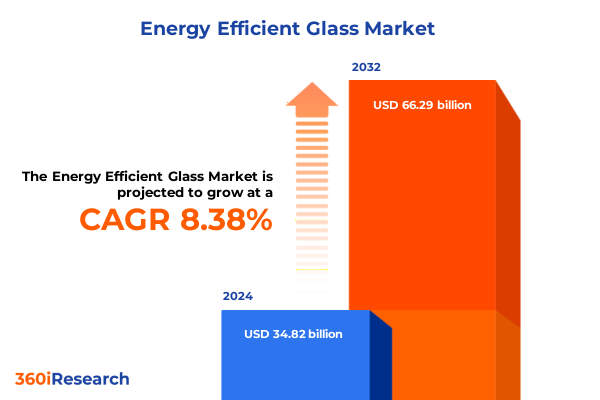

The Energy Efficient Glass Market size was estimated at USD 37.74 billion in 2025 and expected to reach USD 40.91 billion in 2026, at a CAGR of 8.37% to reach USD 66.29 billion by 2032.

Setting the Stage for a Greener Tomorrow with an In-Depth Look at the Evolution and Strategic Importance of Energy Efficient Glass Solutions

Energy efficient glass has emerged as a cornerstone of sustainable building practices, revolutionizing how architects, developers, and engineers approach the design of both new and existing structures. Over the past decade, rapid advancements in coating technologies, dynamic glazing systems, and insulating glass units have elevated performance benchmarks for thermal regulation, solar control, and occupant comfort. As global energy demands continue to rise and environmental targets become more stringent, the strategic application of high-performance glass solutions has demonstrated a significant potential to reduce operational carbon emissions and enhance indoor environmental quality.

In parallel with technological innovation, regulatory mandates and voluntary green building certifications have increasingly incentivized the adoption of energy efficient glazing. The U.S. Environmental Protection Agency’s recent rollout of the Version 7.0 Energy Star Specification for residential windows, doors, and skylights underscores the sector’s commitment to continuous improvement. Version 7.0 criteria, effective October 2023, lowered U-factor requirements and broadened prescriptive pathways for triple glazing and fourth-surface low-E coatings, driving widespread market adaptation of higher-performing products.

Consequently, stakeholders across the value chain-from raw material suppliers to fabricators and installers-are placing a premium on innovative glass formulations that balance thermal performance with cost-effectiveness. This introductory section frames the critical drivers shaping energy efficient glass markets today, setting the stage for a deeper exploration of transformative shifts, policy impacts, and segmentation insights that will define the industry’s trajectory.

Exploring Fundamental Transformations Shaping the Energy Efficient Glass Landscape Driven by Innovation, Regulation, and Sustainability Imperatives

The energy efficient glass landscape is undergoing fundamental transformations fueled by converging forces of regulation, sustainability imperatives, and technological breakthroughs. Advancements in building energy codes have elevated glazing performance requirements, prompting manufacturers to invest heavily in research and development. For example, the California Energy Commission’s 2025 Title-24 Building Energy Efficiency Standards mandate a maximum U-factor of 0.58 for residential fenestration and introduce on-site renewable energy credits for new construction, thereby compelling greater adoption of high-performance glass assemblies. Furthermore, emerging International Energy Conservation Code updates and ASHRAE 90.1 revisions are expected to push energy savings goals even higher, reinforcing the demand for innovative glazing solutions.

Simultaneously, the green building movement continues to gain momentum, with leadership in energy and environmental design (LEED) and the WELL Building Standard providing clear benchmarks for occupants’ health, comfort, and productivity. These voluntary frameworks often exceed baseline code requirements, encouraging the integration of dynamic glass, electrochromic coatings, and vacuum insulated panels to achieve targeted performance credits. As a result, partnerships between glass manufacturers and building technology providers are proliferating, transforming static building envelopes into intelligent, responsive façades.

Moreover, the industry’s focus on lifecycle sustainability is driving collaborative efforts to reduce embodied carbon and adopt circular economy principles. Glass producers are exploring novel furnace technologies, cullet utilization, and alternative fuel sources to minimize manufacturing emissions before products even reach construction sites. These parallel transformations in policy, practice, and production underline a pivotal moment for energy efficient glass, where multi-disciplinary alignment is essential to unlock both environmental and economic value.

Assessing the Cumulative Consequences of the 2025 United States Trade and Environmental Tariffs on Energy Efficient Glass Import Dynamics

In 2025, the United States enacted a series of trade and environmental tariffs that collectively heightened the costs and complexities of importing energy efficient glass products. An Executive Order introduced in April established an additional ad valorem tariff of 10 percent on all imports, followed days later by country-specific duties for trading partners, affecting goods entering after April 9, 2025. This reciprocal tariff action broadly targeted manufacturing inputs, with energy efficient glass materials among the affected categories, thereby elevating landed costs and spurring supply chain reassessments.

Concurrently, the Foreign Pollution Fee Act of 2025 introduced a pollution-based tariff scheme that levies a baseline 15 percent fee on imported glass products with a higher carbon footprint than their U.S. counterparts. This Act incentivizes suppliers to source from lower-emission production facilities or procure carbon credits to mitigate duty liabilities. Consequently, manufacturers and downstream fabricators are recalibrating sourcing strategies to manage increased duty burdens and maintain competitiveness.

The combined effect of these measures has driven accelerated interest in domestic production capabilities and spurred investments in low-carbon manufacturing technologies. By internalizing more of their glass supply chains, companies aim to avoid tariff exposure and meet evolving environmental regulations. As a result, the 2025 tariff landscape has not only reshaped import dynamics but also catalyzed a broader shift toward resilient, emissions-aware supply networks.

Uncovering Critical Segmentation Insights Guiding Market Differentiation Across Product Types, Technologies, End Users, Applications, and Distribution Pathways

Evaluating the energy efficient glass market through the lens of product type, we observe that insulated glass units remain a foundational offering, with air-filled and gas-filled variants supplying residential and commercial applications alike. Laminated and tinted glasses continue to serve niche requirements for safety and solar control, while the low emissivity segment has bifurcated into hard coat and soft coat technologies to balance cost and performance. Smart glass, encompassing electrochromic and thermochromic glazing, is carving out a distinct trajectory, driven by demand for occupant comfort and facade intelligence.

On the technology front, double and triple glazing solutions are widely deployed across climates seeking superior R-values, whereas vacuum insulated glass is emerging as a premium solution for ultra-high performance projects. Dynamic coatings, whether passive or integrated with predictive control software, are rapidly gaining traction in markets emphasizing smart building operations.

End-user segmentation reveals distinct adoption patterns: automotive glass innovations focus on laminated sound-dampening and solar control, while commercial construction prioritizes retrofit and new construction glazing solutions to meet tightening energy codes. Industrial users seek specialized glass for process and safety applications, and residential demand is split evenly between new build and renovation sectors, each with unique performance and aesthetic priorities.

Applications further differentiate market needs, spanning curtain walls, skylights, windows, doors, and specialty facades, with evolving design trends driving form-factor innovation. Finally, distribution pathways-from direct sales arrangements and distributor partnerships to online retail platforms and traditional retail channels-shape how manufacturers reach end users. Taken together, these segmentation dimensions provide a granular framework for understanding market drivers and competitive positioning without relying on oversimplified bullet categorizations.

This comprehensive research report categorizes the Energy Efficient Glass market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- End User

- Application

- Distribution Channel

Illuminating Regional Market Dynamics and Strategic Drivers Across the Americas, Europe Middle East & Africa, and Asia-Pacific in Energy Efficient Glass

Regional dynamics play a pivotal role in shaping the energy efficient glass market, with the Americas, EMEA, and Asia-Pacific each presenting distinct drivers and challenges. In the Americas, stringent state-level building energy codes and federal incentives for decarbonization continue to underpin demand. California’s progressive Title-24 regulations and voluntary green certification programs drive adoption of high-performance glazing, while Canada’s CO2 emissions targets and regional BIPV initiatives amplify market opportunities.

EMEA is characterized by robust regulatory mandates under the European Green Deal and the recast Energy Performance of Buildings Directive, which elevates requirements for nearly-zero and zero-emission buildings. EU member states are mobilizing funding through the Renovation Wave strategy to accelerate deep building retrofits, placing energy efficient glass at the forefront of façade upgrades and retrofit programs. The Middle East is witnessing rapid urban development and sustainability-driven landmark projects, further broadening the addressable market.

Asia-Pacific exhibits high growth potential due to urbanization, rising environmental standards, and government initiatives in China, Japan, and India to reduce building energy intensity. China’s Five-Year Plan emphasizes energy conservation, leading to preferential treatment for low-carbon glazing. Meanwhile, Japan’s Top Runner Program compels manufacturers to continuously improve performance, and India’s Eco-Niwas Samhita building code update highlights the critical role of high-performance fenestration. Collectively, these regional insights underscore the necessity for localized strategies that align with evolving standards, incentives, and project pipelines.

This comprehensive research report examines key regions that drive the evolution of the Energy Efficient Glass market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Strategic Competitive Movements Shaping the Energy Efficient Glass Market’s Competitive Landscape

Industry leaders are leveraging strategic investments and cutting-edge innovations to capture value in the evolving energy efficient glass sector. Guardian Glass, for instance, has recently commissioned a low-energy Prium Float-Melt furnace in Luxembourg that employs a heat-recovery system to preheat oxygen and natural gas, reducing fuel consumption by an estimated 25 percent and carbon dioxide emissions by around 20 percent compared to conventional air-fuel technology. In addition, its partnership with Glass Futures has facilitated pilot-scale testing of electric melting technologies and CCUS demonstrations, underscoring a commitment to decarbonization across manufacturing sites.

SageGlass by Saint-Gobain continues to drive innovation in dynamic electrochromic glazing. The launch of RealTone™ in early 2025 eliminates the traditional bluish tint of electrochromic glass, delivering natural color rendering while preserving glare control and thermal regulation functionalities. This aesthetic breakthrough addresses a key pain point for architects and enhances SageGlass’s ability to integrate smart glazing seamlessly into premium commercial and institutional projects.

View Inc. remains a prominent smart glass pioneer, having installed its fourth-generation dynamic glazing products across more than 48 million square feet of global building space. Its Smart Building Platform integrates environmental sensing, AI-driven light management, and predictive analytics to optimize occupant comfort and energy performance. Despite recent financial restructuring, the company’s R&D focus on modular glazing systems and digital interfaces underscores an enduring commitment to elevating façade intelligence. Together, these strategic initiatives by key market participants illustrate the competitive dynamics and innovation pathways steering the energy efficient glass industry.

This comprehensive research report delivers an in-depth overview of the principal market players in the Energy Efficient Glass market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGC Glass Europe SA

- AGC Inc.

- Asahi India Glass Limited

- Cardinal Glass Industries, LLC

- Central Glass Co., Ltd.

- Corning Incorporated

- CSG Holding Co., Ltd.

- DuPont de Nemours, Inc.

- Guardian Industries Holdings

- Jinjing Group Co., Ltd.

- KAPHS S.A.

- Kibing Group

- Morley Glass & Glazing Ltd.

- Nippon Sheet Glass Co., Ltd.

- PPG Industries, Inc.

- Saint-Gobain S.A.

- SCHOTT AG

- Sedak GmbH & Co. KG

- Taiwan Glass Industry Corporation

- Vitro, S.A.B. de C.V.

- Xiamen Togen Building Products Co., Ltd.

- Xinyi Glass Holdings Limited

- Şişecam Group

Delivering Actionable Strategic Recommendations to Navigate Tariff Pressures and Capitalize on Emerging Opportunities in Energy Efficient Glass

To succeed amid tariff headwinds, regulatory shifts, and intensifying competition, industry leaders must adopt forward-leaning strategies. First, investing in domestic manufacturing capabilities will mitigate exposure to import duties and strengthen supply chain resilience. Establishing localized production hubs, especially in regions with favorable tax incentives or low-carbon energy sources, can yield both cost advantages and ESG credibility.

Second, accelerating R&D in low-carbon manufacturing and advanced glass compositions, such as vacuum insulating glass and novel electrochromic interlayers, will address both performance demands and environmental mandates. Collaborative research consortia with academic institutions and industry alliances like Glass Futures can expedite commercialization of breakthrough technologies.

Third, engaging proactively with policymakers and code bodies is vital to shape pragmatic yet ambitious performance standards. By offering technical expertise during rulemaking, companies can ensure realistic compliance pathways and guard against unintended cost escalations.

Finally, embracing digital tools-from AI-driven design optimization to blockchain-enabled carbon accounting-will enhance transparency across value chains and reinforce product differentiation. Implementing digital product passports and performance analytics platforms can deepen customer relationships and unlock recurring revenue streams. These actionable steps will enable industry stakeholders to navigate complex market dynamics and unlock sustainable growth.

Detailing a Robust Research Methodology Integrating Primary Expert Insights and Comprehensive Secondary Data for Unbiased Market Analysis

This report’s methodology integrates rigorous secondary research with targeted primary insights to ensure comprehensive market coverage and analytical integrity. An initial landscape review drew upon publicly available sources, including regulatory documents, trade publications, and peer-reviewed studies, to map the evolution of performance standards and technology roadmaps.

Subsequently, in-depth interviews were conducted with C-level executives, R&D leaders, and supply chain specialists across glass manufacturing, building design, and construction segments. These dialogues provided real-world perspectives on tariff impacts, product innovation cycles, and regional market nuances. A diverse panel of experts from North America, EMEA, and Asia-Pacific validated emerging trends and stress-tested preliminary findings to ensure global applicability.

Data triangulation techniques-cross-referencing company disclosures, public filings, and market intelligence databases-were employed to enhance data accuracy and uncover proprietary insights. Quantitative analysis was complemented by qualitative case studies, highlighting exemplar projects and vendor strategies.

Finally, all findings were subjected to an internal quality assurance process involving editorial review and fact-checking against primary sources. This methodology ensures that the report delivers an unbiased, actionable roadmap for stakeholders navigating the dynamic energy efficient glass landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Energy Efficient Glass market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Energy Efficient Glass Market, by Product Type

- Energy Efficient Glass Market, by Technology

- Energy Efficient Glass Market, by End User

- Energy Efficient Glass Market, by Application

- Energy Efficient Glass Market, by Distribution Channel

- Energy Efficient Glass Market, by Region

- Energy Efficient Glass Market, by Group

- Energy Efficient Glass Market, by Country

- United States Energy Efficient Glass Market

- China Energy Efficient Glass Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding Insights Highlighting Key Takeaways and Sustained Strategic Imperatives for the Evolving Energy Efficient Glass Market

Energy efficient glass stands at the nexus of technological innovation, regulatory mandates, and sustainability imperatives. Throughout this executive summary, we have explored the foundational role of advanced glazing systems in driving energy savings, improving occupant comfort, and reducing carbon footprints. Transformative shifts-ranging from tightened building codes and green building certifications to groundbreaking materials science-underscore a sector in the midst of rapid evolution.

The 2025 U.S. tariffs exemplify the complex interplay between trade policy and environmental objectives, prompting a strategic pivot toward domestic manufacturing and low-carbon supply chains. Detailed segmentation and regional analyses reveal the nuances of market demand and competition across product types, end-use sectors, and geographies. Moreover, key corporate players are actively redefining industry standards through sustainable manufacturing investments and aesthetic-driven glazing innovations.

Actionable recommendations emphasize the importance of alignment with policy frameworks, investment in next-generation technologies, and the deployment of digital tools to enhance market responsiveness. Underpinning these insights is a rigorous research methodology that blends secondary intelligence with primary expert contributions, ensuring both depth and accuracy.

In conclusion, energy efficient glass represents a critical enabler of decarbonized, resilient built environments. The strategic imperatives outlined herein serve as a blueprint for industry stakeholders to seize competitive advantage and contribute meaningfully to global sustainability goals.

Drive Informed Decision Making Today and Engage Ketan Rohom to Secure the Complete Energy Efficient Glass Market Research Report

Engage with Ketan Rohom to unlock unparalleled insights and equip your organization with strategic intelligence on energy efficient glass. By securing the comprehensive market research report, you will gain access to in-depth analyses, proprietary data, actionable recommendations, and a forward-looking perspective on technological advancements. This essential resource is designed to empower decision-makers across manufacturing, construction, finance, and regulatory sectors to anticipate market shifts and capitalize on emerging opportunities. Connect with Ketan Rohom, Associate Director, Sales & Marketing, to discuss your specific objectives, request a tailored proposal, and arrange for immediate delivery of the report to inform your next strategic move.

- How big is the Energy Efficient Glass Market?

- What is the Energy Efficient Glass Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?