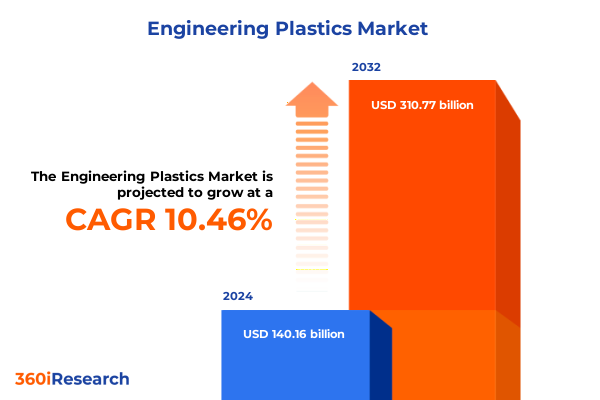

The Engineering Plastics Market size was estimated at USD 155.01 billion in 2025 and expected to reach USD 169.97 billion in 2026, at a CAGR of 10.44% to reach USD 310.77 billion by 2032.

A precise orientation to modern engineering polymers, manufacturing pathways, and the complex end markets shaping strategic material choices

The engineering plastics sector sits at a strategic inflection point as designers, compounders, and global buyers confront accelerating technological change, intensifying regulatory scrutiny, and more volatile trade settings. This report opens with an orientation to the materials, methods, and end markets that define modern engineering polymers, framing the discussion around how Acetal, Polyamide, Polycarbonate and Polyethylene Terephthalate are being configured by formulators and OEMs to meet higher thermal, chemical and mechanical demands. It explains why processing choices - whether Blow Molding, Compression Molding, Extrusion or Injection Molding - matter not only for cost and cycle time but also for downstream recyclability and part performance. The introduction also clarifies the critical distinction among product forms such as Film, Granule, Pellet and Powder, which govern logistics, compounder selection and quality controls across manufacturing networks. Finally, the reader is guided through the dominant application vectors - Automotive (across Exterior, Interior and Under The Hood), Consumer Goods (including Household Appliances and Sports and Leisure), Electrical and Electronics (Circuit Components, Connectors and Enclosures), Industrial (Machinery Components and Pipes and Fittings) and Medical Devices (Diagnostic Equipment and Surgical Instruments) - so that subsequent sections can evaluate material choices in the context of regulatory pressures, end-user expectations and lifecycle constraints.

How regulatory mandates, electrification demands, supply chain reconfiguration, and digital manufacturing are jointly redefining engineering plastics value chains

The past five years have produced transformative shifts that are reordering value chains across the engineering plastics ecosystem. First, regulatory acceleration around plastic waste, recycled-content mandates and raw material traceability is forcing manufacturers to integrate circularity earlier in product design. Corporate commitments to recycled content and emerging legislative frameworks are creating downstream premiums for reliably sourced recycled resins and stronger incentives to redesign for recyclability. In parallel, the rapid pace of electrification and the shift to lighter vehicles have raised material performance requirements for thermal stability, flame retardancy and mechanical toughness; material scientists are therefore prioritizing high-performance polyamides and reinforced polycarbonates for structural and under-the-hood components. Supply chain geography has also shifted: sourcing strategies are now evaluated against trade policy risk and feedstock security, prompting nearshoring and diversification of compounding capacity. Technology adoption is another structural change. Advanced recycling and chemical depolymerization pilots are attracting capital alongside continued investments in mechanical sorting and reprocessing; these pathways are changing which forms and grades of Film, Granule, Pellet and Powder are economically recyclable and which require alternative downstream handling. Finally, digitalization across formulation labs and production lines - from AI-assisted compound optimization to in-line process monitoring for Extrusion and Injection Molding - is reducing development cycles and enabling closer alignment between resin properties and application-specific performance. These combined shifts are not incremental: they are altering supplier-buyer relationships, accelerating product requalification cycles, and elevating the strategic importance of supply chain architecture for every polymer type and processing technique.

The practical consequences of evolving U.S. tariff actions on supply continuity, sourcing decisions, and manufacturing investment choices in engineering polymers

U.S. tariff policy developments in recent years have introduced meaningful complexity for buyers and manufacturers that rely on cross-border sourcing of raw resins, masterbatches and finished components. Policy actions implemented under Section 301 and related measures have been periodically revised, creating a moving target for cost planning and supplier selection. In response, trade policy instruments have included targeted tariff increases on defined product groups and periodic extensions of temporary exclusions that affect specific Harmonized Tariff Schedule lines; these adjustments have occasionally been accompanied by higher-duty actions on select strategic goods. For engineering plastics supply chains that depend on direct imports of polymer resins or finished modules from specific source countries, the cumulative effect is multi-fold: procurement teams face intermittently higher landed costs, logistics teams must manage reassignment of routes and origin declarations, and quality assurance groups must accelerate requalification where alternate suppliers or substitute resin grades are used. The policy environment has also influenced near-term investment choices. Some manufacturers have accelerated capital projects domestically or in allied jurisdictions to insulate production from tariff volatility and secure feedstock continuity. Other players have expanded supplier qualification programs and entered into longer-term offtake and tolling agreements to stabilize volumes and manage the risk of ad hoc duty changes. From a practical standpoint, trade-driven cost differentials are now among the primary variables in make-versus-buy deliberations for components that use Acetal, Polyamide, Polycarbonate and PET; those deliberations often interact with processing choices - for example, where Blow Molding or Injection Molding lines must be adapted to new compound specifications sourced from different geographies. The net result is a more deliberate, policy-aware procurement architecture that combines tariff monitoring, tariff exclusion management when available, and scenario-based sourcing to protect continuity and margin.

Why polymer chemistry, manufacturing method, material form, and application requirements together dictate procurement, qualification, and design trade-offs for engineered parts

Segment behavior varies by polymer chemistries, processing pathways, form factors and application demands, and strategic decisions must reflect those differences. Product type selection - whether a design team chooses Acetal for dimensional stability, Polyamide for toughness and heat resistance, Polycarbonate for impact-resistant transparencies, or PET for barrier and film applications - sets the constraints for downstream processing and recyclability. Those choices determine which processing techniques will be optimal, since Blow Molding, Compression Molding, Extrusion and Injection Molding each impose distinct shear, thermal and cooling profiles that interact with polymer selection and additive systems. Form is an often-overlooked determinant: Film and Powder grades demand different handling, drying and contamination controls than Granule and Pellet formats, and these operational differences directly affect scrap rates and compounder throughput. Application-driven segmentation further complicates supplier selection: automotive components destined for Exterior, Interior or Under The Hood service conditions prioritize different property sets and certification pathways; consumer goods segments such as Household Appliances and Sports and Leisure value aesthetic longevity, ergonomics and serviceability; electrical and electronics use cases like Circuit Components, Connectors and Enclosures require flame retardance, dielectric stability and tight dimensional tolerances; industrial applications across Machinery Components and Pipes and Fittings emphasize wear-resistance and chemical compatibility; and medical-device classes such as Diagnostic Equipment and Surgical Instruments impose strict biocompatibility and sterilization performance requirements. These intersecting vectors mean that a resin grade that is optimal for an injection-molded interior trim part may be unsuitable for an extruded, under-the-hood conduit or a film used in medical packaging. Recognizing these distinctions early reduces downstream redesign cost and accelerates qualification, particularly as regulatory and recycled-content pressures reshape allowable formulations and additive choices.

This comprehensive research report categorizes the Engineering Plastics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Processing Technique

- Form

- Application

How regional policy, feedstock geography, and manufacturing capabilities are determining where engineering plastics capacity and recycling infrastructure are deployed globally

Regional dynamics are shaping where capacity is built, where innovation is concentrated, and how trade flows are routed. The Americas region is characterized by proximity to major automotive and consumer OEM clusters as well as by active legislative interest in recycling standards and recycled-content mandates; these market and policy drivers are encouraging investment in mechanical and advanced recycling infrastructure near large consumption centers. In Europe, Middle East & Africa the regulatory environment is particularly influential: extended producer responsibility schemes, stringent chemical and product safety regimes, and aggressive circularity targets are accelerating adoption of readily recyclable films and higher-purity granules, while Europe remains a strong source of high-performance polyamides and specialty polycarbonates for demanding applications. Asia-Pacific continues to be the dominant manufacturing and feedstock production base for many engineering resins, hosting large integrated petrochemical complexes and compounding capacity; however, geopolitical tensions and trade actions have prompted more nuanced sourcing strategies and stimulated regional reshoring initiatives in parts of Southeast Asia and Japan. These regional realities interact with processing technique choices and form factors - for example, extrusion-heavy supply chains are often tied to regions with low-cost energy and stable access to feedstock, while high-precision injection-molding ecosystems congregate near electronics clusters. For companies designing global product architectures, appreciating these regional contrasts is essential to building resilient supplier networks, diagnosing origin-specific quality risks, and prioritizing capex where it will deliver the greatest security and proximity benefits.

This comprehensive research report examines key regions that drive the evolution of the Engineering Plastics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Why leading producers and converters are blending vertical integration, recycling partnerships, and proprietary compound strategies to protect margin and secure feedstock

Corporate behavior in engineering plastics is now simultaneously collaborative and competitive. Leading chemical producers, compounders and OEM-focused converters are investing in recycling feedstock infrastructure, co-financing plastic recovery facilities, and entering offtake partnerships to guarantee feedstock quality for higher-value grades. A number of integrated chemical companies and downstream partners have publicly announced collaborative investments to secure waste feedstock and to pilot advanced recycling technologies that can convert mixed or contaminated streams back into feedstock for high-performance polymers. At the same time, strategic vertical moves such as tolling agreements, licensing of proprietary compounding recipes, and selective capacity expansions are being used to protect technological differentiation and customer relationships. These twin strategies-closing the loop on feedstock while locking in differentiated formulations-are reshaping commercial negotiation dynamics. Procurement teams now evaluate potential suppliers based not only on price and lead time, but also on documented circularity credentials, the maturity of quality systems for Film, Granule, Pellet and Powder formats, and the supplier’s willingness to share data across a secure digital chain of custody. For OEMs and contract manufacturers in highly regulated end uses such as medical devices and automotive under-the-hood parts, supplier transparency on additives, flame retardants and supply origins has become a non-negotiable element of qualification.

This comprehensive research report delivers an in-depth overview of the principal market players in the Engineering Plastics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Asahi Kasei Corporation

- BASF SE

- Celanese Corporation

- Covestro AG

- Dow Inc

- DuPont de Nemours Inc

- Eastman Chemical Company

- Ensinger GmbH

- Evonik Industries AG

- Formosa Plastics Corporation

- Hitachi Chemical Co Ltd

- Kureha Corporation

- LANXESS AG

- LG Chem Ltd

- Mitsubishi Chemical Group Corporation

- Plastics Engineering Company

- Polyplastics Co Ltd

- Radici Group

- SABIC

- Sinopec

- Solvay SA

- Sumitomo Chemical Co Ltd

- Teijin Limited

- Toray Industries Inc

- Victrex plc

Practical, immediate steps procurement, R&D, and product teams can take to harden supply chains, scale circular feedstocks, and protect product differentiation

Actionable steps for industry leaders should be prioritized around three parallel tracks: supply resilience, circularity integration, and product differentiation. First, companies should perform a rapid-mitigation audit of sourcing concentration by polymer and by processing footprint, then immediately implement scenario-based sourcing playbooks to manage tariff exposure and logistics shocks. Second, corporate R&D and procurement must align to accelerate qualification of mechanically recycled and chemically recycled feedstocks in application-specific pilots, focusing first on higher-volume, lower-risk segments such as selected automotive interior parts and industrial components where requalification barriers are lower. Third, product teams should prioritize additive and grade rationalization to reduce the number of unique formulations carried in production, which lowers contamination risk and improves recyclability for Film, Granule, Pellet and Powder streams. In parallel, investment in digital traceability for resin batches, supplier scorecards tied to circularity KPIs, and collaborative offtake contracts with recovery networks will materially reduce feedstock variability. Finally, to protect premium positions, companies should pursue differentiated material science-developing or licensing composites, reinforced thermoplastics and specialty polycarbonate blends that deliver measurable performance improvements in their target applications while allowing for defined end-of-life recovery options. These recommendations drive near-term operational resilience while positioning firms for regulatory and commercial advantages as recycled-content expectations and product sustainability requirements mature.

A mixed-method evidence base combining primary interviews, technical specification reviews, and policy mapping to produce actionable regional and segment-level insights

The research methodology that informed this report combined a structured review of public policy actions and industry announcements with targeted primary interviews and technical supplier assessments. First, regulatory and trade developments were mapped using official notices, public filings and legal analyses to identify actionable tariff and exclusion timelines. Second, technical reviews examined polymer specifications, processing windows, and form-dependent handling practices through manufacturer technical datasheets, engineering lab white papers, and peer-reviewed literature on mechanical and chemical recycling pathways. Third, the study incorporated primary conversations with compounders, OEM material engineers, and sourcing leads to validate observed shifts in qualification timelines, supplier selection criteria and nearshoring decisions. Where possible, triangulation was used: industry declarations about recycling investments were cross-checked against public project disclosures and third-party reporting to ensure an evidence-based narrative. Finally, regional capacity and capability assessments were informed by a synthesis of policy frameworks, major industrial investments, and observable supply-chain patterns to produce actionable regional guidance. This mixed-method approach balances documentary evidence with practitioner insight to generate recommendations that are both grounded and practicable.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Engineering Plastics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Engineering Plastics Market, by Product Type

- Engineering Plastics Market, by Processing Technique

- Engineering Plastics Market, by Form

- Engineering Plastics Market, by Application

- Engineering Plastics Market, by Region

- Engineering Plastics Market, by Group

- Engineering Plastics Market, by Country

- United States Engineering Plastics Market

- China Engineering Plastics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

A decisive summary emphasizing alignment of trade-awareness, circular design, and material-science innovation as the foundation of competitive differentiation in engineering plastics.

Engineering plastics are no longer simply raw inputs; they are strategic levers that determine product performance, regulatory compliance and supply-chain resilience. Across product types, processing techniques and end-use forms, the industry is adapting to tighter circularity expectations, evolving tariff regimes and rising functional demands from automotive electrification and digitalized electronics. Companies that act now to rationalize grades, qualify circular feedstocks in near-term pilots, and rearchitect sourcing with explicit tariff-readiness will reduce downstream risk and preserve downstream margin. Equally important, organizations that invest in differentiated materials and maintain transparent chains of custody will be rewarded as customers and regulators converge on recycled-content and traceability expectations. The conclusion is clear: the next phase of competitiveness in engineering plastics will be decided by those who integrate trade-policy awareness, circular-design disciplines and disciplined material-science innovation into their operating model.

Immediate next steps to convert engineering plastics intelligence into procurement advantage through a direct consultation with the report team

For decision-makers ready to translate insight into advantage, connect directly with Ketan Rohom, Associate Director, Sales & Marketing, to request access to the full market research report and tailored briefings that align with procurement, product, and regulatory timelines. The report package includes in-depth segment analyses, regional intelligence, and strategic playbooks designed for product teams, sourcing leaders, and M&A advisors who must act quickly in a turbulent trade and technology environment. Reach out to arrange a private walkthrough of the findings, obtain a tailored excerpt aligned to your use case, or schedule a custom consulting engagement to convert insights into executable roadmaps.

- How big is the Engineering Plastics Market?

- What is the Engineering Plastics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?