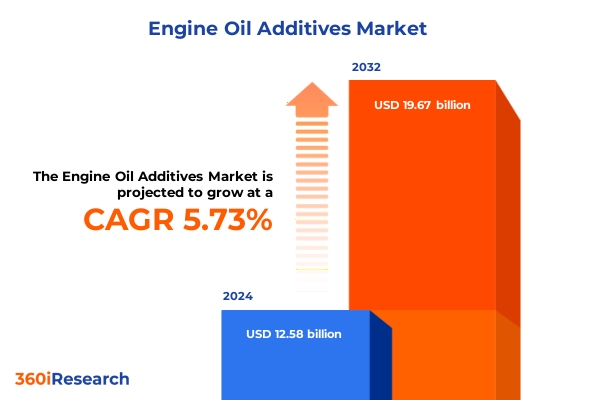

The Engine Oil Additives Market size was estimated at USD 13.27 billion in 2025 and expected to reach USD 14.00 billion in 2026, at a CAGR of 5.77% to reach USD 19.67 billion by 2032.

Setting the Stage for Engine Oil Additives: Defining the Critical Role, Evolving Challenges, and Opportunities in a Dynamic Lubrication Landscape

Engine oil additives form the lifeblood of modern engine protection and performance, addressing diverse challenges from wear prevention to emission control. As engine architectures become more compact and operate under higher thermal and mechanical stresses, the role of specialized chemistries has never been more critical. Additives act at the molecular level to reduce friction, prevent corrosion, inhibit oxidation, and maintain fluidity across a spectrum of operating conditions. This dynamic interplay between base oils and additive packages ensures engines deliver optimal efficiency and longevity, enabling automakers and OEMs to meet evolving regulatory and consumer expectations.

Over the past decade, the additive landscape has undergone a profound transformation driven by heightened environmental requirements, advanced engine technologies, and shifting mobility paradigms. Regulators around the world have implemented stringent emissions and fuel economy standards, compelling lubricant formulators to innovate without compromising performance. At the same time, rising consumer demand for extended drain intervals and cost-effective maintenance has amplified the need for multifunctional chemistries that deliver both protective and performance-enhancing benefits. In this context, market intelligence on technology trends, regulatory impacts, and competitive dynamics has become indispensable for stakeholders seeking to navigate complexity and capitalize on emerging opportunities.

Against a backdrop of global trade uncertainties, rapid electrification, and sustainability mandates, this executive summary provides a concise yet substantive overview of the engine oil additives sector. It highlights transformative industry shifts, assesses the impact of newly imposed U.S. tariffs, elucidates segmentation and regional variations, and profiles leading players shaping the market. By synthesizing critical insights and actionable recommendations, this summary equips decision-makers with the knowledge required to drive innovation, optimize supply chains, and maintain a strong competitive position in a rapidly evolving field.

Emerging Forces Redefining Engine Oil Additives as Sustainability, Electrification, and Digital Insights Drive Unprecedented Technological Evolution

In recent years, sustainability has become a central pillar of additive development, with formulators accelerating the integration of bio-based and eco-friendly chemistries into their portfolios. By leveraging renewable feedstocks derived from plant oils and esters, the industry is reducing reliance on fossil resources while meeting increasingly rigorous environmental regulations and consumer expectations for greener mobility. This shift toward sustainable additives is reshaping R&D priorities, driving partnerships across the chemical and agricultural sectors to secure reliable, high-quality renewable raw materials.

Simultaneously, breakthroughs in nanotechnology are redefining additive performance parameters. Nano-engineered particles enable molecular-level modifications to enhance thermal stability, reduce wear, and optimize frictional characteristics. These innovations significantly extend lubricant life and improve fuel efficiency, especially in high-performance and heavy-duty applications where extreme temperature and pressure conditions prevail. By harnessing nanoscale additives, manufacturers are unlocking new avenues for engine protection and operational efficiency that were previously unattainable.

The industry is also witnessing a convergence toward multifunctional additive packages that consolidate multiple performance objectives into single, streamlined formulations. Anti-wear agents, detergents, dispersants, and friction modifiers are now co-engineered to work synergistically, simplifying formulation processes and reducing additive treat rates. This integrated approach not only enhances engine cleanliness and protection but also supports extended oil drain intervals, aligning with the market’s drive for reduced maintenance costs and environmental impact.

Moreover, the digital era has ushered in AI-driven and IoT-enabled lubricant management systems. Real-time condition monitoring sensors embedded within engine oil circuits can track critical parameters such as viscosity, temperature, and contaminant levels. Predictive analytics then optimize oil change intervals and detect emerging wear patterns before failures occur. This marriage of chemical innovation and digital intelligence empowers fleet operators and OEMs to achieve unprecedented levels of reliability and cost efficiency while safeguarding engine health.

The rapid rise of electric and hybrid vehicles has introduced a new frontier for additive technology. As powertrains shift away from internal combustion, the focus intensifies on thermal management and dielectric performance of lubricants used in battery cooling systems and e-motors. Specialized formulations are emerging to address heat dissipation and electrical insulation requirements, illustrating a fundamental pivot in additive design from traditional combustion-centric roles to electrification-oriented applications.

Assessing the Widespread Effects of 2025 U.S. Tariffs on Engine Oil Additives Industry Supply Chains and Market Demand Dynamics

In March 2025, the U.S. administration invoked Section 232 of the Trade Expansion Act to impose a 25% tariff on imported passenger vehicles and light trucks, effective April 3 for vehicles and May 3 for automotive parts. This measure, framed as a national security action, introduced a permanent surcharge designed to protect domestic manufacturing and has no predetermined expiration date. Further executive orders clarified tariff stacking rules-preventing overlapping duties from compounding excessively on auto parts-yet substantial uncertainty remains regarding the interplay of these tariffs with existing Section 301 measures and free trade agreement commitments.

Although engine oil additives themselves are not direct targets of auto-specific tariffs, the cost of imported base oils, chemical intermediates, and specialized catalysts has risen in tandem with broader automotive import duties. For example, a proposed 50% tariff on Brazilian chemical exports has already disrupted supply chains for compounds used in additive formulations, prompting order cancellations and renegotiations across North America and Europe. This escalation in raw material costs has compelled formulators to reassess supplier agreements and consider near-sourcing strategies to preserve margin integrity and ensure continuity of supply amid a fluctuating trade policy landscape.

Trade body leaders have warned that uncertainty over steel and aluminum tariffs, which impact engine block manufacturing and component production, may slow vehicle output. This, in turn, threatens to dampen the demand for finished lubricants and additives, as OEMs delay production investments in response to unpredictable cost structures. Distributors and formulators are now evaluating long-term contracts, multi-sourcing arrangements, and regional manufacturing hubs to mitigate risk, maintain pricing stability, and safeguard market share in a climate of heightened trade volatility.

Unveiling Segmentation Drivers That Illuminate Diverse Market Behaviors and Growth Trajectories Across Additive Types, Functionalities, Channels, and Applications

The market’s type segmentation offers valuable insight into how each additive category contributes to overall engine protection and performance. Anti-wear agents remain fundamental, forming sacrificial films that prevent direct metal-to-metal contact under extreme loads. Antioxidants extend oil life by neutralizing reactive species that degrade base stocks. Corrosion inhibitors shield critical internal surfaces from acidic by-products, while detergents and dispersants work in concert to maintain engine cleanliness by suspending contaminants and averting deposit formation. Additionally, foam inhibitors, pour point depressants, friction modifiers, and viscosity index improvers each address specific operational challenges-from suppressing air entrainment to ensuring fluidity in subzero climates and optimizing viscosity across temperature extremes.

Analyzing the market through a functionality lens underscores three principal roles. Emission control additives are formulated to reduce harmful exhaust outputs and support catalyst and particulate filter longevity. Performance-enhancing additives deliver measurable improvements in fuel economy, power output, and thermal stability. Protective additives provide the foundation for engine longevity, guarding against wear, deposits, and oxidative breakdown. Together, these functional categories illustrate how precise chemistry selection can align with OEM engine specifications and regulatory compliance requirements.

Sales channel segmentation reveals that offline distribution channels-comprising specialized chemical distributors, OEM partnerships, and direct sales to lubricant blenders-retain primacy for bulk additive procurement. However, a growing share of aftermarket and niche segment sales is migrating to online platforms, where formulators can target smaller batches and expedite technical support. This digital shift is reshaping go-to-market strategies as companies invest in e-commerce capabilities and remote formulation services.

By application, the automotive sector drives the lion’s share of additive consumption, given the high volume requirements of passenger and commercial vehicle maintenance. Industrial equipment applications demand specialized hydraulic, turbine, and gear oil additive formulations to withstand heavy loads and harsh operating conditions. Marine and aerospace industries call for custom chemistries that address corrosion, extreme pressure, and thermal variations encountered at sea and at altitude, illustrating the breadth of additive innovation across diverse end-use environments.

This comprehensive research report categorizes the Engine Oil Additives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Functionality

- Sales Channel

- Application

Exploring Regional Nuances Shaping Engine Oil Additives Markets Across Americas, EMEA, and Asia-Pacific in Response to Economic, Regulatory, and Industry Trends

The Americas region commands a mature and innovation-oriented engine oil additives market, underpinned by a robust automotive manufacturing base in the United States, Canada, and Mexico. The United States, in particular, accounts for a significant proportion of R&D investment, leveraging advanced materials research to develop high-performance antioxidants and friction modifiers that meet both OEM and aftermarket needs. Industrial sectors across North America also drive demand for specialized hydraulic and gear oil additives, while Latin American markets are increasingly embracing multifunctional formulations and strategic distribution partnerships to enhance local blending capabilities.

In Europe, Middle East & Africa, regulatory rigor and environmental mandates exert a strong influence on additive development. The EU’s REACH framework and evolving Euro 7 emissions standards have prompted suppliers to prioritize mid-SAPS and low-ash formulations that protect exhaust aftertreatment systems. Established markets in Western Europe demand solutions that balance performance with stringent carbon footprint targets, while emerging economies in the Gulf Cooperation Council and Africa present opportunities for tailored product offerings, leveraging regional petrochemical integrations to optimize production efficiency and supply chain resilience.

Asia-Pacific stands out as the fastest-growing regional market, propelled by rapid industrialization, surging vehicle ownership, and government initiatives to curb emissions. China, India, and Southeast Asia have become focal points for capacity expansion, with major players investing in local blending and production hubs to serve large domestic consumer bases. The region’s adoption of bio-based and low-viscosity additives aligns with broader sustainability agendas, while accelerated investments in Group II and Group III base oil production capacities underpin formulators’ ability to meet quality standards and regulatory demands.

This comprehensive research report examines key regions that drive the evolution of the Engine Oil Additives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlight on Industry Leaders Charting Market Direction Through Innovative Solutions, Strategic Expansions, and Collaborative Partnerships in Engine Additives

Lubrizol continues to set the pace in additive innovation, recently forging a distribution partnership with IMCD Group in Vietnam to meet escalating lubricant demands across Southeast Asia. This collaboration ensures access to advanced additive technologies, tailored technical support, and streamlined logistics, reinforcing Lubrizol’s regional leadership. Concurrently, its CV1150 heavy-duty diesel engine oil solution earned China’s GB D1 certification after a successful 100,000-kilometer extended drain road test, exemplifying the company’s expertise in aligning global formulations with local emissions and performance requirements. Further capacity expansions at its Zhuhai blending facility will boost production by over 63,000 tonnes per year, strengthening supply chain resilience and local for local servicing.

BASF remains a key component supplier with its ongoing aminic antioxidant capacity expansion in Puebla, Mexico. Scheduled for completion in 2026, this investment addresses the growing demand for oxidation inhibitors in both automotive and industrial applications, enhancing the durability and stability of finished lubricants. The company’s extensive R&D programs are sharpening its next-generation additive pipeline, particularly in areas such as electronics cooling and energy-efficient lubrication.

Chevron Oronite has fortified its market presence through significant production scale and technological breakthroughs. Serving over 1,000 lubricant brands worldwide, the company’s OLOA® 61530 line achieved critical Volvo VDS-5 approval, and its boron-enhanced anti-wear chemistries continue to deliver best-in-class performance for heavy-duty and marine engines.

Infineum’s strategic expansion in India, with a new additive blending facility set to commence operations by Q3 2025, underscores its commitment to localized production and customizable sulfonate and salicylate packages for engine cleanliness and anti-corrosion protection. At the same time, its P6895A package for hybrid powertrains exemplifies forward-looking innovation to support the shifting demands of electrified mobility.

ExxonMobil, Clariant, and others continue to diversify through strategic alliances with OEMs and technology partners, developing digital lubricant management platforms and expanding bio-based additive portfolios to address future performance, regulatory, and sustainability challenges.

This comprehensive research report delivers an in-depth overview of the principal market players in the Engine Oil Additives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Afton Chemical Limited

- AMSOIL Inc.

- Baker Hughes Company

- BASF SE

- Chevron Corporation

- Dorf-Ketal Chemicals India Limited

- Eni SpA

- Evonik Industries AG

- Exxon Mobil Corporation

- Ganesh Benzoplast Limited

- Illinois Tool Works Inc.

- Infineum International Limited

- Jinzhou Kangtai Lubricant Additives CO., Ltd.

- Kemipex

- Lanxess AG

- Lucas Oil Products, Inc.

- MidContinental Chemical Company, Inc.

- Petroliam Nasional Berhad

- R.T. Vanderbilt Holding Company, Inc.

- The Lubrizol Corporation

- TotalEnergies SE

- Valvoline Inc.

- Wuxi South Petroleum Additive Co., Ltd.

Strategic Imperatives for Engine Oil Additives Stakeholders to Capitalize on Innovation, Diversify Supply Chains, and Navigate Regulatory and Trade Complexities

To harness the opportunities emerging from sustainability mandates and performance demands, industry leaders should prioritize robust R&D investments in bio-based and low-carbon additive chemistries. Collaborations with agricultural and biotech firms can secure reliable access to renewable feedstocks, ensuring a competitive advantage as regulations tighten and customer preferences shift towards greener solutions.

Given the evolving tariff landscape, companies must diversify supply chains by establishing near-shore blending and additive production hubs. Regionalizing manufacturing footprints will mitigate trade risk, reduce lead times, and maintain cost competitiveness amid fluctuating import duties on base oils and intermediates.

The integration of digital monitoring and predictive maintenance platforms represents a critical differentiator. Firms should invest in IoT sensors and AI-driven data analytics to offer value-added services, enabling customers to optimize drain intervals, prevent unplanned downtime, and substantiate total cost of ownership models.

In response to the shift towards electrified powertrains, additive suppliers must co-innovate with automotive OEMs to develop thermally conductive and dielectric fluid solutions. Targeted partnerships and pilot programs for thermal management additives will position companies at the forefront of electrification trends, capturing market share as hybrid and electric vehicles proliferate.

Finally, engaging proactively with regulators and industry consortia will ensure early alignment on emerging standards and test protocols. Participation in working groups can streamline product approvals and shape future policy, providing a strategic window to influence criteria that affect additive performance and market access.

Comprehensive Research Framework Detailing Rigorous Data Collection, Analytical Approaches, and Validation Techniques Underpinning the Market Intelligence Report

This report leverages a multi-faceted research methodology designed to deliver robust and unbiased market insights. Primary research involved in-depth interviews with industry executives, technical experts, and key decision-makers across additive manufacturers, lubricant blenders, OEMs, and regulatory bodies. These qualitative discussions provided firsthand perspectives on technology trends, supply chain dynamics, and competitive strategies.

Secondary research encompassed an extensive review of industry publications, regulatory filings, company annual reports, trade association data, and news outlets to triangulate primary insights and establish historical benchmarks. Data triangulation techniques ensured consistency across multiple sources, refining market narratives and validating emerging themes. Proprietary databases were cross-referenced with third-party intelligence platforms to enhance data accuracy and comprehensiveness.

Quantitative analyses employed both bottom-up and top-down approaches to evaluate segmental performance, regional variances, and competitor positioning. Customized modeling frameworks and scenario analyses were utilized to assess the impact of trade policy shifts, regulatory changes, and technology adoptions on market trajectories. Rigorous data validation steps, including peer reviews and editorial quality checks, underpin the credibility of the findings presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Engine Oil Additives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Engine Oil Additives Market, by Type

- Engine Oil Additives Market, by Functionality

- Engine Oil Additives Market, by Sales Channel

- Engine Oil Additives Market, by Application

- Engine Oil Additives Market, by Region

- Engine Oil Additives Market, by Group

- Engine Oil Additives Market, by Country

- United States Engine Oil Additives Market

- China Engine Oil Additives Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Concluding Perspectives on the Evolving Engine Oil Additives Landscape Emphasizing Key Takeaways and Roadmaps for Sustainable, High-Performance Lubrication Solutions

The engine oil additives sector stands at a pivotal juncture, shaped by converging forces of sustainability imperatives, technological innovation, and shifting mobility paradigms. As bio-based chemistries, nanotechnology, and AI-driven monitoring systems mature, additive formulators are poised to deliver unprecedented performance and operational efficiencies while meeting the toughest environmental and regulatory requirements.

Simultaneously, evolving trade policies and tariff regimes underscore the importance of resilient supply chain strategies and regionalized production models. By aligning investments in localized blending hubs and diversified raw material sourcing, industry participants can navigate cost pressures and safeguard market continuity in an unpredictable geopolitical environment.

Leading companies are already differentiating through strategic collaborations, capacity expansions, and purpose-built product platforms for emerging powertrains. To maintain momentum, stakeholders must embrace proactive engagement with regulators, deepen co-innovation partnerships with OEMs, and leverage data analytics to unlock new service-based revenue streams.

Ultimately, success in this dynamic landscape will hinge on the ability to integrate sustainable chemistry, digital intelligence, and agile operational frameworks-ensuring that next-generation additive solutions deliver both enhanced engine protection and a tangible contribution to carbon reduction goals.

Secure Your Competitive Edge: Engage with Ketan Rohom to Access the Definitive Engine Oil Additives Market Research Report and Unlock Strategic Insights

To explore the full suite of strategic insights and in-depth analysis this report offers, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan will guide you through the report’s comprehensive findings and demonstrate how these insights can inform your next strategic move. Don’t miss the opportunity to gain a competitive advantage in the rapidly evolving engine oil additives landscape-connect with Ketan today to secure your copy of the definitive market research report and drive measurable business impact

- How big is the Engine Oil Additives Market?

- What is the Engine Oil Additives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?