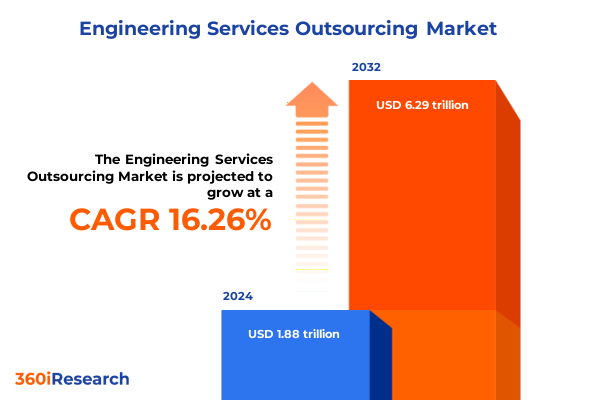

The Engineering Services Outsourcing Market size was estimated at USD 106.34 billion in 2025 and expected to reach USD 114.40 billion in 2026, at a CAGR of 7.84% to reach USD 180.47 billion by 2032.

Positioning Engineering Services Outsourcing as a Catalyst for Innovation, Cost Optimization, and Strategic Partnership in Dynamic Markets

Engineering services outsourcing has emerged as a transformative lever for organizations seeking to accelerate innovation, streamline operations, and harness external expertise without diluting core competencies. As digital disruption reshapes traditional R&D and product development paradigms, companies are increasingly turning to specialized external partners to access niche capabilities in application design, advanced analytics, and modern infrastructure management. This shift not only alleviates internal resource constraints but also establishes dynamic partnerships that foster continuous process improvement and rapid time to market.

Moreover, the proliferation of emerging technologies-ranging from cloud-native architectures to AI-driven digital twins-has elevated the strategic value of outsourcing relationships. Enterprises can now deploy scalable teams with deep domain knowledge to navigate complex digital transformation journeys. Consequently, engineering services outsourcing is no longer viewed purely as a cost-saving measure; instead, it is recognized as a strategic enabler that amplifies organizational agility, fuels product innovation, and supports sustainable growth.

Unpacking the Technological Disruption and Operational Evolution Reshaping the Competitive Landscape of Engineering Services Outsourcing

In recent years, the engineering services outsourcing landscape has been fundamentally redefined by both technological breakthroughs and evolving operational imperatives. Artificial intelligence and machine learning have moved from pilot projects to production-grade deployments, driving demand for service providers that can integrate intelligent automation into every stage of the product lifecycle. Simultaneously, the advent of digital twin technology has created opportunities for virtual prototyping and real-time system monitoring, enabling remote collaboration between clients and offshore development centers.

Furthermore, the shift towards DevOps and agile frameworks has disrupted traditional linear development models. Outsourcing partners are now expected to embed cross-functional teams capable of continuous integration and rapid iteration, accelerating delivery cycles while ensuring high-quality releases. As cybersecurity threats become more sophisticated, service providers must also demonstrate robust security-by-design approaches. Collectively, these transformative shifts underscore the need for a holistic ecosystem of engineering services that blends advanced platforms, flexible engagement structures, and domain-specific expertise.

Assessing the Ripple Effects of United States Tariff Policies in 2025 on Global Engineering Services Supply Chains and Cost Structures

The implementation of new United States tariffs in 2025 has introduced a complex set of cost and supply chain considerations for engineering services clients and providers alike. Tariffs imposed on critical hardware components such as specialized semiconductors, precision machining tools, and raw materials have driven procurement costs higher, prompting many organizations to reevaluate their vendor portfolios. As a result, some outsourcing partners have sought to offset these pressures by diversifying manufacturing and development hubs across tariff-exempt jurisdictions.

Consequently, nearshoring arrangements with Mexico and select Latin American markets have experienced renewed interest as organizations aim to mitigate freight expenses and customs duties. At the same time, providers with robust global delivery networks have leveraged their multi-region sourcing capabilities to optimize cost efficiencies. While the immediate impact of tariffs has manifested in incremental price adjustments, the longer-term effect is accelerating the trend toward resilient, geographically balanced supply chains that combine onshore agility with offshore scale.

Deriving Actionable Insights from Market Segmentation Across Service Offerings, Delivery Models, Engagement Frameworks, Industry Verticals, and Enterprise Sizes

A nuanced understanding of service-type segmentation reveals distinct demand patterns that shape provider strategies. For instance, Application Development and Maintenance continues to dominate outsourcing engagements, driven by a surge in application modernization initiatives and the need for rapid rollout of new functionality. Concurrently, Digital Transformation Advisory within the consulting and advisory segment is witnessing heightened client investment, reflecting a shift from process optimization toward holistic digital journey planning. Infrastructure Management priorities have also evolved, with cloud management leading the charge as companies migrate legacy systems to public and hybrid environments.

Examining delivery models, offshore arrangements remain the cost benchmark for large-scale engineering work, while onshore and nearshore options are gaining traction for projects requiring close collaboration or compliance with local regulations. Within engagement frameworks, the Time and Materials model retains popularity for exploratory or evolving scopes, whereas the Dedicated Team model is favored for strategic, long-term partnerships. Industry vertical segmentation highlights a robust pipeline in Banking, Financial Services, and Insurance, where middleware integration and security testing are mission critical. Meanwhile, Manufacturing clients underscore the importance of automation testing and enterprise application integration to support automotive and electronics production lines. Finally, enterprise-scale clients deploy outsourcing across multiple segments, whereas small and medium enterprises emphasize fixed price models to maintain budgetary discipline.

This comprehensive research report categorizes the Engineering Services Outsourcing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Outsourcing Model

- Engagement Model

- Technology

- End Use Industry

- Organization Size

Revealing Distinct Regional Patterns and Growth Drivers in the Americas, Europe Middle East and Africa, and Asia Pacific Engineering Services Markets

Regional dynamics play a pivotal role in shaping engineering services outsourcing strategies. In the Americas, North America remains the largest consumer of outsourced engineering expertise, with U.S.-based organizations leading digital transformation programs across aerospace, automotive, and healthcare sectors. Mexico and Brazil are emerging as competitive nearshore hubs, capitalizing on proximity, cultural alignment, and competitive labor rates.

Turning to Europe, Middle East, and Africa, Western Europe is characterized by stringent regulatory and sustainability requirements, prompting service providers to integrate green engineering practices and compliance monitoring into their offerings. In the Gulf Cooperation Council, significant public-sector infrastructure investments have fueled demand for advanced systems integration and digital twin solutions. Across Africa, a nascent but rapidly growing technology ecosystem is driven by telecommunications operators and energy sector modernization efforts.

In Asia-Pacific, India and China continue to anchor the offshore delivery model, with providers leveraging vast talent pools to serve global clients in the banking, retail, and life sciences verticals. Australia and Southeast Asian nations are also gaining prominence in specialized consulting and advisory services, particularly in the realms of Industry 4.0 and IoT-enabled smart manufacturing.

This comprehensive research report examines key regions that drive the evolution of the Engineering Services Outsourcing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Positioning and Innovation Strategies of Leading Engineering Service Providers in a Rapidly Evolving Market Environment

Leading engineering service providers are increasingly differentiating themselves through specialized talent networks, strategic partnerships, and technology-driven service lines. Accenture and IBM extend their capabilities with global innovation hubs and cross-industry expertise, focusing on AI-enabled systems and digital twin labs. Tata Consultancy Services and Infosys maintain robust service portfolios in application modernization, cloud migration, and infrastructure resilience, underpinned by extensive onshore-offshore delivery networks.

Capgemini and Wipro emphasize domain-specific solutions in automotive, aerospace, and healthcare, investing in test automation frameworks and cybersecurity operations centers. Meanwhile, mid-sized firms and niche providers leverage specialized competencies-such as semiconductor design services or industrial IoT integration-to carve out positions in high-growth verticals. These companies pursue strategic acquisitions and co-innovation alliances to rapidly scale capabilities, while embedding sustainability and regulatory compliance as core differentiators in their go-to-market propositions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Engineering Services Outsourcing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alten Group

- Capgemini SE

- Tata Consultancy Services Limited

- Akkodis Group AG

- HCL Technologies Limited

- Infosys Limited

- EPAM Systems, Inc.

- Wipro Limited

- Tech Mahindra Limited

- Cyient Ltd

- Quest Global Services Pte. Ltd.

- Entelect Software (Pty) Ltd.

- Accenture plc

- AFRY AB

- Altair Engineering Inc.

- Assystem SA

- AVL List GmbH

- Barton Malow Holdings LLC

- Bechtel Corporation

- Bertrandt AG

- Detroit Engineered Products

- EDAG Engineering GmbH

- Ferchau Engineering GmbH

- Globallogic Inc.

- International Business Machines Corporation

- Kiewit Corporation

- KPIT Technologies Limited

- Neilsoft Ltd.

- New York Engineers

- RLE International Inc.

- WPG Consulting LLC

Delivering Targeted Strategic Recommendations to Empower Industry Leaders to Optimize Investments, Enhance Collaboration, and Drive Operational Excellence

To capitalize on emerging opportunities, engineering services leaders must prioritize investment in digital engineering capabilities, particularly in AI-driven simulation and automation testing. By forging collaborative ecosystems with cloud hyperscalers and technology start-ups, organizations can accelerate innovation and reduce time to market. Furthermore, diversifying delivery footprints across onshore, nearshore, and offshore centers is essential for balancing cost efficiency with agility in response to tariff volatility and geopolitical risks.

In addition, developing flexible engagement models that align incentives with outcome-based metrics will strengthen client-provider relationships. Industry leaders should also cultivate deep domain expertise by establishing centers of excellence focused on high-growth verticals such as renewable energy, automotive electrification, and advanced life sciences. Finally, embedding sustainability and security-by-design principles across the service lifecycle will not only address regulatory mandates but also foster long-term client trust and resilience.

Outlining a Comprehensive Mixed-Method Approach Integrating Quantitative Data Analytics, Expert Interviews, and Survey-Based Primary Research for Engineering Services Insights

Our research methodology integrates a comprehensive mixed-method approach to ensure the rigor and relevance of insights. We commenced with extensive secondary research, reviewing industry journals, regulatory filings, and patent databases to capture macro-economic and technological trends. This was followed by a series of in-depth interviews with senior executives from leading service providers, user organizations, and technology vendors.

Quantitative validation was achieved through a structured survey of engineering and IT leadership across key industry verticals, enabling robust triangulation of qualitative findings. Data integrity was reinforced by cross-checking regional delivery metrics and engagement model preferences against proprietary benchmarking datasets. Finally, all findings underwent peer review by subject matter experts to ensure both accuracy and applicability, delivering a reliable foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Engineering Services Outsourcing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Engineering Services Outsourcing Market, by Service Type

- Engineering Services Outsourcing Market, by Outsourcing Model

- Engineering Services Outsourcing Market, by Engagement Model

- Engineering Services Outsourcing Market, by Technology

- Engineering Services Outsourcing Market, by End Use Industry

- Engineering Services Outsourcing Market, by Organization Size

- Engineering Services Outsourcing Market, by Region

- Engineering Services Outsourcing Market, by Group

- Engineering Services Outsourcing Market, by Country

- United States Engineering Services Outsourcing Market

- China Engineering Services Outsourcing Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3021 ]

Synthesizing Key Findings and Strategic Implications to Illuminate the Future Trajectory of Engineering Services Outsourcing Across Diverse Market Contexts

This executive summary has surfaced the critical trends and strategic imperatives redefining engineering services outsourcing in today’s dynamic environment. The convergence of AI, cloud, and digital twin technologies is transforming traditional delivery models, while 2025 tariff policies have underscored the importance of diversified sourcing strategies. Segmentation analysis reveals nuanced demand patterns across service types, delivery models, and industry verticals, highlighting the need for tailored approaches to engagement.

Regional insights demonstrate varying maturity levels and growth drivers, from nearshore expansion in the Americas to regulatory-driven digital initiatives in EMEA and talent-focused operations in Asia-Pacific. Leading providers are responding with specialized value propositions, strategic partnerships, and targeted acquisitions. As the industry advances, organizations must adopt flexible engagement frameworks, invest in digital engineering competencies, and uphold security and sustainability as foundational principles. These strategic imperatives will illuminate the trajectory toward resilient, innovation-driven engineering services ecosystems.

Engage with Associate Director of Sales and Marketing to Unlock Tailored Engineering Services Market Intelligence That Drives Informed Strategic Decisions

Elevate your strategic decision-making by accessing our comprehensive engineering services market intelligence through a personalized consultation with Ketan Rohom, Associate Director, Sales & Marketing. Engage directly to uncover how this research can address your organization’s unique challenges, illuminate emerging opportunities, and inform your next steps in outsourcing excellence. Reach out today to secure immediate access to in-depth analysis, expert commentary, and tailored insights designed to drive measurable impact across your critical engineering initiatives.

- How big is the Engineering Services Outsourcing Market?

- What is the Engineering Services Outsourcing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?