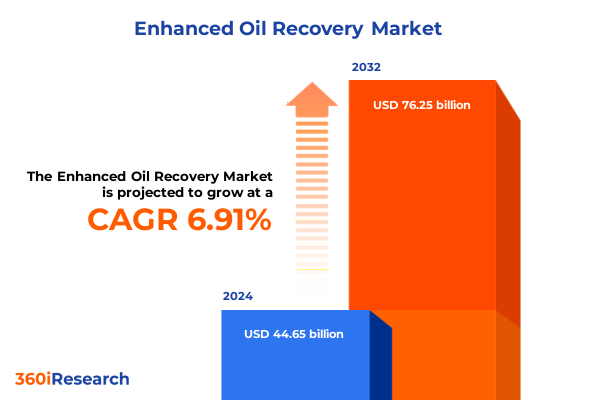

The Enhanced Oil Recovery Market size was estimated at USD 47.60 billion in 2025 and expected to reach USD 50.74 billion in 2026, at a CAGR of 6.96% to reach USD 76.25 billion by 2032.

Unveiling Enhanced Oil Recovery’s Pivotal Role in Maximizing Hydrocarbon Yields and Driving Operational Efficiency Across Global Reservoirs

Enhanced Oil Recovery (EOR) stands as a critical pillar in the global energy industry’s quest to sustain and enhance hydrocarbon production from aging fields. Traditional recovery methods, known as primary and secondary techniques, typically yield only a fraction of a reservoir’s original oil in place. During primary recovery, natural reservoir pressure and artificial lift mechanisms capture roughly ten percent of the original oil output. Subsequently, secondary recovery strategies, such as water or gas injection, extend the productive life of a field by mobilizing an additional twenty to forty percent of the resource.

As economic and environmental pressures intensify, tertiary or enhanced oil recovery methods have emerged as indispensable tools for operators aiming to extract significantly larger volumes of residual oil. These advanced techniques hold the prospect of recovering up to sixty percent or more of the original oil in place, surpassing the limitations of conventional technologies. By injecting heat, gases, chemicals, or microbes, EOR interventions improve reservoir sweep efficiency, reduce oil viscosity, and modify interfacial tensions, enabling access to previously uneconomic hydrocarbon pockets.

In parallel with technological progress, government agencies have increasingly supported EOR research and demonstration projects to align energy security with decarbonization objectives. In April 2024, the U.S. Department of Energy awarded $23.2 million in funding to two projects that evaluate carbon dioxide–enhanced oil recovery coupled with geologic storage in unconventional reservoirs. These initiatives aim to repurpose existing infrastructure while assessing the potential for permanent carbon sequestration within depleted fields, underscoring EOR’s dual role in extending resource recovery and mitigating greenhouse gas emissions.

Examining the Convergence of Technological Innovation Regulatory Reforms and Sustainability Trends Reshaping Enhanced Oil Recovery Paradigms Globally

The landscape of Enhanced Oil Recovery is undergoing transformative shifts driven by innovations in digitalization, evolving regulatory frameworks, and mounting sustainability imperatives. Digital oilfield solutions now integrate real-time monitoring, advanced analytics, and machine learning to optimize injection parameters and predict reservoir behavior. By harnessing high-frequency sensor data, operators can dynamically adjust steam generation, gas composition, and chemical concentrations, achieving precise control over sweep efficiency and mobilization pathways. This convergence of data science and reservoir engineering marks a departure from traditional trial-and-error approaches toward proactive, model-informed decision making.

Simultaneously, policy and regulatory developments are reshaping investment decisions and operational models. Trade measures, such as temporary exclusions from Section 301 tariffs on critical manufacturing machinery through August 2025, have provided relief for domestic sourcing of equipment used in EOR systems, influencing supply chain strategies and capital allocation. At the same time, steel and aluminum duties remain a headwind for tubular goods and pressure vessels, necessitating deeper engagement with domestic fabricators and collaborative procurement to mitigate cost exposures through 2025.

Furthermore, the integration of carbon management objectives into EOR projects reflects a broader shift toward low-carbon hydrocarbon production. Innovative pilots are exploring co-optimization of oil recovery and carbon storage, leveraging depleted reservoirs not only for incremental oil but also for secure, long-term sequestration of CO₂. As environmental risk management and ESG reporting take center stage, stakeholders increasingly view EOR as a bridge between meeting energy demand and advancing climate goals. Taken together, these technological, regulatory, and sustainability forces are redefining EOR strategies and setting the stage for the next wave of industry evolution.

Assessing the Economic and Operational Consequences of Recent United States Tariff Measures on Enhanced Oil Recovery Operations in 2025

United States tariff actions in 2025 have exerted a significant economic and operational impact on Enhanced Oil Recovery activities, influencing both equipment costs and corporate spending priorities. The U.S. Trade Representative extended certain exclusions from Section 301 tariffs on Chinese-origin machinery used in domestic manufacturing through August 31, 2025, alleviating duties on a range of pumps, compressors, and specialized equipment integral to chemical, gas, and thermal EOR systems. This extension has offered temporary reprieve for importers seeking duty-free access to critical components, yet the short-term nature of the measure underscores the importance of supply base diversification and contingency planning.

Conversely, broader steel and aluminum tariffs remain in force, introducing additional cost pressures for downhole tubular goods such as OCTG and pressure vessels. With import tariffs on OCTG products estimated to increase costs by up to fifteen percent, operators face rising expenditures on casing and tubing essential for thermal injection wells and CO₂ pipelines. In response, leading service providers are pursuing localized manufacturing partnerships and long-term purchasing agreements to stabilize input prices.

These tariff-induced cost dynamics have contributed to a conservative capital expenditure climate among oilfield services firms. Baker Hughes, for instance, forecasted a notable reduction in global upstream spending in 2025, attributing $100 to $200 million of earnings pressure to tariff-related cost escalations on steel, aluminum, and imports from China and Europe. As a result, Oil & Gas operators and service companies are redoubling efforts to optimize schedules, renegotiate supplier contracts, and pursue domestic supply chain solutions to maintain project viability under evolving trade constraints.

Exploring Enhanced Oil Recovery Segmentation Across Method Reservoir Type Oil Viscosity and Application Dynamics to Illuminate Key Market Insights

Enhanced Oil Recovery market dynamics are shaped by a spectrum of segmentation parameters spanning method, reservoir type, oil viscosity, and application. Methodological segmentation encompasses chemical flooding techniques such as alkali, polymer, and surfactant flooding; gas injection processes including CO₂ injection, miscible gas, and nitrogen injection; emerging microbial approaches; and thermal interventions like in-situ combustion, steam-assisted gravity drainage, and steam flooding. Each approach exhibits distinct resource requirements, operational complexity, and incremental recovery potential, informing technology selection based on reservoir characteristics and cost structures.

Reservoir type further stratifies EOR adoption, distinguishing between carbonate and sandstone formations. Within carbonate reservoirs, fractured and vuggy architectures present unique flow pathways that respond differently to gas and chemical treatments, necessitating tailored injection schemes and reservoir modeling. Sandstone reservoirs, whether consolidated or unconsolidated, demand careful management of injectant viscosity and sweep control to mitigate channeling and improve volumetric efficiency.

Oil viscosity segmentation differentiates strategies for heavy and light oil. Heavy oil applications rely heavily on thermal methods to lower viscosity thresholds, while light oil plays are more amenable to gas and chemical flooding that exploit miscibility and interfacial tension reduction. Finally, geographical application contexts split between offshore and onshore operations. Offshore platforms impose stringent space, weight, and safety constraints, often favoring injected gas cycles and closed-loop thermal systems, whereas onshore facilities can deploy larger surface infrastructure and handle extensive steam generation or chemical storage. Together, these segmentation dimensions provide a comprehensive framework for evaluating technology fit, investment prioritization, and performance optimization across diverse EOR scenarios.

This comprehensive research report categorizes the Enhanced Oil Recovery market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Method

- Reservoir Type

- Mechanism of Recovery

- Application

- Deployment Type

Mapping Regional Variations in Enhanced Oil Recovery Adoption Trends Across the Americas Europe Middle East Africa and Asia Pacific to Inform Strategic Decisions

Regional diversity in Enhanced Oil Recovery adoption underscores the interplay of resource endowment, regulatory environment, and technological maturity across the Americas, Europe Middle East and Africa, and Asia Pacific. In the Americas, established basins such as the Permian and Gulf Coast benefit from mature infrastructure, abundant CO₂ sources, and favorable fiscal regimes, driving continued investment in both thermal and CO₂-EOR pilots. The region’s existing carbon capture networks, coupled with low-cost CO₂ supplies from natural gas processing plants, reinforce the economic case for tertiary recovery in mature fields.

In Europe, Middle East and Africa, regulatory dynamics and resource heterogeneity create a complex EOR landscape. North Sea operators face stringent environmental regulations and high offshore operational costs, steering them toward gas-based EOR and digital reservoir monitoring to optimize injected volumes. Simultaneously, Middle Eastern producers leverage vast carbonate fields to advance chemical and miscible CO₂ techniques, while sub-Saharan African initiatives explore microbial EOR in emerging plays, often supported by international development finance and technology partnerships.

The Asia Pacific region exhibits a blend of emerging and frontier EOR activity. In Australia and Southeast Asia, enhanced gas injection trials are advancing in gas condensate and light oil reservoirs. China’s extensive heavy oil reserves in the Bohai Bay and Shengli fields have catalyzed steam and chemical EOR programs, enabled by domestic equipment manufacturing and government incentives. Across the region, varying access to CO₂ supplies and water resources shapes the selection and scale of EOR demonstrations, with many operators piloting hybridized approaches that co-optimize resource availability and recovery efficiency.

This comprehensive research report examines key regions that drive the evolution of the Enhanced Oil Recovery market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Service Providers Technology Innovators and Strategic Partnerships Driving Competitive Dynamics in the Global Enhanced Oil Recovery Ecosystem

Leading oilfield service providers and technology vendors have intensified their focus on Enhanced Oil Recovery through strategic partnerships, technology rollouts, and asset repositioning. Halliburton continues to advance its chemical EOR portfolio, integrating proprietary surfactant and polymer formulations with data-driven injection optimization platforms to enhance sweep efficiency. The company’s targeted R&D efforts in reservoir characterization and pilot validation have earned it a prominent role in North American and global carbonate EOR projects.

Schlumberger has prioritized digital reservoir management, embedding machine learning algorithms within its EOR solutions to forecast recovery pathways and optimize injection schedules. By combining its DELFI cognitive environment with advanced simulation workflows, Schlumberger enables clients to run rapid scenario analyses and reduce time to decision. The oilfield integrator has also expanded its CO₂ capture and reuse service offerings, forming alliances with carbon capture specialists to deliver turnkey EOR-integrated carbon management solutions.

Baker Hughes navigates tariff-driven cost pressures by reinforcing its domestic manufacturing footprint and forging long-term supply agreements for critical equipment, offsetting expected earnings impacts from import duties. Weatherford has sharpened its focus on steam-based thermal methods, leveraging surface generation enhancements and remote monitoring to improve operational uptime and safety. Additional innovators such as ChampionX deliver modular chemical injection systems, while smaller technology providers introduce novel microbial EOR packages, collectively enriching the competitive ecosystem and expanding the palette of recovery tools available to operators.

This comprehensive research report delivers an in-depth overview of the principal market players in the Enhanced Oil Recovery market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Air Liquide S.A.

- Baker Hughes Company

- BASF SE

- BP PLC

- Cenovus Energy Inc.

- Chevron Corporation

- China Petroleum & Chemical Corporation

- Clariant AG

- Croda International PLC

- DuPont de Nemours, Inc.

- ExxonMobil Corporation

- Halliburton Energy Services, Inc.

- Linde PLC

- Lukoil Oil Company

- Petroliam Nasional Berhad

- Premier Energy, Inc.

- Schlumberger Limited

- Shell PLC

- TechnipFMC PLC

- The Dow Chemical Company

- Titan Oil Recovery Inc.

- TotalEnergies SE

- Ultimate EOR Services, LLC

- Xytel Corporation

Strategic Imperatives Actionable Best Practices and Investment Priorities for Industry Leaders to Capitalize on Emerging Opportunities in Enhanced Oil Recovery

Industry leaders seeking to capitalize on Enhanced Oil Recovery opportunities must align their strategies with operational excellence, cost management, and sustainability targets. First, prioritizing digital transformation through enterprise-wide integration of reservoir data, predictive analytics, and real-time monitoring can unlock efficiency gains and reduce nonproductive time. By linking well performance metrics with advanced simulation models, decision makers can rapidly test injection strategies and optimize surfactant or steam allocation to maximize incremental yields.

Second, mitigating tariff and supply chain risks requires establishing diversified sourcing channels, including domestic manufacturing partnerships and multi-regional procurement frameworks. Engaging with U.S. Trade Representative processes for tariff exclusions and navigating local content requirements can lower equipment import costs and enhance project economics. Concurrently, collaborative alliances with fabricators and logistics providers can secure priority access to OCTG and pressure vessel capacity.

Third, embedding carbon management objectives into EOR initiatives by co-optimizing CO₂-EOR and storage enhances ESG performance and aligns with emerging regulatory incentives. Leaders should evaluate reservoir suitability for long-term sequestration, develop transparent monitoring protocols, and engage stakeholders in carbon credit schemes. Finally, fostering a culture of continuous learning and cross-functional collaboration ensures swift adoption of best practices, from field-pilot execution to scale-up, positioning organizations to navigate evolving market conditions and capture the full potential of enhanced recovery techniques.

Unpacking the Rigorous Multi Phase Research Methodology Combining Primary Expert Interviews Secondary Data Analysis and Validated Market Intelligence

This research employs a rigorous multi-phase methodology to deliver comprehensive insights on Enhanced Oil Recovery. An initial secondary research phase gathered publicly available literature, technical journals, and government publications to establish foundational knowledge on EOR categories, regulatory developments, and technology trends. Concurrently, industry databases and trade publications were consulted to compile data on tariff actions, equipment innovations, and regional case studies.

Subsequently, primary research comprised in-depth interviews with subject matter experts across oil companies, service providers, and regulatory bodies. These structured discussions probed strategic priorities, operational challenges, and emerging best practices in chemical, gas, thermal, and microbial EOR. Insights from these interviews were triangulated against secondary data to validate findings and refine segmentation frameworks.

Advanced analytical techniques, including thematic analysis and scenario mapping, were applied to assess the cumulative impact of tariff measures and to forecast operational adjustments by service firms. Regional deep-dives integrated qualitative feedback with publicly disclosed project data to highlight adoption variances and technology fit across the Americas, EMEA, and Asia Pacific. This blended methodology ensures that conclusions and recommendations reflect both empirical evidence and expert judgment, delivering actionable intelligence for decision makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Enhanced Oil Recovery market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Enhanced Oil Recovery Market, by Method

- Enhanced Oil Recovery Market, by Reservoir Type

- Enhanced Oil Recovery Market, by Mechanism of Recovery

- Enhanced Oil Recovery Market, by Application

- Enhanced Oil Recovery Market, by Deployment Type

- Enhanced Oil Recovery Market, by Region

- Enhanced Oil Recovery Market, by Group

- Enhanced Oil Recovery Market, by Country

- United States Enhanced Oil Recovery Market

- China Enhanced Oil Recovery Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Synthesizing Critical Findings to Illuminate Strategic Pathways and Potential Evolution of Enhanced Oil Recovery Amidst Future Energy Transformation

The convergence of advanced EOR techniques, evolving trade policies, and decarbonization mandates underscores a pivotal moment for the oil and gas industry. Operators and service providers must navigate a complex interplay of cost pressures due to tariffs, technological breakthroughs in digital monitoring, and the imperative to reduce carbon intensity through integrated CO₂-EOR and storage projects. Aligning strategy with these dynamics will determine competitive positioning and project viability in mature and emerging basins alike.

Segmentation by method, reservoir type, oil viscosity, and application context offers a nuanced lens for technology selection and resource allocation. Meanwhile, regional insights reveal that basin maturity, regulatory frameworks, and infrastructure endowments shape the pace and scale of EOR adoption. Leading companies have demonstrated that strategic partnerships, domestic supply chain optimization, and digital analytics are key differentiators in delivering cost-effective recovery and resilient operations.

In this landscape, actionable recommendations focused on digital integration, supply chain diversification, and carbon management provide a clear path forward. By embedding these imperatives within a robust research-driven framework, industry stakeholders can capitalize on incremental recovery opportunities while advancing sustainability objectives. The findings illuminate a roadmap for maximizing hydrocarbon yields, mitigating trade risks, and reinforcing long-term value creation in the evolving energy transition.

Engage with Ketan Rohom Associate Director of Sales and Marketing to Access Comprehensive Enhanced Oil Recovery Intelligence for Strategic Decision Making

To engage with Ketan Rohom, Associate Director of Sales and Marketing, reach out today to elevate your strategic insights with a comprehensive Enhanced Oil Recovery report tailored to your organization’s needs. Discover how integrating advanced recovery techniques and regional deep dives can inform your next investment and operational decisions. Ketan’s expertise will guide you through the report’s actionable intelligence, ensuring you unlock the full value of market trends, segmentation nuances, and regulatory analyses. Connect now to secure your access to the definitive resource on Enhanced Oil Recovery and transform your approach to hydrocarbon production optimization.

- How big is the Enhanced Oil Recovery Market?

- What is the Enhanced Oil Recovery Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?