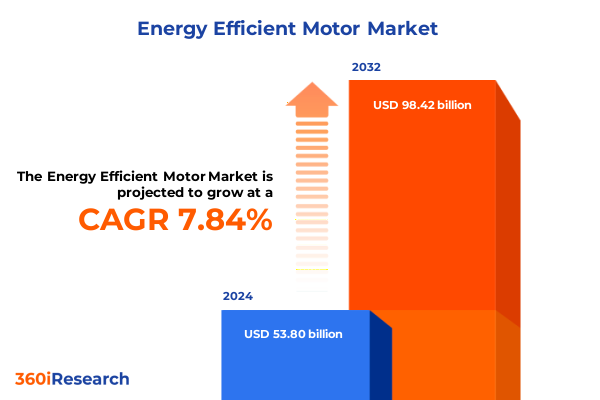

The Energy Efficient Motor Market size was estimated at USD 57.84 billion in 2025 and expected to reach USD 62.22 billion in 2026, at a CAGR of 7.88% to reach USD 98.42 billion by 2032.

Discovering How Energy Efficient Motors Drive Industrial Sustainability and Operational Excellence Across Global Manufacturing Landscapes

Discovering How Energy Efficient Motors Drive Industrial Sustainability and Operational Excellence Across Global Manufacturing Landscapes

In the pursuit of reducing energy consumption and minimizing environmental impact, energy efficient motors have emerged as a cornerstone technology for manufacturers and infrastructure operators globally. These advanced electric machines offer optimized performance through refined electromagnetic designs, improved materials, and precision manufacturing processes, resulting in lower power losses, extended operational lifecycles, and reduced total cost of ownership. As organizations grapple with rising energy prices, tightening regulations, and corporate sustainability mandates, the adoption of these motors has become a critical component of long-term strategy.

Moreover, the evolution of digitalization has empowered stakeholders to harness real-time monitoring and predictive maintenance capabilities, further enhancing the value proposition of energy efficient motors. By integrating intelligent sensors, variable frequency drives, and IoT-enabled analytics platforms, operators can track performance metrics, detect anomalies, and implement timely interventions that prevent unplanned downtime. This convergence of high-efficiency hardware and data-driven management tools paves the way for unprecedented levels of productivity and carbon footprint reduction.

Transitioning to energy efficient motors is not merely a compliance exercise but a strategic investment in resilience. As global markets continue to fluctuate and emission targets grow more stringent, organizations that proactively upgrade their motor fleets will secure lasting competitive advantage. Consequently, understanding the drivers, benefits, and implementation best practices has never been more essential for decision-makers looking to future-proof operations and lead the charge toward sustainable industry.

Examining the Technological Innovations and Stringent Regulatory Transformations Driving the Evolution of Energy Efficient Motor Solutions Worldwide

Examining the Technological Innovations and Stringent Regulatory Transformations Driving the Evolution of Energy Efficient Motor Solutions Worldwide

Recent years have witnessed a remarkable acceleration in motor technology, marked by breakthroughs in electrical steel alloys, refined rotor-stator geometries, and advanced coatings that minimize friction and thermal losses. These innovations have enabled manufacturers to achieve premium and super premium efficiency tiers that deliver substantial energy savings compared to legacy designs. Concurrently, industry bodies and government agencies across major markets have instituted more rigorous minimum energy performance standards, compelling original equipment manufacturers and end-users to upgrade their installations or face non-compliance penalties.

In parallel, the digitization wave has introduced machine learning algorithms capable of optimizing motor control in real time, adapting to varying load conditions to maintain peak efficiency. These adaptive drives not only reduce electrical consumption but also extend motor lifespan by mitigating mechanical stress. The integration of condition monitoring systems further enhances reliability, offering deep insights into vibration patterns, temperature trends, and other critical health indicators. Consequently, the motor ecosystem is evolving into a cohesive network of hardware, software, and data analytics that collectively advance operational excellence.

As a result of these transformative shifts, the landscape is becoming increasingly competitive, driving firms to invest heavily in R&D and strategic partnerships. This competitive environment fosters continuous improvement, accelerates time to market for next-generation solutions, and ultimately elevates industry benchmarks. Forward-thinking organizations that embrace these technological and regulatory changes will not only comply with emerging mandates but also harness the full potential of digitalized, high-efficiency motor systems to stay ahead of the curve.

Analyzing How 2025 United States Tariffs Are Reshaping Supply Chains and Cost Structures in the Energy Efficient Motor Landscape

Analyzing How 2025 United States Tariffs Are Reshaping Supply Chains and Cost Structures in the Energy Efficient Motor Landscape

In 2025, the United States introduced a revised tariff schedule targeting select components and subassemblies critical to motor manufacturing, particularly those originating from certain key export markets. These measures have driven a reconfiguration of established supply chains, prompting manufacturers to evaluate nearshoring options to mitigate duty exposure and logistical complexities. Companies that previously relied on offshore sourcing for specialized stator laminations or high-grade bearings are now exploring domestic partnerships or vertical integration strategies to maintain product availability and cost discipline.

Furthermore, the increased import duties have had ripple effects on production economics, leading to higher base motor prices and tighter margin pressures for distributors and OEMs. In response, many suppliers are renegotiating long-term agreements, diversifying their supplier base, and implementing value-engineering initiatives to offset additional costs without compromising efficiency performance. Some industry participants have also accelerated investments in localized fabrication facilities, seeking to capitalize on incentives offered by state and federal programs aimed at bolstering domestic manufacturing of energy-sensitive components.

These tariff-driven adjustments underscore the importance of agile sourcing and dynamic cost management. Organizations that proactively map their supply chain dependencies and recalibrate their procurement strategies have been able to sustain competitive pricing, preserve delivery lead times, and maintain strong customer relationships. As the U.S. protective measures continue to evolve, market players must remain vigilant and adaptive to safeguard operational continuity and financial health.

Unlocking Diverse Market Segments Through Efficiency Standards, Motor Types, Performance Ratings, Installation Modes, Application Areas, and End-User Profiles

Unlocking Diverse Market Segments Through Efficiency Standards, Motor Types, Performance Ratings, Installation Modes, Application Areas, and End-User Profiles

Detailed examination of the market reveals that efficiency standards serve as a primary differentiator, with product offerings spanning from the foundational standard efficiency class to the highest super premium tier. Each classification corresponds to unique performance thresholds and certification protocols, driving distinctive purchasing priorities among stakeholders focused on regulatory compliance or maximal energy savings. Equally, the dichotomy between alternating current and direct current motor types highlights use-case specificity, as AC solutions dominate high-power industrial applications while DC variants offer precise speed control for specialized scenarios.

Beyond these core dimensions, output rating considerations further segment demand based on power capacity ranges, accommodating small-scale automation tasks, mid-range operational drives, or heavy-duty installations exceeding 90 kilowatts. Installation environment also shapes product selection, as designs optimized for open drip proof conditions excel in accessible, controlled settings, whereas totally enclosed architectures deliver robust protection against dust, moisture, and harsh external influences. Application-based positioning underscores motors’ adaptability in diverse systems, from fluid transport pumps and refrigeration units to material handling conveyors, HVAC setups, and compressor assemblies.

Finally, end-user classification delineates how commercial, industrial, and residential stakeholders prioritize attributes such as upfront capital investment, maintenance simplicity, and energy cost savings. This multi-layered segmentation framework illuminates nuanced purchasing behaviors, enabling suppliers to tailor their portfolios and messaging to resonate with each audience’s operational imperatives and performance expectations.

This comprehensive research report categorizes the Energy Efficient Motor market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Motor Type

- Output Rating

- Phase

- Efficiency Level

- Application

- End-User

- Distribution Channel

Comparing Critical Market Dynamics and Adoption Trends Across the Americas, Europe Middle East & Africa, and Asia-Pacific Regions

Comparing Critical Market Dynamics and Adoption Trends Across the Americas, Europe Middle East & Africa, and Asia-Pacific Regions

In the Americas, strong regulatory impetus and incentive programs have accelerated the uptake of high-efficiency motor retrofits and new installations. This momentum is driven by federal efficiency mandates complemented by state-level rebate initiatives, fostering a favorable environment for distributors and integrators focusing on energy optimization solutions. Conversely, Europe, the Middle East & Africa region exhibits a blend of mature Western European markets with stringent eco-design requirements and emerging markets in the Middle East striving to modernize infrastructure amid rapid urbanization.

In Western Europe, harmonized standards and robust carbon pricing mechanisms have steered procurement toward premium and super premium efficiency tiers, spurring development partnerships between motor manufacturers and drive system developers. Meanwhile, in North Africa and the Gulf states, growing industrial investments and a shift toward sustainable energy portfolios have ignited demand for reliable, low-maintenance motor solutions capable of performing in challenging environmental conditions.

Asia-Pacific presents a heterogeneous landscape where adoption rates vary significantly. Advanced economies such as Japan and South Korea continue to pioneer ultra-efficient motor technologies, supported by comprehensive R&D ecosystems and government subsidies. At the same time, fast-growing Southeast Asian and South Asian markets are experiencing strong growth in manufacturing and infrastructural sectors, creating incremental opportunities for efficiency-driven upgrades despite the prevalence of cost-sensitive purchasing models. Together, these regional dynamics underscore the importance of tailored go-to-market strategies that account for differing regulatory contexts, end-user sophistication, and deployment environments.

This comprehensive research report examines key regions that drive the evolution of the Energy Efficient Motor market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring Strategic Positioning and Innovation Portfolios of Leading Energy Efficient Motor Manufacturers and Suppliers Worldwide

Exploring Strategic Positioning and Innovation Portfolios of Leading Energy Efficient Motor Manufacturers and Suppliers Worldwide

Market leaders are leveraging a combination of advanced engineering, strategic alliances, and comprehensive service offerings to differentiate themselves in a competitive arena. Some firms have introduced modular motor platforms that enable rapid customization, reducing time to market while maintaining economies of scale. Others have expanded their digital ecosystem partnerships, integrating drive controls, cloud-based analytics, and lifecycle service contracts that deliver end-to-end efficiency optimization for customers.

In parallel, select companies are forging cooperation agreements with materials science innovators to pioneer next-generation insulation systems and low-loss lamination steels. These collaborations aim to elevate motor performance thresholds and achieve incremental efficiency gains that appeal to sustainability-focused buyers. Furthermore, several suppliers are broadening their aftermarket service portfolios, providing predictive maintenance subscriptions and remote diagnostics that enhance product reliability and foster long-term customer loyalty.

This strategic emphasis on holistic value propositions-blending hardware innovation, software intelligence, and turn-key service solutions-has elevated competitive dynamics. As a result, manufacturers are continuously refining their offerings, investing in designation-specific certifications, and expanding regional footprint to capture growth pockets. Stakeholders that monitor these developments can align their procurement strategies with the evolving strengths of key players and secure the best possible performance and support frameworks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Energy Efficient Motor market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Advanced Electric Machines Ltd

- Baumüller Nürnberg GmbH

- Bonfiglioli Riduttori S.p.A.

- Danfoss A/S

- Delta Electronics, Inc.

- Emerson Electric Co.

- Franklin Electric Europa GmbH

- Fuji Electric Co., Ltd.

- Hitachi, Ltd.

- Kollmorgen Corporation

- Leroy-Somer by Nidec Motor Corporation

- Menzel Elektromotoren GmbH

- Mitsubishi Electric Corporation

- Moog Inc.

- NORD Drivesystems Pvt. Ltd.

- Parker Hannifin Corporation

- Regal Rexnord Corporation

- Robert Bosch GmbH

- SEW-Eurodrive GmbH & Co KG

- Siemens AG

- Sumitomo Heavy Industries, Ltd.

- Techtop Electric Motors

- TECO-Westinghouse

- Toshiba International Corporation

- VEM Group

- Wolong Electric Group Co., Ltd

- Yaskawa Electric Corporation

Presenting Targeted Recommendations to Drive Adoption, Enhance Efficiency, and Strengthen Competitive Advantage in the Energy Efficient Motor Sector

Presenting Targeted Recommendations to Drive Adoption, Enhance Efficiency, and Strengthen Competitive Advantage in the Energy Efficient Motor Sector

Organizations aiming to maximize the benefits of energy efficient motors should begin with a comprehensive fleet assessment, identifying legacy assets with the highest potential for improvement based on runtime, load profile, and maintenance costs. Such diagnostics enable decision-makers to prioritize retrofit or replacement projects where energy savings and return on investment are most pronounced. Following this evaluation, stakeholders should engage cross-functionally to align capital expenditure plans with broader sustainability objectives and operational goals.

Additionally, sourcing strategies must balance cost considerations with long-term reliability and support. Partnering with vendors offering integrated service contracts can alleviate the burden of in-house expertise requirements, while performance guarantees incentivize suppliers to ensure optimal motor operation. Furthermore, implementing real-time monitoring systems and predictive analytics will drive continuous performance improvements by enabling proactive maintenance and minimizing unexpected downtime.

To stay ahead of regulatory and technological changes, organizations should establish dedicated cross-functional teams responsible for tracking emerging standards and evaluating next-generation technologies. Engaging with industry consortia and participating in pilot programs can provide early access to innovations, ensuring readiness to deploy new solutions as they mature. By adopting these recommendations, industry leaders can secure enhanced energy efficiency, reduced operational costs, and a robust foundation for sustainable growth.

Detailing Rigorous Methodological Framework Emphasizing Primary and Secondary Research Approaches for Energy Efficient Motor Analysis

Detailing Rigorous Methodological Framework Emphasizing Primary and Secondary Research Approaches for Energy Efficient Motor Analysis

This research employs a dual-pronged methodology, combining extensive secondary research with targeted primary engagements. The secondary phase includes a systematic review of industry publications, regulatory databases, technical white papers, and manufacturer specifications to establish a comprehensive understanding of efficiency standards, product portfolios, and market drivers. These insights form the foundational knowledge base for subsequent inquiries.

Building on this, primary research involves structured interviews and surveys with a diverse panel of stakeholders, including equipment end-users, system integrators, motor manufacturers, and component suppliers. These interactions elicit qualitative perspectives on purchasing rationales, performance expectations, and service requirements. In addition, the study incorporates data collection from key public and proprietary procurement platforms to validate sourcing trends and price benchmarks.

To ensure the robustness of conclusions, triangulation techniques are applied, comparing findings across multiple sources to identify consistencies and address discrepancies. Quantitative data undergoes rigorous validation and normalization processes, while thematic analysis of qualitative feedback reveals emerging patterns. This blended approach ensures that the research findings are both data-driven and reflective of real-world experiences.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Energy Efficient Motor market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Energy Efficient Motor Market, by Type

- Energy Efficient Motor Market, by Motor Type

- Energy Efficient Motor Market, by Output Rating

- Energy Efficient Motor Market, by Phase

- Energy Efficient Motor Market, by Efficiency Level

- Energy Efficient Motor Market, by Application

- Energy Efficient Motor Market, by End-User

- Energy Efficient Motor Market, by Distribution Channel

- Energy Efficient Motor Market, by Region

- Energy Efficient Motor Market, by Group

- Energy Efficient Motor Market, by Country

- United States Energy Efficient Motor Market

- China Energy Efficient Motor Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1590 ]

Summarizing Core Findings and Highlighting Strategic Growth Imperatives for Stakeholders in the Energy Efficient Motor Ecosystem

Summarizing Core Findings and Highlighting Strategic Growth Imperatives for Stakeholders in the Energy Efficient Motor Ecosystem

The analysis confirms that energy efficient motors represent a pivotal enabler for organizations seeking to harmonize operational performance with sustainability commitments. Technological advancements, coupled with stricter regulatory frameworks, have elevated efficiency standards and deepened the market’s complexity across performance tiers, motor types, output ratings, installation styles, application domains, and end-user segments. To capitalize on these developments, stakeholders must adopt tailored strategies that reflect the nuances of each market segment, leveraging digitalization and advanced materials to unlock incremental efficiency gains.

Moreover, regional landscapes continue to exhibit distinct adoption patterns, shaped by local regulations, incentive structures, and industrial priorities. Supply chain resilience has emerged as a critical focus area amid evolving tariff environments, necessitating agile procurement models and diversified sourcing networks. Meanwhile, leading manufacturers are differentiating their offerings through integrated solutions, spanning motor hardware, drive controls, and predictive service capabilities.

Moving forward, organizations that align their capital investments with operational insights, foster strategic partnerships, and maintain vigilance over regulatory shifts will be best positioned to thrive. These imperatives underscore the importance of informed decision-making and continuous innovation in navigating the dynamic terrain of energy efficient motor deployment.

Engage with Ketan Rohom Today to Access Comprehensive Energy Efficient Motor Market Insights and Drive Your Strategic Decision-Making

To explore deeper market insights and tailor strategies to your unique objectives, engage directly with Ketan Rohom, whose expertise in energy efficient motor market dynamics ensures you receive personalized guidance grounded in rigorous analysis and industry experience. By partnering with Ketan Rohom, you gain access to comprehensive intelligence on evolving regulatory frameworks, competitive positioning, and emerging opportunities, enabling your organization to make informed decisions with confidence. Reach out today to unlock exclusive sections of the full market research report, designed to drive operational efficiency, reduce costs, and enhance sustainability initiatives across your motor-driven processes. Investing in this research equips your team with actionable data and strategic recommendations that translate into measurable performance gains and a competitive edge in the rapidly transforming landscape of energy efficient motors.

- How big is the Energy Efficient Motor Market?

- What is the Energy Efficient Motor Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?