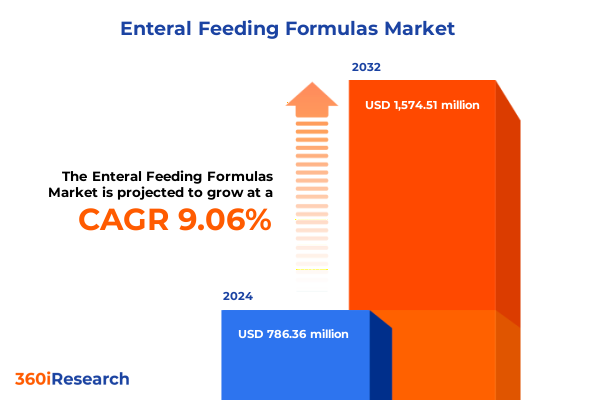

The Enteral Feeding Formulas Market size was estimated at USD 851.44 million in 2025 and expected to reach USD 926.77 million in 2026, at a CAGR of 9.17% to reach USD 1,574.51 million by 2032.

Laying the Foundation for Strategic Insights into the Expanding and Innovation-Driven Enteral Feeding Formula Market Landscape

Enteral feeding formulas have emerged as a critical component in clinical nutrition, addressing the needs of patients who require specialized nutritional support due to impaired gastrointestinal function or inability to intake nutrition orally. This executive summary opens with an overview of the market’s current trajectory, highlighting the convergence of clinical innovation, demographic shifts, and evolving care settings that collectively shape demand for targeted nutritional solutions. By examining both historical milestones and recent developments, this introduction underscores the pivotal role that enteral nutrition plays in enhancing patient outcomes while driving robust commercial activity across healthcare providers and product innovators.

To provide context for subsequent discussions, this section outlines the core drivers and constraints influencing market dynamics. Key factors include regulatory guidance on nutrient composition, reimbursement frameworks across major health systems, and advances in delivery technologies that streamline administration and improve patient adherence. Furthermore, the rise of home care and long-term care settings has catalyzed a shift from hospital-centric models toward decentralized nutrition management, necessitating more versatile and user-friendly formula formats. This landscape overview sets the stage for deeper analysis by framing the pressing questions and strategic considerations that healthcare executives and product developers must address.

Uncovering the Pivotal Technological and Market-Driven Transformations Redefining Enteral Nutrition Provision and Patient Care

Over the past several years, the enteral feeding formula sector has undergone transformative shifts driven by cutting-edge technology, evolving clinical protocols, and heightened patient-centric care models. Driven by digital integration, smart delivery pumps now incorporate remote monitoring functionalities, enabling healthcare professionals to adjust feeding regimens in real time and reduce the incidence of complications such as aspiration or tube occlusion. Simultaneously, advances in formulation science have introduced modular nutrient blends tailored to individual metabolic needs, marking a move away from one-size-fits-all solutions toward precision nutrition that aligns with each patient’s clinical profile.

Moreover, transformative shifts in regulatory and reimbursement landscapes have accelerated market innovation. Regions with updated nutritional guidelines now mandate comprehensive labeling on macronutrient ratios and micronutrient fortification, raising the bar for formula providers to demonstrate compliance and safety. Concurrently, value-based care initiatives incentivize outcomes-driven nutrition interventions, encouraging hospital systems to partner with solution providers that offer integrated services-from patient education to supply chain logistics. As a result, strategic alliances and collaborative models have proliferated, reshaping the competitive arena and prompting traditional manufacturers to expand service portfolios.

Analyzing the Compound Effects of 2025 US Import Tariffs on Supply Chains Product Costs and Strategic Industry Responses

In early 2025, newly implemented United States import tariffs introduced levies on select pharmaceutical-grade proteins, specialized lipids, and delivery device components used in enteral feeding systems. These measures, enacted under revised trade policy provisions, were designed to bolster domestic manufacturing capacity but have yielded a compound effect on global supply chains. As raw material costs rose, procurement teams faced an urgent imperative to renegotiate contracts or identify alternative sources that could mitigate margin erosion without compromising formula quality.

The cumulative impact of these tariff adjustments extends beyond direct material costs, influencing downstream logistics and inventory management. Manufacturers and distributors have reported lengthier lead times as suppliers prioritize higher-margin products, prompting healthcare facilities to reevaluate buffer stock strategies. Consequently, some tier-one providers have accelerated investment in regional manufacturing partnerships, seeking localized production hubs to hedge against import disruptions. This strategic pivot underscores an industry-wide recognition that supply resilience is as critical as product innovation, particularly in a market where uninterrupted nutrition delivery is fundamental to patient well-being.

Furthermore, price adjustments stemming from tariff-induced cost pressures have drawn scrutiny from reimbursement authorities and group purchasing organizations. In response, several industry consortia have petitioned for tariff exclusions on life-sustaining nutritional ingredients, while others are exploring cost-offset initiatives-such as advanced dispensing technologies that reduce wastage-to align with budgetary constraints. These collective actions reflect the sector’s commitment to sustaining affordability and access, even as global trade policies introduce new layers of complexity.

Deriving Actionable Insights from Segmentation Trends Spanning Administration Form Product Age Group and Clinical Demand Profiles

Examining market segmentation reveals nuanced growth patterns driven by clinical requirements and delivery preferences. Administration route insights show that tube feeding remains dominant in acute care settings, with gastrostomy tubes often favored for long-term nutrition while nasogastric tubes serve short-term interventions. Oral feeding formulas, on the other hand, are gaining traction in outpatient and home care contexts, offering patients greater autonomy and ease of use. This dual-channel dynamic compels manufacturers to refine product portfolios that cater to both clinical precision and patient convenience.

Form-driven segmentation highlights a shifting balance between powder concentrates, prized for customizable dosing and extended shelf life, and ready-to-use systems that prioritize sterility and ease of administration. Within the latter, closed systems minimize contamination risk and streamline workflow in intensive care units, whereas open systems afford greater flexibility for individualized formulation but entail higher operational demands. As a result, product development strategies are increasingly tailored to facility protocols and caregiver capacity, underscoring the importance of holistic solution design.

Product type analysis delineates elemental formulas, which supply pre-digested nutrients for severe malabsorption cases; oligomeric blends that support moderate digestive compromise; and polymeric compositions suitable for patients with intact gastrointestinal function. Age group segmentation further refines these distinctions: while adult and geriatric categories drive baseline volume consumption, pediatric applications-spanning from neonatal intensive care to outpatient pediatric clinics-demand specialized nutrient ratios and delivery mechanisms to support growth and development. End user segmentation illuminates the interplay between hospital wards, intensive care units, long-term care facilities, clinics, and home care providers, each exerting distinct requirements on product performance. Finally, nutrient profile considerations demonstrate that high calorie and high protein offerings satisfy critical care and oncology needs, whereas standard formulations serve maintenance and rehabilitation phases, illustrating how therapeutic objectives steer formulation design.

This comprehensive research report categorizes the Enteral Feeding Formulas market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Administration Route

- Form

- Product Type

- Age Group

- Nutrient Profile

- Disease Indication

- End User

Assessing Regional Dynamics and Growth Potentials Across Americas Europe Middle East Africa and Asia Pacific Enteral Nutrition Markets

Regional analysis reveals that the Americas continue to lead in terms of established reimbursement frameworks and integrated care pathways, driving demand for advanced enteral feeding systems in both hospital and home care environments. North America, in particular, benefits from centralized regulatory review processes that expedite product approvals and foster a competitive market landscape. In Latin America, emergent partnerships between local distributors and global manufacturers are expanding access, albeit moderated by variable healthcare infrastructure and reimbursement policies.

The Europe, Middle East & Africa region presents a tapestry of diverse regulatory regimes and health system maturity levels. Western Europe’s stringent nutritional guidelines and robust public funding mechanisms support widespread adoption of innovative formula variants, while Eastern European markets exhibit rising opportunities driven by incremental healthcare modernization. In the Middle East, strategic investments in healthcare infrastructure are catalyzing demand for integrated nutrition care services. Conversely, Africa’s growth is concentrated in urban centers where private healthcare providers partner with international firms to introduce standardized feeding protocols.

Asia-Pacific stands out as the fastest-growing corridor, propelled by an aging population, increasing prevalence of chronic diseases, and rapid expansion of home healthcare services. Japan and Australia lead in high-end, technology-enabled product adoption, whereas China and India exhibit significant upside potential as government initiatives promote domestic production and universal healthcare coverage. These regional nuances underscore the necessity for market entrants to adopt differentiated strategies that align with local regulatory environments, distribution networks, and patient demographics.

This comprehensive research report examines key regions that drive the evolution of the Enteral Feeding Formulas market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Most Influential Industry Leaders Driving Innovation Partnerships and Competitive Strategies in Enteral Feeding Formulas

A handful of global players have cemented their positions as market leaders, leveraging broad product portfolios and extensive distribution channels. Leading manufacturers are differentiating through innovation pipelines that emphasize modular nutrient blends, advanced packaging formats, and digital monitoring capabilities. Strategic alliances with medical device companies have enabled integrated enteral nutrition systems combining pump hardware, formulation cartridges, and real-time data analytics, elevating the standard of patient care and creating stickier value propositions for healthcare providers.

In parallel, specialized nutraceutical firms and emerging biotechs have entered the fray with niche offerings targeting specific clinical indications-such as oncology and metabolic disorders-strengthening competitive intensity. These entrants often partner with academic research centers to co-develop next-generation formulations that incorporate immunomodulatory peptides or gut microbiome–supporting prebiotics. Moreover, cross-sector collaborations with digital health startups have spawned mobile applications for tracking nutritional intake and patient adherence, reflecting a convergence of nutrition science and health informatics.

Competitive strategies increasingly emphasize geographic expansion and channel diversification. Market leaders are forging joint ventures and licensing agreements to access high-growth regions, while also scaling home care distribution networks in response to shifting care paradigms. Simultaneously, M&A activity has concentrated on acquiring technologies that accelerate time-to-market for specialty formulas and complementary devices. This dynamic competitive landscape underscores the importance of continuous innovation and agility for maintaining market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Enteral Feeding Formulas market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories Ltd

- B. Braun SE

- Danone S.A.

- Fresenius Kabi AG

- Global Health Products, Inc.

- Hormel Foods Corporation

- Johnson & Johnson Services, Inc

- Kate Farms, Inc.

- Medline Industries, Inc.

- Medtrition, Inc.

- Meiji Holdings Co., Ltd

- Nestlé SA

- Nutricia North America

- Otsuka Holdings Co., Ltd

- Primus Pharmaceuticals, Inc.

- Real Food Blends by Nutrica

- Reckitt Benckiser Group plc.

- Victus, Inc.

Delivering Practical Strategic Recommendations for Market Leaders to Navigate Challenges and Capitalize on Emerging Nutritional Care Opportunities

To navigate the complexity of evolving enteral nutrition markets, industry leaders should prioritize investment in closed system ready-to-use formulations that enhance safety and reduce caregiver workload. Coupling these products with smart delivery pumps equipped for remote monitoring will address both hospital and home care demands while reinforcing value-based care objectives. In addition, diversifying raw material sourcing through strategic alliances with domestic and regional suppliers can mitigate the impact of trade-related cost fluctuations and secure supply continuity.

Organizations must also cultivate partnerships with health informatics platforms to develop seamless data integration tools, enabling real-time monitoring of patient nutritional status and adherence. By leveraging advanced analytics, providers can tailor interventions more precisely and demonstrate measurable outcomes to payers. Furthermore, expanding service offerings-such as training programs for caregivers and clinical nutrition consulting-will strengthen customer relationships and differentiate solutions in an increasingly crowded marketplace.

Finally, proactive engagement with regulatory bodies and trade policymakers is essential to safeguard access to critical nutritional ingredients. Industry associations should advocate for tariff exemptions and streamlined approval pathways for essential formulations. Simultaneously, companies ought to build internal capabilities for regulatory intelligence to anticipate policy shifts and adapt strategies accordingly. These combined actions will position market participants for sustained growth and resilience in the face of ongoing global and local challenges.

Detailing a Rigorous Mixed Methods Research Methodology Underpinning Insights into Enteral Feeding Formula Market Structures and Trends

The insights presented in this report are grounded in a robust mixed methods research design that integrates both primary and secondary data sources. Primary research involved structured interviews with over fifty subject-matter experts, including dietitians, clinical nutritionists, hospital procurement leads, and supply chain managers. These dialogues provided granular perspectives on product usage patterns, formulary decision criteria, and anticipated shifts in care delivery models.

Secondary research encompassed a comprehensive review of peer-reviewed journals, regulatory agency publications, and industry white papers. Market trend analysis was supplemented by trade association reports and government policy documents, ensuring a broad understanding of both macroeconomic influences and localized regulatory environments. Quantitative data on production volumes and hospital adoption rates were extrapolated from publicly available databases and corroborated through expert validation.

To ensure rigor and reliability, triangulation techniques were employed, cross-referencing insights from multiple stakeholders to reconcile conflicting viewpoints. Segment definitions and regional categorizations were iteratively refined through advisory panel workshops, which included representatives from leading healthcare institutions. This methodological framework underpins the credibility of the findings and supports actionable recommendations for stakeholders across the enteral feeding ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Enteral Feeding Formulas market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Enteral Feeding Formulas Market, by Administration Route

- Enteral Feeding Formulas Market, by Form

- Enteral Feeding Formulas Market, by Product Type

- Enteral Feeding Formulas Market, by Age Group

- Enteral Feeding Formulas Market, by Nutrient Profile

- Enteral Feeding Formulas Market, by Disease Indication

- Enteral Feeding Formulas Market, by End User

- Enteral Feeding Formulas Market, by Region

- Enteral Feeding Formulas Market, by Group

- Enteral Feeding Formulas Market, by Country

- United States Enteral Feeding Formulas Market

- China Enteral Feeding Formulas Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1908 ]

Synthesizing Key Takeaways to Illuminate the Future of Clinical Nutrition Delivery Systems and Stakeholder Decision Pathways

In synthesizing the key takeaways, several overarching themes emerge that illuminate the future trajectory of enteral feeding solutions. Technological integration and precision formulation stand at the forefront of innovation, enabling more personalized nutrition regimens that align with evolving clinical paradigms. Concurrently, supply chain resilience has ascended as a strategic imperative in light of shifting trade policies, compelling stakeholders to reconfigure sourcing and manufacturing footprints.

Segmentation insights reveal that tailored strategies-whether by administration route, product form, age group, or clinical indication-are critical to capturing value in specialized care settings. Regional analyses further emphasize that one-size-fits-all go-to-market approaches are insufficient; nuanced understanding of local regulatory frameworks and healthcare infrastructures is essential to unlocking opportunities across diverse geographies.

Ultimately, organizations that harmonize product innovation, strategic partnerships, and proactive policy engagement will be best positioned to deliver value-based nutrition solutions. The convergence of patient-centric care models and data-driven decision-making will continue to reshape the competitive landscape, offering fertile ground for collaboration between formula providers, device manufacturers, and digital health enterprises. These conclusions underscore the pivotal role of comprehensive market intelligence in driving informed strategic action.

Connect with Ketan Rohom Associate Director Sales Marketing to Secure Comprehensive Enteral Feeding Formula Intelligence for Strategic Leadership

For tailored insights and in-depth analysis that empower strategic decision-making, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. He stands ready to provide you with comprehensive access to the full enteral feeding formula market research report, enabling your organization to gain a competitive edge through data-driven intelligence and bespoke consultation.

- How big is the Enteral Feeding Formulas Market?

- What is the Enteral Feeding Formulas Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?