

Rigorous Multi-Method Research Protocols Ensuring Robust and Reliable Insights Into the Evolving Energy Drink Market Landscape

This research employs a comprehensive methodology that integrates both qualitative and quantitative approaches to deliver a nuanced perspective on the energy drink sector. Primary data collection involved in-depth interviews with key industry stakeholders, including formulators, supply chain managers, and retail executives, to capture nuanced perspectives on ingredient sourcing, regulatory compliance, and channel dynamics. These insights were complemented by consumer surveys designed to assess evolving preferences, purchase drivers, and brand perceptions across demographic cohorts.

Quantitative analysis leveraged trade data, retail scanner information, and financial disclosures from publicly listed beverage companies to triangulate trends in packaging innovation, ingredient adoption, and distribution shifts. Advanced statistical techniques were applied to validate correlations between market drivers and performance indicators, ensuring the reliability of thematic conclusions. Furthermore, the study incorporated a rigorous supplier audit, evaluating production capacities, quality control protocols, and sustainability initiatives across leading raw material providers.

Secondary research encompassed an extensive review of academic journals, regulatory filings, and publicly available industry whitepapers to authenticate historical trends and benchmark regional strategies. Data triangulation was executed through cross-validation of multiple sources, and findings were subjected to a peer review process by internal experts to enhance objectivity. This multi-method protocol ensures the robustness, credibility, and actionable value of the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Energy Drinks market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Energy Drinks Market, by Type

- Energy Drinks Market, by Ingredient Type

- Energy Drinks Market, by Packaging Type

- Energy Drinks Market, by Function

- Energy Drinks Market, by Consumer

- Energy Drinks Market, by Distribution Channel

- Energy Drinks Market, by End Use

- Energy Drinks Market, by Region

- Energy Drinks Market, by Group

- Energy Drinks Market, by Country

- United States Energy Drinks Market

- China Energy Drinks Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2385 ]

Concise Synthesis of Core Insights Underscoring Critical Opportunities and Strategic Imperatives for Energy Drink Industry Leaders

The energy drink market continues to evolve at a remarkable pace, driven by consumer demands for health-oriented formulations, convenience-driven packaging, and immersive brand experiences. Regulatory shifts and tariff policies further shape strategic imperatives, compelling industry players to adopt agile supply chain models and local sourcing strategies. Segmentation analysis underscores the importance of personalized product positioning, while regional dynamics reveal distinct innovation trajectories across the Americas, EMEA, and Asia-Pacific.

Leading companies demonstrate that success hinges on balancing brand heritage with adaptive innovation, merging established market presence with forward-looking ingredient and packaging developments. Future growth will favor those who integrate sustainability, digital engagement, and health credentials into cohesive brand narratives. Moreover, actionable recommendations highlight the critical need for advanced analytics and direct consumer outreach to navigate a landscape characterized by heightened competition and evolving consumer expectations.

As market leaders and challengers alike strategize for the next wave of expansion, the convergence of functional wellness, experiential branding, and regulatory compliance emerges as the focal point for sustained differentiation. By leveraging robust research insights and embracing strategic agility, stakeholders can unlock new growth avenues and solidify their position within this dynamic category.

Engaging Call to Action to Connect with Ketan Rohom for Exclusive Access to the Definitive Energy Drink Market Research Report

If you’re seeking a comprehensive, data-driven exploration of the energy drink sector to sharpen your competitive edge, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. His expertise in guiding industry leaders through nuanced market landscapes will ensure you receive tailored insights that align with your strategic objectives. Engage directly to explore bespoke research packages, gain deeper clarity on emerging opportunities, and secure an actionable intelligence suite designed to drive your next phase of growth. Don’t miss this opportunity to transform raw data into decisive action-contact Ketan Rohom today to purchase the definitive energy drink market research report.

- How big is the Energy Drinks Market?

- What is the Energy Drinks Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?