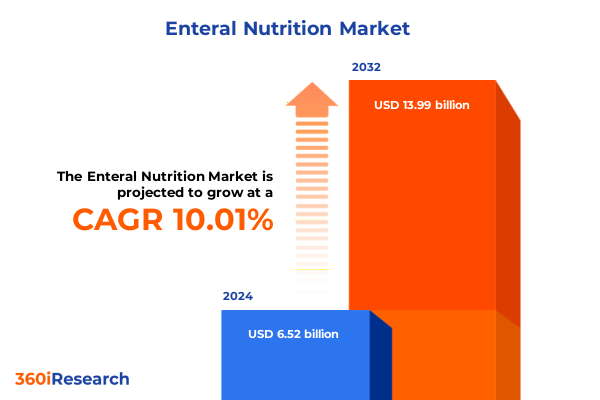

The Enteral Nutrition Market size was estimated at USD 7.10 billion in 2025 and expected to reach USD 7.74 billion in 2026, at a CAGR of 10.17% to reach USD 13.99 billion by 2032.

Setting the Stage for Next-Generation Enteral Nutrition Solutions that Address Evolving Clinical Needs and Patient Quality-of-Life Expectations

Enteral nutrition has emerged as a critical pillar in modern healthcare, delivering targeted nutritional support to patients who cannot meet their dietary needs by conventional means. As clinical understanding deepens, the focus has shifted from merely providing caloric sustenance to optimizing formula compositions for specific medical conditions, improving gastrointestinal tolerance, and enhancing patient quality of life. This evolution underscores a transition from one-size-fits-all feedings toward precision nutrition strategies that address complex metabolic demands.

In recent years, the convergence of advanced clinical research and technological innovation has sparked novel formulations enriched with immunomodulatory agents, specialized fibers, and condition-specific nutrients. Meanwhile, the growing prevalence of chronic illnesses, such as diabetes, renal impairment, and pulmonary disorders, has intensified demand for tailored solutions. As a result, the enteral nutrition market is being reshaped by evidence-based protocols that aim to mitigate complications and accelerate patient recovery.

Furthermore, the rise of home healthcare and telehealth monitoring has expanded the scope of enteral feeding beyond hospital walls, empowering caregivers and patients to manage regimens within domestic settings. This shift has prompted manufacturers and service providers to refine delivery systems, develop digital monitoring platforms, and streamline supply chains for seamless continuity of care. Consequently, the current landscape demands robust insights into emerging formulations, clinical efficacy data, and operational best practices to guide strategic initiatives.

Unraveling the Paradigm Shifts Reshaping Enteral Nutrition Delivery and Formulation to Drive Enhanced Clinical Outcomes and Operational Efficiency

The enteral nutrition sector is experiencing transformative shifts driven by multidisciplinary innovation, regulatory reform, and shifting care paradigms. Over the past two years, manufacturers have placed heightened emphasis on incorporating prebiotics, probiotics, and postbiotics into formulations, harnessing the gut–immune axis to reinforce host defenses and reduce infection-related complications. Simultaneously, advancements in modular nutrient delivery have enabled clinicians to tailor macro- and micronutrient ratios in real time, aligning therapeutic interventions with individual metabolic responses.

Regulatory bodies have also played a pivotal role in this landscape revolution by updating guidelines to reflect evolving safety profiles and emerging clinical evidence. These changes have catalyzed streamlined product approvals for novel immune-enhancing ingredients, while fostering transparency in labeling and quality standards. As a result, stakeholders are obliged to navigate increasingly complex compliance requirements, balancing innovation with stringent safety mandates.

Moreover, digital integration is redefining enteral feeding practices. Smart feeding pumps equipped with connectivity features now allow continuous monitoring of infusion rates, patient tolerance metrics, and supply utilization. Integrating these systems with electronic health records facilitates data-driven adjustments and remote oversight by multidisciplinary care teams. These converging forces, propelled by patient-centricity and technological capability, are reshaping the rhythm of enteral nutrition delivery and raising the bar for clinical outcomes.

Evaluating the Ramifications of 2025 United States Tariff Policies on Raw Material Availability, Cost Structures, and Supply Chain Resilience in Enteral Nutrition

The implementation of new tariffs in early 2025 has introduced significant variables into the cost structures and supply dynamics of enteral nutrition. By imposing higher duties on key raw materials-ranging from specialized proteins to high-purity fiber concentrates-these policies have elevated procurement costs for manufacturers who rely on global supply chains. Consequently, tier-one producers are reevaluating sourcing strategies, prioritizing partnerships with domestic suppliers and accelerating investments in vertically integrated production capabilities to mitigate exposure to future trade fluctuations.

In addition, increased import levies have prompted a shift in pricing models across distribution channels. Hospital systems, which traditionally negotiate bulk contracts, are now facing elevated per-unit costs, driving renewed scrutiny of formulary compositions and prompting discussions around alternative feeding regimens. Meanwhile, retail pharmacies and online distributors are grappling with narrower margins, spurring consolidation among channel players and encouraging flexible pricing frameworks that align with payer reimbursement trends.

Despite these headwinds, the tariffs have also stimulated local innovation. Domestic ingredient producers are expanding capacities, and start-ups are exploring substitution of legacy raw materials with sustainable, homegrown alternatives. In turn, this regional reshoring fosters improved supply chain resilience, reducing lead times and enhancing responsiveness to demand surges. Ultimately, the interplay between trade policy and industrial adaptation is recasting competitive dynamics in the enteral nutrition market landscape.

Harnessing Multifaceted Segmentation Perspectives to Uncover Critical Insights Across Product Types, Administration Routes, Forms, Channels, and Age Cohorts

A granular examination of product type segmentation reveals how distinct formulation categories are shaping clinical practice. Blenderized diet options have regained traction among caregivers seeking natural, customizable nutrient blends, while specialized formulas continue to attract interest for their disease-specific designs. Within these, diabetic formulations are refined to moderate glycemic load, whereas renal-focused compositions prioritize electrolyte balance. Fiber enriched, immune modulating, and probiotic supplemented variants cater to gastrointestinal health and systemic immunity, highlighting the convergence of nutrition science and targeted therapy. Standard formulas, encompassing modular, oligomeric, and polymeric designs, serve as foundational options, each offering unique profiles in macronutrient distribution and absorption kinetics.

Form considerations further underscore market diversity. Liquid formats remain the predominant choice in acute care, given their ready-to-administer profile, whereas powder offerings have become favored in home settings for logistical advantages such as reduced storage footprint and flexible reconstitution. Turning to administration routes, the landscape is divided between oral nutrition solutions that support patient autonomy and tube feeding systems optimized for precision delivery in clinical environments. Distribution channel segmentation reflects in-hospital procurement practices through dedicated hospital pharmacies, the convenience and reach of online platforms, and the accessibility of retail pharmacy outlets, each channel adapting pricing and support services to its operational context. Finally, age group considerations distinguish adult from pediatric requirements, illustrating how metabolic demands and safety parameters drive formulation adjustments, packaging innovations, and caregiver education protocols.

This comprehensive research report categorizes the Enteral Nutrition market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Route Of Administration

- Distribution Channel

- Age Group

Analyzing Regional Dynamics to Illuminate Growth Drivers and Adoption Patterns for Enteral Nutrition Across the Americas, EMEA, and Asia-Pacific Markets

Regional dynamics exert profound influence on market progression, with geographic nuances shaping both opportunities and obstacles. In the Americas, the proliferation of home healthcare services and a robust hospital network underpin stable demand. Patient advocacy for patient-controlled feeding, combined with reimbursement frameworks that incentivize clinical nutrition interventions, sustains a fertile environment for product diversification. Conversely, Europe, Middle East & Africa presents a mosaic of regulatory landscapes where harmonization efforts coexist with localized policies. Here, cross-border trade agreements and convergence on quality standards accelerate product approvals, yet varied healthcare funding models require adaptive commercial strategies.

Meanwhile, the Asia-Pacific region is emerging as a high-growth frontier, driven by expanding healthcare infrastructure, rising incidence of lifestyle-related diseases, and government investments in nutritional care programs. Local manufacturers are ramping up capacity to serve both domestic needs and export demands, often collaborating with international partners to co-develop formulations that align with regional dietary preferences. Differences in cold chain logistics and rural access necessitate tailored distribution frameworks, while digital health initiatives-such as tele-nutrition platforms in urban centers-are enhancing patient engagement and compliance. Collectively, these regional characteristics underscore the importance of localized business models that respect regulatory complexities, cultural context, and infrastructural realities.

This comprehensive research report examines key regions that drive the evolution of the Enteral Nutrition market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Shaping the Competitive Landscape of Enteral Nutrition Through Technological and Clinical Advancements

Key players in the enteral nutrition arena are leveraging R&D investments, strategic alliances, and portfolio expansion to fortify their competitive positioning. Leading formulators are diversifying specialty lines by integrating the latest bioactive ingredients and advancing novel delivery formats-such as ready-to-use bag systems with built-in flow sensors. At the same time, a wave of mergers and acquisitions is consolidating capabilities in ingredient sourcing and manufacturing, enabling scale advantages and cost efficiencies in reaction to global trade headwinds.

Innovation ecosystems are also taking shape, with several organizations partnering with academic centers and contract research firms to validate clinical outcomes and accelerate product pipeline approvals. These collaborations often focus on pioneering immune-supportive formulations and exploring 3D-printed modular feeds that promise unprecedented personalization. In addition, a new cohort of agile start-ups is emerging, concentrating on digital health integration, patient adherence platforms, and microbiome-targeted solutions-forcing incumbents to revisit legacy technologies and hasten digital transformation.

Beyond product innovation, service differentiation has become equally critical. Providers are deploying comprehensive training programs, virtual monitoring services, and predictive analytics to optimize feeding regimens and minimize complications. By combining clinical expertise with supply chain agility, these organizations aim to deliver end-to-end solutions that resonate with healthcare providers, payers, and patients alike.

This comprehensive research report delivers an in-depth overview of the principal market players in the Enteral Nutrition market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- B. Braun Melsungen AG

- Baxter International Inc.

- Danone S.A.

- DSM Nutritional Products AG

- Fresenius Kabi AG

- Global Health Products, Inc.

- Hormel Foods Corporation

- Kate Farms Inc.

- Mead Johnson & Company, LLC

- Medtrition Inc.

- Meiji Holdings Co., Ltd.

- Nestlé S.A.

- Nutricia Advanced Medical Nutrition

- Nutritional Medicinals, LLC

- Otsuka Pharmaceutical Co., Ltd.

- Perrigo Company plc

- Real Food Blends LLC

- Reckitt Benckiser Group PLC

- Victus Inc.

Strategic Playbook for Industry Leaders to Navigate Market Complexities, Optimize Portfolio Offerings, and Capitalize on Emerging Opportunities in Enteral Nutrition

Industry leaders must act decisively to navigate evolving market dynamics and secure sustainable growth. First, they should establish agile supply chain frameworks that incorporate dual sourcing strategies for critical specialty ingredients while fostering partnerships with regional manufacturers. This approach will mitigate the impact of tariff fluctuations and ensure uninterrupted product availability.

Next, organizations are advised to accelerate digital integration by embedding connectivity features into feeding systems and collaborating with telehealth platforms. By leveraging real-time infusion data and predictive adherence algorithms, companies can partner with care teams to fine-tune patient regimens and demonstrate differentiated value to payers. In addition, tailoring product portfolios to reflect both standardized formulations and bespoke modular options will position companies to address diverse clinical needs across inpatient and home care settings.

Moreover, capitalizing on regional growth pockets requires dedicated market access strategies that align with local reimbursement models and regulatory requirements. Engaging in cross-functional forums with key opinion leaders and policy makers can facilitate approval pathways for novel ingredients while building consensus on evidence-based nutrition protocols. Finally, establishing robust outcomes tracking programs-supported by longitudinal clinical studies-will generate compelling real-world evidence to reinforce product efficacy, strengthen payer negotiations, and drive broader adoption across care settings.

Detailing Rigorous Research Methodology Integrating Qualitative and Quantitative Approaches to Ensure Robust and Transparent Insights Into Enteral Nutrition Trends

This analysis is grounded in a comprehensive methodology that merges qualitative insights with rigorous quantitative validation. Initial stages involved in-depth interviews with senior clinicians, dietitians, procurement specialists, and supply chain executives across major healthcare institutions. These discussions enabled the identification of critical clinical imperatives, formulation performance criteria, and emerging operational challenges.

Simultaneously, an extensive review of peer-reviewed literature, regulatory filings, and patent landscapes provided a secondary research foundation to corroborate industry trends and innovation trajectories. Key macroeconomic and trade policy data were integrated to contextualize the recent tariff impacts and regional growth differentials. Quantitative analyses were executed using a structured database of product launches, distribution channel metrics, and corporate financial disclosures, ensuring a transparent audit trail for all findings.

To refine accuracy and relevance, preliminary insights were presented to an expert panel comprising nutrition scientists, healthcare economists, and logistics specialists. Their feedback informed iterative adjustments to segmentation frameworks, formulation profiles, and regional dynamics assessments. The culmination of these efforts is a robust, multi-angle perspective designed to guide stakeholders through the complexities of the enteral nutrition ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Enteral Nutrition market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Enteral Nutrition Market, by Product Type

- Enteral Nutrition Market, by Form

- Enteral Nutrition Market, by Route Of Administration

- Enteral Nutrition Market, by Distribution Channel

- Enteral Nutrition Market, by Age Group

- Enteral Nutrition Market, by Region

- Enteral Nutrition Market, by Group

- Enteral Nutrition Market, by Country

- United States Enteral Nutrition Market

- China Enteral Nutrition Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesis of Critical Findings and Perspectives to Illuminate the Path Forward for Stakeholders in the Evolving Enteral Nutrition Ecosystem

Throughout this executive summary, we have traversed the foundational principles of enteral nutrition, examined the sweeping shifts in clinical and technological paradigms, and assessed the tangible effects of 2025 tariff reforms. By integrating granular segmentation analysis with regional dynamics and competitive intelligence, a holistic picture emerges: enteral nutrition is at a pivotal juncture characterized by heightened personalization, supply chain realignment, and digital transformation.

Key takeaways include the accelerating adoption of condition-specific formulations, the strategic reorientation toward domestic sourcing in response to trade policies, and the critical role of integrated care pathways powered by connected feeding systems. The segmentation insights underscore the diverse needs of patient populations, while regional observations highlight differentiated trajectories across the Americas, EMEA, and Asia-Pacific. Furthermore, leading organizations are distinguishing themselves through breakthrough R&D collaborations, advanced delivery platforms, and comprehensive service offerings.

As the market continues to evolve, the confluence of clinical evidence, policy shifts, and technological innovation will further redefine standards of care. Stakeholders who proactively align their strategies with these forces will not only fortify market positions but also deliver superior clinical outcomes and operational efficiencies. This synthesis sets the stage for informed decision-making as the enteral nutrition landscape advances into its next phase of growth and maturation.

Take Immediate Action to Secure Comprehensive Market Intelligence and Benefit From Expert Guidance Provided by Associate Director Ketan Rohom Today

To explore these comprehensive insights in depth and secure an authoritative roadmap for your strategic decision-making, reach out to Ketan Rohom, Associate Director, Sales & Marketing. Engage directly to discuss tailored data packages, exclusive advisory materials, and customized implementation support that will empower your organization to thrive in the evolving enteral nutrition landscape. Contact Ketan today to gain seamless access to the full scope of analysis and begin capitalizing on the trends, intelligence, and expert perspectives contained within the complete market research report

- How big is the Enteral Nutrition Market?

- What is the Enteral Nutrition Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?