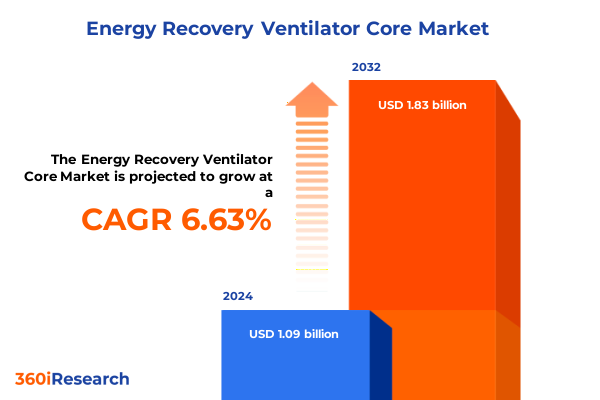

The Energy Recovery Ventilator Core Market size was estimated at USD 1.16 billion in 2025 and expected to reach USD 1.24 billion in 2026, at a CAGR of 6.66% to reach USD 1.83 billion by 2032.

Introduction to the Critical Significance and Evolving Functionality of Energy Recovery Ventilator Cores in Advanced Thermal and Moisture Exchange Applications

The energy recovery ventilator (ERV) core stands at the heart of modern ventilation strategies, providing an indispensable bridge between environmental sustainability and occupant comfort. By recovering energy from exhaust air streams and transferring it to incoming fresh air, these cores minimize thermal losses and reduce mechanical heating and cooling demands. This mechanism not only enhances indoor air quality but also aligns with increasingly stringent energy codes and green building certifications, serving as a cornerstone technology for both new construction and retrofit applications. As environmental concerns intensify and building performance standards evolve, ERV cores have emerged as a critical component in achieving balanced, high-efficiency ventilation solutions.

Over the past decade, the underlying functionality of ERV cores has advanced significantly, driven by material science innovations, digital control system integration, and enhanced manufacturing precision. Today’s cores are engineered to deliver precise moisture transfer and thermal exchange, contributing to healthier indoor environments while reducing operational carbon footprints. This executive summary presents a high-level synthesis of key dynamics shaping the ERV core landscape, encompassing transformative industry shifts, the implications of recent trade policy developments, granular segmentation insights, regional differentiators, and strategic recommendations. By situating these elements within a cohesive narrative, decision-makers can navigate both immediate priorities and long-term investment strategies with clarity and confidence.

Unveiling the Pivotal Transformations Reshaping the Energy Recovery Ventilator Core Industry Through Innovation and Regulatory Influence

The ERV core industry has undergone a series of profound shifts that redefine both product design and market positioning. Technological breakthroughs in rotating wheel and static-plate core architectures have elevated thermal efficiency benchmarks, while novel composite and polymer materials have unlocked new levels of corrosion resistance and weight reduction. Simultaneously, the proliferation of smart controls and IoT-enabled monitoring platforms has expanded the role of ERV cores beyond passive exchange modules to intelligent system components capable of real-time performance optimization and predictive maintenance scheduling.

Concurrently, tightening regulatory frameworks-encompassing national building energy codes and international sustainability protocols-have heightened demand for ventilation solutions that deliver measurable efficiencies. Incentive programs and evolving certification standards now reward superior energy recovery rates and reduced greenhouse gas emissions, reshaping procurement criteria across commercial, industrial, and residential segments. In tandem with these regulatory drivers, amplified stakeholder awareness regarding indoor air quality and operational cost containment has propelled ERV cores into the spotlight as a strategic priority for facility managers and design engineers alike. The convergence of these technological and policy forces has established a new industry paradigm, where innovation and compliance coalesce to dictate competitive advantage.

Assessing the Comprehensive Effects of 2025 United States Tariff Measures on Procurement Strategies Supply Chains and Component Costs in the ERV Core Market

In 2025, the United States government implemented a series of tariffs targeting imported core materials and finished ventilation components, fundamentally altering the cost dynamics of ERV core manufacturing and procurement. Higher duties on aluminum extrusions and specialty ceramics have amplified raw material expenditure, prompting manufacturers to reassess global supply chains and pursue closer collaboration with domestic suppliers. This shift has driven extended lead times for critical components as production capacity realigns to accommodate new sourcing patterns.

The cumulative impact of these measures extends beyond cost inflation, influencing strategic procurement choices and capital allocation decisions. Organizations have begun diversifying their vendor base to include regional fabricators capable of mitigating tariff exposure, even as they invest in material substitution programs that explore alternative polymers and composite laminates. In certain cases, manufacturers have opted to absorb incremental import costs temporarily, seeking to preserve customer relationships and maintain competitive pricing in the short term. However, as these duties remain in effect, the industry is steadily adapting through increased vertical integration and efficiency-driven process improvements. Ultimately, the tariff environment has accelerated a broader reevaluation of resilience in the ERV core supply chain, fostering a more agile and locally oriented market structure.

In-Depth Examination of Segmentation Dimensions Illuminating Diverse Opportunities Across Product Types Materials Controls Designs Technologies and Applications

Segmentation analysis reveals a richly differentiated ERV core landscape shaped by product architecture, material composition, control sophistication, and installation context. Product type diversity spans heat pipe cores that leverage counter-flow thermal exchange, plate type cores renowned for compact cross-flow configurations, rotary wheel cores optimized for continuous rotation, and run-around coil cores that afford flexible ductwork integration. Material innovation further refines this spectrum, with aluminum retaining prevalence for its thermal conductivity, ceramic emerging for high-temperature resilience, composite laminates delivering enhanced corrosion resistance, and polymer matrices providing lightweight, mold-resistant alternatives.

Control system configurations offer distinct value propositions, ranging from manual adjustments that deliver cost-effective baseline performance to fully automated smart controls that harness sensor data for dynamic airflow modulation. Core design choices underscore divergent engineering priorities, as counter-flow cores achieve maximal thermal transfer efficiencies while cross-flow cores enable simplified installation footprints. Technological paradigms bifurcate into rotating wheel mechanisms, prized for their high enthalpy recovery, and static-plate frameworks, which simplify maintenance procedures and reduce moving part complexity. Moreover, mounting type analysis differentiates ceiling-mount solutions tailored to commercial settings from floor-mount units more commonly found in retrofit and residential scenarios.

Installation type exerts a significant influence on core selection, contrasting new construction projects-where design flexibility allows for integrated core placement-with retrofit installations that frequently demand modular, compact core modules compatible with existing duct networks. Application insights extend from commercial ventilation systems in office and retail environments to industrial contexts requiring robust particulate handling, and onto residential ventilation solutions that prioritize noise reduction and energy neutrality. Finally, distribution channels bifurcate into offline networks-encompassing direct sales channels and distributor or supplier partnerships-and online platforms, which include both company-owned eCommerce portals and third-party website marketplaces. Each segmentation axis illuminates a unique facet of customer preference, cost structure, and system performance, collectively guiding strategic positioning and product development roadmaps.

This comprehensive research report categorizes the Energy Recovery Ventilator Core market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- Control System

- Core Design

- Technology

- Mounting Type

- Installation Type

- Application

- Distribution Channel

Strategic Regional Dynamics and Growth Determinants in the Americas Europe Middle East Africa and Asia Pacific Markets Shaping ERV Core Adoption Trends

Regional dynamics shape the ERV core industry in pronounced ways, reflecting local regulatory climates, infrastructure maturity, and environmental imperatives. In the Americas, leading markets exhibit a pronounced emphasis on high‐efficiency aluminum cores and smart control retrofits, driven by stringent state‐level energy codes in the United States and Canada’s aggressive carbon legislation. The region’s sophisticated building management ecosystems have encouraged the adoption of modular core designs and integration with data analytics platforms to optimize facility performance continuously.

In Europe, the Middle East, and Africa, policy harmonization under European Union energy directives has accelerated uptake of ceramic and composite cores capable of sustaining performance in extreme temperature differentials. Retrofitting older building stocks in Western Europe complements robust new construction activity in the Gulf Cooperation Council states, where capital investments prioritize green building credentials. Meanwhile, African urban centers are beginning to explore energy recovery solutions to address rising cooling demands and grid reliability concerns, creating nascent growth corridors for both static-plate and rotating wheel core technologies.

Across Asia‐Pacific, the convergence of rapid urbanization and government incentives has propelled core development in China, Japan, South Korea, and select Southeast Asian economies. High-rise residential and commercial projects leverage run-around coil cores to balance space constraints with energy optimization, while innovative polymer cores find favor in regions with high humidity and corrosion risk. Japan’s early adoption of smart controls has influenced neighboring markets, encouraging manufacturers to localize component sourcing and collaborate on IoT interoperability standards. Collectively, these regional insights underscore a mosaic of market drivers, each demanding tailored technological, regulatory, and partnership strategies to succeed.

This comprehensive research report examines key regions that drive the evolution of the Energy Recovery Ventilator Core market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Critical Analysis of Leading Industry Participants Highlighting Competitive Strategies Technological Advancements and Partnerships in the ERV Core Space

Leading ERV core industry participants have distinguished themselves through varied competitive approaches, blending advanced R&D investment with strategic channel partnerships. Key players have prioritized material science programs that explore next-generation composite matrices and polymer blends, seeking to extend product lifecycles and improve moisture exchange coefficients. Simultaneously, collaborations with control system developers have yielded integrated offerings that combine core modules with sensor arrays, leveraging machine learning algorithms to predict maintenance interventions and adapt performance to occupant behavior patterns.

Several frontrunners have pursued global manufacturing footprints paired with targeted localization initiatives, enabling rapid response to tariff disruptions and regional compliance requirements. Others have opted for niche specialization, focusing on premium ceramic cores designed for heavy industrial exhaust streams or bespoke rotary wheel solutions optimized for high‐humidity environments. Distribution strategies also vary, with some enterprises emphasizing direct OEM partnerships for large‐scale infrastructure projects, while others cultivate omnichannel frameworks that blend distributor networks with proprietary online sales platforms to reach end‐users more effectively.

Collectively, these corporate strategies illustrate a competitive environment where technological differentiation, supply chain robustness, and go-to-market agility define leadership standings. Organizations attuned to evolving customer demands and policy landscapes have established early mover advantages, setting new benchmarks for efficiency, reliability, and sustainability in ERV core deployments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Energy Recovery Ventilator Core market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Beijing Holtop Air Conditioning Co., Ltd.

- Carrier Global Corporation

- ConsERV by Dais Corporation

- CORE Energy Recovery Solutions GmbH

- Daikin Industries, Ltd.

- Dais Corporation

- Energy Recovery Industries Corp. S.R.L.

- Field Controls, LLC

- Fujitsu Limited

- Greencheck Fan Corporation

- Himpel Co., Ltd.

- Hoval Aktiengesellschaft

- Innergy Tech Inc.

- Johnson Controls International PLC

- Karyer Heat Transfer Industry And Trade Inc.

- Klingenburg Gmbh

- Lennox International Inc.

- LG Electronics Inc.

- Mitsubishi Electric Corporation

- Nortek Air Solutions, LLC

- Oji Industrial Materials Management Co., Ltd.

- Polybloc AG

- Renewaire LLC

- Taesung Co., Ltd.

- Xiamen Air-Erv Technology Co., Ltd.

Actionable Recommendations for Industry Leaders to Enhance Operational Efficiency Drive Innovation and Strengthen Market Positioning in the ERV Core Sector

To navigate the evolving ERV core environment, industry leaders should prioritize holistic integration of advanced materials and digital controls, ensuring product portfolios align with emerging energy codes and sustainability targets. Partnering with regional suppliers can mitigate tariff-related disruptions while fostering local supply chain resilience. Implementing modular core designs adaptable to both new installations and retrofit scenarios will broaden addressable markets and simplify logistical planning.

In parallel, companies should invest in data analytics platforms that leverage real-time performance metrics, transforming ERV cores from passive components into proactive system enhancers capable of demand-response modulation. Cross-functional collaboration between engineering, sales, and regulatory affairs teams can accelerate certification processes and identify opportunities within incentive-driven markets. Finally, cultivating strategic alliances with building automation providers and facility management firms will unlock integrated solution pathways that differentiate offerings and strengthen long-term customer retention.

Overview of Research Methodology Emphasizing Data Collection Analytical Frameworks and Validation Techniques in the ERV Core Market Analysis

This research initiative combined primary and secondary data collection methods to ensure analytical rigor and comprehensive coverage of the ERV core landscape. The primary research phase involved in-depth interviews with industry experts, facility managers, and OEM representatives to validate core performance metrics, material selection criteria, and distribution dynamics. Secondary sources, including technical standards publications, trade association reports, and regulatory filings, supplemented these qualitative insights with objective reference points on code requirements and policy developments.

Data analysis employed a multi-tiered framework encompassing segmentation cross-tabulation, competitive benchmarking, and scenario impact assessment. Methodological validation techniques included triangulation across diverse data sets to confirm emerging trends and sensitivity analyses to test the robustness of supply chain and tariff impact conclusions. Together, these methodological pillars underpin the credibility of our findings and ensure that strategic recommendations are grounded in a nuanced understanding of both macro-level drivers and granular operational considerations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Energy Recovery Ventilator Core market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Energy Recovery Ventilator Core Market, by Product Type

- Energy Recovery Ventilator Core Market, by Material Type

- Energy Recovery Ventilator Core Market, by Control System

- Energy Recovery Ventilator Core Market, by Core Design

- Energy Recovery Ventilator Core Market, by Technology

- Energy Recovery Ventilator Core Market, by Mounting Type

- Energy Recovery Ventilator Core Market, by Installation Type

- Energy Recovery Ventilator Core Market, by Application

- Energy Recovery Ventilator Core Market, by Distribution Channel

- Energy Recovery Ventilator Core Market, by Region

- Energy Recovery Ventilator Core Market, by Group

- Energy Recovery Ventilator Core Market, by Country

- United States Energy Recovery Ventilator Core Market

- China Energy Recovery Ventilator Core Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 1908 ]

Reflections on Strategic Implications Emerging Trends and Insights for Stakeholders Navigating the Evolving Energy Recovery Ventilator Core Landscape

As the energy recovery ventilator core industry continues its trajectory toward higher efficiency and intelligence, stakeholders must remain vigilant to intersecting forces of technology, regulation, and global trade. The accelerating adoption of smart control integrations and advanced composites will redefine performance expectations, while tariff environments demand robust supply chain strategies and vendor diversification. Regional disparities in policy incentives and infrastructure maturity underscore the need for tailored market approaches that align with local drivers and capital availability.

Ultimately, the convergence of innovation imperatives and sustainability targets will elevate ERV cores from niche components to central enablers of future-ready built environments. By synthesizing the insights presented in this summary, decision-makers can chart informed pathways toward resilient procurement, strategic partnerships, and product differentiation. Embracing these imperatives will not only optimize operational outcomes but also secure a leadership position in a market defined by continuous improvement and heightened environmental accountability.

Invitation to Connect with Ketan Rohom Associate Director Sales Marketing to Secure Your Comprehensive Market Research Report on Energy Recovery Ventilator Core

Our report offers a panoramic view of emerging technologies regulatory shifts and competitive landscapes that directly impact strategic planning for ventilation system stakeholders. By engaging with Ketan Rohom, Associate Director of Sales & Marketing, you gain access to tailored insights that address your organization’s unique challenges and objectives. Ketan leverages extensive industry expertise to guide you through the report’s most salient findings and recommend best practices that can be immediately applied to procurement, product development, and partnership initiatives.

Whether you seek to optimize material sourcing mitigate tariff-related risks streamline control system integration or identify high-growth regional priorities, this comprehensive analysis equips you with the knowledge to transform strategic intent into actionable outcomes. Connect with Ketan today to explore bespoke licensing options flexible data packages and executive briefings that ensure your team remains at the forefront of energy recovery ventilation innovation. Secure your copy now to accelerate decision-making and unlock new pathways for sustainable and efficient indoor air quality solutions.

- How big is the Energy Recovery Ventilator Core Market?

- What is the Energy Recovery Ventilator Core Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?