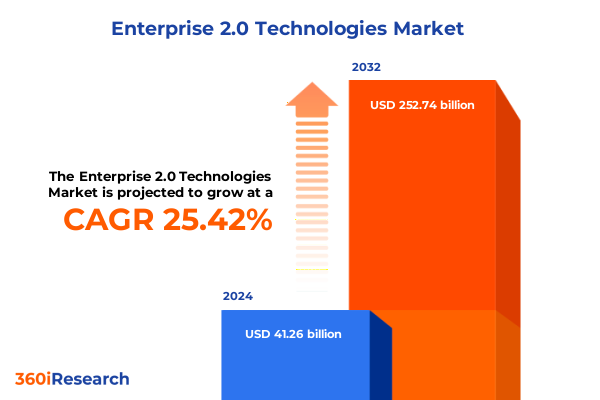

The Enterprise 2.0 Technologies Market size was estimated at USD 51.88 billion in 2025 and expected to reach USD 65.23 billion in 2026, at a CAGR of 25.38% to reach USD 252.74 billion by 2032.

Exploring the Rise and Strategic Imperatives of Enterprise 2.0 Technologies in Shaping Modern Digital Workplaces and Collaborative Ecosystems

Enterprise 2.0 represents a fundamental shift in how organizations harness digital tools to foster collaboration, drive innovation, and streamline business processes. Coined in Andrew McAfee’s seminal 2006 MIT Sloan Management Review article, the term describes the use of emergent social software platforms within companies or between enterprises and their partners, enabling freeform, frictionless participation and emergent structures that evolve organically over time. These platforms emphasize egalitarian interaction, optional workflows, and the ability to capture diverse content types, creating environments where knowledge workers can rendezvous, connect, and co-create knowledge with unprecedented agility.

Unveiling the Fundamental Disruptions Transforming Enterprise Collaboration Through AI Driven Hybrid Models and Cloud Native Ecosystem Evolution

The Enterprise 2.0 landscape is being reshaped by a confluence of transformative trends that are rewriting the rules of workplace collaboration and process automation. At the forefront is the integration of generative and agentic artificial intelligence, which is transitioning from basic task assistance to autonomous multiagent systems capable of independently executing complex workflows. Leading organizations are embedding these intelligent agents into core enterprise applications such as service desks and customer support platforms, resulting in significant reductions in case resolution times and elevating human roles to focus on strategic, creative tasks.

Analyzing the Aggregate Economic and Operational Effects of Recent United States Tariff Measures on Enterprise Technology Supply Chains

In 2025, the United States enacted a series of tariffs and trade measures that are exerting profound effects on enterprise technology supply chains. In late March, an additional 25 percent ad valorem tariff on imported automobiles and auto parts was implemented, targeting national security concerns under Sections 301 and 232 of U.S. trade law, with final details published in the Federal Register. Simultaneously, Executive Order 14245 introduced a 25 percent tariff on all goods imported from any country that imports Venezuelan oil, creating new cost considerations for hardware and component sourcing. Earlier in March, steel and aluminum tariffs imposed under Section 232 continued to prompt countermeasures from the European Union, Canada, and Mexico, leading to ongoing trade negotiations and supply chain realignments.

Revealing Critical Insights from Comprehensive Segmentation of Enterprise 2.0 Markets Across Applications Deployment Modes Sizes Verticals and Payment Models

A nuanced understanding of Enterprise 2.0 adoption emerges when examining the market through multiple segmentation lenses. When viewed by application, organizations are evaluating advanced analytics and reporting solutions to glean deeper operational insights, adopting business process management platforms to orchestrate workflows, leveraging collaboration and social networking tools to facilitate real-time knowledge exchange, utilizing enterprise content management systems to govern unstructured data, and embracing mobile collaboration capabilities to support a distributed workforce. Deployment mode speaks to a dynamic balance between cloud services, hybrid models, and on-premises installations, with private and public cloud options further enabling scalability and data residency compliance. Organization size reveals that while large enterprises pursue comprehensive digital workplace platforms to drive enterprise-wide transformation, small and midsize firms focus on modular solutions that can scale from small to midsize operations. Industry vertical differentiation highlights that sectors such as banking, financial services and insurance; healthcare; government; IT and telecom; manufacturing; education; and retail each tailor their Enterprise 2.0 implementations to meet regulatory, operational, and customer engagement requirements. Finally, payment model preferences-from freemium access to perpetual licensing and subscription frameworks-reflect evolving buyer journeys, budget models, and long-term value realization approaches.

This comprehensive research report categorizes the Enterprise 2.0 Technologies market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Payment Model

- Organization Size

- Deployment Mode

- Application

- End User

Uncovering Key Regional Drivers and Growth Trajectories for Enterprise 2.0 Technologies Across the Americas EMEA and Asia Pacific Markets

The Americas region continues to lead in innovation and adoption of digital workplace technologies, driven by robust investments in cloud infrastructure and a strong focus on hybrid work environments that blend remote and in-office collaboration. However, ongoing trade dynamics and regulatory complexities underscore the importance of supply chain resilience and local hosting strategies. In Europe, the Middle East & Africa, stringent data privacy regulations and a multi-jurisdictional landscape are catalyzing interest in unified, compliant content management and secure collaboration platforms that can navigate these requirements. This region’s mature IT market is also seeing an uptick in AI governance frameworks as organizations prioritize responsible AI deployment. In Asia-Pacific, rapid digital transformation initiatives and significant mobile workforce growth are fueling demand for lightweight, secure mobile collaboration tools, with public cloud adoption expanding to support scalable cross-border projects. Regional variations in digital maturity and infrastructure readiness are giving rise to tailored solutions that can adapt to diverse economic and technological contexts.

This comprehensive research report examines key regions that drive the evolution of the Enterprise 2.0 Technologies market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Innovations and Competitive Dynamics Among Leading Enterprise 2.0 Technology Providers Driving Market Evolution

A handful of leading technology providers are shaping the direction of the Enterprise 2.0 market through strategic product innovation and strategic partnerships. ServiceNow, for example, reported a spectacular second quarter of 2025 with adjusted earnings rising over 30 percent and revenue increasing by more than 22 percent year-over-year, attributing this growth to its expanding AI capabilities and the recent acquisition of Moveworks that broadened its enterprise automation portfolio. At Knowledge 2025, the company unveiled its next-generation AI Platform, featuring deep integrations with major cloud and AI ecosystem partners to orchestrate intelligent workflows, governed through a centralized AI Control Tower for enterprise-wide visibility and compliance. Meanwhile, Slack has positioned itself as the collaboration hub for the agentic era by embedding generative AI features such as trusted AI-powered search, channel recaps, and autonomous Agentforce capabilities into its platform, now included across all paid Salesforce plans to drive adoption at scale.

This comprehensive research report delivers an in-depth overview of the principal market players in the Enterprise 2.0 Technologies market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Avaya Inc

- Bravenet Web Services Inc.

- CafeX Communications Inc

- Capgemini SE

- Cisco Systems, Inc.

- Dell EMC Corporation

- Dialogic Group, Inc.

- Enghouse Systems Ltd.

- Fujitsu Limited

- Google LLC

- International Business Machines Corporation

- Microsoft Corporation

- NEC Corporation

- Open Text Corporation

- Oracle Corporation

- Salesforce, Inc.

- SAP SE

- Thomson Reuters Corporation

- Tumblr by Automattic

- VMware, Inc.

- Vonage Holdings Corp.

- Weebly by Square, Inc

- Wix.com, Inc

- WordPress

- Zoho Corporation

Formulating Targeted Action Plans to Accelerate Adoption Delivery and Value Realization of Enterprise 2.0 Technologies for Industry Leaders

Industry leaders should prioritize a pragmatic roadmap for integrating Enterprise 2.0 technologies by starting with a clear articulation of strategic objectives and aligning them with use cases that deliver immediate operational value. Securing executive sponsorship and establishing cross-functional governance ensures that digital workplace initiatives are driven by measurable outcomes and sustained momentum. Concurrently, organizations must invest in change management programs that build digital fluency and foster a culture of collaboration, enabling users to embrace new collaboration patterns and AI-driven workflows. Technology architects should adopt a modular integration strategy, leveraging open APIs and low-code development tools to reduce implementation risk and drive rapid iteration. To manage emerging security and compliance challenges, a robust AI governance framework must be enacted alongside continuous monitoring of usage, performance, and ethical considerations. Finally, leaders should establish a feedback loop to capture user insights and refine digital workplace capabilities over time, ensuring that investments in Enterprise 2.0 translate into lasting competitive advantage.

Detailing the Rigorous Multi Source Research Methodology and Frameworks Employed to Develop a Holistic Enterprise 2.0 Technology Analysis

This research combines rigorous secondary and primary methodologies to deliver a comprehensive view of the Enterprise 2.0 market. Secondary research included an extensive review of industry literature, trade publications, regulatory filings, and technology white papers to map product evolution, adoption drivers, and regulatory impacts. Key public sources were augmented with proprietary data models to contextualize deployment patterns across regions, industries, and organization sizes. Primary research involved in-depth interviews with technology executives, digital workplace leaders, and subject-matter experts, alongside surveys of enterprise IT decision-makers to validate market hypotheses and uncover emerging trends. Quantitative analysis was conducted using curated data sets, triangulated against public financial disclosures and vendor solution portfolios, while qualitative insights were synthesized through structured thematic coding. This blended approach ensures that the findings reflect current industry dynamics and anticipate the trajectory of Enterprise 2.0 innovation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Enterprise 2.0 Technologies market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Enterprise 2.0 Technologies Market, by Payment Model

- Enterprise 2.0 Technologies Market, by Organization Size

- Enterprise 2.0 Technologies Market, by Deployment Mode

- Enterprise 2.0 Technologies Market, by Application

- Enterprise 2.0 Technologies Market, by End User

- Enterprise 2.0 Technologies Market, by Region

- Enterprise 2.0 Technologies Market, by Group

- Enterprise 2.0 Technologies Market, by Country

- United States Enterprise 2.0 Technologies Market

- China Enterprise 2.0 Technologies Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Key Themes Strategic Implications and Future Outlook of Enterprise 2.0 Technologies in the Broader Digital Transformation Landscape

The overview of Enterprise 2.0 technologies underscores an era defined by the convergence of social collaboration, AI-driven automation, and cloud-first architectures. Strategic segmentation reveals how applications, deployment modes, organization size, industry requirements, and payment models intersect to shape adoption pathways. Regional analysis illustrates that although maturity levels and regulatory contexts vary, the imperative for resilient, secure, and intuitive collaboration platforms is universal. Leading providers are responding with innovative AI platforms, deep ecosystem integrations, and customer-centric strategies that drive strong financial performance and market momentum. By synthesizing these insights, organizations can chart a course toward digital workplaces that harness collective intelligence, streamline complex workflows, and deliver measurable business outcomes in an increasingly dynamic global environment.

Engage with Ketan Rohom to Access Comprehensive Enterprise 2.0 Research Insights and Propel Strategic Decision Making with Expert Guidance

Ready to unlock the full potential of Enterprise 2.0 technologies in your organization? Ketan Rohom, Associate Director of Sales & Marketing, is available to provide you with a personalized walkthrough of our comprehensive market research report. By engaging directly with Ketan, you will gain tailored insights that address your strategic goals, receive expert guidance on leveraging the latest collaboration innovations, and explore custom solutions designed to enhance digital workplace effectiveness. Reach out today to schedule your consultation and take the first step toward accelerating your digital transformation journey with confidence.

- How big is the Enterprise 2.0 Technologies Market?

- What is the Enterprise 2.0 Technologies Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?