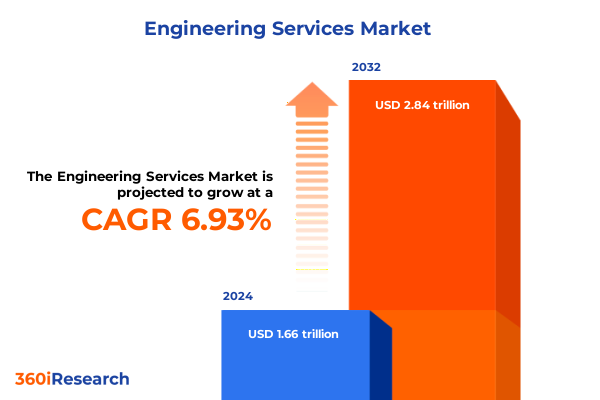

The Engineering Services Market size was estimated at USD 1.77 trillion in 2025 and expected to reach USD 1.88 trillion in 2026, at a CAGR of 6.87% to reach USD 2.82 trillion by 2032.

Navigating the Engineering Services Revolution with Strategic Insights That Empower Decision Makers to Seize Emerging Opportunities in a Global Environment

In an era defined by rapid technological innovation and shifting global dynamics, engineering services have emerged as a pivotal enabler of industry transformation. The confluence of digitalization, Internet of Things deployments, and advanced analytics has elevated the role of engineering service providers from traditional project executors to strategic partners in value creation. As organizations grapple with complex product lifecycles, heightened regulatory scrutiny, and increasing demands for sustainability, they are turning to specialized engineering expertise to bridge capability gaps and accelerate time to market.

Amid geopolitical tensions and persistent supply chain volatility, businesses are reevaluating their outsourcing strategies to balance cost efficiency with resilience. This landscape demands a deep understanding of regional trade policies, evolving talent models, and emerging technology platforms. By synthesizing the latest developments across service types, delivery approaches, and industry verticals, this report provides decision-makers with a comprehensive executive-level overview of the forces reshaping the engineering services domain. Through this lens, leaders can identify strategic inflection points, anticipate critical risks, and capitalize on next-generation opportunities within a competitive global environment.

Uncovering the Transformative Forces Reshaping Engineering Services to Drive Innovation, Efficiency and Competitive Advantage Across Modern Industrial Ecosystems

The engineering services space is undergoing a profound metamorphosis driven by the integration of artificial intelligence, digital twins, and cloud-based engineering platforms. These transformative tools enable organizations to simulate complex processes, optimize product designs, and preemptively identify failure modes, significantly reducing development cycles and resource waste. Concurrently, the push for sustainability is compelling service providers to embed circular economy principles into product engineering and process optimization, minimizing environmental footprints while delivering cost savings.

Moreover, the rise of remote work and distributed project teams has recalibrated traditional delivery paradigms. Off-site and remote services now complement on-site expertise, enabling seamless collaboration across geographies and time zones. This hybrid model enhances agility and scalability for both long-term contracts and short-duration projects. As talent ecosystems evolve, firms are investing in upskilling initiatives and strategic partnerships to secure specialized capabilities in robotics, automation, and advanced materials. In this context, industry stakeholders that embrace digital transformation and flexible talent models position themselves to capture the full potential of the engineering services market.

Assessing the Far-Reaching Effects of United States Tariffs in 2025 on the Engineering Services Landscape Including Cost Structures and Strategic Responses

The United States’ tariff policies in 2025 have exerted notable influence on engineering services cost structures and client engagement strategies. Heightened duties on steel and aluminum imports have rippled through industries such as automotive, construction, and energy infrastructure, prompting service providers to reassess supply chains and negotiate material cost escalations with clients. In parallel, targeted levies on advanced manufacturing equipment have driven increased demand for local sourcing and domestic partnerships to mitigate import surcharges.

Service providers have responded by diversifying their procurement networks and leveraging regional production hubs to maintain competitive pricing. Nearshoring initiatives have gained traction as organizations seek to shorten lead times and reduce exposure to cross-border tariff volatility. Furthermore, the cumulative effect of 2025 tariffs has underscored the importance of transparent cost models and flexible contract terms, encouraging providers to adopt more collaborative pricing structures. Looking ahead, firms that proactively navigate evolving trade regulations and embed tariff risk management into their service offerings will be best placed to sustain profitability and deliver value amid an increasingly complex global trade environment.

Illuminating Market Segments Across Service Type, Business Model, Delivery Model, Duration, Industry Verticals and Client Profiles to Reveal Growth Drivers

Market segmentation reveals that asset management related services have gained prominence as organizations seek to extend the life cycle of critical assets through predictive maintenance and lifecycle analytics. Concurrently, automation related services are accelerating the adoption of robotics, machine vision, and AI-driven control systems to enhance operational throughput. Process engineering experts are increasingly pivotal in optimizing manufacturing workflows, integrating sustainability metrics, and ensuring regulatory compliance. Equally, product engineering teams remain central to innovative design, focusing on lightweight materials and modular architectures to meet evolving customer demands.

Within business model dynamics, in-house engineering arms continue to handle strategic, core competencies, while a surge in O utsourced engineering services underscores the drive for specialized expertise and cost arbitrage. The delivery model spectrum spans off-site and remote services that offer scale and flexibility, as well as on-site engagements that ensure deep domain immersion and immediate responsiveness. Service duration further differentiates providers as clients engage in long-term contracts to underpin continuous improvement initiatives, while short-term projects cater to rapid prototyping and proof-of-concept requirements.

Industry vertical analysis highlights aerospace and defense organizations partnering with engineering firms for both aircraft manufacturing and spacecraft design challenges. Automotive OEMs and suppliers draw on component design and system integration specialists to advance electric and autonomous vehicle roadmaps. Energy and utilities projects, spanning oil and gas infrastructure as well as renewable energy ventures, leverage multidisciplinary teams to balance reliability and sustainability goals. Client type segmentation underscores the complex needs of public agencies, which require stringent compliance and security protocols, alongside the growing outsourcing appetite among large enterprises and agile small to medium enterprises seeking rapid market entry.

This comprehensive research report categorizes the Engineering Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Business Model

- Delivery Model

- Service Duration

- Industry Vertical

- Client Type

Mapping Strategic Opportunities Through Regional Analysis of Americas, Europe Middle East & Africa, and Asia-Pacific Market Dynamics and Sectoral Strengths

Regional analysis reveals that the Americas continue to lead in technology innovation and oil and gas infrastructure, with engineering service firms capitalizing on nearshoring trends in Mexico and Canada to mitigate U.S. tariffs. This region also benefits from robust investment in defense modernization programs and automotive electrification, driving demand for advanced engineering solutions. In Europe, Middle East & Africa, stringent environmental regulations and the push toward renewable energy projects have elevated the role of sustainability-focused engineering services, while defense and aerospace initiatives maintain a steady requirement for high-value design and testing expertise.

The Asia-Pacific region, anchored by China, India, and Southeast Asian manufacturing hubs, remains a hotbed for rapid industrial expansion. Engineering services here are characterized by high-volume production engineering, infrastructure development, and digital manufacturing initiatives. Governments across the region are investing heavily in smart city deployments, 5G infrastructure, and advanced semiconductor fabs, creating new avenues for specialized service providers. These regional dynamics underscore the importance of tailored go-to-market approaches, strategic partnerships, and localized talent development to capture opportunities across disparate regulatory environments and growth trajectories.

This comprehensive research report examines key regions that drive the evolution of the Engineering Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players Driving Innovation, Strategic Partnerships, and Competitive Differentiation in Engineering Services Across Global Markets

Leading companies in the engineering services sector have been distinguished by their ability to integrate digital platforms with domain expertise. Global integrators are forging alliances with cloud providers and technology vendors to deliver end-to-end solutions that span design, simulation, and operational analytics. Innovation leaders are investing in proprietary digital twin capabilities and augmented reality tools that accelerate on-site assembly and maintenance processes. Meanwhile, specialist firms are differentiating through focused vertical expertise, particularly in high-value segments such as spacecraft design, advanced driver-assistance systems, and offshore renewable energy infrastructure.

Strategic partnerships have become a key driver of competitive differentiation, with many players collaborating across the value chain to offer modular service bundles. Mergers and acquisitions remain a critical path to augmenting capability portfolios, particularly in areas like artificial intelligence for predictive maintenance and automated quality inspection. Companies that successfully align their go-to-market strategies with emerging client demands-such as sustainability compliance, rapid prototype cycles, and remote asset monitoring-are securing marquee contracts and reinforcing their market positions. These developments highlight the intensifying competition among top-tier providers to deliver not only technical proficiency but also the consultative guidance that drives long-term client success.

This comprehensive research report delivers an in-depth overview of the principal market players in the Engineering Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- International Business Machines Corporation

- Siemens AG

- Jacobs Engineering Group Inc

- Robert Bosch GmbH

- Fluor Corporation

- AECOM

- WSP Global Inc.

- STRABAG SE

- Honeywell International Inc.

- Oracle Corporation

- Larsen & Toubro Limited

- Safran S.A.

- Capgemini SE

- Worley Limited

- Bechtel Corporation

- Eurofins Scientific SE

- Accenture PLC

- Balfour Beatty Inc.

- SNC-Lavalin Group Inc. (AtkinsRéalis)

- Tata Consultancy Services Limited

- Wipro Limited

- NTT DATA Group Corporation

- HCL Technologies Limited

- Stantec Inc.

- Alten Group

- Intertek Group PLC

- Arcadis NV

- HDR, Inc.

- John Wood Group PLC

- DXC Technology Company

- Ramboll Group A/S

- KBR, Inc.

- Alfanar Group

- Gannett Fleming, Inc

- Tetra Tech, Inc.

- Jones Lang LaSalle Incorporated

- Tech Mahindra Limited

- SLR Consulting Limited

- Michael Baker International

- Vanasse Hangen Brustlin, Inc.

- Algoscale Technologies, Inc.

- Bentley Systems, Incorporated

- Bureau Veritas SA

- Charles River Laboratories International, Inc.

- Corbus, LLC.

- Damco Group

- Geocomp by Sercel

- Mott MacDonald Group Limited

- Simpson Gumpertz & Heger (SGH) Inc.

- Tatweer

Empowering Industry Leaders with Actionable Recommendations to Capitalize on Market Trends, Mitigate Risks, and Foster Growth in Engineering Services

Industry leaders should prioritize the deployment of integrated digital twin platforms to simulate end-to-end product and process scenarios, enabling faster decision cycles and reduced resource waste. Complementing this, firms can forge strategic alliances with cloud and software vendors to create scalable ecosystems for data-driven engineering. Strengthening flexible delivery models-balancing off-site remote expertise with on-site deployment-will allow service providers to adapt quickly to client requirements and regional constraints.

To mitigate tariff-related cost pressures, organizations should diversify supplier bases and develop contingency plans that leverage nearshore and local sourcing options. Investing in modular contract structures will facilitate transparent cost management and foster collaborative vendor-client relationships. Furthermore, enhancing workforce capabilities through targeted upskilling programs in AI, robotics, and advanced materials will address talent shortages and secure essential expertise. Finally, embedding sustainability metrics into core service offerings will differentiate providers in highly regulated industries and align with the global imperative for environmentally responsible engineering practices.

Detailing a Rigorous Research Methodology Combining Primary Interviews, Secondary Data Analysis, and Qualitative Assessment to Ensure Robust Insights

This report’s insights are underpinned by a rigorous research methodology that integrates primary and secondary data streams to ensure robustness and validity. The primary component encompassed structured interviews with C-level executives, engineering directors, and procurement heads across target industries. These dialogues provided firsthand perspectives on evolving service requirements, procurement strategies, and the impact of tariff policies. In addition, expert roundtables with industry veterans and technology partners were conducted to validate emerging trends and challenge preliminary hypotheses.

Complementing this, secondary research involved a comprehensive review of public filings, government trade publications, regulatory databases, and leading technology whitepapers to capture quantitative benchmarks and historical baselines. The qualitative assessment included thematic analysis of industry conferences, patent filings, and trade association reports to identify innovation hotspots and supply chain shifts. All data points were triangulated through cross-verification protocols to mitigate bias and ensure consistency. This multi-faceted approach delivers a transparent and replicable research framework, providing stakeholders with a high degree of confidence in the strategic recommendations presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Engineering Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Engineering Services Market, by Service Type

- Engineering Services Market, by Business Model

- Engineering Services Market, by Delivery Model

- Engineering Services Market, by Service Duration

- Engineering Services Market, by Industry Vertical

- Engineering Services Market, by Client Type

- Engineering Services Market, by Region

- Engineering Services Market, by Group

- Engineering Services Market, by Country

- United States Engineering Services Market

- China Engineering Services Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesizing Key Findings and Strategic Implications to Frame the Future of Engineering Services in an Era of Continued Disruption and Opportunity

By synthesizing the key drivers of digital transformation, tariff-induced supply chain shifts, and evolving client expectations, this executive summary illuminates the multifaceted nature of today’s engineering services landscape. It is clear that the integration of advanced analytics, AI-enabled simulation, and flexible delivery models will differentiate success stories from the rest of the market. Simultaneously, navigating the complexities introduced by 2025 tariff regimes requires proactive supply chain diversification and transparent cost management frameworks.

Segment-level insights emphasize that growth trajectories will vary by service type and industry focus, while regional dynamics highlight the importance of localized strategies. The competitive landscape is marked by innovation-driven partnerships and the strategic acquisition of niche capabilities. Ultimately, organizations that adopt a holistic, data-driven approach to service delivery-coupled with sustainable engineering practices-will position themselves at the forefront of a rapidly evolving sector. This conclusion underscores the imperative for continuous adaptation, strategic foresight, and collaborative value creation across the engineering services ecosystem.

Unlock Exclusive Strategic Insights and Drive Your Competitive Edge by Partnering with Ketan Rohom to Access the Comprehensive Market Research Report Today

If you are ready to deepen your understanding of the engineering services ecosystem and gain a competitive advantage, reach out to Ketan Rohom, Associate Director, Sales & Marketing, to access the comprehensive market research report. By partnering directly with Ketan Rohom, you will receive personalized guidance on how the insights apply to your organization’s unique challenges and strategic priorities. Engage with an expert who can help you navigate the complexities of evolving service models, regional trade dynamics, and emerging technology trends. Secure your copy today to unlock actionable recommendations, in-depth regional and segment analysis, and a robust methodology that ensures you stay ahead in a rapidly changing industry.

- How big is the Engineering Services Market?

- What is the Engineering Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?