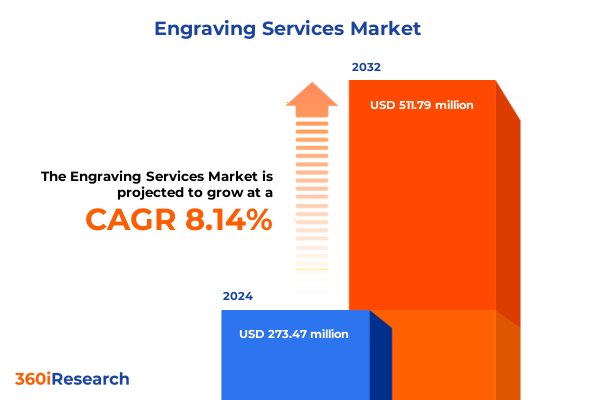

The Engraving Services Market size was estimated at USD 295.38 million in 2025 and expected to reach USD 317.71 million in 2026, at a CAGR of 8.16% to reach USD 511.79 million by 2032.

Exploring the Evolution of Engraving Services and Its Strategic Implications for Precision Manufacturing and Customization

Engraving services play a pivotal role in contemporary manufacturing and personalization strategies, offering unparalleled precision and aesthetic differentiation across a broad spectrum of industries. From automotive components that demand exacting tolerances to personalized jewelry pieces that speak to individual identity, the art and science of engraving are at the nexus of craftsmanship and advanced production techniques. At its core, engraving transforms raw materials into expressive finished goods, bridging traditional practices with modern demands for customization and scalability.

As market forces evolve, engraving has moved beyond purely decorative purposes to become a critical enabler of traceability, branding, and functional component design. Key end users in sectors such as electronics and medical devices rely on intricate engravings to convey safety information, serial codes, and quality markings that underpin regulatory compliance and after-sales service. Meanwhile, luxury goods and signage providers leverage engraving to elevate perceived value and reinforce brand narratives.

With digital adoption accelerating across manufacturing, the engraving services domain is experiencing a renaissance of innovation. Advanced software platforms now integrate seamlessly with laser and electrical discharge machining equipment, empowering service providers to deliver rapid prototyping and small-run production at previously unattainable speeds. This introduction sets the stage for a deeper exploration of the forces reshaping the engraving services market and highlights how stakeholders can capitalize on emerging opportunities.

Charting the Emergence of Intelligent Automation and Digital Integration as Defining Transformations Reshaping Engraving Services

The engraving services industry is undergoing a profound transformation driven by the convergence of digital automation and advanced material processing. Intelligent systems now orchestrate multi-axis laser and mechanical engraving tools with minimal human intervention, elevating levels of repeatability and throughput. This shift toward automation not only accelerates delivery timelines but also reduces reliance on specialized labor, paving the way for broader adoption in high-volume production settings.

Concurrently, the integration of digital design and cloud-based collaboration platforms has redefined how clients engage with engraving service providers. Real-time design iteration, remote proofing, and automated cost estimation have streamlined the customer journey, reducing barriers to entry for small and medium-sized enterprises seeking bespoke engraving solutions. This digital interface fosters closer collaboration and enables rapid pivoting in response to changing market demands.

Sustainability considerations have also emerged as a transformative force, influencing both equipment development and material selection. Providers are investing in energy-efficient laser systems and exploring recyclable substrates, responding to customer expectations for environmentally responsible manufacturing. These industry-wide shifts underscore a new era of strategic agility, where service providers leverage technological integration and eco-innovations to deliver differentiated offerings that resonate across diverse end-use segments.

Assessing the Comprehensive Impact of 2025 United States Tariff Measures on Material Costs and Competitive Dynamics in Engraving Services

The introduction of new United States tariff measures in 2025 has exerted a significant cumulative effect on the engraving services ecosystem, particularly by elevating costs for key input materials and specialized equipment. Metal substrates such as aluminum and steel have faced heightened import duties, prompting service providers to reassess supplier relationships and explore domestic sourcing alternatives. This shift has triggered a wave of strategic procurement adjustments as providers seek to mitigate margin pressures and maintain competitive pricing structures.

Material cost increases have rippled through downstream applications spanning aerospace components to decorative metal signage, compelling manufacturers to evaluate trade-offs between quality, turnaround time, and price. In many cases, providers have strengthened partnerships with local material processors to secure favorable rates while diversifying material portfolios to include lower-duty substrates such as certain plastic grades. Such strategic diversification has become essential for sustaining operational resilience.

Moreover, the tariff landscape has catalyzed a reassessment of supply chain configurations, with an uptick in reshoring initiatives aimed at bringing value-added engraving operations closer to end-user markets. This realignment supports faster response times and enhances risk management, albeit requiring additional investment in domestic capacity. As providers adapt to these protective measures, the cumulative impact of U.S. tariffs continues to reshape competitive dynamics and inform strategic decision making across the engraving services sector.

Unveiling Critical Segmentation Perspectives Revealing How Technology Application Material and Service Divisions Drive Opportunity in Engraving Services

A nuanced understanding of market segmentation illuminates the diverse levers that drive demand and competitive differentiation within the engraving services landscape. From a technology perspective, service providers deploy chemical engraving techniques for precise metal etching alongside electrical discharge machining for intricate component detailing, while laser engraving delivers high-speed customization across a spectrum of substrates and mechanical engraving remains crucial for deeper-cut applications in durable materials.

Application-driven analysis reveals that engraving services are integral to core sectors such as automotive and aerospace, where serial numbering and traceability are paramount, as well as electronics, which depend on microscale markings for circuit boards and connectors. The jewelry and personal items segment-spanning bracelets, necklaces and rings-capitalizes on engraving to imbue products with bespoke narratives, while medical device engraving covers essential diagnostic equipment, implants and surgical instruments, ensuring regulatory compliance and patient safety. Additional application areas such as nameplates, tags, signage and awards underscore the versatility of engraving across both functional and decorative contexts.

Material considerations further differentiate service offerings, as glass substrates provide elegant solutions for premium branding, metals including aluminum and steel meet rigorous mechanical requirements, plastics such as acrylic and polycarbonate strike a balance between cost and performance, and wood imparts artisanal appeal for upscale furnishings. Lastly, service models comprise off-site production centers capable of handling large-scale batch orders and on-site engraving solutions that deliver rapid turnaround and customization directly at client facilities. This layered segmentation framework guides strategic positioning, enabling providers to tailor capabilities to distinct market niches.

This comprehensive research report categorizes the Engraving Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Application

- Material

- Service

Delineating Regional Dynamics Across Americas Europe Middle East Africa and Asia Pacific to Illuminate Distinct Drivers and Competitive Conditions

Regional dynamics exert a profound influence on the competitive and operational contours of the engraving services market. In the Americas, the United States leads a robust ecosystem driven by advanced manufacturing infrastructure, close proximity to high-value end-use sectors and growing reshoring trends. This environment fosters rapid innovation cycles and strong domestic supply chains, while Canada and Latin American markets contribute niche specialization in materials processing and cost-effective contract services.

Across Europe, Middle East & Africa, diverse regulatory standards and luxury-driven demand define market characteristics. Western Europe’s emphasis on quality certification and sustainability propels adoption of eco-friendly engraving technologies, while luxury goods manufacturers in Italy, France and the United Kingdom leverage precision engraving to reinforce premium branding. In the Middle East, infrastructure investments and visionary urban development projects spur demand for large-scale signage and architectural engraving applications, and select African markets are emerging as cost-competitive sourcing options for standardized products.

The Asia-Pacific region remains the global manufacturing powerhouse, combining high-volume production capacity with rapid technology adoption. China and South Korea lead in laser engraving equipment exports, supported by domestic innovation in automation and digital integration. Meanwhile, Southeast Asian economies offer strategic cost advantages for off-site services and are enhancing capabilities in materials such as polycarbonate and acrylic. Together, these regional nuances shape the competitive landscape and inform targeted market engagement strategies.

This comprehensive research report examines key regions that drive the evolution of the Engraving Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players Innovations Partnerships and Strategic Positioning Shaping Competitive Advantage in the Engraving Services Sector

The competitive landscape of engraving services is characterized by established global operators and agile specialist providers, each leveraging unique capabilities to command market share. Leading firms invest heavily in research and development to refine laser cutting precision, integrate software-driven workflow management and enhance sustainability credentials. Through strategic partnerships with materials suppliers and CAD/CAM platform providers, these key players deliver end-to-end solutions that span design validation to post-engraving finishing.

Smaller niche specialists differentiate through customized service offerings, such as on-site engraving units tailored for rapid emergency replacements in the industrial sector or artisanal engraving workshops that focus on high-value luxury goods. Collaboration among major equipment manufacturers and contract service bureaus has given rise to new service models, blending off-site capacity with regional micro-facilities to meet both high-volume and just-in-time requirements.

Partnerships and acquisitions have bolstered the capabilities of market participants, enabling providers to expand material processing portfolios and enter adjacent markets such as digital etching and additive finishing. As competitive intensity heightens, companies that demonstrate agility in adopting emerging technologies and aligning service delivery with evolving customer expectations will maintain a strategic edge in this rapidly maturing market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Engraving Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A-1 Engraving Company, Inc.

- Able Engravers, Inc.

- Accubeam Laser Marking, Inc.

- Ashford Lasers

- Badges Plus Limited

- BlueFin Agency, Inc.

- Bolder Engraving

- Couple Lab

- eMachineShop by Micro Logic Corp.

- Engrave Tech.

- GPG PRINTING PTE LTD.

- Guangzhou Komaspec Mechanical and Electrical Products Manufacturing Co. Ltd

- Hai Tech Lasers, Inc.

- Harrisons Laser Technology Limited

- INNOTECH, LLC by T1 Group

- Krintech Ltd

- Laser Impressions, Inc.

- MEB Kamppi

- Nano Hone

- NYC Engraving Service

- OC Engraving by Kluz International Corporation

- Ponoko Inc.

- Precision Engraving Inc.

- Sheffield Engraving Ltd.

- Sine-tific Solutions, Inc

- Southern Reclaimed Salvage Barn.

- Synertek

- Xometry, Inc.

Delivering Targeted Strategic Recommendations Empowering Industry Leaders to Capitalize on Technological Integration and Market Diversification Opportunities

To capitalize on market opportunities and navigate evolving industry dynamics, engraving services leaders should prioritize the advancement of digital integration across core operational processes. By deploying unified software platforms that synchronize design inputs, production scheduling and quality assurance workflows, organizations can accelerate time-to-market while maintaining rigorous precision standards. In parallel, forging strategic alliances with material suppliers will help stabilize input costs and secure preferential access to emerging substrate technologies.

Diversification of service offerings is another key lever for growth. Providers that extend capabilities beyond traditional metal and plastic engraving to incorporate composite materials, glass etching and digital texturing services can capture a wider array of end-use segments. Simultaneously, investment in modular on-site engraving solutions will strengthen responsiveness to localized demand and bolster customer loyalty in industries with critical downtime constraints.

A commitment to sustainability should underpin all strategic initiatives, from selecting energy-efficient laser systems to adopting circular material workflows. Engraving services firms that transparently demonstrate environmental stewardship will meet the rising expectations of global customers and differentiate in tender processes for public and private sector contracts. Ultimately, a balanced focus on technology adoption, supplier collaboration and green credentials will empower industry leaders to drive performance and secure long-term competitive positioning.

Detailing the Robust Research Framework and Methodological Approach Underpinning Insights and Ensuring Analytical Rigor in Engraving Services Analysis

This research leverages a rigorous, multi-phase approach to deliver actionable insights into the engraving services market. Secondary research began with an exhaustive review of industry publications, vendor white papers and regulatory frameworks to map the competitive landscape and identify key market drivers. Concurrently, financial disclosures and patent filings were analyzed to ascertain technology development trajectories and investment patterns.

Primary research encompassed structured interviews with senior executives from leading service providers, materials suppliers and equipment manufacturers, as well as focused discussions with design and procurement heads at major end-user companies across automotive, electronics and medical device sectors. These qualitative insights were triangulated with quantitative data gathered via targeted surveys to ensure representativeness across industry segments and geographies.

Data validation protocols, including cross-verification against third-party databases and iterative expert review sessions, safeguarded the reliability and accuracy of findings. Analytical techniques such as segmentation analysis, competitive benchmarking and thematic trend mapping provided the foundation for the detailed insights presented throughout this report. This methodical framework ensures that strategic recommendations are grounded in comprehensive, empirically supported evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Engraving Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Engraving Services Market, by Technology

- Engraving Services Market, by Application

- Engraving Services Market, by Material

- Engraving Services Market, by Service

- Engraving Services Market, by Region

- Engraving Services Market, by Group

- Engraving Services Market, by Country

- United States Engraving Services Market

- China Engraving Services Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Concluding Strategic Observations Emphasizing Core Trends Competitive Imperatives and Future Trajectories of the Engraving Services Ecosystem

The engraving services sector stands at a strategic inflection point, where technological innovation, shifting trade policies and evolving customer expectations converge to reshape competitive paradigms. Digital automation and integrated design-to-production workflows are driving productivity gains, while heightened tariff environments compel service providers to optimize supply chains and explore on-shore capabilities. At the same time, granular segmentation by technology, application, material and service model highlights the importance of tailored offerings that address specific end-use needs.

Regionally, market conditions vary significantly, from the advanced manufacturing ecosystems of North America to luxury-driven demand in Western Europe and high-volume production hubs in Asia-Pacific. Leading companies distinguish themselves through sustained investment in R&D, strategic partnerships and a robust sustainability agenda. For market participants, the imperative is clear: embrace digitalization, foster supplier collaboration and diversify service portfolios to remain agile in a landscape defined by rapid change.

By synthesizing structural trends with nuanced competitive analysis, this report illuminates the pathways to value creation and long-term growth. As stakeholders navigate the complexities of tariff pressures, material innovations and customer demand for personalized solutions, the insights herein will serve as a strategic compass to guide decision making and investment priorities.

Connect with Associate Director Ketan Rohom to Secure Comprehensive Engraving Services Market Research Insights and Drive Strategic Decision Making

For organizations seeking to deepen their understanding of the engraving services landscape and turn strategic insights into tangible outcomes, a detailed market research report offers an indispensable foundation. To secure comprehensive analysis of transformative market shifts, segmentation insights, regional dynamics, and competitive positioning, please connect directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. His expertise will guide you through report highlights tailored to your unique business requirements and ensure you have the actionable intelligence needed to refine your strategic roadmap. Engage with Ketan Rohom today to access the full suite of data, expert interpretation, and bespoke advisory support that will empower your organization to navigate the competitive engraving services market with confidence and drive sustainable growth.

- How big is the Engraving Services Market?

- What is the Engraving Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?